Peering into the crystal ball of Wall Street doesn’t have to be a cryptic endeavor. Unearthing the secrets behind the sharp rises and sudden dips requires a keen eye on the factors affecting the stock market forecast. It’s a game of chess where every move by the Fed, a twitch in GDP, or an overnight shift in market mood could turn kings into pawns.

In the coming chapters, I’ll guide you through the economic indicators and financial subtleties that paint the bigger picture. We’ll connect the dots between central bank policies and the wavering lines of stock charts. Uncover how a company’s earnings report can spell success or chaos in the trading arena. In a world brimming with information, let’s focus on what really steers the markets.

The Fed’s Footprint: Central Bank Decisions and Monetary Policy

Interest Rate Strategies and Their Market Impact

When central banks tweak interest rates, it’s like they’re turning a giant wheel that speeds up or slows down the economic engine. Picture a big dial that can make your savings grow faster or slash what you pay on loans. This is no child’s play; we’re talking serious money moves here. Central bank decisions can make prices for things like houses and cars go up or down. And yes, they can make your wallet feel heavier − or lighter.

Now, interest rate changes have this magic wand effect on stocks. Let’s say rates drop. It’s like the stock market gets a green power-up, making it more attractive for investing. Why? Because bonds and savings accounts don’t pay much, so people buy stocks instead, hoping for bigger wins. But when rates hike, it’s the opposite. The stock market might sulk because other places might look better for parking your cash.

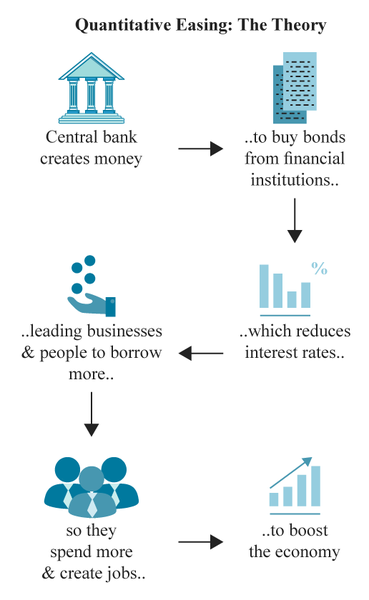

Quantitative Easing and Its Influence on Equities

Have you ever heard of quantitative easing (QE)? It’s like the central bank goes on a shopping spree, but instead of clothes, it buys loads of government bonds and other investments. This big buy-in pumps money into the system, making it easier for banks to lend you cash for your big dreams.

And stocks? They love QE! It’s like they’re at a party with a never-ending supply of their favorite snacks − cash! When the central bank pumps money into the economy, businesses find it easier to grow and investors are more eager to buy stocks. Think of it as financial confetti making the stock market dance with joy.

But it’s not all about parties. When the central bank eventually says it’s time to clean up and stops QE, stock markets might get a tiny bit grumpy. They got used to lots of cash and aren’t so keen on the idea of less money floating around. This is when smart investors keep a keen eye on what’s next.

In short, don’t underestimate the Fed’s moves. They lay down tracks for the stock market train. Keep your eyes peeled on interest rate changes and the central bank’s cash flow magic with QE. It’s a sure bet these will shake up the stock market playground in ways that really matter to your pocket.

Inflation and GDP: Macroeconomic Factors Steering Stock Performances

Dissecting the Inflation-Stock Price Correlation

Inflation and stock prices love to dance. Their dance steps can be tricky. When inflation goes up, it costs more to buy stuff, and companies might make less money. This can cause stock prices to drop. But sometimes, slight inflation can signal a strong economy, and that’s good for stocks. Think of inflation like chili peppers—just enough can make the dish great, too much and it’s hard to swallow.

How GDP Growth Translates to Equity Market Dynamics

Let’s talk about GDP growth and stocks. When a country’s GDP rises, it means the economy is growing. This is awesome for companies because it means more dough to make and sell stuff. This can lead to beefier profits and higher stock prices. It’s like when a garden grows a lot of tomatoes, there’s plenty to go around, and everyone is happy.

Now, let’s get real. You’ve got to keep an eye on inflation and GDP, they’re big deals in the stock world. If inflation gets too hot, the central bank might hike up interest rates to cool things down. Higher rates can make borrowing money pricier, and that can hit stocks like a ton of bricks.

On the flip side, if GDP keeps chugging along, creating jobs and wealth, that’s like music to investors’ ears. More money and jobs mean people spend more, and that’s a high-five for stocks.

Don’t forget, though, other stuff matters, too. We’ve got central bank decisions that can make or break the party. Changes in interest rates can be game-changers for stocks. Then there’s corporate earnings that tell us if companies are scoring or fumbling. And let’s not forget, the world stage is full of drama with geopolitical events that can shake markets up.

Ever watch folks in the stock market? They’re a jumpy bunch. Market sentiment analysis keeps tabs on their mood swings. Stock valuation methods help us figure out if a stock is bargain-priced or too pricey. And keeping an eye on financial market trends is like having a crystal ball, almost.

Bottom line: remember inflation and GDP are like the weather for stocks. Too stormy or too sunny, either way, it changes how you want to play outside. Keep your eyes peeled on these big kids on the block, because when they move, they move mountains. And that, my friends, is how the cookie crumbles in the stock market’s wild world.

Corporate Health and Geopolitical Dynamics: Earnings and Events that Reshape Markets

Corporate Earnings Reports: Navigating Through Noise and Numbers

Do earnings reports affect stock prices? Yes, they do, a lot. They show if a company makes money or not. Investors listen in. Gains mean stocks may rise. Losses might lead to falls. It’s a bit like a report card for companies.

Let’s dive in deep. Every three months, companies tell us how they did. It’s their earnings report. They share sales, profits, debts, and more. Good news can boost a stock’s price. Bad news can drop it fast. Smart folks like you and me use this to decide. We pick stocks by how well a company does. But wait, it’s not only about good or bad.

People also compare what’s expected with what happens. If a company beats the guess, prices can jump. If not, prices may take a hit. This makes earnings season a key time for the market. It can swing prices this way and that.

Geopolitical Events: Understanding Market Volatility Amidst Uncertainty

Do events around the world impact stocks? Yes, they shake markets up! World news can make stocks jump or fall. It’s a big deal for money folks and regular Joes.

Let’s break this down. The world is a busy place. Elections, wars, deals, and even tweets can stir markets. If news scares people, they may sell stocks. They crave safety. But if news gives hope, folks might buy more stocks. They smell profit. Prices can go up.

Here’s a good example: oil. Trouble in oil lands can make oil prices shoot up. Companies that need lots of oil may then have to spend more. This can cut into their profits. Stock prices may drop. But for oil companies, high oil prices mean more cash. Their stocks might climb.

In the end, both earnings reports and world events can move stock prices. Money masters watch them close. They help figure out where stocks may go. It’s a mix of numbers, news, and how people feel. This shapes how stocks do. And that, my friends, is a piece of the puzzle in the stock forecast mystery.

The Market’s Pulse: Sentiment, Valuation, and Trend Analysis

Market Sentiment Analysis: The Behavioral Drive of Stock Movements

Have you ever felt the buzz in the stock market air? That’s market sentiment for you. It’s how people feel about stocks overall. It’s about fear or cheer that spreads among investors. This feeling can push stock prices up or down.

How do people figure out this feeling, you ask? They look at news, reports, and even social media. They see if investors are happy or scared about the future. This can make a big difference. If many investors feel good, they might buy more stocks. This pushes prices up. But if they’re worried, they might sell. This can cause prices to drop.

Market sentiment isn’t just a gut feeling. It’s a powerful force, and we can measure it too. We use special tools and surveys to understand it. By knowing the mood, we make better guesses about stock moves.

Let’s say a big company’s stock is in the news a lot. If the news is good, people might feel more hope. They’ll want to buy that stock. This can make the price go higher.

Financial Market Trends: Beyond the Hype to Long-Term Indicators

Now, let’s talk trends. Not the latest fashion, but the paths stocks take over time. These trends show us more than what’s hot today or tomorrow. They can show us where the market might go in the next few years.

Financial trends include a lot going on in the world. Things like new tech or big deal changes between companies. These can sway the whole market. Also, when many stocks move together in a certain way, that’s a trend. It gives us clues about the market’s future.

To spot these trends, analysts dig deep. They look at charts and lots of numbers. They check how stocks have done in the past. This helps them guess where they’re going. It’s not perfect, but it gives us a good idea. While some follow the crowd, smart investors look for real, lasting trends. Those are the moves that can count most in the long run.

In short, trends are like the market’s path. They help us to think ahead about where stocks might head.

So, there we have it – feelings and paths. In stocks, both are big deals. They help us see what could be next. It’s part of the great mystery of the market. By looking at sentiment and trends, we get closer to solving it.

In this post, we dove into how key factors like the Fed’s moves, economy growth, and big world events affect stocks. We saw how interest rates can make markets rise or fall. We also learned that when the government buys a lot of bonds, it can make stock prices go up.

We talked about how high prices can scare stock buyers and what happens to stocks when a country’s economy is doing well or badly. Then, we explored how a company’s money report and events in other countries can make stocks jump around. At last, we looked at how people feeling hopeful or scared can change stock prices, and why it’s key to look at trends, not just the hot news.

Now, to finish up, remember that smart stock moves come from understanding all these parts. Keep a close eye on what’s happening with money policies, how much things cost, and big news. This can help you guess what might happen with stocks. Being in the know can help you make smart choices in a world where stocks move fast. Thanks for reading! Let’s keep learning and growing our money smarts together.

Q&A :

What are the key factors that impact stock market predictions?

Stock market forecasts are influenced by a broad array of factors. These range from macroeconomic indicators like GDP growth rates, inflation, and unemployment figures to microeconomic factors such as individual company earnings and management performance. Additionally, political stability, monetary policy changes, and market sentiment are crucial, as they can dramatically sway investor confidence and, consequently, stock prices. Understanding the interplay of these aspects is essential for making informed predictions about stock market movements.

How does global economic performance affect stock market forecasting?

Global economic performance significantly affects stock market forecasting, primarily because markets are interconnected and sensitive to international trade and investment flows. A robust global economy generally leads to higher confidence and increased investment, propelling stock markets upward. Conversely, a sluggish or unstable global economy can lead to decreased risk appetite, resulting in lower stock prices. Key metrics include global trade balances, currency exchange rates, and economic health indicators of major trade partners.

Can political events forecast stock market trends?

Political events can have a profound impact on stock market trends as they can alter investor expectations about the future economic and regulatory environments. Elections, legislative changes, geopolitical tensions, or peace agreements can all serve as catalysts for market movements. Investors often analyze political stability and government policies related to taxation, trade, and industry regulations when forecasting stock market trends.

How do interest rates influence stock market forecasts?

Interest rates are a foundational element in the realm of stock market forecasts. Central banks use interest rate policies to manage economic growth. When rates are low, borrowing is cheaper, likely stimulating investment and expansion, and potentially leading to stock market gains. High interest rates, however, can increase borrowing costs, slow down economic growth, and potentially cause stock market declines. Investors closely observe central bank announcements and interest rate trends to gauge the market’s direction.

In what ways do company earnings reports affect stock market predictions?

Company earnings reports are critical in shaping stock market forecasts as they provide a direct insight into a company’s performance and profitability. Positive earnings typically suggest a healthy, growing company, often resulting in a stock price increase. Conversely, disappointing earnings can lead to stock sell-offs. Frequent monitoring of aggregated earnings reports during earnings seasons can offer a broader sense of the market’s overall health and anticipated trajectory.