As our wallets feel the pinch, central banks raising interest rates to control inflation can’t be ignored. It’s a power move, a daring strategy testing the bounds of our economy. Dive right in and you’ll uncover why this bold action is seen as a must to calm the rising tide of prices. We’re peeling back the layers on how this heavy lifting by the central bank can indeed turn the tide on inflation’s relentless surge. And trust me, it’s not just about pulling levers and pushing buttons; it’s an intricate dance of supply, demand, and the delicate balance of our financial well-being. Let’s break down the real deal behind these rate hikes and get to the bottom of the inflation beast. Buckle up, because we’re about to take a deep dive into the economic machine that keeps our wealth afloat—or sinks it.

Understanding Central Bank Interest Rate Decisions

The Role of Interest Rates in Monetary Policy Tightening

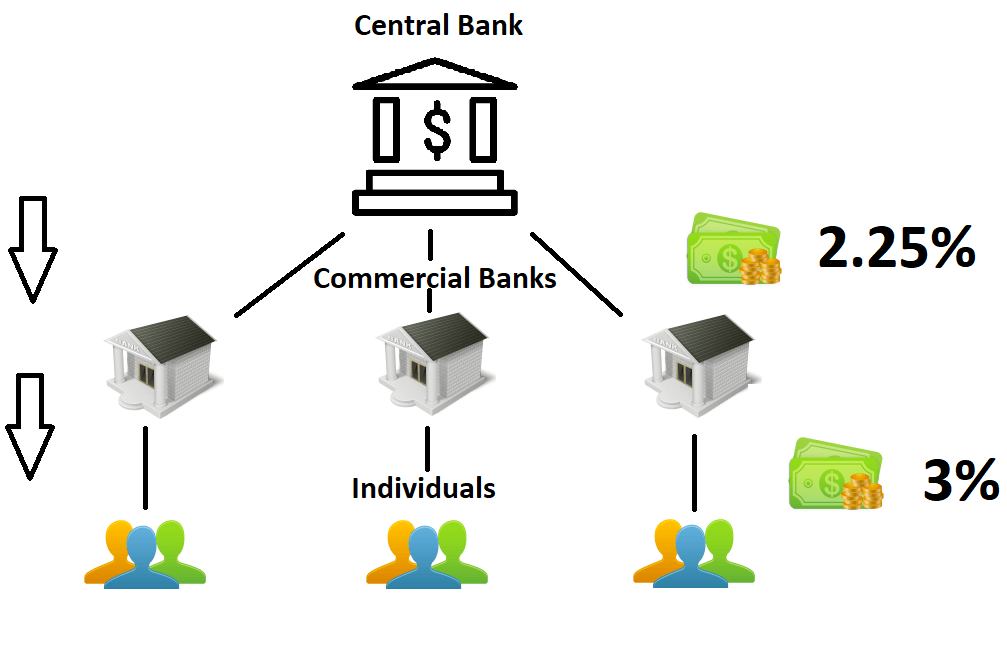

Central banks use interest rate hikes as brakes. Imagine a speeding car. The economy is like this car. When it goes too fast, prices rise quickly, like speed on a meter. That’s inflation. By upping interest rates, it becomes pricer to get loans. This cools down spending, much like tapping a car’s brakes.

Evaluating the Effectiveness of Inflationary Pressures Control

Central banks eye the CPI to measure inflation. The CPI tells them how prices change over time. When it climbs fast, that means things cost more for folks. It shows inflation is on the rise. Central banks aim to ease this hike, keeping price leaps mild. Raising rates is one strong move to do this. It aims to tame the rush of spending, making sure prices don’t shoot up too fast.

Here’s the deal: when central banks up interest rates, borrowing money costs more. It’s not just for folks but also for businesses. Spend less, borrow less – that’s the plan. This can slow down an economy that’s too hot. It’s a balance act for sure. Will it cool the economy just right or too much? That’s the big question.

Controlling these pressures is no small task. It’s like finding the sweet spot in steering the money flow. Get it right, and the economy hums along fine. Miss it, and we might face some tough times, like fewer jobs or less money for folk’s pockets. No one wants that. But if central banks nail it, we can all breathe easier with prices that don’t jump too high.

Interest rate changes shake up many things. They can affect how much it costs to get a home or start a business. They impact the cash folks have for saving or spending. The central bank, kind of like a guardian, sets rates thinking about all this. Their goal? Keep prices steady so that the economy stays strong, now and ahead.

The rates set by central banks are super crucial. They touch almost everything in our day-to-day money lives. So when you hear about rates going up, know that’s a central bank doing its job. It’s watching out for runaway prices and making moves to keep things stable for all of us.

Remember, a steady and cool economy is what we aim for. We want steady jobs, fair prices, and homes we can afford. That’s the point of these rate hikes, tough as they may feel. So when you hear about the federal funds rate or CPI, it’s all part of the big move to keep our money ship steady as we sail through the storm of rising prices.

Measuring the Impact of Interest Rate Hikes on the Economy

How Higher Borrowing Costs Shape Consumer Spending and Saving

When central banks raise interest rates, they cause a big stir. It’s like they’re telling us, “Hey, let’s slow things down a bit.” They want to stop prices from going too high, too fast. This is called monetary policy tightening. It means it gets more costly to borrow money. Think of it like this: when the interest rate hikes impact our wallets, we think twice about buying that new bike or taking a loan for a holiday.

People start to save more because the bank pays more for their savings. This can be good for a while, but if we all stop spending altogether, businesses suffer. They count on us to buy things. With less money moving around, the economic cooling measures kick in. You’ll see things not sell as fast, and prices may stop climbing.

The Ripple Effect from Mortgage Rates to Business Investment

Now, let’s talk houses. Higher mortgage rates mean your dream home costs more each month. Ouch, right? That pinch in your budget can lead to you and many others buying less. This is what pros call a hawkish central bank stance. They’re tough on inflation but it can chill the economy.

Businesses feel the squeeze too. They need loans to grow and make stuff. Higher interest rates mean higher costs for them. This is economic contraction at work. Sometimes, if the cost gets out of hand, jobs can get cut. Nobody wants that. But it can happen when we’re reeling in too much spending.

We also look at clues called economic indicators like the Consumer Price Index (CPI). This index tracks how much our everyday stuff costs. If it goes up too fast, it’s a red flag for inflation. The central bank watches this closely. If the CPI shoots up, they’ll nudge up those rates to cool it down.

We have to keep a balance though. Too much tightening, and we might stop the economy’s heart. Too little, and it’s like the economy has a fever with prices soaring. This is the central bank’s tightrope walk. I keep my eyes peeled on these moves, analyzing the trends so we can all stay a step ahead. Hawk-eyed and focused on the financial road ahead, that’s the central bank for you. And me? I’m right there, decoding their signals so you know when to save, spend, or just strap in for the ride.

Remember, it’s all about balance. We need to keep our economy healthy—not too hot, not too cold. Just right, that’s the goal.

Interpreting Economic Indicators Amidst Rate Adjustments

Analyzing Trends through the Consumer Price Index (CPI)

When central banks tweak interest rates, it’s a big deal. They aim to steer the economy in the right direction. The Consumer Price Index, or CPI, is one tool they use. It shows how prices change over time for regular stuff we buy. Think of it like a shopping list that keeps track of price tags every month. When the CPI goes up, life gets pricier for folks. This means inflation is on the rise, and it pinches our wallets.

Now, imagine the central bank as a goalie. It’s their job to block inflation from scoring too high. They do this by hiking up interest rates, which is like turning down the economy’s heat. When they do that, people tend to spend less because borrowing money becomes more costly. Higher interest rates can cool things down when prices rise too fast.

Assessing Inflation Expectations and Currency Valuation Dynamics

Next, central banks look at inflation expectations. This is what people think will happen to prices in the future. If folks expect prices to jump, they might ask for higher wages. This can push prices up more, sort of like a self-fulfilling prophecy. It’s a tricky cycle.

Central banks must also keep an eye on how much our money is worth. That’s where currency valuation comes in. Higher interest rates can make our money stronger compared to other countries’. This is good for buying things from abroad but can be tough for local businesses selling stuff overseas.

So, by raising interest rates, central banks try to balance everything out. It’s their move to keep prices stable, like goalies defending against unfair inflation shots. They watch the CPI, think about how we feel about future prices, and try to line up the value of our dough just right. It’s not easy, but getting it right is key for a happy, healthy economy.

Strategic Responses to Inflation: Central Banks’ Policy Tools

Balancing Expansionary and Contractionary Monetary Strategies

When prices soar, folks feel the pinch. To ease this, central banks get to work. They use a tool belt of monetary strategies to balance the economy. You see, two key tools they use are like hot and cold water taps for the economy. Expansionary strategies make money flow easy, boosting spending and jobs. But when the economy overheats, with prices rising too fast, they switch to contractionary strategies.

Their goal with contractionary tactics is to cool things down. Think of it as the central bank raising their hand, signaling ‘enough’. By making borrowing costlier, they hit the brakes on spending. It’s like taking a little air out of a too-puffy balloon without popping it. Central banks aim for a soft landing, not a crash.

The big move in these moments is hiking interest rates. Higher rates make loans for cars, homes, and starting a business more expensive. They also affect how much you make from savings. With higher interest, putting money in the bank could earn you more. So, people may save instead of spend, slowing down price jumps. This is the cold tap in action, slowing the steam.

The Long-Term Vision for Price Stability and Economic Health

Now let’s zoom out and look at the long game. Central banks don’t just think about today. They set sights on lasting stability and a healthy economy for all. That includes you, me, and the next generation. A steady ship is the goal, avoiding wild ups and downs in prices and work.

We’ve got to have stable prices to plan our futures with confidence. Businesses can invest in new stuff and hire folks. Families can budget for the things they need. Stable prices allow this, and central banks pull the strings to keep us on course.

They keep an eye on the Consumer Price Index, or CPI, measuring price changes for everyday goods. Think of it as a big shopping list that tells us if life’s getting pricier. Central banks use it like a map, guiding their interest rate hikes. It helps them see past short-term winds, aiming for a steady destination.

In the long run, these policies bank on making things predictable. With fewer price spikes, you’ve got a clearer road ahead. Jobs and wages can grow without inflation eating them up. And when businesses plan for a stable future, they plant seeds for growth and jobs.

Central banks play the long game. They tweak and turn interest rates, using their tools to write our economy’s story. It’s a fine balance, a dance with dollars and cents, but it’s done for a steady beat we can all move to. With eyes on a future where everyone can afford their dreams, central banks fine-tune their symphony of monetary measures. And we all hope for a masterpiece.

We’ve explored how central banks use interest rates to steer the economy. Interest rates can slow or speed up growth, and they’re vital for keeping inflation in check. We’ve seen how rate hikes impact our wallets, our saving habits, and businesses large and small. It’s clear, interest rate changes send ripples through the economy, affecting everything from the price you pay for a house to how much your savings might earn.

Understanding economic signs like the CPI helps us grasp these changes. Inflation expectations and how money values shift are part of this big picture. Central banks have a tough job. They have to balance the now with the future, always aiming to keep prices stable and the economy humming along.

In the end, it’s about making smart moves to ensure our economic health stays on track. Whether you spend, save, or invest, these changes touch us all. Let’s keep a sharp eye on these trends, as they shape our financial landscape day by day.

Q&A :

Why are central banks raising interest rates to combat inflation?

Central banks often raise interest rates as a strategy to control inflation by making borrowing more expensive. This aims to reduce consumer and business spending, which in turn can help to slow down economic growth and decrease inflationary pressures. Higher interest rates increase the cost of loans and mortgages, encouraging savings over spending.

How do higher interest rates reduce inflation?

When central banks hike interest rates, borrowing costs go up for consumers and businesses. This generally leads to a decrease in spending and borrowing, which can slow down price increases across the economy. As demand for goods and services falls, prices tend to stabilize or increase at a slower pace, helping to bring down the rate of inflation.

What are the potential risks of central banks raising interest rates too quickly?

Raising interest rates too quickly can lead to a significant slowdown in economic activity. This can increase the risk of unemployment as businesses scale back on investment and production. Additionally, it can put pressure on individuals with variable rate debts, such as mortgages, potentially leading to higher default rates. If not managed carefully, there’s also a risk of pushing the economy into a recession.

How does raising interest rates affect the currency value?

Higher interest rates can lead to an appreciation of the country’s currency. This is due to the fact that higher rates offer better returns on investments held in that currency, making it more attractive to foreign investors. A stronger currency can help reduce the cost of imported goods, contributing to lower inflation. However, it can also impact the competitiveness of exports.

What is the role of central banks in inflation control besides raising interest rates?

Apart from raising interest rates, central banks have several other tools to control inflation. They can adjust reserve requirements for banks, influencing how much money is available for lending. Central banks can also conduct open market operations, buying or selling government securities to influence the money supply. Additionally, they can utilize forward guidance to influence market expectations and control inflation indirectly through policy communications.