In March 2025, tensions over tariffs imposed by President Donald Trump erupted as he applied new tariffs on Canada, Mexico, and China, causing Bitcoin (BTC) to plummet dramatically from $95,000 to $86,062 within 24 hours. The cryptocurrency market was in turmoil, with investors in a state of panic—once again, Trump became the focal point of a global economic storm.

The Tariff Trigger in March 2025 from Trump

On March 1, 2025, Donald Trump triggered an economic “fuse” by signing a decree imposing new tariffs, causing global financial markets to stir. With this decision, he imposed a 25% tariff on goods from Canada and Mexico and increased tariffs on imports from China by an additional 10%, bringing the total tariff on Chinese goods to 20%. Trump explained this as a tough measure to combat fentanyl smuggling and human trafficking across the Canada-Mexico border, along with the influx of illegal drugs from China into the U.S.

This decree did not come as a surprise, but its severity was shocking. On February 1, 2025, Trump signed an initial version but delayed it for 30 days to allow Canada and Mexico to implement border control measures. When these countries failed to provide satisfactory responses, he immediately finalized the tariffs without leaving room for negotiation. In a speech at the White House, Trump firmly stated, “They had their chance, but now time is up.”

Tensions escalated as the decree was issued during a period of economic instability in the U.S. The Federal Reserve’s Atlanta branch recently lowered its GDP growth forecast for Q1 2025 from -1.5% to -2.8%, a significant drop from the previous +3.9% just weeks earlier. Trump’s targeting of the three major trading partners—Canada, Mexico, and China—was not just a trade move but a threat that could pull the world into a vortex of instability. From trading floors to coffee shops, Trump’s tariff decree became a hot topic of debate, putting markets on high alert.

Bitcoin Plummets – Cryptocurrency Market in Turmoil

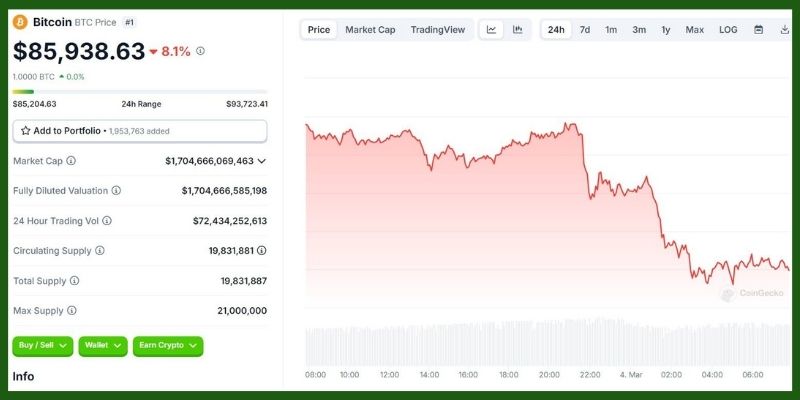

Trump’s tariff tensions dealt a severe blow to the cryptocurrency market, causing Bitcoin—the “crypto king”—to plummet. Within 24 hours, BTC dropped from $95,000 to $86,062, erasing previous gains fueled by Trump’s rumored plan to establish a national cryptocurrency reserve fund including BTC, ETH, XRP, SOL, and ADA. Not just Bitcoin suffered; the entire cryptocurrency market was severely shaken. Ethereum (ETH) fell by 15%, from $2,550 to $2,130, while altcoins like XRP, SOL, and ADA also plummeted with average declines exceeding 15%.

The chaos spread across the crypto ecosystem. The total market capitalization evaporated by 11%, from its peak to just $2.9 trillion—the lowest since November 2021. Bitcoin’s dominance surged to 58%, indicating investors hastily sought safer havens amidst the chaos. Data from CoinGlass revealed $810 million in derivative liquidations within 24 hours, mostly from long positions, pushing the Fear and Greed Index to 15—a level of extreme fear not seen since Bitcoin broke below $80,000 at the end of February 2025.

From small investors to large funds, no one could react in time to this price drop. Hopes for a new growth phase for cryptocurrencies, thanks to Trump’s previously friendly gestures, evaporated when the tariff decree turned all predictions upside down.

Why Bitcoin Couldn’t Hold Up?

Bitcoin’s price drop was not just an immediate reaction to the tariff decree but also stemmed from deeper factors. First, the tariff tensions shook confidence in the global economy. Canada, Mexico, and China are pillars in the U.S. supply chain, from wood and energy (Canada), cars and components (Mexico), to consumer goods (China). The 25% tariff on the two North American countries and increased taxes on China raised fears of supply chain disruptions, rising prices, and inflation. U.S. stocks immediately plummeted—Dow Jones lost 800 points, Nasdaq fell by 3%—triggering a wave of selling off risky assets like Bitcoin and cryptocurrencies.

Second, the tariff decree shattered market optimism. Just a day earlier, confidence was high due to two major announcements: TSMC’s commitment to invest $100 billion in building five chip factories in Arizona, creating thousands of jobs, and Trump’s plan to establish a cryptocurrency reserve fund. These factors pushed Bitcoin to a peak of $95,000, with hopes for a new era for cryptocurrencies. But the tariff decree was a surprise blow, extinguishing all optimism and causing investors to turn away from crypto to protect their capital against the bleak economic outlook.

Third, the unstable U.S. economy was the “straw that broke the camel’s back.” The GDP growth forecast for Q1 2025 was sharply reduced from -1.5% to -2.8% by the FED Atlanta, raising fears of a global recession. In this situation, cryptocurrencies—known for their volatility—became the first target for capital withdrawal, sending Bitcoin and altcoins into an uncontrollable free fall. The combination of tariffs, shattered expectations, and economic instability turned Trump’s decree into a “storm” that sank the cryptocurrency market.

Prospects After the Price Drop

Bitcoin’s price drop raises significant questions about the prospects of the cryptocurrency market amidst tariff tensions. In the short term, the outlook is not promising. If panic persists, Bitcoin risks breaking below $80,000—the lowest since November 2024—while altcoins, with lower liquidity, could suffer even greater losses. Canada has voiced concerns through Prime Minister Justin Trudeau, Mexico fears the collapse of its automotive sector, and China is expected to retaliate strongly—all of which increase global economic pressure. This could drive commodity prices up, inflation higher in the U.S., and force the FED to consider raising interest rates, adding more pressure on cryptocurrencies.

However, in the long term, there is still hope. If Trump’s tariff decree achieves its goal of controlling drugs and smuggling, the U.S. economy might stabilize, creating conditions for Bitcoin and cryptocurrencies to recover. Previously, the market had hoped for friendly crypto gestures from Trump, such as a national reserve fund, and if he reduces tensions with neighboring countries, confidence could return. But if the trade war escalates, with Canada cutting wood exports, Mexico reducing car supplies, and China limiting raw materials, the cryptocurrency market could enter a prolonged “winter,” making it difficult for Bitcoin and altcoins to regain their luster.

Investors now need to closely monitor reactions from affected countries and the FED’s next moves. A positive signal from Trump—such as a tariff delay or reconciliation talks—could be a lifeline for Bitcoin. But in the worst-case scenario, the crypto market will face dark months, requiring patience and new strategies to weather the storm.

Trump’s March 2025 tariff tensions have sent Bitcoin plummeting from $95,000 to $86,062, dragging the cryptocurrency market into turmoil amidst global economic instability. From the tough decree to international reactions, everything contributed to deepening the shock. Financial Insight Daily beleives, This serves as a warning that Bitcoin cannot withstand policy “storms”; its future remains a significant question mark.