Trends in digital payment security are zooming ahead in 2023, and you need to keep up. With hackers on the prowl, your money needs more than a virtual lock. I’ll show you how the latest tech shields your cash like a fortress. From unbreakable codes to smart tools that spot thieves, your payments are safe. Get the scoop on turning your transactions into digital Fort Knox. Ready to be a payment security whiz? Let’s dive in.

Enhancing Online Transaction Security in 2023

The Evolution of Encryption Protocols in E-Commerce

We all buy stuff online a lot. It’s fast and easy, but it can be risky, too. Bad guys are smart and always trying to steal your card info. We fight back with better locks on our digital doors, known as encryption protocols. This year, we’re seeing big changes here.

Encryption scrambles your payment data when you buy online. This makes it hard for hackers to read. Every year, we get better at doing this. Now, in e-commerce, we’re moving to even stronger encryption called “next-gen payment encryption.” It’s like going from a good lock to a vault in your online shopping cart.

This new tech keeps your data safer than before. With these changes, you can shop with less worry. Your card number gets turned into a secret code no one else can use. Even if someone gets this code, they can’t buy stuff with it. That’s how we keep your online shopping safe.

For example, think about when you pay with your phone at the store. That’s contactless payment technology. It’s easy, right? Tap, pay, and go. Well, that works because of something called tokenization. This replaces your real card number with a fake one for one-time use. It’s like giving a secret knock at a door that only the store knows.

Contactless payments are growing fast. You’ve seen people tapping their phones or cards on the reader, it’s super quick. Now, we’re making sure it’s also super secure. The same way we use secret codes online, we use them in stores. This means the bad guys can’t just grab your info out of the air.

What about your digital wallet? That’s where you keep your card info on your phone. We protect this too. The trick is to lock your wallet not just with a password. We use things like your fingerprint or your face to make sure it’s really you. That’s biometric authentication payments.

Mobile wallet protection is key when you’re paying with your phone. If a thief takes your phone, they shouldn’t be able to buy stuff, right? That’s why we have security steps, like asking for your finger to approve each buy. If the phone doesn’t know your finger, it won’t make the buy.

And if you’re buying from your phone, we’re helping you stay safe there, too. Secure mobile pay apps keep your card details hidden. They act like a safety net. If you drop your card info, no one else can pick it up.

Tackling Digital Payment Risks with Advanced Technologies

Digital payment risks are always out there. We keep making new tools to stop the bad guys, though. Things like artificial intelligence fraud detection are like having a super smart security guard. They watch for anything odd, 24/7, to keep your money safe.

When you make a payment, it needs to be checked fast for any risks. We have real-time payment monitoring for that. Just like a guard on watch, this system checks all payments right away. If it sees a problem, it can stop the payment before the bad guys get anything.

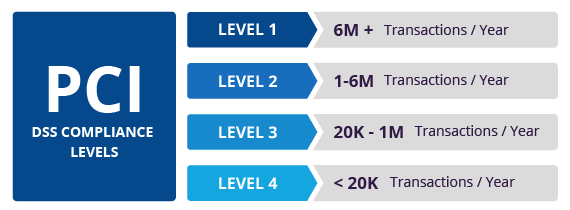

Another big part of fighting these risks is staying up to date with rules. We have laws for how online payments must be safe. When these update, like with PCI DSS compliance, it’s our job to follow them. Think of this as a rulebook for how to keep your online money moves safe.

We don’t want you to stress about buying online. So, we work hard on ways to keep you safe from digital payment risks. Things like checking who you are in different ways, watching your payments all the time, and sticking to the newest safety rules. This is important stuff for everyone.

In the end, it’s all about making sure you can buy what you need without worries. We’re always working on new shields against the tricks thieves try. This year, we’re using even better locks, smart guards, and the latest rules, so your online buys are secure. And that means you can click “buy” with peace of mind.

The Rise of Biometric and Multi-Factor Authentication

Implementing Biometric Authentication in Payments

Your fingerprint or face can now guard your money. That’s what we call biometric authentication. It’s a powerful key that only you have. And it’s making payments with your phone or tablet more secure in 2023. When you buy something, these unique traits unlock the payment. This means it’s really hard for a bad guy to pretend they’re you and use your cash.

Biometric authentication checks your identity with things like fingerprints, face recognition, and even the way you walk or type. These methods are super fast and work well, so they’re becoming more popular every day. We use them in all sorts of digital payment tools, from banking apps to shopping on the web. It’s an extra safety step that’s simple to use but really tough to break.

How Multi-factor Authentication Strengthens Mobile Wallet Protection

Keeping your digital wallet safe is much like a treasure chest with multiple locks. Multi-factor authentication is just that: several different locks on your treasure. It mixes something you know, like a password, with something you have, like your phone, and something you are, like your fingerprint. Think of it as a triple-threat to thieves!

In 2023, as we use our phones more to pay, security measures like this matter a lot. Each added step makes it harder for someone to break in. It’s a bit like having secret passwords and handshakes that only you and your phone know. And guess what? Even if one pass gets stolen, your money’s still safe because a thief would need all the parts to get past the security.

Banks and shops are using multi-factor authentication because it really helps keep your online shopping and banking safe. Every time you log in or pay, you might type a password, get a text with a code, and use your face or finger. This makes sure it’s really you doing the spending.

From biometric scans to codes from messages – every layer matters. Multi-factor authentication is like a superhero team for your money. It just makes everything stronger. So when you add these methods to your payment routine, you’re building a fortress around your cash.

Multi-factor authentication turns your phone into a trusty sidekick in the battle against fraud. Even if bad folks get one key, they won’t get far without the rest. It’s all about not putting your eggs in one basket – the more baskets, the better for your money. And feeling safe is key when we’re talking about your hard-earned cash.

In 2023, paying for stuff online should be easy and safe. Thanks to biometric and multi-factor authentication, you get both. It’s a mix of convenience and top-notch security. We’re staying one step ahead of the bad guys, and that’s great news for everyone who wants to keep their money safe while enjoying the quick, cool ways to pay today.

Leveraging Artificial Intelligence for Fraud Prevention

AI in the Battlefield Against Financial Cybercrime

Artificial intelligence changes how we fight crime in our banks and online shops. It helps us spot bad actions fast and stop thieves before they can do harm. Think of AI as a smart guard that never sleeps. It watches over your money all the time. With AI, we can now see patterns that point to fraud, and we can do it way faster than before. This way, we keep your cash safe.

AI works like a brain that learns what’s normal and what’s not when you send or get money. When something odd pops up, like a huge buy on your account, it tells your bank right away. But it’s not just large things that it catches. AI can spot even small signs that might mean trouble. By doing this, it keeps your money out of the wrong hands. This smart tool is getting better every day, helping banks and shops protect your money like never before.

Real-Time Payment Monitoring: A New Era of Vigilance

Now let’s talk about watching payments as they happen. This is big news for keeping your money safe in 2023. Real-time payment monitoring is like having a superhero watch over every penny you spend or earn. It checks every little step of a money move from start to finish. With this watchful eye, if fraud pops up, we can stop it right then and there.

How does it work? Imagine you pay with your phone at the store, right away computers start to check that payment. They look at things like where you are, and what you’re buying. If the computers see something that does not match what you usually do, they can send a warning. This way, no waiting – we act fast to keep your money safe.

Such quick checks are a game-changer in digital payment security. Before, we had to wait and see if something bad might happen. Now, we jump in the moment something seems off. And that’s a win for everyone who wants to keep their money safe every single day.

With the help of AI and these new ways to watch over transactions in real-time, we’re moving into the future of payment security. No doubt, this is where we’ll see some of the most exciting wins in the fight against money crime in the digital world. And that’s something we can all feel good about.

Adhering to Regulatory Standards and Advancements

The Implications of PCI DSS Compliance in 2023

In the world of online transaction security, keeping up with rules is key. One big name is the PCI DSS. That stands for Payment Card Industry Data Security Standard. It’s a set of rules to make sure card info stays safe. Every business that deals with card payments must follow these. If they don’t, they may face fines or even get cut off from card networks. PCI DSS updates happen often to fight new threats. This means 2023 brings its own set of new rules.

For anyone taking card payments, following PCI DSS is not just smart; it’s a must. It’s like a strong fence around a house, keeping bad guys out. New updates in 2023 make this fence even stronger. They hit on things like better encryption and strict access controls. They also demand strong monitoring tools to watch for suspicious actions round the clock.

Understanding PSD2 Regulations for Enhanced Payment Security

Now, let’s talk about another set of rules called PSD2, like a twin to PCI DSS. It stands for the second Payment Services Directive. It comes from Europe but its impact goes far and wide. This set of rules makes banks open doors to third-party payment services. Yet, it doesn’t miss out on security. PSD2 makes sure customer data stays safe when it travels across these new paths.

PSD2 also brings in strong customer checking, like a two-key system to get into a safe. This may include things you know, things you have, and things you are, like passwords, phones, and fingerprints. It’s not just about keeping data safe. It’s about keeping trust in the whole payment system. With PSD2, you have to show your face, not just once but twice, to prove it’s really you making the payment.

Every business in the EU now has to dance to the tune of PSD2. But guess what? Many outside Europe do the same because it’s top-notch security. If you get payments from folks in Europe or if you’re a tech company looking to work with EU banks, PSD2 can’t be ignored. Embrace it, and you show everyone you take payment safety as seriously as a bodyguard takes their job.

Both these sets of rules, PCI DSS and PSD2, are all about trust. They tell us safety isn’t just about locks and codes. It’s about building a world where you can shop and pay without worry. It’s about making sure nobody takes what’s not theirs. So, as we surf this big wave of digital payments, let’s make sure everyone wears their safety gear. Let’s all do our part to stick to the rules and keep the online world a safe spot to spend and send money in 2023.

We covered a lot today about making online payments safer in 2023. From encryption’s growth to smart tech in our fight against crime, these steps are big. We saw how using your body’s features and needing more than one proof can make mobile wallets tough to crack. With AI, we keep an eye on transactions like never before, spotting risks fast.

Rules like PCI DSS and PSD2 aren’t just red tape—they’re vital to keeping your money safe. As I close, remember these layers of security work together. They make sure that every time you buy something online, you’re not just crossing fingers; you’re backed by some solid tech and rules. It’s about staying a step ahead of the bad guys and knowing that, with each click, you’ve got the right shields up to keep your dollars safe. Keep these points in mind, and your online shopping will be more secure than ever. Stay sharp and keep your transactions safe. Here’s to safer spending, smarter tech, and stronger shields in 2023 and beyond!

Q&A :

What Are the Latest Trends in Digital Payment Security?

The landscape of digital payment security continuously evolves with advancements in technology. Some of the latest trends include the use of biometric authentication methods like fingerprints and facial recognition to authorize transactions, which enhances security by linking transactions to the user’s unique physical traits. The adoption of tokenization and encryption has also seen an uptick; this turns sensitive data, such as credit card numbers, into a string of unintelligible characters until it reaches the payment processor, thereby reducing the risk of data breaches. Moreover, the shift towards contactless payments, which are not only convenient but also secure with one-time codes for each transaction, has gained momentum.

How Is Artificial Intelligence Improving Digital Payment Security?

Artificial Intelligence (AI) plays a pivotal role in predicting and preventing fraudulent transactions in real-time by identifying patterns that are indicative of fraudulent behavior. AI systems learn from a vast array of transaction data and customer behavior, allowing them to flag transactions that deviate from the norm. Furthermore, AI-driven risk management tools can dynamically adjust security measures based on the transaction context, enhancing the customer experience by reducing false declines while still maintaining a high level of security.

Why Is Multi-factor Authentication Important in Digital Payment Security?

Multi-factor Authentication (MFA) is crucial in adding an extra layer of security to digital payment processes. By requiring users to provide two or more verification factors to gain access to a device, account, or transaction, MFA significantly decreases the likelihood of unauthorized access. This is because even if one factor, like a password, becomes compromised, unauthorized users still need to bypass additional security barriers, which could include a text code sent to a mobile device, an email confirmation, or biometric verification.

How Can Consumers Ensure Their Digital Payment Security?

Consumers play a pivotal role in safeguarding their own digital payment security. One fundamental step is to use strong, unique passwords for each payment-related account and to change these passwords regularly. It is also advised to only make payments on secure, trusted networks and to avoid conducting financial transactions over public Wi-Fi. Additionally, consumers should monitor their bank statements routinely for any unauthorized transactions and utilize any security features offered by their payment service providers, such as transaction alerts.

What Is the Impact of Blockchain on Digital Payment Security?

Blockchain technology has brought about a revolutionary impact on digital payment security by offering decentralized transaction processes that reduce the risk of fraud and breaches. Since the blockchain is immutable and with cryptography securing the transactions, it is much more difficult for hackers to alter or forge transaction details. Also, smart contracts can automate transaction validations, reducing the reliance on intermediaries while simultaneously maintaining a high level of security and trust in the payment process. The transparency and traceability of blockchain payments empower consumers and businesses alike with a more secure and efficient means to transact digitally.