What causes stock market crash? That question nags every investor out there. Crashes strike like thunder, leaving markets shaky and investors nervous. I’ll take you behind the scenes, revealing what really tips the first domino. We’ll decode market signs, eye those high peaks of overvalue, and spot risks hiding in plain sight. Then, we’ll dive into economic health checks that spell out loud warnings. Come along for a critical look at shocks that rock our financial worlds and the history lessons we should not ignore. Trust me, understanding these triggers can mean the difference between sleeping soundly and staring at the ceiling.

Deciphering Stock Market Crash Triggers

Overvaluation and Speculative Bubbles

How do overvalued stocks trigger crashes? They create risky bubbles. When prices climb higher than actual value, watch out. This can lead to big problems. Think about the dotcom bubble. Companies’ stock prices soared too high, too fast. Then, real worth caught up, and they fell hard.

Next, speculative bubbles. They’re like overvalued stocks on steroids. Everyone wants in. They think they’ll make easy money. Prices shoot up. The truth? There’s often not much to back those prices. When everyone realizes, panic hits. People sell fast. Prices plummet. That’s how markets crash.

So, remember the dotcom burst and the Wall Street crash of 1929. Both were nasty. Tons of money gone. People felt it deep. See, crashes from bubbles can hurt folks a lot.

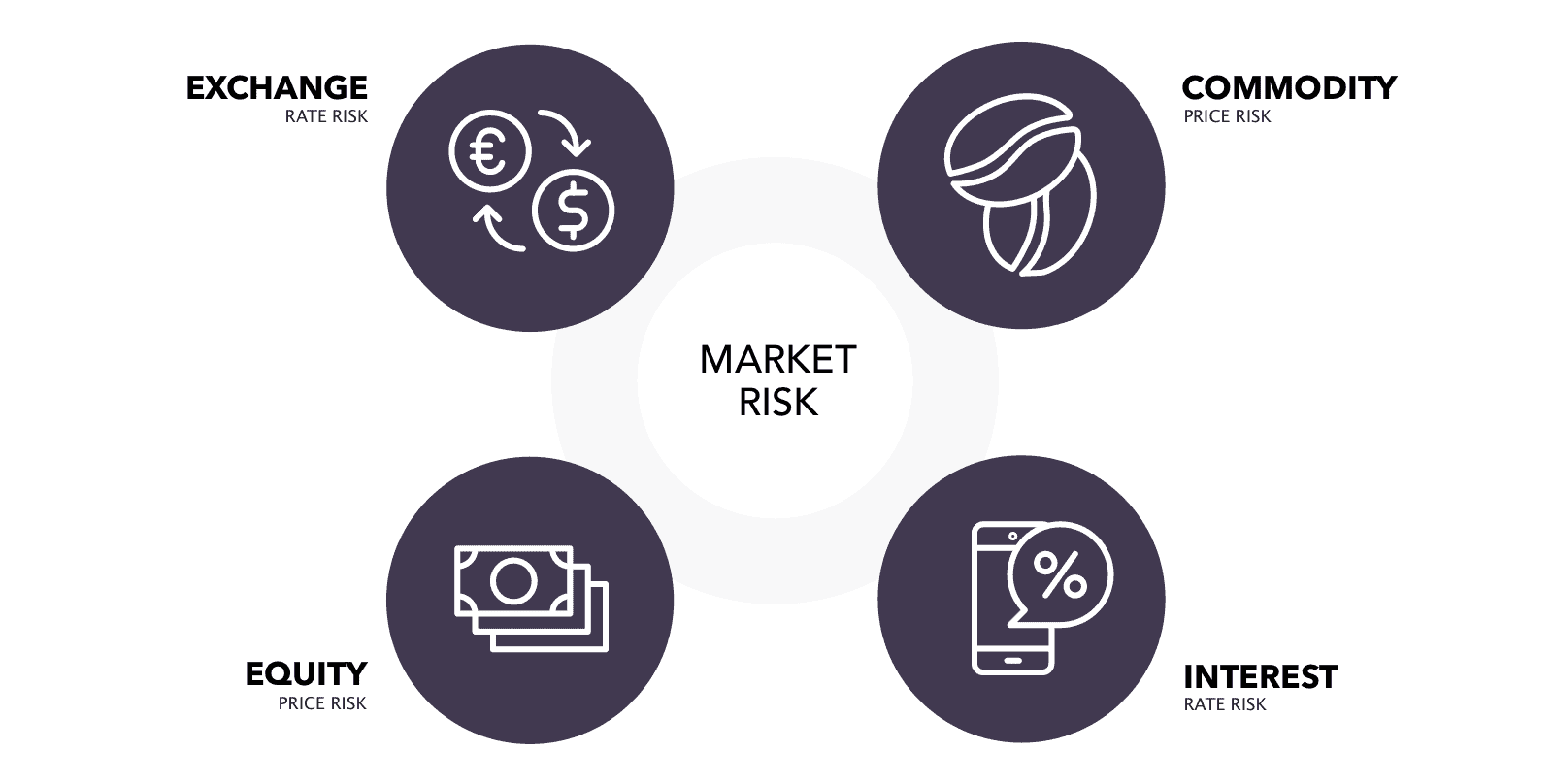

Systemic Risks and Financial Market Volatility

Now, let’s talk systemic risks. These are big dangers hiding in the financial system. They can shake everything when they strike. Picture one bad loan causing trouble for banks everywhere. That’s systemic risk. It can lead to things like the 2008 crisis. Houses were in play. Then, the loans backing them weren’t solid. It hit banks, and the shock spread.

Volatility? Markets bounce up and down. That’s normal. But when it’s wild? That’s volatility. It can scare investors. It makes things shaky. Sometimes markets drop hard.

Think Black Monday 1987 or the 2008 financial crisis. Markets lost a lot, and it happened fast. That kind of drop comes from fears about the economy or sudden bad news.

Okay, why do crashes happen? Bubbles can burst. System risks can come out. Markets go wild. It all leads to drops. Stocks might not be worth what we paid. Banks might be in over their heads. It’s about risks not seen or ignored. When they show up, they hit hard.

We’ve seen before how ugly it gets. Jobs lost. People’s savings gone. Learning from these is key. Watch for the signs. Be smart about where you put your money. It can help you stay safe when the market gets rough.

In the end, crashes can come out of nowhere. But knowing what’s happened before? That helps us get ready. It’s not about fear. It’s about being smart and watching closely. The signs are there if you know where to look.

Economic Indicators and Their Impact on Equity Markets

The Effect of Interest Rate Hikes and Inflation

Have you seen prices go up at the store? That’s called inflation. It makes things cost more. Higher prices can make people spend less. When people buy less, companies make less money. Then, their stock’s value can drop. Now, the people who run our money, like the Federal Reserve, they try to stop inflation. How? They make it more expensive to borrow money. This is an interest rate hike.

Imagine you want to buy a bike on a loan, but the loan costs more now. You might wait to buy the bike. Many people and companies do the same. They put off big buys or plans. Still, it takes time for these changes to show. Sometimes, the economy slows down too much. Companies earn less, people lose jobs, and stock prices fall. This can lead to a stock market crash. Remember, when loans cost more, people and businesses spend less. This can be a trigger for the market to crash.

Assessing the Unemployment Rate and Market Liquidity Concerns

What about jobs? When fewer people have work, they spend less money. This is bad for businesses. Companies may see their profits drop. When profits fall, stocks can fall too. It’s like a big cycle. Now, this is where market liquidity comes in. Liquidity means how easy you can buy or sell something fast without changing its price. If stocks go down, people want to sell them. But what if no one wants to buy? The market gets stuck. No buys or sells, or it happens at really low prices.

This can hurt everyone’s cash. It’s like a traffic jam, but with money. In a traffic jam, you can’t go anywhere, and in a market without liquidity, your money is stuck. When stocks go down, and no one can sell, panic starts. People worry they will lose everything. Then, they sell at any price, making prices drop even more. It can happen fast—a flash crash. It’s a quick, big drop in stock prices. It’s another trigger for a crash.

Crashes are scary, but knowing about these signs helps. Interest hikes slow spending and borrowing. Less work for people means less spending too. Both can push stocks down. If you can’t sell stocks when you want, prices can drop a lot. These are just a few things that can trigger a crash. There’s more to learn but keep an eye on jobs, prices, and how easy it is to buy or sell stocks. It can tell you a lot about the market’s health. And when you know what to look for, you might spot trouble before it happens.

The Role of External Shocks in Market Instability

High-Frequency Trading and Flash Crashes

When machines trade stocks super fast, they can cause sudden crashes. This is high-frequency trading. It’s like a huge crowd at the doors of a shop on sale day. Everyone wants the best deals. If people start to push or hurry, it can get messy fast.

What is a flash crash?

A flash crash is a rapid fall in prices. It happens when high-speed traders sell a heap of stocks super quickly. It can make markets dip in a blink. This is bad news because people lose trust in the market. Look at May 6, 2010 – stocks took a big dive in minutes because of this.

Geopolitical Events and Emerging Market Crises

Big news about countries can scare people who invest. If a country has trouble, like a fight over land or big changes in who leads, it hits the stocks. Markets don’t like surprises. So when scary things pop up, people might sell their stocks fast.

What kind of geopolitical events affect the stock market?

Ways a country can fight or struggle, like wars or laws that shock people, can change stock prices. When issues fire up in one place, they can spread to others, causing trouble in many markets.

What’s an emerging market crisis?

When newer markets in developing countries face trouble, it’s an emerging market crisis. Problems can come from things like owing too much money or prices of goods dropping. This makes people nervous about investing there, and that fear can spread to bigger markets, too.

Historical Precedents and Psychological Factors

Analyzing Past Market Crashes for Future Insights

Let’s take a trip back in time. To learn what makes stock prices fall hard, we look at old crashes. Understanding these helps us get ready for what might come next. From the Great Depression market collapse to the recent 2008 financial crisis, each event has lessons for us. They show how fear can spread fast in markets. Also, they reveal how things like bad loans or too much debt can hurt the economy a lot. These are red flags we watch for even today.

The Psychology of Panic Selling and Investor Sentiment Shifts

Why do people sell all at once, causing a crash? It often starts with worry. When news of risk hits, fear can spread like wildfire. Investors think, “I must sell now or lose more.” This rush to sell can crash prices, since everyone’s doing it. It’s like a big game of musical chairs—no one wants to be last. High-frequency trading can make this worse by selling super fast. In heavy times, it’s feelings, not facts, that can move markets most. Understanding this cycle of fear can make us smarter investors.

Market swings can be scary, but knowing history and the mind games in play can help us stay calm. We learn to spot the signs and keep our cool. That’s how we can handle the ride and come out ahead.

In this post, we’ve dived into what can shake up the stock market. We looked at how too much hype can puff up prices and then pop, like a giant bubble. We saw dangers that can shake the whole system, like big waves tossing a boat. We peeked at how money costs and job numbers affect stocks. And we didn’t ignore the big, sudden shocks that can come from nowhere, rocking markets hard.

Let’s not forget how the past can teach us, and how fear can spread fast, making people sell in a rush. From bubbles to panic, many things can trip up the market. But knowing these triggers helps you stand firm when others may stumble. Stay smart, stay calm, and remember what history has taught us. That’s how you keep your footing when the market ground shakes.

Q&A :

What Factors Can Trigger a Stock Market Crash?

Crashes in the stock market can be precipitated by a variety of factors including economic shocks, panic selling, speculative bubbles bursting, regulatory changes, or catastrophic events. The interplay of these elements can rapidly undercut investor confidence, leading to sharp declines in market values.

How Does Investor Behavior Contribute to Stock Market Crashes?

Investor behavior is a fundamental component of stock market dynamics. Fear and herd mentality can lead to a market selling frenzy, known as panic selling, which can precipitate a crash. Conversely, irrational exuberance can inflate asset prices to unsustainable levels, increasing the risk of a subsequent crash when confidence wanes.

Can Economic Indicators Predict a Stock Market Crash?

Certain economic indicators, such as high price-to-earnings ratios, market volatility indices (like the VIX), and inverted yield curves, can signal the increased likelihood of a market downturn. However, predicting the precise timing of a stock market crash is notoriously difficult, if not impossible.

What Role Do Interest Rates Play in Stock Market Crashes?

Interest rates can significantly impact the stock market. Central banks may raise rates to curb inflation, which can increase borrowing costs for companies and reduce consumer spending. Higher interest rates can lead to decreased profits for companies, potentially contributing to a market sell-off if investors recalibrate their expectations for future earnings.

How Do Global Events Influence Stock Market Crashes?

Global events, including geopolitical tensions, international conflicts, and pandemics, can cause significant uncertainty in financial markets. The rapid spread of information can exacerbate the impact of these events, resulting in swift changes to market sentiment and increased volatility that can lead to a market crash.