Liquidity Pool (LP) Tokens are a type of digital asset that represents an individual’s share in a decentralized exchange’s liquidity pool. These liquidity pools are created when users deposit their assets to facilitate smooth and efficient trading on platforms like Verse DEX by Bitcoin.com. By participating in liquidity pools, users help improve liquidity and ensure transactions occur quickly and efficiently, while also earning rewards from transaction fees. In this article, Financial Insight Daily will take a closer look at What Are Liquidity Pool (LP) Tokens and how they work in the world of decentralized finance (DeFi).

What Are Liquidity Provider (LP) Tokens?

Liquidity Provider (LP) tokens are cryptocurrency assets issued to users who provide liquidity to decentralized platforms like Uniswap.

In decentralized finance (DeFi), liquidity is a crucial factor for markets to function efficiently, allowing traders to easily buy and sell cryptocurrencies without causing significant price fluctuations. Liquidity providers contribute to this process by locking their assets into liquidity pools, which are token groups managed by smart contracts. Other traders can then exchange cryptocurrencies directly from the assets in the pool, rather than having to match orders with another trader as in traditional order book models.

In return for their contribution, liquidity providers receive LP tokens, which represent their share of the total crypto value in the pool. These tokens are typically fungible, and holders can freely trade or transfer them like any other token.

How Do LP Tokens Work?

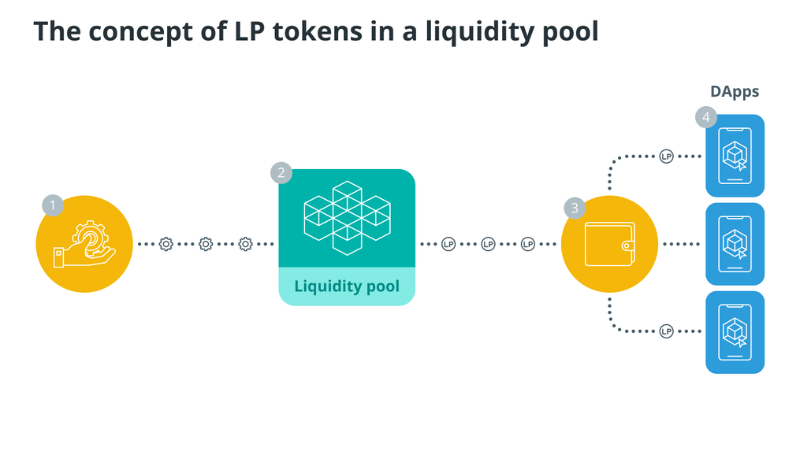

The process of earning and using LP tokens involves several steps:

- Contributing Assets: The liquidity provider contributes an equal value of two different cryptocurrencies (usually a token pair) to a liquidity pool on a specific DeFi platform. For example, in the ETH/DAI liquidity pool, the user will contribute an equal amount of Ether (ETH) and Dai (DAI).

- Creating LP Tokens: After the assets are contributed, the DeFi protocol will mint and assign LP tokens to the liquidity provider. The amount of LP tokens received is proportional to the amount of liquidity the provider contributed to the pool.

- Earning Rewards: When other traders perform swaps on the platform using the liquidity pool, they will pay fees for each transaction. The protocol distributes a portion of these transaction fees to the cryptocurrency liquidity providers as rewards. Holders can claim these rewards periodically.

- Dynamic Pool Incentives: The value of digital assets in the liquidity pool fluctuates due to trading activity and changes in the market prices of cryptocurrencies. Therefore, the value of the liquidity provider’s tokens also changes based on the performance of the pool.

- Exiting the Pool: If the liquidity provider decides to withdraw their digital assets from the pool, they can do so by burning their LP tokens. After burning, the smart contract will release their corresponding share of the underlying assets back to the user.

Benefits and Risks of LP Tokens

Benefits:

- Earn Passive Rewards: Liquidity providers (LPs) earn a share of the transaction fees generated on the platform, which can provide them with a passive income stream.

- Participate in DeFi: LP tokens allow users to actively participate in the DeFi ecosystem by providing essential liquidity. This system eliminates the need for centralized liquidity providers like market makers.

- Yield Farming: Some DeFi protocols allow LP token holders to stake their tokens to generate additional profits. This strategy, known as “yield farming,” helps traders maximize their potential profits from a deposited asset pair.

Risks:

- Impermanent Loss: LPs may face the risk of impermanent loss, which occurs when the price of tokens in the liquidity pool changes compared to their initial contribution. However, this loss is considered unrealized, as prices may return to their original market value. LPs only realize the loss if they exchange their tokens when the price is lower.

- Market Risk: The value of LP tokens is directly affected by the price volatility of the underlying cryptocurrencies, exposing liquidity providers to market fluctuations.

- Smart Contract Risk: DeFi platforms rely on smart contracts, and any vulnerabilities or exploits in the code could lead to financial losses for users.

Why Are Liquidity Provider (LP) Tokens Important?

Liquidity Provider (LP) tokens are a crucial part of the DeFi ecosystem, allowing users to contribute to liquidity pools and earn rewards for their participation.

While LP tokens offer exposure to various types of assets, they also come with risks such as impermanent loss and market volatility.

As with any investment, users should conduct thorough research and fully understand the associated risks before participating in DeFi liquidity provision.

Liquidity Provider (LP) tokens play an essential role in the decentralized finance (DeFi) ecosystem. By allowing users to contribute to liquidity pools and earn rewards, LP tokens help improve liquidity, which is crucial for efficient trading. However, while LP tokens offer various benefits such as passive rewards, yield farming opportunities, and participation in DeFi, they also come with risks like impermanent loss, market volatility, and smart contract vulnerabilities.