What’s Next for Sustainable Investing? Trends Shaping the Green Future

Money talks, but now it’s going green. As an expert, I’ve seen sustainable investing break from niche to norm, reshaping our future. It’s more than a trend; it’s a must-do for those who want their investments to reflect their values and drive change. We’re on the brink of something big, so let’s dive into how green is becoming the new gold in finance. Ready to join the green wave? Let’s unpack this together.

The Evolving Landscape of ESG Criteria and their Impact on Investment Strategies

Staying Ahead with Environmental Social Governance Criteria

Think of green money. This means investing to help our planet. We do this by choosing where to put our money wisely. We look at companies. Do they care for our Earth? They must follow rules called ESG criteria. It spells good for both profits and our future.

Now, to put it plainly, what are ESG criteria? They are rules that check if a company is kind to the Earth, cares for people, and is run right. Companies that do well with these can be good bets. They can grow and make money over time. They often dodge big risks linked to climate change and social issues. You wouldn’t want to miss out, right?

People want more green in their portfolios. There are good ways to do it. We can pick stocks, bonds or funds that follow ESG rules. This can help Earth and grow your money. Green bonds are seeing brighter days ahead. People buy them to fund clean energy and more. They are part of a big trend. More folks want to do good with their money. And we’re just setting off!

Could investing get even greener? You bet. Companies are getting smart. They find ways to keep Earth clean. They cut carbon footprints while making money. Everyone wants a piece of this giant, growing pie. It means putting your money where your heart is.

Ethical Investment Funds: Investing with a Conscience

Money talks. It says what you stand for. Ethical investment funds are here to make it shout. They pick stocks that do good things. Clean air and water. Fair work places. Good health care. They care about the present and the future. This kind of investing is growing fast. And it’s helping us shape a world we all want to live in.

So, how do these funds work? We dig deep into companies. We see if they act fair and green. The ones that pass get into the fund. We watch them close to make sure they stay true. Investors get to help the world and could make profit too.

What else? We also check numbers. We match what companies say to what they do. This is called ESG reporting. It has to be right on. That way, folks can trust they’re backing the right horses.

But it’s more than making money. It’s about each of us doing our bit. The UN has goals. They dream of a better world for all. Ethical funds aim to turn that dream into cash flow. They can push from small change to big waves. Investors become heroes for our planet.

Stick your ear to the ground. You’ll hear talk of a green future that’s here to stay. There’s a rush towards new ways to invest that feel right. Everyone’s eyes are on this. The best part? We’re just getting warmed up. Keep your eyes on the green horizon. Change is here, and it’s making wallets and the world a better place.

The Rise of Green Financial Instruments and their Role in Shaping the Market

Green Bonds Future Outlook: Brighter Than Ever?

Green bonds are like a lighthouse, guiding big money towards a green future. Their job is to fund projects that help the earth. The future? It looks super bright for these bonds. People everywhere want to save our planet. So, they put their cash in these bonds. This means more money goes to things like clean energy and eco-friendly transport.

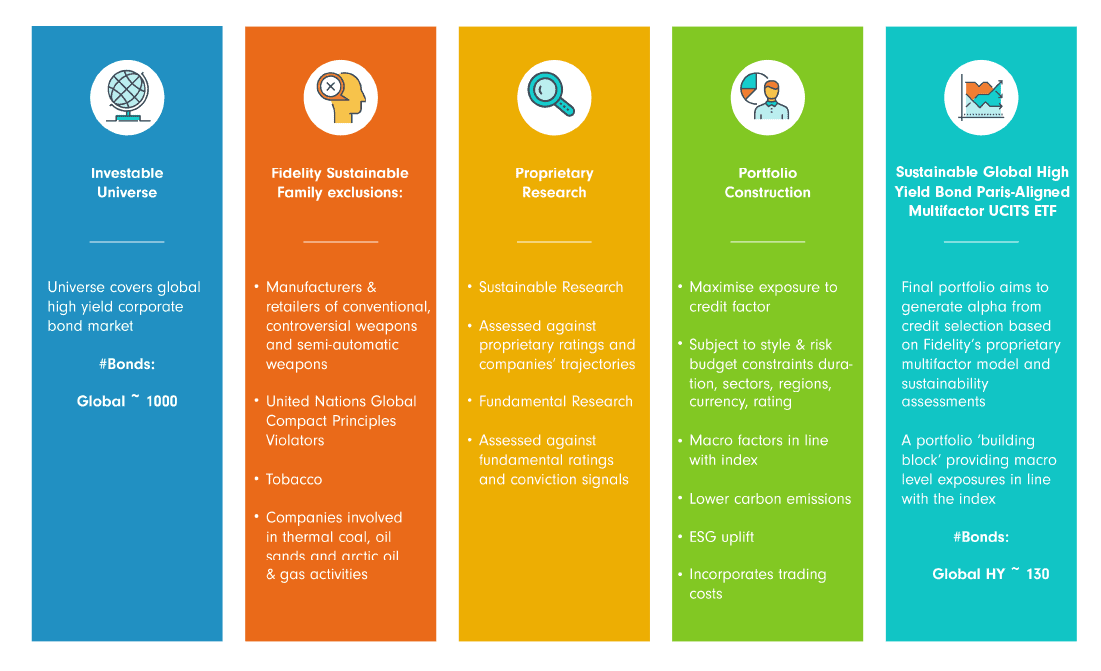

Sustainable ETFs Performance and Market Reception

Now, let’s chat about ETFs—those bundles of stocks you can buy and sell like one. Not just any ETFs, but the ones focused on being kind to Mother Earth. They’re called sustainable ETFs. How well do they do? Folks like them a lot, and they’re growing fast. This is because people dig that they can make money while also doing good.

You see, these green ETFs show us the path to a world where your wallet and your values can be friends. And they’re not just for show either. They pick companies that follow strict rules about looking after the planet, treating people right, and running a tight ship. This way, when you put your money in, you’re part of a squad making good change happen.

Investing in ETFs that care about the earth is not only cool but smart. Big brains in finance say that companies good at ESG stuff often make more dough over time. So you get to help the planet and could score some wins money-wise too.

Now you might wonder, “Is this just a fad?” Nope, it’s more like a wave that’s getting bigger. As our world faces more weather mess-ups and folks calling for change, money talks. It tells companies to step up their game and take care of the world we all share.

So what’s the deal with these green instruments in the market’s future? It’s not just looking good; it’s looking great. These tools help fight stuff like climate change and make sure our Earth has a tomorrow. The word on the street is that this is what smart investing looks like now. It’s not tough to see why: people, planet, and profit can all win together.

With every bond bought and ETF invested in, we’re like gardeners. We plant seeds for trees we might not chill under but our kids will. Making money while making a difference? Now that’s a win-win if I ever saw one. And this is just the start; the green wave in investing is picking up speed, ready to ride into a future where the air’s cleaner, the water’s clearer, and our pockets aren’t empty either. We’re in this together, and every choice to invest in green is like voting for the kind of world we want to live in.

Assessing and Managing Climate Risk in Investment Portfolios

Climate Risk Assessment in Finance: Necessity or Choice?

Is climate risk assessment in finance a must or a choice? It’s a must. We now see major shifts. They make us look at how the weather can change our money game. Storms, heat, and cold snaps can hurt businesses. So can laws to fight climate change. Big-money folks get this. They now check on climate risks before they put cash down.

We use science and data to spot these risks. We look at floods, droughts, and storms. Then we figure out how they could hit money flows. It’s like checking the health of our planet and our pockets at the same time. The goal? To keep our cash safe and help our Earth breathe easier.

Carbon Footprint Reduction Investing: From Niche to Norm

Do you ask how green a company is before you invest? More and more people do. Carbon footprint reduction investing is now a big deal. It’s not just a small, special thing. It’s what smart money does. People want their cash to fight pollution. They want to back the good guys.

They pick funds that help clean the earth. They bet on firms with less smoke and waste. This is how they push for a brighter tomorrow. It sends a clear note to all: clean up or miss out. Green is the color of the future, in nature and in funds.

And what about the big stuff we hear about like green bonds and solar power? They’re part of this story, too. Clean energy wires grow strong. Buildings rise that don’t waste heat or light. This is the green scene we build our hopes on.

As we step into this green future, we know this much is true. Money can be a force for good. It’s not just about more cash in hand. It’s about making earth a better spot for all. We all have a role to play. It starts with a simple choice. Back the future you wish to see. Your money is your vote for the world you want. Keep it green, keep it smart.

The Future of Regulatory Compliance and the Growth of Impact Investing

Navigating Sustainable Investing Regulations: A Roadmap for Investors

Have you heard about sustainable investing rules? They make sure investments help the planet and people. Investors, listen up! The future of ESG investing is tied to these rules. Rules shape how we use environmental social governance criteria. This affects our choices and guides our money. We keep an eye on laws to make smart moves.

What is ESG? It stands for Environmental, Social, and Governance. It’s about picking stocks that care for these areas. Imagine picking teams for a game, but you choose those who also protect the earth. That’s ESG. It’s picking stocks with a heart.

Rules are changing. We must update how we manage money. We want to follow the rules and do good with our investments. Staying in line with regulations is tough. But it’s worth it. We aim to make money and a difference.

We expect more rules soon. This means we must be ready to change. Sustainable investment strategies, they matter now more than ever. They bring profit and follow rules too. It feels good to win this way.

Investors now want to know all about ESG. They care about how a company acts. Is it hurting the earth? Does it treat people fairly? Does it run without sneaky tactics? Sustainable investing regulations ask these questions. We need answers to invest wisely.

The Dual Pursuit of Profit and Purpose in Impact Investing Trends

Now let’s talk impact investing trends. This means putting money in places that do good. And yes, they still make money. We call this the dual pursuit. Seeking profit with purpose.

We see growth in impact investing. It’s like a soccer team scoring goals by playing fair. We invest in companies that fix real-world issues. Climate change, hunger, fair work – they’re on our list. And guess what? These investments are doing well.

We love seeing money help others. Not just once but over time. That’s the power of impact investing. It spreads good as it grows. We take climate risk assessment in finance seriously. We want our money to stand against climate change.

Renewable energy funds are part of this story. They are like planting seeds for a green future. These funds put money in solar, wind, and other earth-friendly power. They are growing fast, just like the plants they support.

There’s also a buzz about sustainable ETFs performance. They track how green investments do. Like a fitness tracker for our planet’s health. They show us we can win by investing green.

Ethical investment funds, we dig them. They avoid harm and aim for good. They are cool like the other side of the pillow. We search for these funds. We want to back winners that also care.

Guys, this stuff is real. We can make money and be heroes for the earth. Let’s keep pushing for profit and purpose together.

We just explored how ESG criteria shape investment moves today. We started with how staying ahead with ESG can make a huge difference. Ethical funds let us invest and keep a clear conscience. Then, we checked out green financial tools that are changing the game. We pondered if green bonds will keep shining bright and how sustainable ETFs are doing in the markets. We delved into managing climate risks in your investments, seeing if they are now a must-have. We noted that putting money in low-carbon options is becoming usual for many. Lastly, we toured the new world of investing rules and saw how impact investing is on the rise, matching profits with purpose.

I say, thinking green and ethical in investing isn’t just nice — it’s essential. More folks want their money to do good and grow. It’s clear to me this is not a passing trend. It’s the smart way to invest for a future we can all enjoy. Let’s keep pushing forward, making money moves that help our planet and people.

Q&A :

Certainly! Here are some FAQs tailored for the topic “What’s Next for Sustainable Investing?” with SEO optimization in mind:

What are the emerging trends in sustainable investing for the next decade?

The evolving landscape of sustainable investing is expected to see a surge in innovative trends. Key focuses include the integration of environmental, social, and governance (ESG) criteria in investment analysis, impact investing aiming to generate social and environmental impact alongside financial returns, and new regulations enhancing disclosure requirements. The rise of green bonds and the exploration of sustainable investing in new markets and sectors such as clean energy and sustainable agriculture also signify the shift towards more responsible investment strategies in the next decade.

How will technological advancements shape the future of sustainable investing?

Technology is set to revolutionize sustainable investing through advancements in data analytics, artificial intelligence (AI), and blockchain. These enhancements will improve the assessment and reporting of ESG metrics, making sustainable investments more accessible and transparent. Additionally, tech-powered solutions are likely to emerge for monitoring the impact of investments, thus ensuring that sustainability objectives are met and can be quantified for investors and stakeholders alike.

What role will policy and regulation play in the evolution of sustainable investing?

Governments and regulatory bodies are increasingly recognizing the importance of sustainability in the financial sector. Policies such as the EU’s Sustainable Finance Action Plan and the US’s SEC proposed rules on climate-related disclosures aim to create a more conducive environment for sustainable investing. These policies are expected to standardize ESG reporting, prevent greenwashing, and potentially incentivize companies and investors to prioritize sustainable practices.

How will investor demand influence the trajectory of sustainable investing?

Investor demand is a powerful force driving sustainable investing forward. As awareness of social and environmental issues grows, so does the appetite for investments that reflect personal values and offer the potential for positive impact. This demand is prompting asset managers to develop more sustainable investment products and is pushing companies to improve their sustainability profiles to attract investment.

What challenges does sustainable investing face as it continues to grow?

While sustainable investing is gaining momentum, it also faces significant challenges that could shape its future. These include the need for better standardization of sustainability metrics, the persistence of greenwashing, and the potential for market saturation as more players enter the field. Moreover, sustainable investments must consistently demonstrate competitive financial performance to maintain their appeal to a broad investor base. Addressing these challenges is essential for the continued growth and effectiveness of sustainable investing.

These questions and answers should provide a strong foundation for addressing common queries about the future of sustainable investing, and are formatted and optimized for search engines.