Uniswap is a prominent decentralized finance (DeFi) trading platform built on the Ethereum blockchain. It enables users to trade cryptocurrency assets without the need for intermediaries. Uniswap’s rapid growth has revolutionized the way cryptocurrency is traded, offering new opportunities for investors. So, what is Uniswap? Let’s explore in detail in the article below.

What is Uniswap?

Uniswap is a decentralized exchange (DEX) that allows users to trade cryptocurrency without relying on intermediaries, such as centralized exchanges (CEX). Developed on the Ethereum blockchain, Uniswap utilizes an Automated Market Maker (AMM) mechanism to facilitate automated transactions through liquidity pools. This creates an open trading environment that is not controlled by any organization, ensuring users can trade easily and securely.

Uniswap stands out by completely eliminating the need for traditional order books, replacing them with user-generated liquidity pools. This not only offers high flexibility but also helps reduce slippage during trades.

Uniswap’s development team and investors

Uniswap was founded by Hayden Adams, a software engineer who previously worked at UniSwap Labs. The platform’s development team consists of experts with extensive experience in blockchain and finance, supported by major investors in the industry.

One of the most prominent investors is Andreessen Horowitz (a16z), one of the largest venture capital firms in the tech industry, which supported Uniswap during its early development stages. This team has built Uniswap into one of the most powerful decentralized trading platforms in the DeFi ecosystem.

Key features of Uniswap

Uniswap boasts several distinctive and convenient features that make trading quick and easy within the DeFi ecosystem. Below are the four main features of Uniswap that users should know:

Swap (Token Swap)

The Swap feature on Uniswap allows users to easily swap one ERC-20 token for another. The process is simple and intuitive: users select the input and output tokens, then specify the amount to be traded. The protocol automatically calculates the amount of output tokens the user will receive. After confirmation, the transaction is executed, and the output tokens are directly transferred to the user’s wallet.

Technically, the Swap on Uniswap operates using an Automated Market Maker (AMM) mechanism, as opposed to order books used by traditional exchanges. This allows real-time reflection of exchange rates and slippage through liquidity pools.

Liquidity Pool

Each token pair on Uniswap is supported by a liquidity pool, which is a smart contract containing the balance of two ERC-20 tokens. Liquidity Providers (LPs) contribute to this pool to create liquidity for trades. By providing liquidity, LPs receive Liquidity Tokens, which represent their share of the liquidity in the pool.

When trades occur, LPs earn a 0.3% fee on each transaction, distributed based on their contribution to the pool. LPs can withdraw their liquidity at any time by burning their Liquidity Tokens. This feature encourages community participation in maintaining liquidity for the Uniswap platform.

Flash Swap

Flash Swap is a unique feature introduced in Uniswap V2. It allows users to withdraw any amount of ERC-20 tokens without immediate payment, as long as the user repays or completes the transaction within the same transaction. This feature offers flexibility and convenience for more complex trades, such as settling positions on DeFi platforms like Compound or Maker.

Flash Swap optimizes complex trading strategies without requiring a large balance in the wallet. Users can execute trades without needing to lock up initial capital, as long as the loan is repaid immediately.

Oracle

The Oracle in Uniswap is a crucial component that provides on-chain price data for other DeFi applications. Uniswap V2 integrated a decentralized oracle system that records real-time price data and prevents price manipulation.

With Uniswap’s Oracle, price data is recorded in such a way that price manipulation becomes extremely costly and nearly impossible over short periods. This ensures transparency and fairness for transactions and DeFi applications utilizing Uniswap’s price data.

Thanks to these special features, Uniswap is not only a decentralized exchange (DEX) but also a key tool in the decentralized finance (DeFi) ecosystem, offering opportunities for both users and investors to participate in the cryptocurrency market effectively and securely.

Uniswap’s development roadmap

Uniswap has undergone several stages of development, continuously improving to become one of the leading decentralized exchange (DEX) platforms in the DeFi ecosystem. Below are some key milestones in Uniswap’s development:

Uniswap V1 (2018) – The beginning of a revolution

Launch: Uniswap V1 was launched in November 2018 by Hayden Adams with the goal of creating a decentralized exchange that enables the trading of ERC-20 tokens without the need for intermediaries.

Operation mechanism: The first version used the Constant Product Market Maker (CPMM) mechanism, allowing direct trades between ERC-20 tokens without requiring an order book.

Key feature: This was the beginning of decentralized exchanges (DEX), aiming to reduce dependency on centralized exchanges like Binance or Coinbase.

Uniswap V2 (2020) – Upgrade with new features

Launch: Uniswap V2 launched in May 2020, introducing several key improvements to enhance the user experience.

Key features:

- Direct trades between ERC-20 tokens: Uniswap V2 allowed trading between ERC-20 tokens without converting to ETH, reducing gas fees.

- Oracle and Anti-Front-running: The oracle feature was added to provide accurate pricing for smart contracts and mitigate front-running attacks.

- Transaction fees: Uniswap V2 retained the 0.3% transaction fee for liquidity providers (LPs).

Impact: Uniswap V2 opened up new opportunities for liquidity providers and cryptocurrency traders within the DeFi platform.

Uniswap V3 (2021) – Focusing on performance optimization

Launch: Uniswap V3 was released in May 2021, with breakthrough features and improvements aimed at enhancing trade efficiency and reducing gas fees.

Key features:

- Concentrated liquidity: LPs can select the price range where they want to provide liquidity, rather than providing liquidity across the entire price range. This helps increase profits and reduce trading costs.

- Range orders: Uniswap V3 introduced range orders, allowing users to adjust liquidity positions based on different trading strategies.

- Flexible liquidity: LPs can optimize returns by adjusting liquidity conditions to match market demand.

Impact: Uniswap V3 became a leader in improving decentralized exchange efficiency, helping reduce trading fees and improve liquidity.

Uniswap V4 (Expected in 2024) – The future of DeFi

Expected features: Uniswap V4 will continue to enhance existing features and could introduce groundbreaking improvements in reducing transaction fees, optimizing liquidity, and minimizing slippage. Features such as “modular architecture” and “new AMM designs” may be added, making Uniswap even more flexible and powerful.

Vision: Uniswap aims to further optimize the trading experience, increase stability, and enhance compatibility with multiple blockchains, while maintaining its role as one of the leading DeFi platforms.

With each update, Uniswap has consistently innovated and improved to align with the evolving trends in DeFi and blockchain. These advancements not only help Uniswap maintain its position but also contribute to the overall growth of the decentralized finance ecosystem.

How does Uniswap work?

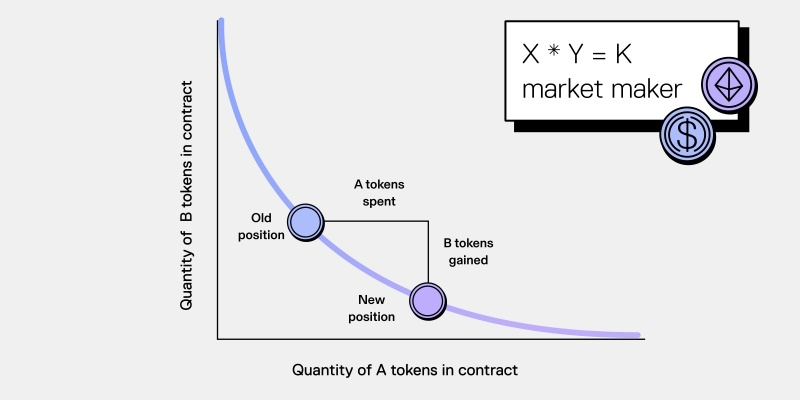

Uniswap operates based on the Automated Market Maker (AMM) mechanism, which eliminates the need for intermediaries or order books used by traditional exchanges. Instead, tokens are traded through liquidity pools contributed by users. Each liquidity pool on Uniswap is a pair of ERC-20 tokens, such as ETH/USDT or ETH/DAI. When a user wants to trade, they exchange their tokens for those in the pool, and the value of the tokens is automatically adjusted based on the Constant Product Market Maker (CPMM) formula.

Uniswap ensures that the exchange rate between two tokens in a pool remains stable by using the following mathematical formula: x ⋅ y = k

Where x and y are the quantities of the two tokens in the pool, and k is a constant. When a trade occurs, the ratio between the two tokens changes, and the token values are automatically adjusted. This helps maintain stable pricing and prevents market manipulation.

Users can provide liquidity by depositing tokens into Uniswap’s pools. When trades occur, they earn a share of the transaction fees (typically 0.3%) as a reward. This creates a highly incentivized ecosystem for participants.

Uniswap Token (UNI Token)

Basic information about UNI Token

- Token name: Uniswap Token

- Token symbol: UNI Token

- Blockchain: Ethereum, BNB Chain, Arbitrum, Optimism

- Total supply: 1,000,000,000 UNI

- Circulating supply: 753,766,667 UNI

Use Cases of UNI Token

- Governance: UNI Token is the governance token of the Uniswap platform, allowing holders to participate in important decisions related to the development and changes of the protocol.

- Storage in treasury: Previously, UNI Token was used as a reward in liquidity mining activities. However, the remaining supply of UNI is now locked in the platform’s Treasury and may be released through governance votes in the future, depending on the community’s decision.

Storing and trading UNI Token

As UNI follows the ERC-20 and BEP-20 standards, investors can store this token on various wallets such as Metamask, Trust Wallet, Coin98 Wallet, etc. Additionally, UNI can also be stored on exchanges that list this token, making it easier for trading.

Through the information above, investors can easily grasp the basic features of the UNI token and how to use it within the Uniswap ecosystem.

Participants on the Uniswap platform

On Uniswap, there are three main participants in the trading process:

Traders: These are individuals who conduct token trades on the platform. They can buy or sell any ERC-20 token without the need to find a trading partner.

Liquidity providers (LPs): These are individuals who contribute liquidity to liquidity pools. By providing liquidity, LPs earn rewards from transaction fees on the platform. This is a crucial component that helps Uniswap maintain high liquidity and ensure smooth transactions.

Uniswap governance: Uniswap uses the UNI token to govern the platform. Major decisions regarding the platform’s changes and development are made through votes from the community of UNI token holders. This ensures the platform remains decentralized and not controlled by a single group or organization.

Advantages and disadvantages of Uniswap

Advantages of Uniswap

Decentralization: Uniswap operates without intermediaries, which enhances transparency and security in transactions.

High liquidity: With numerous liquidity pools, Uniswap provides high liquidity for ERC-20 tokens.

Low transaction costs: Compared to centralized exchanges, Uniswap has relatively low transaction fees, especially with version 3, which helps users save on costs.

Disadvantages of Uniswap

Slippage: In large-volume trades or volatile markets, users might experience slippage, which is when the token price changes before the transaction is completed.

Impermanent loss: Liquidity providers may face impermanent loss when the value of tokens in the pool changes significantly from their original value.

Ethereum dependency: Since Uniswap operates on the Ethereum blockchain, users may face high gas fees and delays during periods of congestion on the Ethereum network.

So, “What is Uniswap?” has been thoroughly explained to you through this article by Financial Insight Daily. Uniswap has become one of the leading decentralized exchanges in the DeFi ecosystem. With its innovative AMM mechanism, high liquidity, and powerful features, Uniswap not only allows users to easily trade ERC-20 tokens but also provides opportunities to earn profits from liquidity provision. Although there are some drawbacks like slippage and impermanent loss, Uniswap still maintains its position in the cryptocurrency community and will continue to grow strongly in the future.