In the DeFi (Decentralized Finance) market, inefficiencies are inevitable, and this creates attractive financial opportunities. Arbitrage, or price discrepancies, is one of the prominent opportunities that offer the potential for significant profits with a low risk-to-reward ratio when executed properly. However, participating in DeFi arbitrage is far from simple; it requires participants to have in-depth market knowledge and strong technical skills. In this article, Financial Insight Daily will explore the arbitrage opportunities in DeFi, how they work, and how to leverage them effectively.

What is Arbitrage

Arbitrage is the process of buying and selling the same asset simultaneously in different markets to profit from slight differences in its price. It takes advantage of short-term variations in the price of identical or similar financial instruments across different markets or in different forms. Simply put, arbitrage is when you sell an asset for more in one market than what you bought it for in another. In the context of DeFi, arbitrage presents itself in several forms, each offering unique opportunities for profit. Let’s dive deeper into the various arbitrage strategies available in the DeFi space.

What is Bridge Arbitrage?

Bridge Arbitrage in DeFi refers to the practice of taking advantage of price discrepancies between different blockchains by using cross-chain bridges. A cross-chain bridge allows users to transfer assets, such as ETH, between different blockchain networks. This is particularly useful in the decentralized finance (DeFi) space, where there may be price differences for the same asset across various blockchains or layer-2 solutions. In the case of Bridge Arbitrage, participants can transfer an asset like ETH from Ethereum’s mainnet to a Layer-2 solution (e.g., Arbitrum, Optimism) and capitalize on the price differences between these networks, making a profit in the process.

How It Works

he concept of Bridge Arbitrage is relatively simple in theory. Here’s how it works step by step:

- Initial Transfer: You begin by transferring assets such as ETH from the Ethereum Mainnet to a Layer-2 network (e.g., Arbitrum or Optimism). This is done using a cross-chain bridge, which allows your assets to temporarily exist on the Layer-2 solution.

- Wait for Price Discrepancy: After the transfer, you wait for a price discrepancy between the Layer-2 network and the Ethereum Mainnet. Due to liquidity differences and market conditions, the price of ETH on Layer-2 might be slightly higher or lower than its price on the Ethereum Mainnet.

- Return the Assets: After the price discrepancy has been identified, you then transfer your ETH back to the Ethereum Mainnet, taking advantage of the price difference. For instance, if ETH is cheaper on the mainnet and more expensive on the Layer-2 network, you can sell your ETH at a higher price on the Layer-2 and buy back at a lower price on the mainnet, securing a profit.

Difficulty and Profit

- Low Difficulty: The mechanics of Bridge Arbitrage are relatively straightforward. The process typically involves transferring assets from one network to another using a cross-chain bridge and monitoring for price differences. Once you identify a favorable price discrepancy, you perform the transfer to lock in your profit. The process doesn’t require advanced technical knowledge but does require an understanding of the price dynamics on different networks and the ability to use cross-chain bridges.

- Low Risk: The risk involved in bridge arbitrage is generally considered low because it involves the transfer of an asset back and forth between networks rather than engaging in complex trades or volatile markets. The main risks arise from potential price fluctuations, transaction fees, and network congestion, which could eat into profits. However, if done properly, it is often seen as a lower-risk strategy compared to other types of arbitrage.

Stablecoin Arbitrage

Stablecoin Arbitrage refers to the strategy of exploiting price discrepancies that occur with stablecoins, such as USDT (Tether), USDC (USD Coin), or DAI. Stablecoins are designed to maintain a stable value by being pegged to a reserve asset, usually the US dollar, with a target price of $1. However, due to market fluctuations, liquidity issues, or crises in the ecosystem, stablecoins can occasionally trade below or above their pegged value. Traders can capitalize on these discrepancies by buying stablecoins at a lower price and selling them once the price returns to its pegged value.

A classic example of Stablecoin Arbitrage occurred after the collapse of the LUNA ecosystem in 2022. The algorithmic stablecoin UST, part of the Terra ecosystem, lost its peg to the US dollar, causing severe market turmoil. During such a collapse, even well-established stablecoins like USDT can experience short-term drops below their target value, creating arbitrage opportunities for traders.

How Stablecoin Arbitrage Works

The process of stablecoin arbitrage involves buying the stablecoin when its price drops below its pegged value and waiting for the price to return to its intended value (usually $1 USD). Here’s a step-by-step breakdown:

- Price Discrepancy Identification: Traders first monitor the price of a stablecoin (e.g., USDT) across different exchanges or markets. If the price drops below $1 (for example, USDT may be trading at $0.98), this creates an opportunity for arbitrage.

- Purchase the Stablecoin: Once a price discrepancy is identified, the trader can purchase the stablecoin at the lower price. Since stablecoins are pegged to a fixed value, this represents an opportunity to buy the asset below its inherent worth.

- Sell for a Profit: After the price of the stablecoin returns to its pegged value (e.g., when USDT returns to $1), the trader can sell the asset at its original pegged value, making a profit from the difference in price.

- Repeat the Process: If the price continues to fluctuate, traders can continue the process by repeatedly buying low and selling at the pegged value to secure consistent profits. These opportunities may arise during times of market volatility, liquidity crises, or when large buy or sell orders distort the price of stablecoins.

Profit and Risk in Stablecoin Arbitrage

While stablecoin arbitrage can be relatively easy to execute, it carries certain risks that traders should be aware of:

- Low Difficulty: The process of stablecoin arbitrage is generally straightforward. Stablecoins are typically traded across many platforms and exchanges, so it’s easy for traders to spot price discrepancies and take advantage of them. The difficulty lies in the speed at which these opportunities arise and the efficiency of the market in correcting them.

- Price De-Pegging Risk: The major risk involved in stablecoin arbitrage is the phenomenon of “de-pegging.” A stablecoin’s value is generally maintained by algorithms or reserves (in the case of fiat-collateralized stablecoins). However, if the mechanism holding the peg fails (such as during a liquidity crisis or a system-wide failure), the stablecoin may lose its peg and trade at a significantly lower price. Traders who buy a de-pegged stablecoin might not be able to sell it at the fixed price they expect, leading to substantial losses. This was notably the case during the collapse of Terra’s UST, where the algorithmic stablecoin lost its peg and triggered a market-wide sell-off.

- Algorithmic Stablecoin Risk: Algorithmic stablecoins (those not backed by collateral but rather by algorithms to maintain their peg) can be particularly risky in arbitrage. These stablecoins are more susceptible to market volatility, sudden de-pegging, and catastrophic events (such as the collapse of the Terra ecosystem). If an algorithmic stablecoin loses its peg, the price can drop significantly, making it difficult to profit from the arbitrage opportunity or even leading to losses.

- Transaction Fees and Liquidity: While stablecoin arbitrage may seem simple, transaction fees (gas costs, exchange fees, withdrawal fees) can erode the profit margin. In addition, liquidity issues on certain exchanges may prevent the ability to execute trades at optimal prices, and slippage can also affect the profitability of the arbitrage.

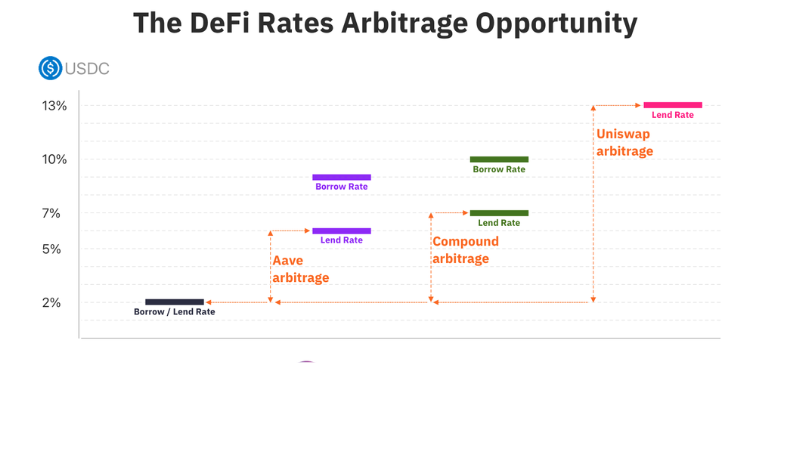

Yield Arbitrage

Yield Arbitrage involves seeking interest rate discrepancies between lending and borrowing platforms. For example, you might borrow DAI at a lower interest rate on a platform like Aave and lend it on another platform at a higher interest rate, profiting from the rate difference.

- Profit opportunity: Yield discrepancies can arise between DeFi and CeFi platforms.

- Difficulty: Such opportunities are rare and often disappear quickly.

Asset Arbitrage

Asset Arbitrage involves exploiting price differences between exchanges. For example, you can buy Bitcoin (BTC) at one exchange at a lower price and sell it at another exchange at a higher price. Another example is the price discrepancy between ETH and staked ETH on platforms like LIDO.

- Operation: Bots are often used to execute these transactions automatically. However, they require coding skills and significant capital to generate profits.

Risks and Complexity

- Smart contract risk: Smart contracts across different exchanges could have bugs or vulnerabilities that can be exploited, risking your funds.

- Asset price risk: Events like stablecoin de-pegging can introduce unexpected risks for arbitrage traders.

- Gas risk: Volatile Ethereum gas fees can erode the profits from arbitrage.

Arbitrage opportunities in DeFi present an exciting way for traders to capitalize on inefficiencies in the market. Whether it’s through Bridge Arbitrage, Stablecoin Arbitrage, Yield Arbitrage, or Asset Arbitrage, these strategies allow participants to profit from price discrepancies across different platforms or blockchains. While the potential for profit is significant, especially when market conditions are volatile, it’s essential to approach these opportunities with caution and expertise.