Stepping into the stock market can feel like wandering through a maze. You know there’s a way to smarter investing, but the path isn’t clear. Good news: I’ve got the map. Below, we’ll unravel the Top 10 financial market analysis tools for beginners. Each tool is user-friendly, won’t break the bank, and is great for those starting out. From investment analysis essentials to free charting software, we’ll explore platforms that simplify trading. Then, dive into technical and fundamental analysis without getting lost in jargon. Last but not least, I’ll show you how to set up your very own trading workstation. Let’s get you set up for success.

Understanding Investment Analysis Tools for Beginners

Exploring User-Friendly Stock Market Software

Picking the right tools can make or break your trading game. Good news, though! There are stock market software pieces designed just for new investors like you. Let’s dive into what these are.

First off, you might wonder, “What is stock market software for novices?” It’s special tech that helps you trade without stress. You can see stock prices, check out charts, and even trade with a click.

These tools are made easy. Think about it like playing a new video game. At first, it seems tough. But once you learn the controls, you’re golden. That’s what user-friendly stock market software is like.

But how do they help you actually trade? Easy. They show live prices and charts. This means you see what your stocks cost now, not hours ago. Plus, you get to play with virtual money before using real cash. This lets you learn without risking your piggy bank.

Recognizing Affordable Trading Tools

Now, let’s talk about saving money while making money. You’re starting out, so you might not want to spend a ton right away. That’s smart. There are trading tools that don’t cost an arm and a leg.

What are affordable trading tools for new investors, you ask? They are like a sweet deal on your favorite game. You get all the fun without emptying your wallet. These tools let you check stocks, learn trading, and more, all while being kind to your budget.

Can you actually find free financial charting software? Yes, you can! There are tools that show you fancy charts and they won’t charge you a dime. This is like getting a top-notch game for free. You learn how to read markets and make smart moves without owing anything.

These tools are great because they give you the power. You get to make choices based on facts and real data. And when it’s time to play with real money, you’ll be ready. So, use these affordable tools to get a head start.

Remember, starting small doesn’t mean thinking small. Use these simple tools to learn big financial moves. With them, you’ll grow from a rookie to a pro before you know it.

Navigating Through Easy-to-Use Trading Platforms

Learning with Free Financial Charting Software

When you start investing, free financial charting software is a must. It lets you see price moves and trends without cost. The best part is you don’t need to be a pro to get it. With these tools, you can get the hang of reading charts. You’ll track stocks like a seasoned investor in no time.

One such software is TradingView. Many call it the best for folks new to the game. It’s full of features that are easy to learn. You’ll draw on charts, check out indicators, and even share ideas with others.

Utilizing Real-Time Stock Analysis Applications

Real-time stock analysis apps are key for quick updates. They give you stock prices as they change, second by second. As a newbie, apps like Robinhood make your life easier. There’s no fluff, just clear facts. Plus, they keep tabs on user-friendly economic indicators. This means you’ll watch the market like the experts but with ease.

For those serious about learning, these real-time apps offer more than just prices. Many include articles, alerts, and analysis to help make sense of the money world. You stay informed and ready to make smart choices.

So, let’s get down to business. As a beginner, why not start with tools that are simple and kind on the wallet? Free charting software and real-time apps set you on the right path. Lead with savvy, not just luck. Your future portfolio will thank you!

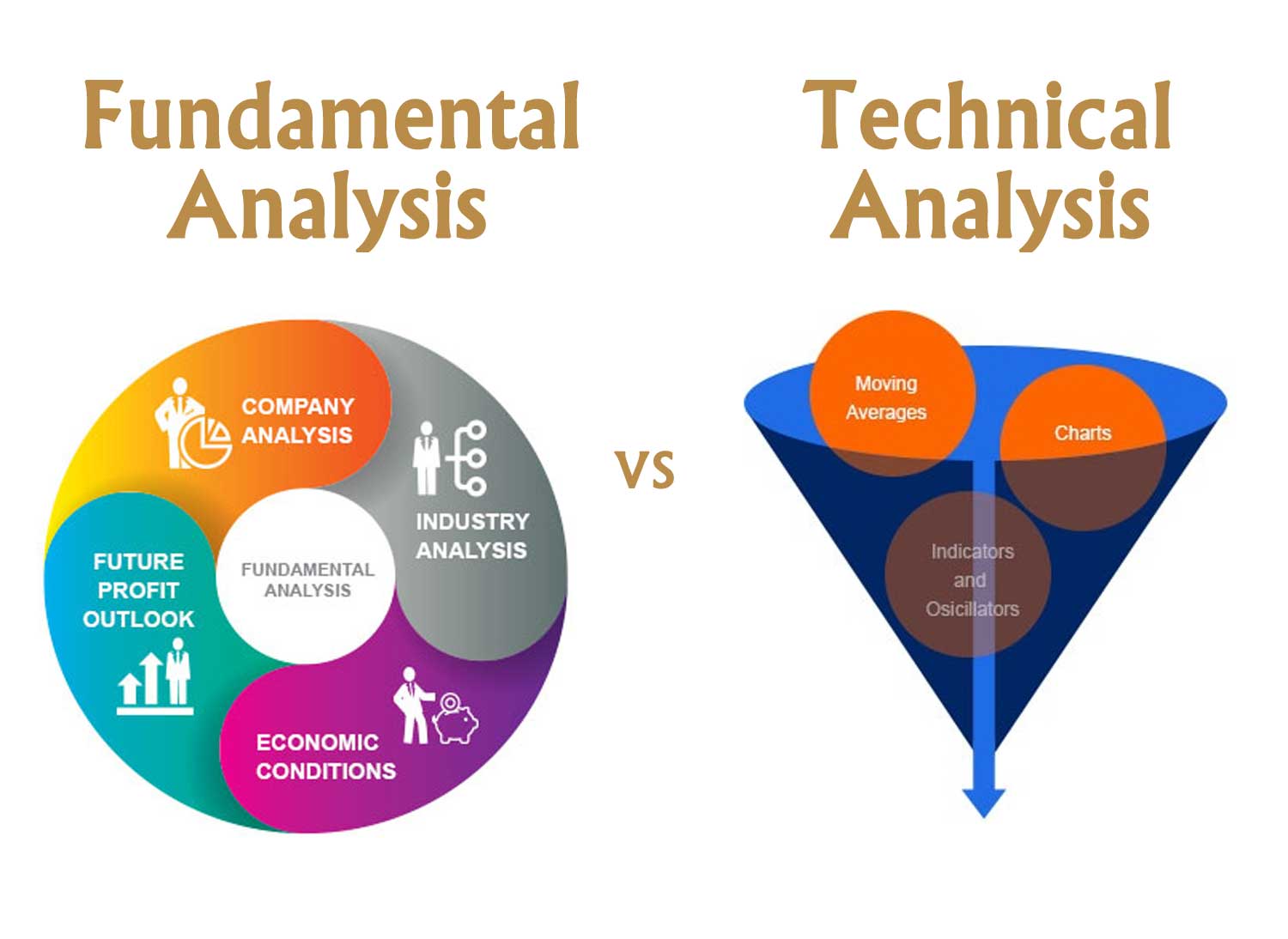

Diving into Technical and Fundamental Analysis

Comparing Portfolio Trackers and Market Scanners

Let’s talk about how to keep your stocks in check. Picture a tool that watches your stocks like a hawk. That’s a portfolio tracker. It shows if you’re making or losing cash and which stocks are stars. Now, imagine a radar that hunts for hot stock tips. That’s a market scanner.

When picking these tools, choose what feels right and fits your budget. Want to start without spending a dime? Look for free tools first. Some have features just right for new folks like us. They’re simple and get the job done.

“Which are the best portfolio trackers for beginners?” Beginners love tools that are easy and clear. They should track gains, losses, and give updates in a snap. As for scanners, pick ones that sort stocks fast and in ways that make sense to you.

Educational Tools: Virtual Platforms and Paper Trading

Now, let’s gear up with learning aids. You don’t just jump into a pool without knowing how to swim, right? Start with a virtual stock exchange platform. It’s like a game where you trade with play money. No risk, all the learning.

Got it? Good. Now on to ‘paper trading’. It’s not about crafting. It’s practice trading, where you pretend to buy and sell stocks. You learn the ropes without the risk. It’s a solid first step before spending your hard-earned cash.

“What is paper trading software for practice?” It’s a way to trade pretend money as you learn. Say you’re starting with a fake $1,000. You pick stocks, watch them, and see what happens. If they tank, you’re cool because it’s all practice.

Learn for real, without the risk, and when you’re set, dive into the market for real. It’s your turn to kick off this adventure. Exciting times await!

Setting Up for Success: Beginner Trading Workstations

The Essentials: Charting Tools and Stock Picking Services

You want to trade stocks, right? Let’s set up a cool trading spot. First, you need neat charting tools and stock picking help. These let you see price moves and find good stocks.

What are the top charting tools good for new folks? Look for ones that are clear and simple. You can find charts for free or at low cost. They should have lines, bars, and colors to show prices.

Stock picking services give tips on which stocks might do well. They’re like your stock market pals. Some of these services are free. Others might cost a bit, but they give great advice for starters.

Do charting tools and stock picking services make a difference? Yes, they do! With good tools, you can trade smarter, not harder. Also, you will feel more sure about your picks.

Guidance for Equity Research and Economic Calendars

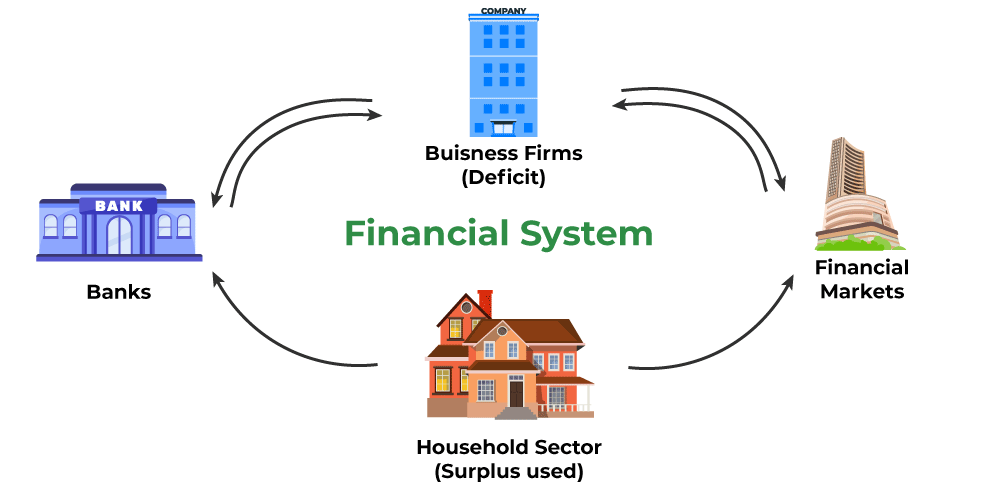

Now, let’s talk about research and timing. Equity research tools help you dig deep into companies. You’ll see if a stock is worth your money.

How about timing? When to buy and sell? That’s where economic calendars come in handy. They show you news that might change stock prices. Look for ones that are easy to read.

What should a newbie trader’s workstation have? It should have charting software, stock tips, research tools, and an economic calendar. Don’t forget a good computer and a fast internet link, too.

So, are we all set? You bet! With these tools, you’ll start strong in the stock market. Just take your time and learn as you go. Happy trading!

In this post, we’ve looked at basic tools to help beginners in investment analysis. We explored simple stock market software and affordable trading tools that make starting out less daunting. We navigated through trading platforms that are user-friendly, using free charting software and apps that let you see stock info in real time.

We dived deep into technical and fundamental analysis, comparing portfolio trackers and scanners. We also saw how virtual platforms and paper trading can teach you without real money risks. Lastly, we set up a newbie-friendly trading station with vital charting tools and stock picking services, and we covered how to use equity research and economic calendars for smart trading.

Investing might sound complex, but it’s all about having the right tools and knowing how to use them. Use what we’ve talked about today to build a solid foundation for your investment journey. Stay curious, keep learning, and don’t fear starting small. Your future savvy investor self will thank you!

Q&A :

What are the best financial market analysis tools for beginners?

For beginners looking to delve into financial market analysis, it’s crucial to choose tools that are user-friendly yet insightful. Some top recommendations include Yahoo! Finance for comprehensive stock data, TradingView for sophisticated charting and live quotes, and MetaTrader for access to real-time trading. These platforms help novices understand market trends without overwhelming them with complexity.

How can beginners effectively use financial market analysis tools?

Beginners should start by getting familiar with basic features such as price charts, market news feeds, and fundamental analysis tools available in their chosen platform. It’s also beneficial to follow market experts and practice with paper trading features to gain practical experience without financial risk. Many tools offer tutorials and community forums which new users should actively utilize for learning.

Are there any free financial analysis tools suitable for beginners?

Yes, there are several free tools that beginners can use without any cost. Examples include the basic version of TradingView for chart analysis, Finviz for stock screening, and the app “Investing.com” for tracking multiple asset classes. While these free tools often have limitations, they’re a good starting point for those new to financial markets.

What features should beginners look for in a financial market analysis tool?

Beginners should look for tools with intuitive interfaces, educative resources, customizable charts, stock screeners, and access to historic data. It is also beneficial if the tool offers demo accounts or simulation features that allow for practice without using real money. Lastly, security features cannot be overlooked, even for beginners, to ensure that any personal data used in the tool is well protected.

Is technical analysis or fundamental analysis more suitable for beginner investors?

Both technical and fundamental analysis have their place for beginner investors, but many often find technical analysis to be more accessible to start with due to its visual nature. Beginners can learn to recognize patterns and trends on charts which can be easier than interpreting financial statements required in fundamental analysis. However, a solid long-term investment strategy typically involves understanding both. Some financial market analysis tools provide resources for learning both types of analysis.