Maverick Protocol is an innovative decentralized finance (DeFi) protocol that aims to transform the way liquidity is managed and optimized in the crypto ecosystem. By utilizing a unique automated market maker (AMM) structure, Maverick Protocol allows liquidity providers to customize their liquidity provision strategies, enabling higher efficiency and greater returns. Unlike traditional AMMs, Maverick Protocol enables more flexible and dynamic trading opportunities, offering a more user-centric approach to DeFi. With its focus on scalability, security, and ease of use, Maverick Protocol is paving the way for more accessible and efficient decentralized finance solutions. In this article, we will dive deeper into what is Maverick Protocol , how it works, and why it is gaining traction in the DeFi space.

What Is Maverick Protocol?

Maverick Protocol is an advanced DeFi protocol that provides an AMM DEX trading platform with a unique design called Dynamic Distribution AMM. This design helps optimize capital efficiency for users, liquidity providers (LPs), DAOs, treasuries, and developers.

The protocol uses the Directional LPing mechanism, allowing liquidity providers to flexibly choose the price range without needing to monitor liquidity positions and without incurring excessive fees.

Maverick Protocol has launched on Ethereum and zkSync Era networks, recording impressive transaction fees and attracting attention from the DeFi community.

The ecosystem of Maverick Protocol

Maverick Protocol is a DeFi protocol designed to optimize liquidity usage efficiency and build an interconnected ecosystem of application layers. The ecosystem of Maverick Protocol consists of five main components:

- Blockchain platform: Maverick Protocol operates on blockchains such as Ethereum and zkSync, providing the foundation for transactions and smart contracts.

- Token: The protocol utilizes tokens such as stablecoins and Liquid Staking Tokens (LST) to support transactions and provide liquidity.

- Trading aggregators: Maverick Protocol integrates with platforms like 1inch and Paraswap, allowing users to access order books and prices from various exchanges, optimizing trading.

- Liquidity aggregators: The protocol collaborates with liquidity hubs like Tokemak and Chicken Bonds to concentrate liquidity from multiple sources, ensuring high liquidity for transactions.

- Data and other dApps: Maverick Protocol integrates with data services and decentralized applications (dApps) like DeBank and The Graph to provide market information and data analysis for users.

Features of Maverick Protocol

Maverick Protocol is an advanced DeFi protocol that offers many unique features aimed at optimizing liquidity usage efficiency and providing a smooth trading experience for users. Below are the key features of Maverick Protocol:

- Bin (Bucket): Before exploring the products, it’s important to understand the term “Bin” in Maverick Protocol. A Bin is the smallest unit of a price range when providing liquidity. Users can choose one or more Bins when supplying liquidity. For highly volatile assets, the platform recommends setting the Bin at 2%, and for stablecoins, from 0.02% to 0.05%.

- Swap: This feature allows users to swap between different types of tokens with low slippage. Currently, Maverick Protocol supports token swaps on two blockchains: Ethereum and zkSync.

- Pools: This feature allows users to provide liquidity with different modes, fee levels, and Bin widths to earn transaction fees.

- Boosted Positions: This new feature helps liquidity pools create incentive campaigns to attract users. These Boosted Positions provide greater control and flexibility for liquidity providers when supplying liquidity in specific pools. Each Boosted Position is set in one of three liquidity modes: Left, Both, or Static.

- Stake MAV: This feature allows users to stake MAV tokens and receive veMAV in exchange for governance voting rights. Users will choose “Create New Stake” to start staking MAV. In the “New Stake” interface, users will enter the amount of MAV and the staking duration to receive veMAV. The more MAV staked for a longer duration, the larger the veMAV balance, which grants higher governance rights.

Maverick Protocol Operation Mechanism

Maverick Protocol is an advanced DeFi protocol that provides unique products and operational mechanisms aimed at optimizing liquidity usage and offering users a smooth trading experience. Below are the products and AMM (Automated Market Maker) models of Maverick Protocol:

Products of Maverick Protocol:

- Swap: Similar to other DEX platforms, users can trade assets with each other, and Maverick provides the best prices for these transactions.

- Pools: Liquidity providers can deposit assets into pools with different modes, fee levels, and Bin width to earn transaction fees.

- Portfolio: A management interface for liquidity positions and user assets, helping users track and optimize investment performance.

AMM Models of Maverick Protocol:

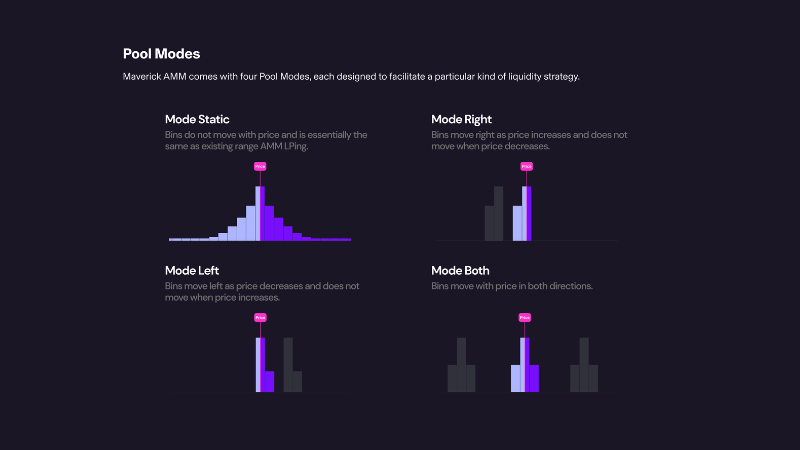

Maverick Protocol offers four main liquidity modes:

- Mode Right: The Bin moves right when the price increases and does not move when the price decreases. When the price exceeds the liquidity zone, the Bin will shift right. However, when the price decreases outside the active liquidity zone, the Bin will not move.

- Mode Left: The opposite of Mode Right, the Bin moves left when the price decreases and does not move when the price increases. When the price falls beyond the liquidity zone, the Bin will move left. However, when the price increases outside the active liquidity zone, the Bin will not move.

- Mode Both: The Bin moves in both upward and downward price directions outside the liquidity zone. However, the risk of permanent loss can be very high in this mode.

- Mode Static: The Bin remains fixed and does not move when the price exceeds the liquidity zone.

Maverick Protocol is redefining decentralized finance by providing a more efficient and flexible platform for liquidity providers and traders alike. Its innovative Dynamic Distribution AMM design and unique liquidity management features offer enhanced capital efficiency, while its ecosystem seamlessly integrates with various DeFi platforms and services. By empowering users with greater control over their liquidity positions, as well as introducing features like Boosted Positions and staking options, Maverick Protocol is set to drive the next wave of growth in the DeFi space. With its focus on scalability, security, and user experience, Maverick Protocol is paving the way for more accessible and sustainable decentralized financial solutions.

Stay tuned with Financial Insight Daily for the latest updates on Maverick Protocol and other emerging trends in the DeFi landscape.