When to invest in growth stocks vs value stocks is more than just a timing matter; it’s about smart strategy. As an investing guru, I’ve seen the market swings, and the impact they have on your portfolio can be huge. Getting this decision right means understanding the risks and rewards. Whether it’s the high-flying potential of growth stocks or the steady-as-she-goes promise of value stocks, knowing which to pick and when can be the key to your financial success. Let me guide you through the ins and outs of each approach to make sure you’re clued-in on the best moves for your money.

Understanding Growth vs Value Stocks: Core Principles and Performance Factors

Defining Growth and Value Stocks

Growth stocks are like sprinters. They run fast and aim to win big quickly. They’re often tech companies with hot products. Their prices can soar as they grow. So, when should you invest in them? Right before they speed up – but this can be tricky! You need to spot the early signs of success. These include rising sales and new, popular products. But, be ready. These stocks can dip fast if the company trips.

Value stocks are more like a treasure hunt. They’re companies priced low, often unfairly. Think of them as hidden gems waiting for you to find them. You dig them up when the market hasn’t yet seen their true worth. How? Look at their steady earnings, solid business plans and reliable dividends. You want to grab them when they’re unloved and inexpensive, before others catch on.

Evaluating Historical Performance and Market Cycles

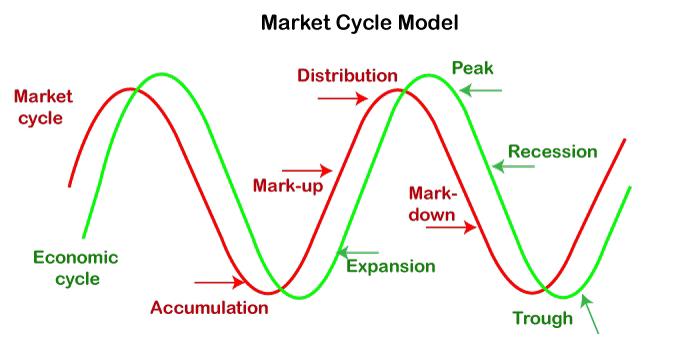

Stocks dance to the market’s rhythm, and history can teach us the moves. Over time, growth stocks have had amazing runs but also big crashes. Value stocks often chug along more slowly, steadying your portfolio when times get tough. Check the past to see how these stocks have done in good and bad times.

Let’s talk market cycles. They’re like seasons. Sometimes, when everything’s blooming, growth stocks shine. Other times, when it’s chilly out, value stocks can warm your investments. You must watch the market closely. Understand when to wear your summer shorts or winter coat. This means knowing when the economy is booming or slowing down. It’s smart to buy growth stocks as they start their race, but be quick to spot when the season is changing. Then, it might be time to turn to those stable, cozy value stocks.

Let’s get real – it’s not just about fast growth or good deals. You want a mix. A favorite mix of mine has strong runners and hidden treasures. This way, you don’t bet it all on one race. Diversification is your friend. It means not putting all your eggs in one basket. It helps keep your money safe when the market gets wild.

Are you a risk-taker willing to ride the roller coaster? Then growth stocks can be exciting. But, they can also give you a scare. If you like things calmer, value stocks might be more your style.

The key to success is balance and timing. Know when to jump in and when to hold back. Keep an eye on sales and earnings. Watch for low prices on solid companies. And most of all, keep learning. The market keeps changing, and so should your strategies. Remember, it’s not just about picking stocks. It’s about timing, patience and a little bit of courage. Choose wisely, invest smartly, and the race to reach your financial goals is yours to win.

Assessing the Macro Landscape: When to Target Growth Stocks

Macroeconomic Indicators and Growth Stock Potential

You’re eyeing growth stocks, I get it. But wait. Let’s chat about timing. It’s all about the big picture, folks. Just like a pro coach reads the game, you need to read those tricky market signs. What’s hot in the news? And I mean the big stuff – are prices for things going up (hello, inflation)? Or is everyone out there buying and feeling great (yep, economic growth)?

These signs help us spot the right time for growth stocks. When the economy booms, and people spend like there’s no tomorrow, growth stocks often follow. They jump in value ’cause businesses rake in more dough. But we gotta keep it real – just ’cause the economy looks sunny, doesn’t mean every growth stock’s a winner. You need to pick wisely, friend.

And let’s not forget about risk. How much game are you willing to bring to the table? Growth stocks can soar high but can also take a nosedive. Be sure this thrill ride is your cup of tea before hopping on.

Timing Entry Points for Growth Stocks Amid Market Sentiment Shifts

So you wanna know the secret sauce to timing your stock buys? First, cast a keen eye on what’s going down in the market. Is everyone freaked out or super cheery? This stuff sways how stocks swing.

Look out for dips. If everyone’s scared and selling, it might just be your golden ticket to snag a solid growth stock on the cheap. But play it cool. Don’t just jump at any dip. Be smart, and lean on some real deal homework – stuff like how much cash the company has, and if it’s got a killer edge over the other guys.

Remember, we’re not about chasing fads. That’s for amateurs. We’re here to scoop up the gems before they shine – that’s where the real gold lies.

So, strap in, watch those macros like a hawk, and get ready to make some smooth moves. The name of the game is to buy killer growth stocks that are about to hit a major stride. Do this right, and you’re looking at sweetsville, population: you. But if this sounds like a heart-pumper, maybe ease off the gas, switch lanes, and cruise into value stock city. They’re the snug blanket to growth stocks’ wild fire.

Alright, team. Keep your head in the game. Spot those macro clues. Judge how much heat you can handle. And grab those growth stocks when the time’s just right. This is how you play the long game. And this, my friend, is how you win.

Investing in Value Stocks: Identifying Opportunities and Timing

Recognizing Value Stocks and Their Characteristics

Value stocks seem tricky, but let’s keep it simple. They’re like sales at your favorite store – quality items, low prices. You’re looking for strong companies selling for less than they’re worth. Think discounts.

Why are they cheaper? Maybe the company’s hit a rough patch. Or folks just aren’t seeing its true worth. That’s where you swoop in. The goal: Buy low, and later, when others catch on, sell high.

So, what signals a value stock? Simple things. Lower price compared to earnings, solid dividends, and a history of steady if not flashy success. They’re the tortoises in the race – slow and steady wins.

Let’s chat about timing your buy. It’s huge! Warren Buffett says it’s about being fearful when others are greedy and greedy when others are fearful. Watch for market drops. That’s your cue. Stocks on sale!

Strategies for Incorporating Value Investing Principles

Dive into value investing with a plan. Mix it up with both growth and value stocks. Your equity portfolio strategy must tie well with your risk tolerance. Safer bets? Stick closer to value stocks.

Start with a look at the basics. Fundamental analysis is your best friend. It tells you if a stock’s really a bargain. Look at debts, earnings, all that good money stuff. If a company’s healthy but its stock’s down, you may have found gold.

History matters, too. Past performance can give clues. Did the stock bounce back from lows before? That’s a good sign. Look at the macroeconomic factors too. Things like how the economy’s doing can affect your picks.

Now, think long-term. Short-term wins are nice, but value investing’s a marathon, not a sprint. Patience is key. Your great find might take a while to shine. Staying calm through ups and downs pays off.

Remember, it’s all about balance. Don’t dump all your cash into one stock. Diversification matters. Mix value stocks with some growth picks. That way, your risks are spread out. And that’s smart investing.

There you have it. Keep an eye on prices and the big picture. Choose wisely, with a cool head. Value stocks can be a brilliant move for your wallet. They’re not the loud party guests. They’re the ones that stick with you, reliable and strong.

Balancing Your Portfolio: Integrating Growth and Value Investments

Diversifying with Growth and Value Stocks

When mingling growth and value in your stocks, you hit two birds with one stone. Growth stocks are like seedlings. They can grow fast and bring new fruit. Value stocks are like big, sturdy trees. They may not grow as fast, but they can weather storms. You need both in your garden, right?

To diversify means not putting all eggs in one basket. You pick different kinds of stocks. So, if one type falls, others can keep you standing. With growth and value stocks mixed, your money can rise with market highs and hold strong when lows hit.

Aligning Financial Goals with Investment Strategies

Here’s a fun fact: Your money goals shape your stock choices. Want to build wealth fast? Growth stocks might be your jam. But if you’re eyeing a stable climb, value stocks could be better friends. Picture your money as a team of runners. Some sprint, others are marathon pros. You choose who runs based on the race you’re in.

Risk is like food spices: some like it hot, others not. Your taste for risk guides you. If big swings scare you, lean on value stocks. But if you’re cool with risks, growth stocks can spice things up. It’s all about finding your flavor.

Market smarts mean knowing when to make your move. Good timing can help you buy low, sell high. Sounds easy? It’s not always. You’ve got to watch the market like a hawk. Stay sharp, stay patient.

History teaches us much, even with stocks. Look back to see how stocks have done in good and bad times. This can help you guess how they might do in the future. Your equity portfolio strategy must play well with these lessons from the past.

In the stock world, growth and value often dance to different tunes. Tech stocks, for example, maybe growth stars today but could fall out of the spotlight tomorrow. On the other hand, a low-key industrial company could suddenly shine as a value pick. You’ve got to keep an eye on each sector. This way, you can see who might be the next star of the show.

Last but not least, don’t chase myths. Growth stocks won’t always outperform, and value stocks aren’t always safe. Know the game, play it smart.

This stock mix affects how your money grows. It’s important to check in with your plan regularly. Markets change, and so do life goals.

To wrap up, mixing growth and value stocks is smart. It‘s like having a team with players who can cover for each other. Make sure you match your team to your money dreams and how much risk you can handle. Keep learning, stay curious, and your money could go a long way!

In this post, you learned the ropes of growth versus value stocks. We covered their basic ideas and how history shows their ups and downs. Then we saw when to lean into growth stocks, like when the economy’s signs point up. We also checked how to pick the best times to buy in. With value stocks, you got tips on spotting real deals and mixing them into your money plan smartly.

Here’s what to take away: Balance is key. Mix growth and value stocks to match your money goals. Don’t chase one over the other. Aim for a well-rounded set of investments. That way, you stand a better chance to see your stash grow over time. Keeping your eyes on the big and small pictures, you can make smarter, sharper choices. Happy investing!

Q&A :

When is the best time to invest in growth stocks?

Investing in growth stocks is typically best when the market is on an upswing and the economic outlook is positive, as these conditions favor companies with high growth potential. These stocks might not pay dividends, as earnings are often reinvested to fuel further growth. Younger investors or those seeking greater capital appreciation might prefer growth stocks, especially during bullish market phases.

How do you decide between investing in growth stocks and value stocks?

The decision to invest in growth or value stocks should align with your financial goals, investment horizon, and risk tolerance. Growth stocks usually appeal to investors looking for high return potential in expanding companies, albeit with higher volatility. In contrast, value stocks attract those looking for undervalued companies that may offer stable dividends and have the potential for price appreciation as the market corrects their undervaluation.

What are the characteristics of growth and value stocks?

Growth stocks are characterized by their higher-than-average earnings growth rates, often in emerging sectors or industries. They usually have high price-to-earnings ratios and may not pay dividends as profits are reinvested in the business. On the other hand, value stocks trade at a lower price relative to their fundamentals, such as earnings or book value, often due to temporary setbacks. They may offer dividends and could provide a margin of safety with a potential for price appreciation.

Can you diversify your portfolio with both growth and value stocks?

Absolutely! Diversifying your portfolio across both growth and value stocks can help mitigate risk and capitalize on different market conditions. Combining these investment strategies can balance out the volatility often associated with growth stocks with the steadier performance that value stocks traditionally offer. This diversified approach allows you to take advantage of growth opportunities while having a safety net in undervalued assets.

What market conditions favor value stocks over growth stocks?

Market conditions that favor value stocks usually include economic downturns, low-interest-rate environments, or periods where the market is favoring mature, well-established companies. During these times, investors often gravitate towards value stocks for their perceived safety, lower volatility, and potential mispricing. Inflationary periods can also see investors turn to value stocks, especially those in sectors like energy and financials, due to their ability to possibly outperform in such conditions.