Stock Market Forecast Essentials: Navigate Your Investments Smarter

Gone are the days of guessing games in stock trading. With the right Resources for stock market forecast, you can make informed choices. Smart investors don’t just trust their gut; they lean on robust prediction tools. We’ll explore how algorithmic trading can sharpen your strategies and why financial forecasting models are crucial. You’ll discover how technical analysis software and market trend indicators work to your advantage. And I’ll walk you through the power of economic forecast reports and market sentiment. Ready to dive in? Let’s decode predictive analytics and machine learning to transform how you trade. Your investment savvy deserves it.

Understanding Stock Market Prediction Tools

Embracing Algorithmic Trading Predictions

When it comes to smart investing, algorithmic trading predictions are your new best friend. These amazing tools use math to find patterns in the stock market. They can help us make fast, smart choices about where to put our money. How cool is that? Instead of guessing, we can use these predictions to make money in the stock market.

Algorithm-based forecasting services are behind the power of these predictions. They can sort through tons of data in a blink. They look at past prices and trends to guess where stocks are headed next. It’s like having a crystal ball, but it’s all math and computers. This means we put less guesswork into our investments. And that makes us feel a bit more at ease.

Utilizing Financial Forecasting Models

Let’s chat about financial forecasting models next. These are smart tools that look at what might happen in the market. They look at stuff like how much people are making, spending, and other money signs. It’s like taking a peek into the future of money.

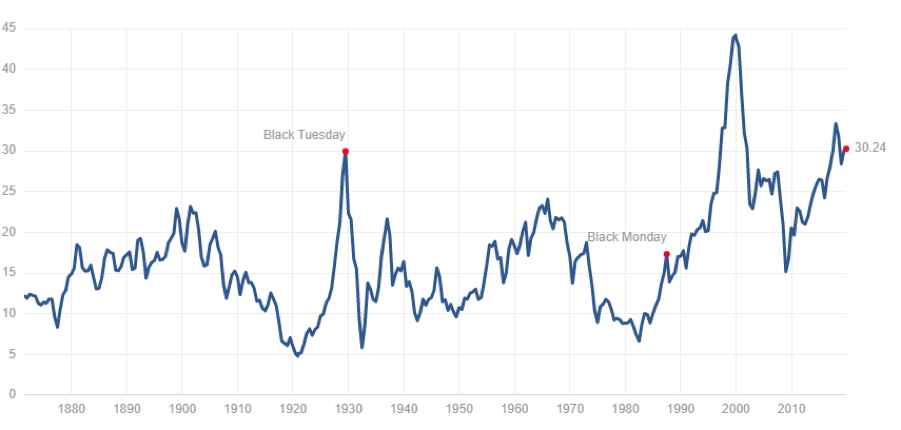

These models are important for making good money choices. They help by showing the possible ups and downs in the market. So, they can whisper to us the best times to buy or sell stocks. We can thank economic indicators for investors for these hints. These indicators are like signposts on the investing road. They show us which way the money is moving.

Tools like stock market prediction apps and investing software analysis are on our team too. They take a lot of info and crunch the numbers. This helps us see which stocks might be stars and which might flop. We get to look at all the clues before we decide where to put our hard-earned cash.

And let’s not forget about market sentiment analysis. This is like measuring the mood of the stock market. It checks out what people are saying and feeling about the market. We can use this to understand if people are scared or excited about investing. Sometimes, when a lot of people feel good about the market, it means stock prices might go up.

Using stock prediction machine learning is another smart move. Machine learning is like giving a computer a brain that gets better over time. It can learn what makes the stock market tick. Then it can give us hints about which stocks might do well.

In summary, we’ve got a toolbox of cool stuff like quantitative trading models, investment analysis platforms, and technical trading tools. They make it easier to know when to buy or sell stocks. They can also help us stay chill when the market goes all wacky. With these tools, we can make smarter choices and maybe even make more money. And that’s what investing is all about, right?

Leveraging Investment Analysis Platforms

Unpacking Technical Analysis Software Capabilities

Tools shape traders. Great tools make for smarter investing. Imagine driving a car without a fuel gauge. You wouldn’t know when to refuel. Without technical analysis software, it’s the same in the stock market. You trade blind. Thankfully, these tools read the market’s pulse. They look at past prices and volumes. This data drops clues for future moves. It’s looking back to see ahead.

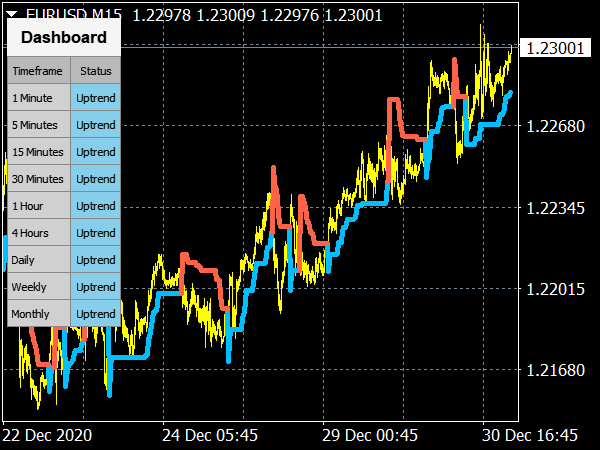

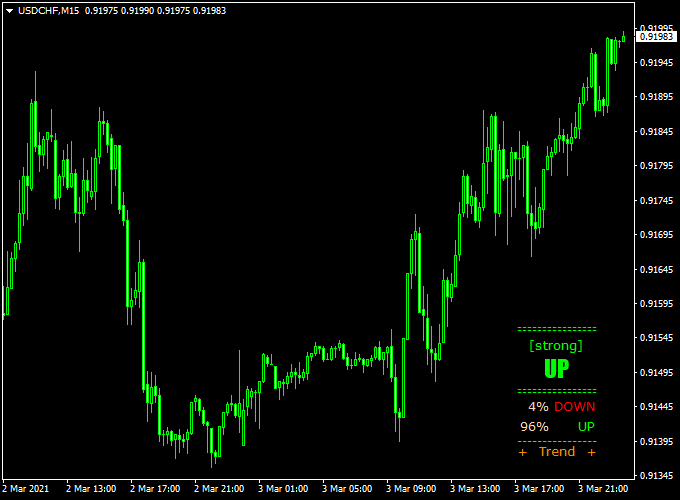

With investing software analysis, we turn guesses into educated picks. These platforms come loaded. They boast indicators like Moving Averages, RSI, and Bollinger Bands. How do they help? Moving Averages smooth out price action. They cut through the noise, showing trends. RSI gauges if stocks are over or under sold. Bollinger Bands predict volatility. When price bands tighten, get ready. A big move may be brewing.

Simple, right? Yet these tools are mighty. They help us spot buy or sell signs. Those new to investing find them user-friendly. You won’t need a math degree. The software does the heavy lifting. You focus on making choices. The best tech helps you grow your money tree with care. It’s like finding a hidden map to treasure in the stocks you eye.

Interpreting Equity Market Trend Indicators

Now, let’s chat about equity market trend indicators. “What’s a trend?” you ask. It’s a stock’s general direction. Up, down, or flat. Why care? Because trends are friends. Go with trends, not against. Like swimming with the current, it’s easier. Fighting trends can make for tough times.

Investment analysis platforms show these trends. They use price action, volume, and time. It’s not about one day’s move. It’s the tale over weeks, months, or years. Look for patterns. Is the stock making higher highs? It’s likely in an uptrend. Your signal to consider hopping in. If it’s dropping to new lows, beware. It might be time to step away.

Algorithms help too. They use past data to guess future moves. Think weather forecasts but for stocks. Stock forecast algorithms use lots of data points. They improve as they learn. No crystal ball needed. They give smart insights to shape your decisions.

Beyond algorithms, we keep ears to the ground. It’s called market sentiment analysis. How do people feel about the market? Scared or bullish? This mood impacts stock prices. A scared market can dip. A bullish one? It may rise. Remember, mood can change fast. Keep a steady hand on the wheel.

Predicting stocks is part science, part art. With the right tools, you can paint a brighter financial future. These platforms offer help for every level. Newbies get tutorials. Pros enjoy advanced features. All to make sure you’re not left in the dark. They’re your hedge against guesswork and hunch-based bets.

In essence, use these platforms to stay sharp. Keep learning, stay curious. The stock market keeps on changing. Your tools should too. Adapt and thrive in this exciting investment jungle.

Integrating Economic Indicators and Market Sentiment

Analyzing Economic Forecast Reports

Let’s dive into how economic forecast reports can guide us. These reports are like weather forecasts for the market. They help us see what might come next in the world of cash and stocks. By looking at how money moves and grows, they guess what the stock market might do. They look at things like jobs reports, the cost of living, and how much stuff people buy.

Economic reports tell us how the country’s doing. They give us clues about how well people can spend money. If folks have jobs and can buy the TV, toys, or food they like, it’s a good sign for the market. We watch these numbers close to see how they change. These changes can make the stocks we pick go up or down.

Good investing means knowing these reports. They shape how we think and what we do with our money. If you get these reports and see what’s in them, you can make smart moves before others. It’s like getting news on who might win a race. Knowing this stuff can make you win in stocks too.

Conducting Market Sentiment Analysis

Now, let’s chat about market sentiment. It tells us what people feel about the market. Are they scared or happy to spend money? This feeling can push the prices of stocks. It’s a bit like a game. If most folks think stocks will go up, they buy more. This can make prices go up too.

Market sentiment is tricky. It’s like guessing what your friend will like for their birthday. We look at what people tweet or post online about stocks. We listen to big bosses and people who know a lot about money. We see how they act – bullish like a charge or bearish like they’re hiding for winter.

When we review all this chat, we get a good guess of where things might go. It’s another tool we use, along with all those reports and numbers. Both big pros and folks at home use it to choose the best stocks.

Putting it all together, we use tools that mix solid facts and how people feel. This helps tell us where the stock market might jump. We want to know when to ride the wave or when to sit tight. This knowledge gives us power. We can plan better and maybe make more money.

Figuring out stocks can be tough. But using these forecast reports and feeling the market mood can make you a pro. You learn to see what happens before it comes. It’s like being a treasure hunter with a map. You might find the gold first.

By taking both facts and feelings into the mix, you can play the stock game better. You get ready for what’s coming. That’s what makes your moves sharp and your money work hard. This way, we are all set to ride the highs and lows of the market game.

Advancing with Predictive Analytics and Machine Learning

Exploring Stock Forecast Algorithms

Let’s dive into stock forecast algorithms. They help us see where the market might go. These tools look at past market data and try to spot upcoming trends. Imagine you have a crystal ball, but for stocks. These algorithms are like that, but they use math, not magic. We feed them tons of data. This data can be past stock prices, how many goods a company sells, or big global news.

Stock forecast algorithms use all this info to guess future prices. Some use simple math, while others use complex machine learning. Machine learning lets the computer learn as it goes, getting smarter over time. But remember, they’re just educated guesses. No tool gets it right every time. That’s why smart investors don’t rely on just one tool.

Deploying Financial Market Simulators and Trading Bots

Now, let’s talk about financial market simulators and trading bots. Think of market simulators like video games. They let you practice trading without risking real money. You can try different moves, learn from mistakes, and get better. They show you the ropes of buying and selling stocks in a safe place.

Trading bots are a bit different. They are like having a robot friend that trades for you. You tell the bot what rules to follow, and it trades stocks on its own. It’s like autopilot for investing. Some bots use simple rules, like buying when a stock hits a certain price. Others might use those fancy stock forecast algorithms we talked about before.

Both simulators and bots can make trading less scary. They help you learn and make moves without you having to watch the stock market all day. This is great for new investors or really busy people. Just remember to check on your bot buddy. You need to make sure it’s doing what you want.

In using these advanced tools, it’s important to stay humble. They are powerful, but not foolproof. Always use them with careful thinking and never stop learning. By combining these technologies with your own smarts, you can make better choices with your money. And that’s what being a smart investor is all about.

To wrap up, we’ve dived into smart tools that predict stock movements. We talked about how algorithmic trading uses complex math to spot buying and selling chances. Plus, we looked at forecasting models that crunch numbers to guess future prices.

We also explored platforms that help with tech analysis and how to read signs that hint at where stocks might head next. Moreover, we can’t ignore how big economy events and people’s feelings about the market shape stock prices. These clues give us a broad picture of where things might go.

Lastly, we’ve seen that learning about algorithms and using simulators can seriously up our investment game. These tools are like having a crystal ball but for stocks, weaving together tons of info to guide our choices. So, stay sharp, use these smart tools, and you’ll have a better shot at making wise investment moves. Remember, no tool is perfect, but they sure help us play a stronger game in the stock market. Let’s use what we’ve learned and get investing!

Q&A :

Certainly! In order to create SEO-optimized FAQ content for the keyword “Resources for stock market forecast,” I’ll draft unique questions and their concise answers that are likely to resonate with users’ queries related to the topic. Here they are in Markdown format:

What are the best resources for accurate stock market forecasts?

When searching for reliable stock market forecasts, consider multiple sources to gather a consensus view. Leading financial news websites, stock analysis software, and investment research firms are top resources. Experts also recommend monitoring reputable financial newspapers, subscribing to stock advisories, and using stock market simulation tools which can provide insights and forecasts based on historical data and current market trends.

How can I use historical data to forecast stock market trends?

Historical data can be used to identify patterns and trends in the stock market by analyzing key metrics like price movements, trading volume, and market sentiment over different periods. Various technical analysis tools and software allow investors to backtest strategies using historical data, which can serve as a resource for making educated forecasts about future market directions.

Can economic indicators predict stock market performance?

Economic indicators such as GDP growth rates, employment statistics, inflation rates, and consumer confidence indices can provide valuable insights into the overall health of the economy and, by extension, potential stock market performance. Although not foolproof predictors, these indicators when combined with thorough market analysis can help in forecasting stock market trends.

What role do expert analyses play in forecasting the stock market?

Expert analyses play a significant role in stock market forecasts. Financial analysts and industry experts use a combination of technical analysis, fundamental analysis, and economic indicators to predict market movements. Their insights can provide a well-rounded perspective that includes both quantitative data and qualitative assessments of industry and company-specific developments.

Are there automated tools that can predict stock market trends?

Yes, there are automated tools known as algorithmic trading systems that utilize mathematical models to predict stock market trends. These systems can analyze vast amounts of market data in real-time to forecast potential movements. However, while these tools can aid in decision-making, they should be used in conjunction with other resources and human judgment to account for market complexities.