Growth vs. Value Investing: Beginner Strategies Unveiled!

Which investment strategy is better for beginners, growth or value? As a new investor, you want choices that suit your goals without making your head spin. Picking between growth or value investing can feel like a tricky quiz. I’m here to break it down and guide the way. We’ll dive into what makes each strategy tick, and where they can lead your money. Keep reading and prepare to make a savvy choice that aligns with your future financial plans.

Decoding Investment Strategies: Growth and Value Defined

Understanding Growth Investing: Characteristics and Potential Returns

Let’s crack the code on growth investing. It’s like looking for the next sports star in the stock market. Just like scouts search for top athletes, growth investors look for companies with big potential. They bet on businesses they think will make more money in the future. High earnings can mean the stock price goes up, which is what investors want.

Growth stocks don’t often pay dividends. Instead, they reinvest earnings to grow faster. The risk? Higher. The reward? Potentially big, but if the company doesn’t perform, the investor can lose money. Before picking these stocks, think about if you’re ready for a ride that can be bumpy.

Value Investing Basics: Identifying Undervalued Opportunities

Now, let’s talk about value investing. It’s like finding hidden treasure at a yard sale. Value investors look for stocks sold for less than they’re worth. They believe the market has made a mistake in pricing. By buying these undervalued stocks, investors hope the price will rise to the true value.

What makes a stock undervalued? Maybe the company is not in the spotlight, or the whole industry is out of favor. But with solid fundamentals, the potential for profit is there. The risk can be lower, but patience is key. Prices don’t go up overnight. It can take time for others to see what you’ve spotted.

When learning about stocks, it’s important to do your homework. Read up on terms like “price-to-earnings ratio” and “dividend yield.” They can help you find these hidden gems.

Both growth and value investing have their place. Your choice should align with your financial goals, how much risk you can handle, and how long you plan to invest. Remember, a mix of both strategies can also work well. Use your smarts and the right tools to pick the best path for you.

Evaluating Beginner Investment Fundamentals

Starting with Financial Planning: Goals and Risk Tolerance

When you start investing, think about your goals. Why do you want to invest? You might want to grow your money for things like a house, college, or retiring with comfort. Then, there’s risk tolerance. This means how much risk you’re okay with. Some folks can watch their investments rise and fall without worry. Others might not sleep well if their stocks drop even a tad.

Your goals and comfort with risk shape your investment plan. If you have long-term goals and can handle some ups and downs, growth stocks might be for you. These are shares in companies expected to grow fast. They can make you more money but also come with more risks. On the flip side, value investing is like getting a great deal on something really good. You look for strong companies’ stocks that cost less than they should. They might not grow as quick, but they can be more stable.

Asset Allocation for Novice Investors: The Role of Diversification

Let’s talk about asset allocation. This means where you put your money across different types of investments. You could put it all in stocks, but that’s like riding a rollercoaster without a seatbelt. Instead, mix it up! Combine stocks, bonds, and maybe some cash investments. This mix keeps you steady when the market gets bumpy.

Diversification is like not putting all your eggs in one basket. It’s spread across different things. Think stocks in tech, healthcare, and energy, not just one. Or you can mix growth and value stocks. This way, if one area dips, the rest can help balance your portfolio. It can make the difference between a bad day and a bad year.

Investing is a journey, not a sprint. It’s about knowing what you’re heading for and how bumpy the road you can handle. It’s also about not tossing all your money in one spot, but spreading it out. That way, you’re set for the long ride, ready for highs and lows. And as you learn more, you tweak your mix to fit where you’re at and where you want to be. It’s personal, exciting, and with the right plan, can take you to some great places.

Historical Performance and Market Conditions: Informing Your Investment Choice

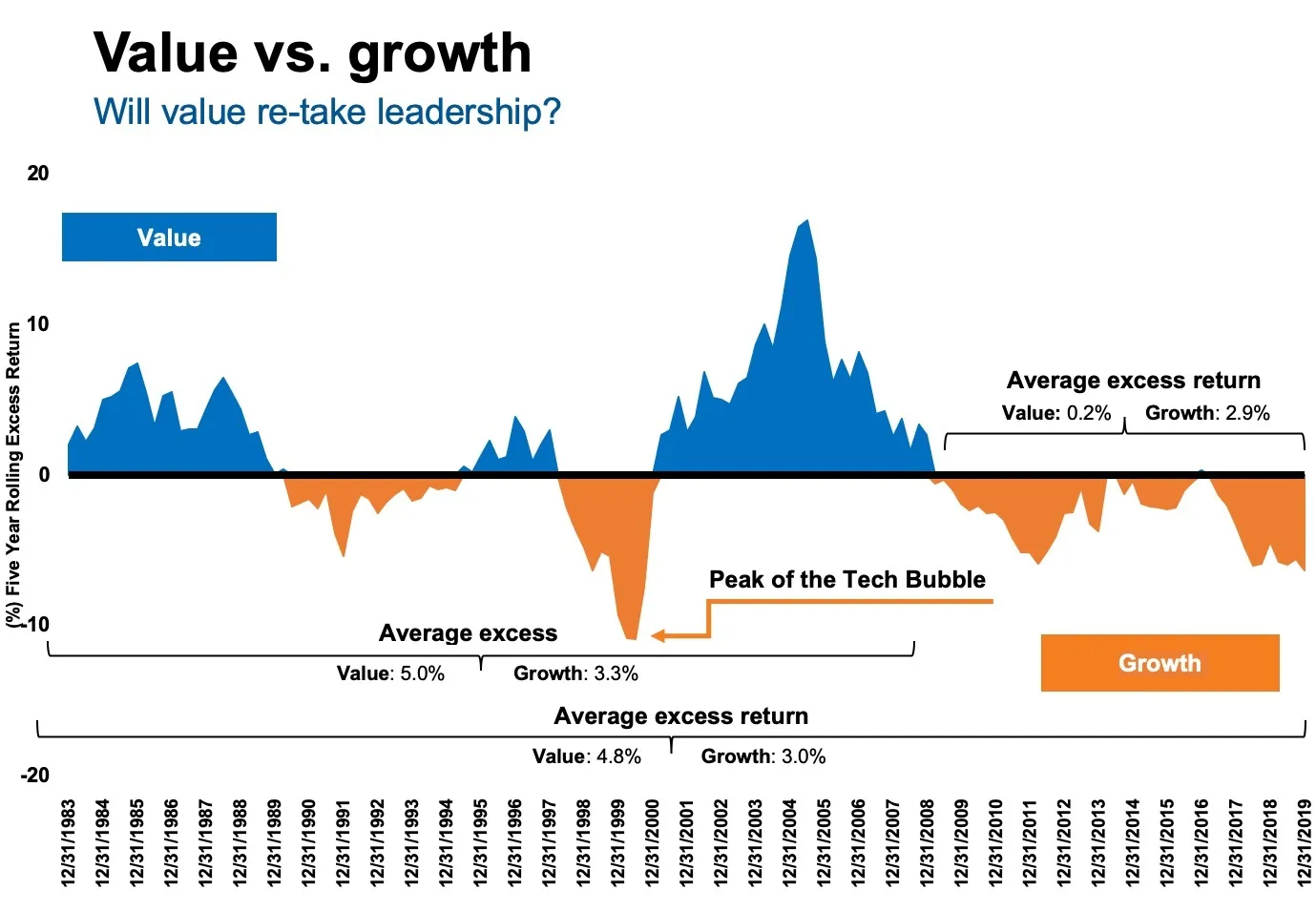

Growth vs. Value Investing Returns: What History Tells Us

When you start investing, knowing history helps a lot. It can point you to smart choices. Let’s talk about growth and value investing. Growth stocks are like shiny new tech gadgets. They’re all about potential. Companies that make growth stocks aim high. They want to earn more as fast as they can. So, if you bet on them and they win, you win big. But remember, with high hopes come high risks.

Now let’s chat about value stocks. Think of them as hidden treasures. They’re not in the spotlight but are steady and strong. They might be selling for less than they’re actually worth. That’s your chance to buy cheap and wait for the price to go up.

Over the years, both growth and value stocks have had their winning seasons. Sometimes growth stocks soar. Other times, value stocks are the steady winners. But if we check the long game, value stocks often win. They can provide steady growth and they’re not as bumpy as growth stocks.

Economic Indicators: Timing and Sector Considerations for Beginners

Okay, so we’ve heard about growth and value. But when do you jump in? And where do you put your money? That’s where economic indicators come in. These are like signs on the road. They help us see where the economy is going.

Take unemployment rates, for example. If fewer people are without jobs, it’s a good sign. It often means the economy is ding well. When the economy is up, growth stocks might soar even higher. But when times are tough, value stocks might be safer. They can be like a sturdy boat in a storm.

Now, let’s think about sectors. Some parts of the market, like tech, are home to many growth companies. Others, like utilities, have more value companies. If you’re a beginner, look at what the market’s doing. Then, choose the right time and place to invest. It’s like planting seeds. You want good soil and the right season to grow your money.

Timing the market is tricky. It’s hard to guess the perfect moment to buy or sell. So, for us beginners, it’s often better to buy and hold. Pick good stocks and stay the course. That way, you don’t have to worry about timing as much.

Beginners can win at investing with patience and a plan. Know what kind of investor you are. Are you up for risks with big rewards? Or do you want a safer path? Choose growth or value depending on that. And don’t forget: the market changes, but with a solid plan, you can stick to your goals and grow your nest egg.

Tools and Techniques for Modern Investors

Navigating Robo-Advisors and ETFs: The Beginner’s Guide

When you start in the market, you have to pick smart tools. Robo-advisors are like your personal robot helpers. They make investing simple. You tell them your goals and how much risk you’re comfy with. Then, they build you a portfolio. They use clever math to keep it on track. For newbies, this takes out the guesswork.

ETFs, or exchange-traded funds, are another cool tool. Think of them as baskets of stocks or bonds you can buy. Just one ETF can give you a slice of a whole market. This spreads out risk, which is key for protecting your cash. When you buy a mix of ETFs, you get diversification. That’s a big word for not putting all your eggs in one basket.

Financial Statements and Stock Analysis: Simplified for New Market Participants

Stock market lingo can feel like a weird code. But don’t stress, you can crack it. A company’s financial report is like its report card. It tells you if it’s making cash and how it spends it. Look for profits and debts. More cash flow is often a good sign.

For growth stocks, you want to see high earnings growth. Growth stocks don’t always pay out cash to you. They put earnings back into the company to grow fast. Tech companies are often in this group.

On the flip side, value stocks may not grow as quick. But they could be hidden gems selling for less than they’re worth. You’re looking for strong companies at bargain prices. They often pay dividends. That’s money in your pocket while you wait for their price to go up.

Both growth and value investing have their places. Your best bet is to have a mix to balance risk and rewards.

Remember, good investing isn’t about getting rich fast. It’s about planning and patience. Money can grow big when you give it time. So start now, even with a little. Watch it multiply with compound interest, like magic!

Pick tools that work for you and get into the game. Play it smart, and let time do the heavy lifting. Your future self will thank you.

In this post, we dug into investment basics. First, we broke down growth and value investing, highlighting their distinct traits and possible gains. Then, we talked about starting with a solid financial plan and how spreading your bets can help you as a new investor. We also looked at past trends, which can teach us about the performance of growth and value strategies. Finally, we jumped into today’s tools like robo-advisors and easy ways to read company reports.

To wrap up, investing isn’t just about picking stocks. It’s a game of planning, knowing your limits, and using the right tools. Understanding these facets arms you with confidence to make smart choices in the market. Happy investing!

Q&A :

What is the difference between growth and value investment strategies?

Growth investment strategy focuses on companies that exhibit signs of above-average growth, even if the share price appears expensive in terms of metrics such as price-to-earnings or price-to-book ratios. Investors hope that these companies will continue to increase in profitability and market share, which can result in higher stock prices.

On the other hand, value investment strategy involves picking stocks that appear to be trading for less than their intrinsic or book value. Value investors look for companies with strong potential that are undervalued by the market. They believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond with a company’s long-term fundamentals, giving an opportunity to profit when the prices return to their correct value.

Which investment strategy is best for beginners: growth or value?

Selecting the best investment strategy as a beginner depends on one’s personal objectives, risk tolerance, time horizon, and interest in the market. Growth investing might suit those who are looking for higher returns and are willing to take on more risk and volatility. Conversely, value investing might appeal to beginners who are more conservative, patient, and interested in long-term value creation. Beginners should do thorough research or consult with financial advisors to determine which strategy aligns with their financial goals and investment profile.

How can beginners evaluate growth and value stocks?

Beginners can evaluate growth stocks by looking into metrics like earnings growth rate, return on equity (ROE), and projections for future earnings. It is also crucial to consider the company’s market dominance, product innovation, and sector growth potential.

To evaluate value stocks, beginners may analyze financial statements to understand the company’s assets, liabilities, revenues, and expenses. Key ratios commonly used include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. Furthermore, understanding the reasons behind a stock’s undervaluation is vital – whether it’s due to temporary challenges or more systemic issues within the company.

How does market volatility affect growth and value investing?

Market volatility can have distinct effects on growth and value investing strategies. Growth stocks, typically having high valuations based on future potential rather than current earnings, can be more sensitive to market swings. Therefore, during periods of high volatility, growth stocks may experience larger price fluctuations.

Value stocks, often being more stable and tied to the company’s actual current earnings and assets, might not be as severely impacted by market volatility. In some cases, market downturns may present buying opportunities for value investors, who can purchase undervalued stocks at an even lower price, expecting them to rebound over time.

What should beginners do to manage risk in growth or value investing?

Beginners should manage risk in growth or value investing by diversifying their portfolio, which involves spreading investments across various sectors, industries, and even investment strategies. This can help mitigate the risks associated with having all your capital tied to the performance of a single stock or market segment.

Additionally, beginners should only invest money they can afford to lose, avoid making emotional decisions based on short-term market movements, and continuously educate themselves about the market and their chosen investment strategy. Setting clear financial goals and having a long-term perspective can also reduce the urge to make impulsive decisions during periods of market volatility.