Best stocks to buy in 2024: are you ready to make your move? As an experienced investor, I live for the thrill of spotting the gold before the rush. The market’s always shifting, and tomorrow’s winners are today’s hidden gems. I’m here to give you the insider tips and keen insights you need. We’ll dive into emerging sectors, uncover undervalued picks, and tailor strategies to ensure your portfolio shines in 2024. Get set for high growth without the jargon. Let’s ride the wave to market domination, together.

Identifying Top Stock Investments for 2024

Evaluating Stock Market Forecast Trends and Predictions

Let’s get right to the chase. When we talk about the best stocks to buy in 2024, it’s all about the future. What’s going to make money? We don’t have a crystal ball, but we can spot trends. Trends tell us where the money might flow.

So, what does the stock market forecast for 2024 say? It points to tech, green energy, and healthcare. These areas are hot and getting hotter. People love their gadgets, going green, and keeping healthy. Companies in these areas could see their stocks soar.

Pinpointing Stocks with High Growth Potential

Now, let’s dig into some specifics. We’re looking for high growth potential. What are these stocks? Often, they’re not the big names yet. They might be smaller, but they’re ready to explode. They’ve got great ideas, great leadership, or they’re in a super-hot field.

Think of investing in equities in 2024 as a treasure hunt. You want those hidden gems. These promising stocks of 2024 could be in tech, like the next big app. Or in renewable energy, where the world is putting its dollars.

I can’t tell you the exact names of these stocks right here. Yet I can tell you where to look. Look at the sectors we just talked about. Tech, renewable energy, and healthcare. Also-don’t forget AI and biotech. These fields are changing our world. And changing worlds mean growing stocks.

Each year investment opportunities in stocks pop up. It’s like a game of musical chairs. Some sectors rise, and others fall. For 2024, keep an eye on markets ready for a leap. We’ve seen energy shift towards clean sources. Electric cars are everywhere. Solar panels too. Companies making these could be your 2024 market winners.

What about wow factors – those stocks that simply blow up? AI is one to watch. Machines that learn? That’s future right there. And with the global push for better health, biotech is booming. New cures, new treatments – there’s big money in that.

Now, don’t run off buying every stock you see. I’ve been doing this for years, and I’m still careful. When I give stock portfolio recommendations for 2024, it’s after a lot of digging. I look for the undervalued stocks to watch. The ones that don’t just look good on paper.

Make this your plan for high-performance stocks in 2024. Look at the industry. Is it growing? Then look at the company. Is it solid, with good leaders? Does it make something we need? If your answers are yes, you might have a winner.

And that’s my take as a stock analyst for 2024. Stay sharp, look ahead, and maybe we can both see some solid gains. After all, finding top stock investments in 2024 isn’t just my job. It’s our ticket to a nice piece of that future money pie.

Investing Strategies for a Profitable Portfolio in 2024

Diversification Techniques and Sector Analysis

To win in 2024, you need a mix of stocks. This means having bits from different areas. Think of it like a smoothie with many fruits. More variety makes things stronger in your portfolio. Stocks from tech, health, and energy make a great blend. Tech is booming. Health keeps growing. Energy is vital and changing. Put them all in and you’re set for a good year.

Now, let’s talk sectors. It’s not just about picking any stock. We want the best. We want the stars of their sectors. Spotting winners isn’t simple. We look at numbers, trends, news, and more. Some call this homework. I call it the hunt for gold. With all that info, we find the gems. We find stocks that not just inch up but leap forward.

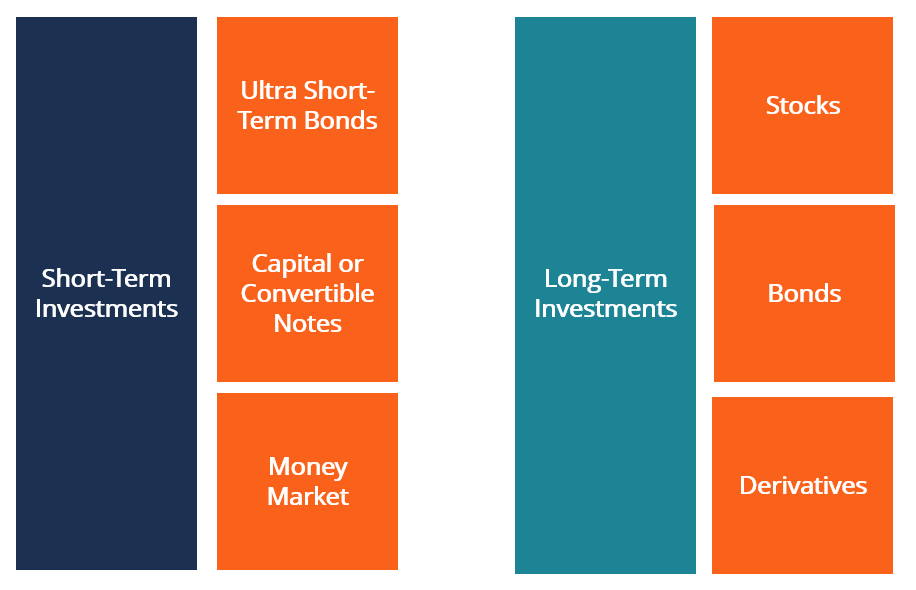

Analyzing Long-term Stock Investments vs. Short-term Opportunities

When we say long-term, we mean stocks we’ll keep while we grow older. These are for the future. They are safe and steady, like a trusty old bike. Short-term is different. It’s fast. It’s for quick wins. Like a sprint, in and out, but more risky. The trick is to balance both. Long-term for your dreams ahead, and short-term to spice things up now and then.

For 2024, what’s the move? It’s both. Mix them up. Get the steady ones for peace of mind. Then add some zippy ones for fun. This way, if things go wild, you’re cool. If things fly high, you win too. It’s about being smart. Watching the road but also ready to jump. This is how we play the game. This is how we aim to win.

In stock talk, we know numbers are king. So, we look at the past to guess the future. We take notes from 2023. We eye every twist and turn to guess 2024’s map. Predicting is risky, but no guts, no glory. And with sharp moves, we get the crown. Remember, the market is a puzzle. And we’re here to solve it.

In a nutshell, 2024’s plan is clear. We diversify, we study sectors, and we balance time. We keep long-term anchors and short-term racers. It’s a dance of fast and slow. With sharp eyes on trends, we pick stocks that can soar. We’re set for a mix that is fresh and bold. This is our path to a top-dog portfolio in 2024.

Emerging Sectors and Undervalued Stocks to Watch

Scouting for Renewable Energy and Biotechnology Market Leaders

Investing in equities in 2024 means looking at renewable energy and biotech. Why? These sectors are growing fast. And they aim to solve big problems. Think clean power and health.

Looking at renewable energy, watch for companies making big steps. These could be in solar, wind, or new tech we’re just seeing. They could lead the market. Most of all, they could give your stock picks a good boost.

One key tip: Go for firms with solid tech and a clear edge in the market. They stand a better chance to grow. Plus, they can be undervalued. This means you could buy these stocks at low prices before they shoot up.

We all know health is a big deal, too. Biotech firms work on life-saving drugs and treatments. So, investing in these could mean big wins as their products hit the market. Already, some drugs and therapies are changing lives. Your goal? Find firms doing work in areas with no good treatment yet. They could become the next big stock in 2024.

The Rise of Artificial Intelligence: Stocks Poised for Growth

Artificial intelligence (AI) is not just buzz. It’s a robust stock sector in 2024. Top tech companies are all in on AI. And it’s easy to see why.

AI helps us in many ways. From smart cars to helping doctors, it’s all around us. What’s more, it’s getting better every day. This means investing in AI could pay off as it grows. Your stock market tips for 2024? Look for firms that use AI in new, smart ways. These could be your high-performance stocks.

Remember, tech moves quick. So, your top stock investments for 2024 need a good look at AI. You want stocks that can use AI to lead their fields. That way, you’re in on the ground floor of growth.

So, let’s wrap it up. Renewable energy, biotech, and AI. These are your next big things in 2024. Keep these in your sight when investing in equities in 2024. They’re ripe with potential and could be your ticket to a profit-filled year. Choose wisely, and you could find a gem among these promising stocks.

Structuring a Robust Stock Portfolio for Market Domination

Incorporating Financial Sector and Blue-Chip Stocks for Stability

To nail market wins, mix in some stable giants. Imagine a basketball team. Now, mix seasoned pros with your top draft picks. That’s how we mix blue chips and sector leaders in a stock portfolio for a sure win. Think of blue-chip stocks as your all-star players. They have good records, they’re big, and they win games—think of companies everyone knows and trusts. They bring calm to your portfolio when markets get rough.

Now, let’s focus on the financial sector stocks. Like great team coaches, banks and insurers steady the play. They can grow your cash just by being part of the banking world, which always is in demand. When times get tough, they often still stand firm, making them key for your stock defense. You want safe plays? Look at these stocks.

Low risks and steady growth make these your go-to for portfolio muscle. By investing in equities of big-name companies, you’re setting the stage for a solid run. You don’t win races on luck. Smart choices in steady stocks bring home the trophy. So, pick companies that keep shining, even when the game gets tough. That’s how you build to last.

Identifying Dividend-Yielding Stocks for Consistent Returns

Cash return on stocks sounds good, right? That’s dividends for you. They pay you back just for holding onto their shares. Think of it like getting paid to cheer for your favorite team. Dividend stocks give you a part of their profit every year. This adds to your overall stock score. What’s the smart move here? Look for companies that hand out cash regularly. We want ones that keep lifting their dividends—signs they’re doing great and sharing wins.

How do you find these stars? Check their history. You want long stretches of dividend handouts. Look for firms lifting payouts year by year. This means they’re not just strong now, but they keep getting better. Use this strategy, and your portfolio will thank you. These stocks bring in cash when things look down and keep rising when they look up. It’s like having a player who scores both in defense and attack.

You want a tip? Tech and healthcare often skip dividends for growth. It’s your call on where you stand—if you want steady cash, aim for other fields. Not all industries play the same.

To wrap it up, make your portfolio rock-solid with big, reliable players from the financial and blue-chip leagues. Don’t forget those dividend payers. They’re part of the winning formula for cash that keeps coming, no matter how markets move. You keep these tips in your play, and your stock portfolio will stand tall, ready to take on the games of 2024.

We looked into picking top stocks for 2024, checking out trends and finding those big-growth gems. Smart strategies will help you build a money-making mix in your portfolio. Don’t just bet on short wins; think about the long haul too. Also, check out new areas and undervalued stocks—like clean power and tech brains—that could really take off. A solid set of stocks, with firm favorites and new stars, will make your money work hard. Remember, toss in some dividend champs to keep that cash coming. In short, stay sharp, spread your bets, and watch for tomorrow’s high-flyers. It’s your move for winning at stocks in 2024. Keep it smart, keep it balanced, and you’re set for success.

Q&A :

What are the projected top-performing stocks for 2024?

Investors looking toward 2024 are keen to identify stocks with solid growth prospects. While no one can predict future market leaders with absolute certainty, industry analysts often point to tech innovators, renewable energy companies, and healthcare firms as potentially high-performing sectors. Due diligence and attention to market trends are essential when considering stock investments for 2024.

How do I choose the best stocks to invest in for 2024?

Choosing the best stocks for any investment year requires a blend of strategic thinking and research. Look at companies with strong fundamentals, such as healthy cash flow, solid growth projections, and competitive advantages within their industries. Analyst reports and market data can provide insights into which stocks are poised for growth in 2024.

What trends should investors watch when selecting stocks for 2024?

In the financial world, staying ahead of trends is key for a successful investment strategy. For 2024, keep an eye on sectors that are benefitting from long-term trends like digital transformation, sustainability, and demographic shifts. Emerging technologies such as AI, 5G telecommunication, and electric vehicles might also be areas where growth-oriented stocks can be found.

Can international stocks be good buys for 2024?

Yes, diversifying your portfolio with international stocks can provide growth opportunities and mitigate risk. Look for emerging markets with growing economies and industries. It’s important, though, to consider geopolitical stability, currency risks, and foreign investment regulations when evaluating international stocks for 2024.

What should long-term investors consider when picking stocks for 2024?

Long-term investors should focus on stocks with a potential for steady growth, strong business models, and the ability to withstand market fluctuations. Companies leading in innovation, with a history of adapting to changes and consumer needs, often make for sound investments. Don’t forget to re-evaluate your long-term holdings regularly to ensure they’re still aligned with your investment goals for 2024 and beyond.