Growth vs. Value Stocks: Unveiling the Investment Mysteries

Ever scratch your head, pondering What is the difference between growth and value stocks? These two power players in the stock market are like the tortoise and the hare of investing. Growth stocks sprint ahead, offering the allure of big profits as they blaze through revenue records. But don’t count out value stocks – these steady eddies might just have golden eggs in their nests with their attractive price tags. In this no-nonsense guide, I’ll break down how these stocks differ and why their unique qualities might sync with what you’re looking for in your portfolio. From their core definitions to their role in your long-term investment strategy, I’ve got the insights you want and the expertise you need. Strap in, folks – it’s time to demystify these investment giants.

Understanding the Core of Growth and Value Stocks

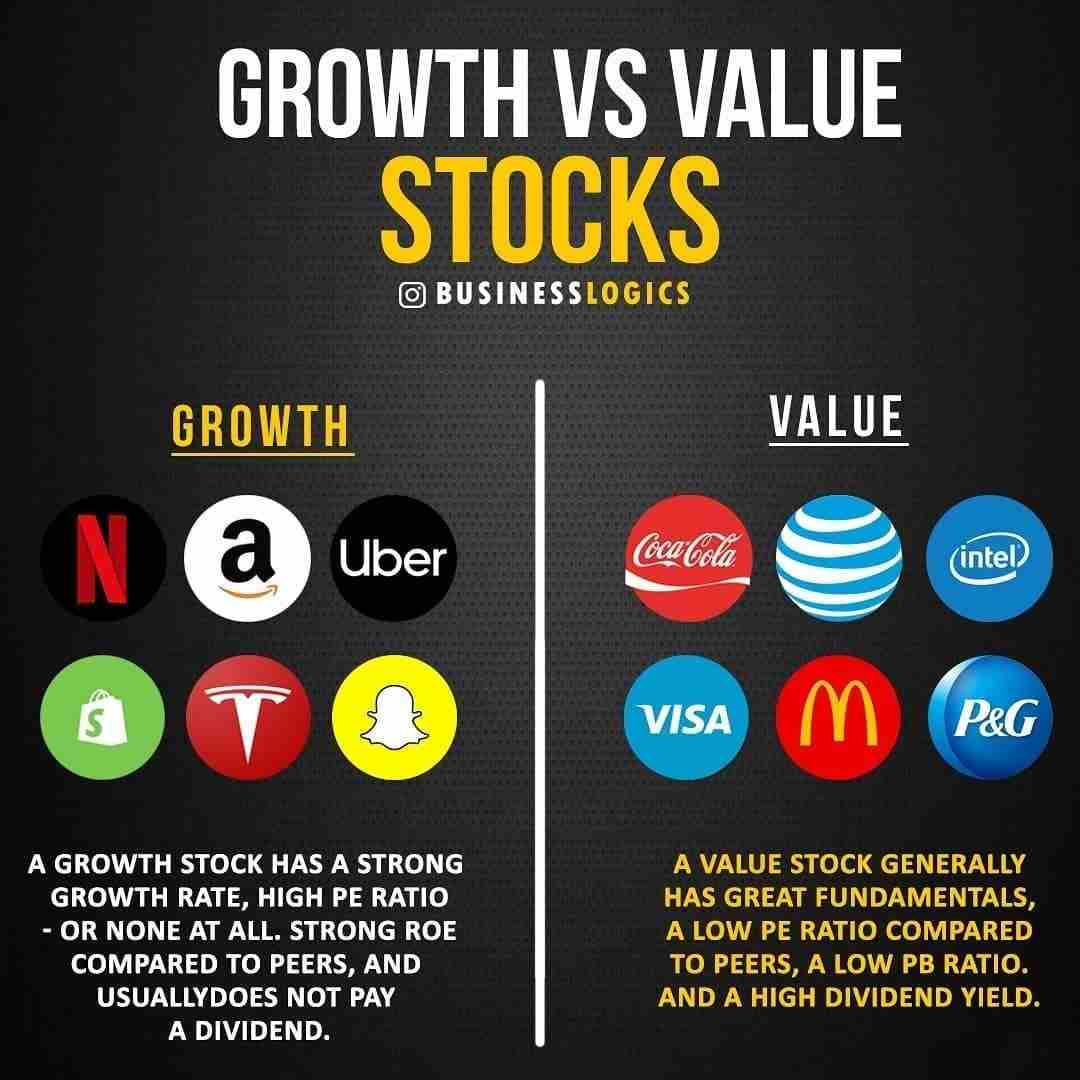

Defining Growth vs Value Investing Characteristics

What builds the core of growth and value stocks? Let’s dig deep.

Growth stocks are like rockets. They aim high and grow fast. These are companies that reinvest earnings back into the business. They aim to become leaders and push limits. So, growth investing focuses on firms that show signs of above-average growth.

Value stocks, on the other hand, are like hidden treasure. They may seem dull but are often underpriced. Investing in value stocks means finding deals. It’s buying shares that trade for less than their book value. These firms might not grow as fast, but they can be stable and strong.

Here’s a key point. Growth stocks seldom pay dividends. Why? Because they use their profits to grow even more.

Value stocks often pay dividends. This is because the companies want to share their profits with the owners, the shareholders.

Contrasting Revenue Growth and Dividend Yields in Stock Types

Now, how do revenue growth and dividend yield differ between these stock types?

Growth stocks explode in sales. They constantly push to earn more each year. But these companies usually don’t offer dividends. The money goes back into the company to fuel more growth.

Value stocks may not have sky-high sales numbers. Yet, they often hand out portions of profit as dividends. This gives a regular income to investors. Sometimes, these stocks have been around longer. They prove to be steady ships in a stormy market.

When we talk about market capitalization, growth stocks come in all sizes. Some are huge tech firms. Others might be smaller but full of energy and new ideas. Value stocks tend to be steady players in the market. They can be big companies that have been around the block. Or, they could be less known but solid.

Picking stocks is like choosing a path. Do you take the fast, exciting trail? Or the steady, well-worn road? Think about what you want in the long run. High-growth potential can be thrilling but can come with more bumps. Value stocks might not grow fast, but they can offer a calmer ride and regular cash through dividends.

Investors often look at P/E ratios and P/B ratios to compare these stocks. These tools show how the market values each dollar of earnings or book value. These ratios help tell if a stock is a deal or too pricey. Growth stocks often have high P/E ratios, meaning the market expects big things. Value stocks might have lower ratios, showing they might be bargains.

Remember, the ride with stocks always has ups and downs. Team up growth and value stocks to balance it out. This mix can suit many investor goals and risk levels.

Smart investing isn’t just knowing facts and figures. It’s matching your choices with your dreams. It’s a mix of smarts, guts, and getting the timing right. So, choosing growth or value stocks isn’t just about numbers. It’s about who you are as an investor.

To wrap up, growth and value stocks suit different types of investors. Knowing which fits your style is key. It’s a big world out there in the stock market. Dive deep into your choices, and you can find your best fit. Growth for speed and thrill, value for steadiness and deals. What’s your pick?

Analyzing Metrics: Financial Indicators and Stock Valuations

Exploring P/E Ratio and P/B Ratio Differences

Let’s dive into some key numbers. When we talk about stocks, two big ratios come up: P/E and P/B. P/E, or price-to-earnings, measures how much you pay for $1 of earnings. A high P/E often tags a growth stock, showing that folks expect big things from it. They’re ready to pay more now, thinking the company’s profit will soar later.

P/B, or price-to-book, compares a stock’s price with the company’s book value. Think of it as what you’d get if the company sold everything and paid all its bills. Value stocks shine here. They often have lower P/B ratios, meaning you might be getting a bargain.

The Role of Company Earnings and Fundamental Analysis in Assessing Stocks

Now, let’s talk earnings. They’re like a company’s report card. And in stocks, they really matter. For growth investors, it’s all about the future. They bet on companies with earnings that could shoot up. Value investors are different. They look for steady, solid earnings now, for a nice price.

Fundamental analysis is our toolkit for this. It helps us dig into a company’s health, beyond just numbers. We check out how it makes money, its leaders, and its edge over rivals. It’s like giving a car a test run, not just kicking the tires. For growth stocks, we look at potential. For value stocks, we check for hidden gems, overlooked by others.

There you have it, friends. Numbers that guide us, earnings that tell a story, and analysis that digs deep. It’s about matching the right stock with the right strategy. And with that, you’re on your way to smarter investing.

Strategic Investment: Aligning Stock Types with Investor Goals

Evaluating Long-Term Investment Approaches vs. Timing the Market

When you play the long game in stocks, your goal isn’t a quick win; it’s building wealth over many years. Aim to find shares that will grow steadily in value. It’s like planting a tree and waiting for it to bear fruit. You pick companies that seem strong, with the chance to become even stronger (think high-growth stock potential). Then wait for your investment to bloom.

Short-term players try to guess the best times to buy or sell stock for fast profit. They watch the market with a hawk’s eye. This takes skill and often leads to more risks. So what’s best? Think about how much time you’ve got, and how much risk feels okay for you. Then decide if you’re in it for a long haul, or if you prefer the thrill of the chase.

Risk Tolerance and Portfolio Diversification: Growth and Value Perspectives

How do you feel about risk? Everyone’s different. If roller coasters make you sick, you might prefer value stocks. They’re usually less pricey and more stable, with companies that have been around the block. We look for stuff like how much a firm is worth (market capitalization), dividend yield, and if a stock’s price is low compared to earnings (P/E ratio).

But maybe you’re the type who loves excitement. Growth stocks could be your speed. They don’t often pay dividends because they reinvest profits to grow fast. Risks are higher, but so are possible rewards. These stocks can change price quick — up or down. Look for rising sales (revenue growth) and other signs that a company is expanding fast.

Building a mix of both growth and value stocks could be smart. It’s like having a balanced diet. Too much of one thing isn’t good. When you spread your bets, you hedge against big losses. You’ve got steady performers and high fliers all in one basket.

Picking stocks that match your goals, risk level, and time frame is the key. It’s also why understanding these things matters so much. It’s not just about the thrill of picking winners. It’s about making choices that fit who you are and what you want your money to do for you. Use what you learn about stock types to create an investment strategy that’s as unique as you are.

Market Dynamics: Navigating Economic Cycles and Market Trends

Historical Performance and Future Potential of Growth and Value Stocks

When we talk about stocks, we see two main styles: growth and value. Growth stocks are like the race cars of the stock market. They go fast and aim high! Companies behind growth stocks make big sales and shoot for the stars. They don’t pay out dividends much, but people buy them for their big future potential. Think of cool tech companies that grow fast.

Value stocks are more like sturdy trucks. They keep going, slow and steady. These stocks come from companies that may not grow as quick, but are solid. They often give money back to shareholders through dividends. They are like trusted friends that have been around and don’t cost too much.

Stocks are tricky, though. They can go up and down with how the world’s money flows. Growth stocks can soar when times are good. But if the money tide turns, these stocks can fall fast too. Value stocks often shake less when trouble hits. They may not zoom to the stars, but they hang on tight and can protect your money better during bad times.

Economic Indicators Impacting Growth Stocks Risks and Value Stock Stability Factors

Now, every stock type dances to the beat of the economy’s drum. Growth stocks do well when things look up. When people have jobs and spend money, these stocks can grow a lot. But there’s a catch. If costs rise too much, or banks change how they lend money, growth stocks can dip. They rely on good times to keep up their fast pace.

Value stocks don’t sweat the small stuff as much. They’ve seen it all and can stay more cool when costs go up. These stocks grow slow, but they’re tough and last long. They can be smart picks when the money world looks rough because they stick around. They may not shoot up fast, but they can keep you in the game when others may not.

So, what does this all mean for you and your money? If you dream big and like taking chances, growth stocks might excite you. But remember, they can go up and down a lot. If you want to keep things steady and safe, then value stocks can be your rock. They can help you sleep at night, knowing your money won’t swing wild with the market winds.

Choosing between growth and value is not just about what the stocks do. It’s also about who you are as an investor. It’s your money story, and these stocks are the characters. Some investors even mix it up, holding both types to balance their bets. They match their money moves with how they see the world and their place in it.

In the end, the stock market is a big, busy place with lots of paths to pick from. Growth and value stocks are like guides that can help you find your way. Knowing which one fits your style and goals can make a big difference. And whatever you pick, remember, in the twisty journey of investing, it’s all about finding the right steps to reach your money dreams.

In this blog, we dug deep into growth and value stocks, uncovering what sets them apart. We looked at their unique traits, from how fast companies expand to their dividend payouts. We also tackled the big financial terms like P/E ratio and P/B ratio, breaking down what these mean for a company’s worth.

We then matched investing strategies with personal goals. Whether you’re in it for the long haul or timing the market, knowing your own risk game is key. We learned that a mixed bag of stocks might just be your best bet.

Lastly, we talked about how stocks behave over time and in different economic climates. Growth and value stocks each have their moments to shine, depending on market shifts.

Here’s my final take: a smart investor knows their stuff, plans for the future, and keeps an eye on the market’s pulse. Mixing growth and value stocks could just be the move that sets you up for success. Happy investing!

Q&A :

What exactly defines growth versus value stocks?

Growth stocks are represented by companies with the potential for high earnings growth, often reinvesting profits back into the business for expansion, innovation, and market share capture. They typically have higher price-to-earnings ratios and might not pay dividends. On the contrary, value stocks are tied to companies that are considered undervalued in relation to their financial performance and market price. These stocks often pay dividends, have lower price-to-earnings ratios, and are seen as bargains to investors.

How do growth and value stocks perform in different market conditions?

Growth stocks generally perform best in bullish markets when investors are optimistic, as they are willing to pay more for the perceived higher future earnings. Conversely, value stocks may outperform during bearish or volatile markets because of their potential for stable earnings, undervaluation, and the dividends they often provide. However, market conditions are just one of the many factors influencing stock performance.

Can investors include both growth and value stocks in their portfolio?

Yes, including both growth and value stocks in a portfolio can provide diversification benefits. This mixed investment strategy allows investors to tap into the aggressive earnings potential of growth stocks while balancing it with the conservative safety net of value stocks, which could potentially mitigate risk and volatility.

Are tech stocks typically considered growth or value?

Tech stocks are usually categorized as growth stocks due to their high potential for scaling, rapid urbanization, and continuous innovation, propelling them to reinvest earnings and often delay or forgo dividend payouts in favor of expansion. This results in higher price-to-earnings ratios, aligning with growth stock characteristics.

What are the key indicators to identify growth and value stocks?

To identify growth stocks, key indicators include high future earnings growth rates, high price-to-earnings (P/E) ratios, and often a lack of dividends. For value stocks, look for low P/E ratios, discounted stock prices relative to book values, and steady dividend yields. The intrinsic value of value stocks is often higher than the current market price, and they are regarded as undervalued by the investor community.