Financial Disintermediation: How Fintech Unlocks Direct Power in Your Wallet

Gone are the days when big banks held all the cards. Financial disintermediation and Fintech are throwing open the doors, pushing aside the middlemen, and placing financial control back into your hands. Imagine a world where you lend, borrow, and manage your money without ever needing to step inside a bank. That’s not just a dream; it’s becoming our new reality. So let’s dive in and unpack how tech-savvy tools are giving you the direct power to make smarter, faster financial decisions. From your pocket to your future, it’s all about claiming the driver’s seat in your financial journey.

The Rise of Peer-to-Peer Financial Platforms

Redefining Lending and Borrowing

Gone are the days when you had to go to the bank, hat in hand, for a loan. The web flipped the script with peer-to-peer lending platforms. These spaces let you borrow money straight from another person. They cut out the middleman – the banks. So, more cash stays in your pocket.

Here’s how it shakes out: say you need money for a car. In the past, you’d hit up a bank. Now, you hop on these platforms, and you’ll find folks willing to lend you cash. Often, you get better rates than banks could dream of giving you. It’s quick, too – no long lines, no endless forms.

Maybe you’ve got the extra dough instead. With these platforms, you can become the bank. Lend your money to others and make a tidy sum in interest. It’s a win-win, shaking up the finance game in the best way possible.

Empowering Users Through Decentralization

Decentralizing money—that’s the name of the game. It means putting the power back in your hands, not Wall Street’s. Think about when you pay at the store. If you use cash, the deal’s between you and the cashier. Fintech’s like that but online.

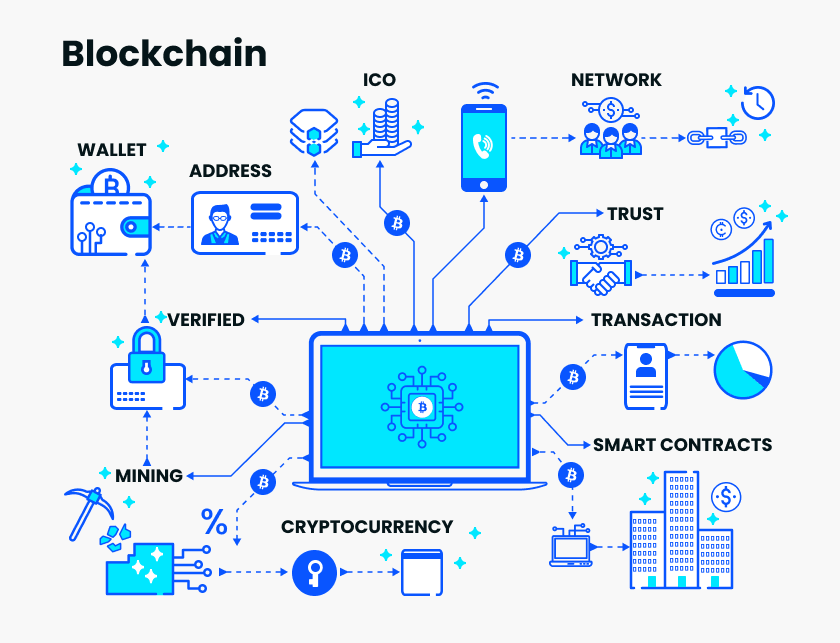

Blockchain’s the secret sauce here. It’s a tech that backs cryptocurrency. But it’s bigger than just Bitcoin. It’s about keeping your money safe online. When you do a deal over blockchain, it’s locked tight and open for you to see. No sneaky fees, no hidden rules.

With apps and platforms popping up like daisies, your money’s never been more in your control. Mobile payments growth? It’s through the roof, putting banks on notice. Fintech innovations aren’t just ideas; they’re in your pocket, changing how you do dollars and cents.

Ever heard of a digital wallet? It’s like your leather wallet but better. It holds cash, sure – but also coupons, tickets, and your shopping list. It’s a tool that tags along everywhere your phone goes.

And that’s just the start. Investment apps teach you to grow your money. Crowdfunding lets you back the next big thing with just a few clicks. This isn’t just a service; it’s a shift to give you the reins of your financial future.

So, if you’re tired of old-school bank lines and you’re ready for control, fintech has your back. It’s not just changing banks; it’s changing lives. Financial freedom? It’s no longer just a dream. With fintech, it’s in your pocket. Get ready to unlock the power.

Blockchain’s Role in Fintech Evolution

Enhancing Security and Transparency in Transactions

Imagine a bank vault, but everyone has a peek at it. That’s blockchain. It’s a tech that makes sharing money safe and clear as glass. With blockchain, when you send cash, it’s like sending a text that everyone can see, but no one can change. Kind of like writing in permanent marker on the world’s bulletin board.

This matters because sometimes, money things can be tricky. You might not know where your money is or if it’s safe. With blockchain, you can. Each step of the money moving is tracked. No one can try to play tricks, because everyone is watching. That’s making a lot of folks excited about how we use our wallets.

Case Studies: Blockchain Adoption by Traditional Banks

So, banks saw this new kid, blockchain, and thought, “Can’t beat them, join them.” They are using blockchain to make everything better.

Big banks are now starting to use blockchain. They want to be safe as a bike with five locks. And they want us to know it. They are letting us look at their homework. We can now check if everything adds up.

For example, major banks settled a deal using blockchain. It was lightning-fast. And it was as clear as a sunny day. People didn’t need to wait or worry. They could see their money move step by step.

Some banks team up with fintech startups. They use blockchain together to send money across the world. It’s like having pen pals, but instead of letters, you swap cash. With this tech, even the little banks can play in the big leagues. They can offer what the giants do but faster and clearer.

In the end, blockchain in banks means your money is safer. It’s like having a money guard dog. It helps you sleep tight, knowing no one will sneak off with your cash. And you can check in on it whenever you want.

To wrap it up, what’s happening is pretty big. Banks are changing from the inside out. They’re shaking hands with fintech and saying, “Let’s be buddies.” And it’s all to make sure the power sits snug in your pocket. With blockchain, banks are becoming as quick as a rabbit and as open as a book. The future of our wallets seems bright and shiny from here.

The Intersection of Fintech and Consumer Empowerment

Mobile Payment Innovations and User Adoption

Think about the last time you paid for coffee. Did you pull out cash, or did you tap your phone? More people now tap. That’s fintech at work. Fintech, or financial technology, changes how we shop, bank, and handle money. With smartphones, we see a new money world. We’ll focus on two big changes: mobile payments and personal finance tools.

First, mobile payments. They’re growing fast. Think of it like magic in your pocket. Your phone becomes your wallet. You pay quick and safe. No more digging for coins. Why are people switching to phone payments? It’s easy. It’s there with you all the time. Like when you pick up a snack or fill up your car. Plus, it’s neat seeing your payment go through in seconds.

Companies keep making payment apps better. Some let you send money to friends. Others help you split dinner bills. And they use things like your fingerprint to keep cash safe. Mobile payments mean you can say bye to that heavy wallet.

Personal Finance Management with Robo-Advisors and Investment Apps

Now, let’s talk about how fintech helps you watch your cash. There are new tools for saving and investing. These aren’t old school. Even if you’re new, you’ve got a shot at growing your stash.

Here’s where robo-advisors come in. These are smart programs that help you invest. You tell them your money goals, and they work out the plan. They’re cheap and smart. They keep an eye on your cash all the time. For beginners, this is a game-changer. It’s like having a money coach in your pocket.

Then, there’s a bunch of apps for investing. They’re built for folks just starting out. You can start small and learn as you go. Some apps round up change from what you buy and invest it for you. Think of it as a piggy bank that grows on its own. And as you get better, you can try new ways to invest.

This is what fintech is about. Making big money moves simple for everyone. It gives you the power to take charge of your cash. With a few taps, you can pay, save, and grow your funds.

So, you see fintech isn’t just for big banks or finance whizzes. It’s for me and you. It lets us do more with our money without a big cost or fuss. Fintech is changing the game, giving us the power to manage our money better. And as it grows, we’ll find even more ways to make our money work for us.

Navigating Through Regulatory and Security Challenges in Fintech

Balancing Innovation with Compliance in Digital Banking

Fintech rocks the way we handle money. Folks, like you and me, now bank with a tap. Apps and tools from fintech startups make life easy. But hey, banks can’t just do as they wish. They must play by the rules to keep our cash safe. This is where it gets tricky. Banks love new tech to serve you better. They also must make sure it’s all above board with laws and such.

Peer-to-peer lending and blockchain are stars in banking these days. They let us send money fast and keep it all in check. But these tools must stay in line with the rules. We can’t forget how fast mobile payments are growing. This means more work to keep every dime secure.

Enhancing Trust with Fintech Security Measures

Trust is huge in fintech. You want to know your money’s safe. Fintech’s got this with top-notch security. Think of it like a superhero guarding your wallet. It fights off bad guys wanting to steal your info or cash.

Your app could use blockchain to keep things clear and safe. This tech is a champ at stopping fraud. It’s like having a super secure lock on your money. Innovation in fintech is all about making sure you can relax. You need to trust that your money sleeps tight.

Banks who get into fintech want to give you the power. They mix new tech with the trusty old systems. This way, they bring you the best of both worlds. Cryptocurrency and fintech go hand in hand. They’re part of why banking’s changing so much. These changes could let you do things your way, on your terms.

And guess what? Fintech is not just about the big bucks. It’s opening doors for people with less cash too. This means better chances for everyone to grow their money. Big data and AI step in to make sense of all your spending. They help fintech learn what you like, offering tips to save and spend smarter.

But here’s the deal: it’s not just a bed of roses. Fintech faces challenges. New apps and platforms need to pass strict checks. This keeps our money from falling into the wrong hands. And fintech has to always stay one step ahead. Bad folks keep finding new ways to break in and take what’s not theirs. That’s why fintech keeps making its shields stronger.

Payment gateways in fintech are the gatekeepers of your transactions. They’re the ones that say “Yes, this pay-in or pay-out can go through.” They have to be fortress-strong, so your money only moves when you say so.

So, to sum it up: fintech’s taking big steps to keep you and your money safe. It faces the challenge of rules and sly crooks. But, it’s ever learning and getting better, to put you in charge of your cash. Fintech’s not perfect, but it sure is making a splash, setting out to sprinkle a bit of that direct power right into your wallet.

In this post, we dug into how fintech is changing money management for everyone. We started by looking at peer-to-peer platforms that shake up how we lend and get loans. These platforms give power to regular folks, not just big banks. Then, we discussed blockchain. It’s making money moves safer and more open. Even old-school banks are getting on board.

Next, we explored how new tech lets us pay with our phones and manage money smarter with apps and robo-advisors. This is big for you and me – we get more control over our cash.

Lastly, we tackled the tricky parts: the rules and risks in digital finance. Staying safe and following the law matters tons even when money gets digital.

Here’s the bottom line: Fintech is here, and it’s awesome. It gives you more power over your cash and keeps it safe. Let’s keep our eyes on these changes because they’re not just cool – they’re shaping our financial futures.

Q&A :

What is financial disintermediation and how does it relate to Fintech?

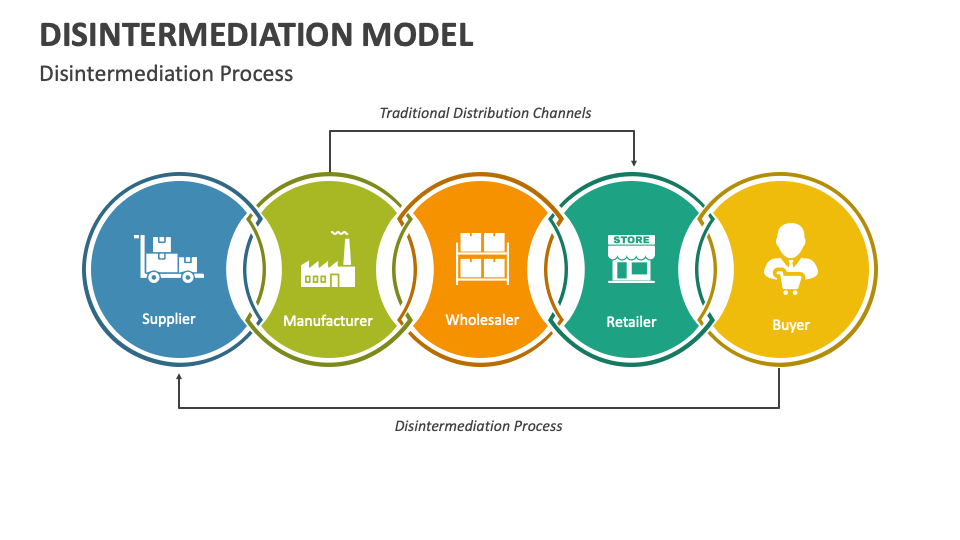

Financial disintermediation refers to the process where consumers or businesses bypass traditional financial intermediaries, such as banks and credit unions, to conduct financial transactions directly. This could be facilitated through various means including investment in securities, peer-to-peer lending networks, or through online platforms. Fintech, or financial technology, is closely related as it provides the technology that enables disintermediation by offering tools and platforms that make these direct transactions possible, efficient, and secure.

How has Fintech contributed to the trend of financial disintermediation?

Fintech has spearheaded the trend of financial disintermediation by developing innovative financial services that are often more user-friendly, accessible, and cost-effective than those offered by traditional financial institutions. This includes mobile payment systems, crowdfunding platforms, and cryptocurrency exchanges, among others. By leveraging technologies like blockchain, artificial intelligence, and data analytics, Fintech startups have been able to create alternatives to traditional financial models, thus decreasing the reliance on banks and other intermediaries.

What are the benefits of financial disintermediation for consumers?

Consumers can benefit from financial disintermediation through potentially lower costs, as the removal of intermediaries can reduce transaction fees. They also get access to a wider range of financial products and services, increased transparency, as well as more control over their financial transactions and investment choices. The convenience and customization offered by many Fintech platforms can also lead to a more personalized financial experience.

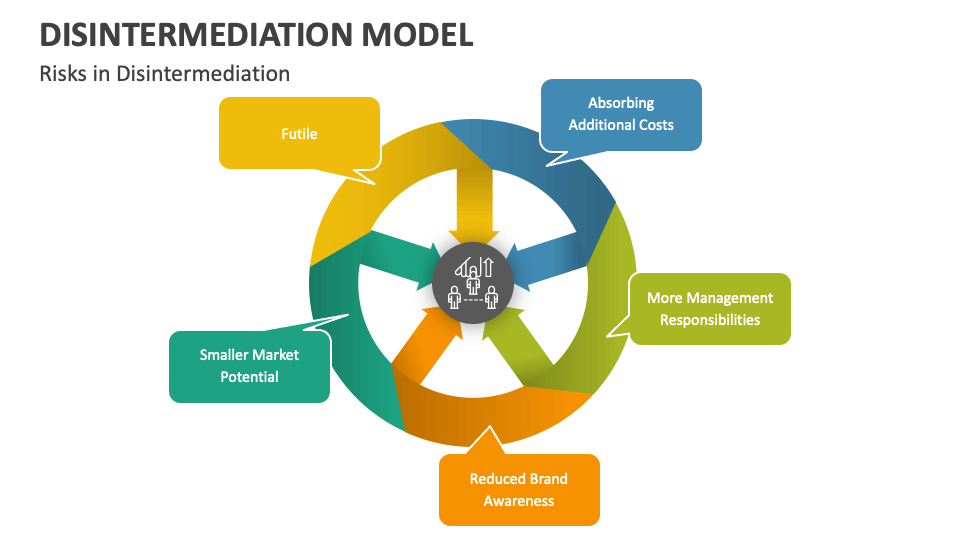

Are there any risks associated with financial disintermediation?

While financial disintermediation offers several advantages, it also comes with risks. Direct access to financial markets without the guidance of intermediaries may expose consumers and businesses to complex decision-making where they might lack expertise. Additionally, the regulatory environment for new Fintech services may not be as well-defined, potentially increasing the risk of fraud or loss. It is important that consumers do their due diligence and understand the terms of service and risks involved in any financial transaction they undertake directly.

How is regulation evolving to address the changes brought by financial disintermediation and Fintech?

Regulation is constantly evolving to adapt to the disruptive nature of financial disintermediation and the rise of Fintech. Regulators are working to balance the promotion of innovation with the need to protect consumers and maintain financial stability. This involves updating existing financial regulations, creating new frameworks for emerging financial products and services, and enhancing consumer protection laws. Moreover, regulatory bodies are increasingly collaborating with Fintech firms to understand the technology and to develop regulations that are conducive to growth while ensuring fair competition and the integrity of the financial system.