LSDFi, or Liquidity Staking Derivatives Finance, is an emerging trend in the decentralized finance (DeFi) space that combines staking assets with the ability to create flexible trading opportunities. This concept allows users to optimize their staked assets for profit while maintaining liquidity and managing risk effectively. LSDFi unlocks attractive investment opportunities in the crypto space, offering benefits such as the ability to participate in yield farming, lending, and trading without needing to withdraw assets from staking. In this article, we’ll explore What is LSDFi? how to use LSDFi them to leverage crypto opportunities effectively

What is LSDfi?

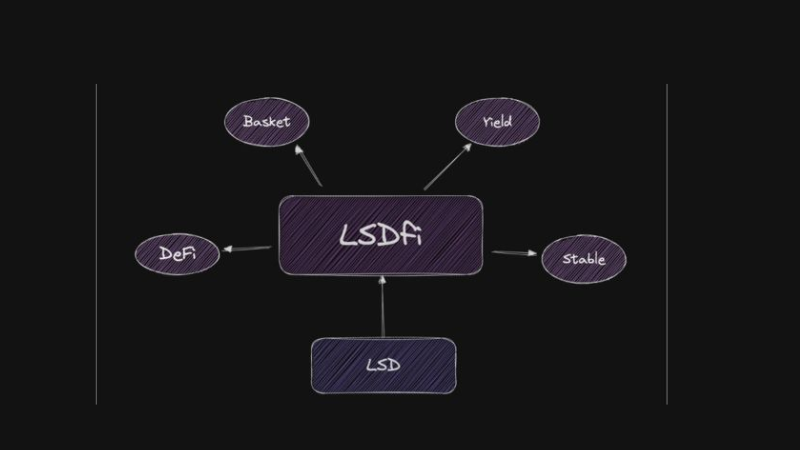

Liquid Staking Derivatives Finance (LSDfi) is a specialized branch of Decentralized Finance (DeFi) that leverages liquid staking derivatives (LSDs) to offer more liquidity and financial opportunities for staked assets. LSDs are tokenized representations of assets that are staked in proof-of-stake (PoS) blockchains. These tokens allow users to unlock the value of their staked assets by enabling trading, lending, and other financial activities while the original assets remain staked.

LSDfi takes the concept of liquid staking a step further by creating a suite of financial products and services centered around these liquid staking derivatives. By utilizing LSDfi, users can access new investment strategies, earn rewards, and participate in DeFi activities such as liquidity provision, yield farming, and staking-based lending without having to unstake their assets.

Key Components of LSDfi

- Liquid Staking Derivatives (LSDs): Liquid Staking Derivatives (LSDs) are tokenized versions of staked assets, allowing users to keep the value and staking rewards of their original assets. When an asset is staked, it is typically locked up and cannot be used in other DeFi activities. LSDs solve this problem by creating a tradable token that represents the staked asset, thus providing liquidity without sacrificing the staking rewards. These tokens can be used in various DeFi protocols or traded while the original assets remain staked and earn rewards

- DeFi Protocols: DeFi protocols are decentralized platforms that integrate LSDs into their ecosystems. These protocols offer a wide range of financial products, such as lending, borrowing, trading, and yield farming. By incorporating LSDs, DeFi platforms can enable users to leverage their staked assets without losing the benefits of staking. For example, users can lend their LSDs to earn interest or use them as collateral to borrow funds, creating a dynamic new avenue for capital utilization in the crypto space

- Staking Pools: Staking pools aggregate staked assets from multiple users to enhance liquidity and efficiency. By pooling their assets, users can increase their staking power, allowing them to earn higher staking rewards and participate in more lucrative opportunities. Additionally, these pools often facilitate the issuance of LSDs, allowing participants to benefit from the liquidity of their staked tokens. Staking pools help reduce individual risk and provide a more scalable solution for users seeking to participate in the staking process with smaller amounts of cryptoHow LSDfi Works

- Staking and Tokenization: Users start by staking their assets, such as Ethereum (ETH), in a staking pool or through a staking service. In exchange for staking their assets, users receive Liquid Staking Derivatives (LSDs). These LSDs are tokenized representations of the staked assets and give users the right to receive staking rewards. While the assets remain staked and continue to generate rewards, users now have liquid tokens (LSDs) that represent their staked holdings

- Utilization of LSDs: Once users have LSDs, they can leverage these tokens within the DeFi ecosystem in various ways

- Trade LSDs: LSDs can be exchanged on decentralized exchanges (DEXs), allowing users to gain liquidity or speculate on their value

- Lend and Borrow: LSDs can be used as collateral to borrow other assets, or they can be lent to earn interest, allowing users to capitalize on their staked assets without un-staking them

- Participate in Yield Farming: Users can stake their LSDs in different DeFi protocols to earn additional rewards, thus maximizing the utility of their tokens

- Earning Rewards: Despite being used for various DeFi activities, the underlying staked assets continue to earn staking rewards. Users can either choose to have these rewards automatically reinvested into the system or claim them periodically. This allows users to maintain the benefits of staking while also leveraging the flexibility that LSDs provide in the DeFi space

Benefits of LSDfi

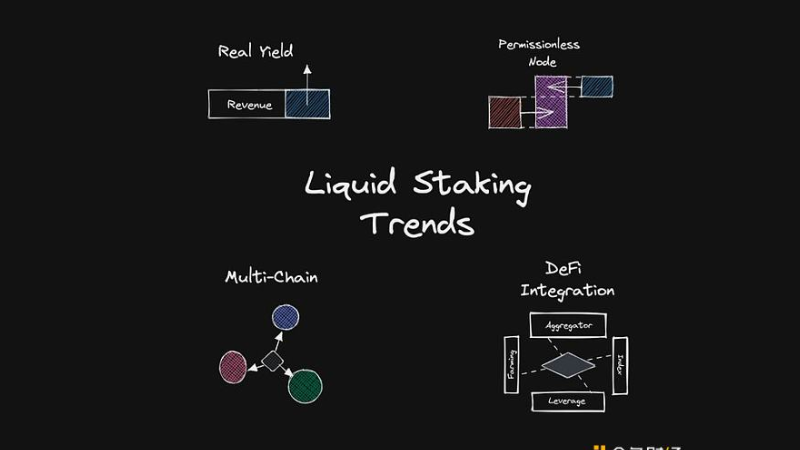

- Enhanced Liquidity: LSDfi offers significant improvements to liquidity by allowing users to trade and utilize Liquid Staking Derivatives (LSDs) while still earning staking rewards. This overcomes one of the main limitations of traditional staking, where assets are locked for a period of time and cannot be accessed for other purposes

- Increased Capital Efficiency: LSDfi enables better capital efficiency by allowing users to use LSDs as collateral in lending and borrowing platforms. This means the same staked asset can generate multiple income streams, maximizing its utility and making it more profitable for users

- Diversification of Investments: LSDfi provides users with more options for diversifying their investments. Users can allocate LSDs across different DeFi protocols, engage in various yield farming opportunities, or hedge their positions, allowing for more strategic and diversified portfolio management

- Risk Mitigatio: Many LSDfi platforms come with built-in risk management features, such as over-collateralization and liquidation mechanisms, to help protect users from adverse market movements. This adds an additional layer of safety for users engaging with DeFi protocols

Use Cases of LSDfi

- Yield Optimization: LSDfi enables users to optimize their yields by participating in multiple DeFi protocols. Users can stake their assets, receive LSDs, and use them in yield farming or liquidity mining programs, thus earning additional rewards while still benefiting from their staked assets

- Collateral for Loans: LSDs can be used as collateral within lending protocols, allowing users to borrow other assets without the need to unstake their original holdings. This provides access to liquidity without giving up the staking rewards generated by their assets

- Decentralized Exchanges (DEXs): LSDfi enhances the liquidity of decentralized exchanges by adding more trading pairs and creating deeper liquidity pools. Users can trade LSDs against other assets, improving the overall liquidity and trading experience on DEXs.

- Hedging and Speculation: LSDfi offers new opportunities for traders to hedge against market volatility or speculate on the future value of staked assets. This provides a new dimension to trading in the DeFi landscape, as traders can now manage risks and take advantage of market movements using LSDs.

LSDFi (Liquidity Staking Derivatives Finance) is revolutionizing the DeFi landscape by providing enhanced liquidity and flexibility for staked assets, allowing users to unlock the full potential of their investments without needing to unstake. With the ability to participate in yield farming, lending, and trading while still earning staking rewards, LSDFi opens up new avenues for capital efficiency and risk management. Its key components—liquid staking derivatives, DeFi protocols, and staking pools—empower users to leverage their staked assets in a way that was previously impossible with traditional staking methods

Financial Insight Daily will continue to track and analyze developments in LSDFi and other emerging trends in DeFi, bringing you the latest insights to help navigate the rapidly changing world of cryptocurrency and decentralized finance