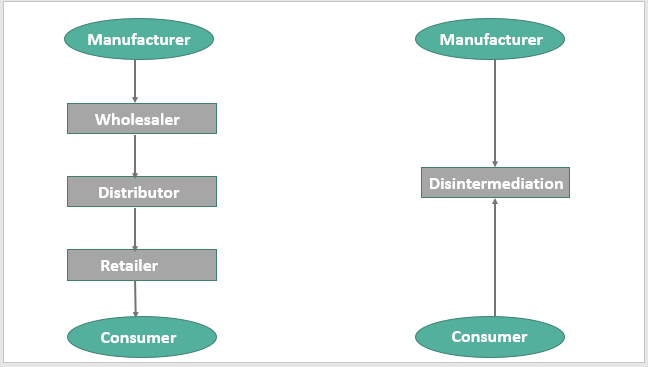

Imagine a world where you keep more of your money, and deals close faster. No long waits or paying extra to someone just to move your own cash. That’s the heart of The future of financial disintermediation. You don’t need a crystal ball to see where this trend is going. With new tech like blockchain, and a push from services like peer-to-peer lending and crowdfunding, it’s clear: we’re heading for a future with less middlemen in finance. This doesn’t just mean changes; it means a financial revolution. Is it risky? Sure. But the rewards could be huge. So, let’s dive in and see what this middleman-free future has in store for us.

Understanding the Rise of Decentralized Finance

The Driving Forces Behind Decentralized Finance Trends

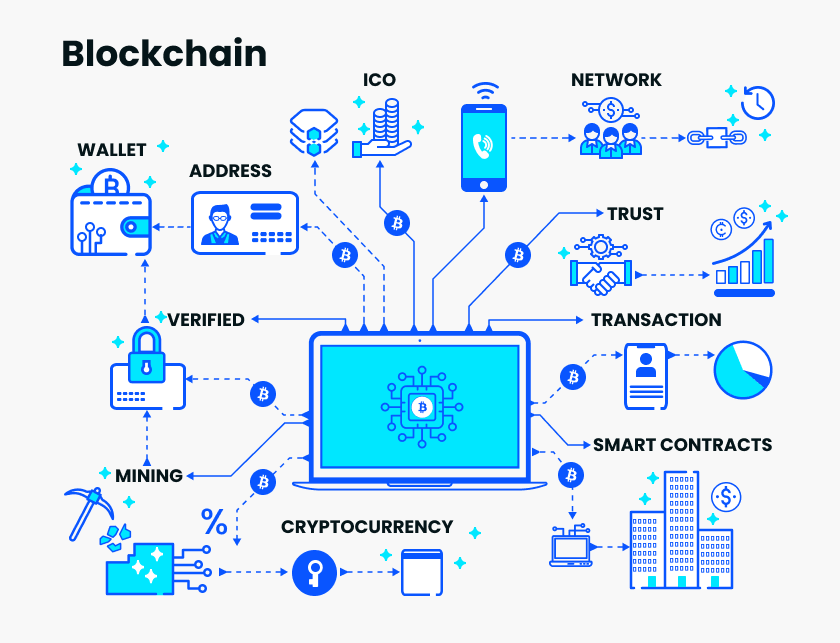

Money makes the world go round, we often hear. But how we handle money is changing fast. Instead of banks, new tech like blockchain is stepping in. This shift is big, and it’s shaking up the future of banking. Why? Because blockchain lets people deal with money without a middleman. That’s decentralized finance, or DeFi for short. It’s all about cutting out the bank guy and making things fair and open.

When we talk about DeFi, think of it like a giant Lego set. Each piece is a different service you might need from a bank. But with DeFi, you snap these pieces together the way you want. It’s that flexible. You’re in charge, not some big bank. The rise of digital currencies, such as Bitcoin, has pushed this even further. Now, money can be digital and move at the speed of the internet.

But DeFi isn’t just about cool tech. It’s a response to real needs. In many places, banks can’t reach everyone. DeFi steps in with online platforms for investing, peer-to-peer lending growth, and more. It’s helping people who were left out. Plus, with fintech innovation, services get smarter and cheaper. That’s good news for everyone.

Now, think, how does peer-to-peer help? Easy. You lend money to someone, and they pay you back with interest – no bank needed. Big deal, right? Because this is how the peer-to-peer lending growth skyrockets. More people lending and borrowing, directly. And it’s just the start.

Decentralized Versus Traditional Banking: A Comparative Analysis

Let’s pit the new against the old: decentralized finance trends versus classic banks. It’s a real David and Goliath story. But who wins? Well, DeFi is quick, open, and it works all day, every day. No more waiting for the bank to open. And the impact of blockchain on banking doesn’t stop there. It keeps your money safe with high-tech code – they call it cryptography.

Then there’s traditional banking. It’s been around for ages, and it’s got a lot of trust and experience. But it can be slow, and guess what? You pay for every step. Those ATM fees, account charges — they add up. In a world where we’re all about immediate results and cutting costs, DeFi seems like it’s racing ahead.

So, what does this all mean for the everyday person? Your paycheck might land in a digital wallet, not a bank. You could borrow money for a car from a crowd, not a banker. And sending cash to a friend across the world? It might just be as simple as a text message.

As a banking disintermediation expert, I see all this happening right now. It’s not just talk; it’s real change. People are finding new ways to handle their money that’s simpler and more direct. And it’s not slowing down. The tracks are laid out for a big shift in how we all think about and use money. The future is knocking on the door with the promise of a world without middlemen in finance. And that future is bold, empowering, and ready for the taking.

Blockchain’s Transformative Impact on Financial Services

How Blockchain Technology Enhances Payment Systems and Security

Imagine sending money to a friend instantly, without a bank in the middle. This is what blockchain allows us to do. It’s a tech that stores data in blocks that are chained together. Each block is like a digital ledger, recording every transaction.

Now, think about security. With blockchain, every transaction is encrypted and linked to the previous one. It’s tough for hackers to change data without being noticed. This means your money is safer than in traditional banks.

Still, the best part of blockchain is how it makes payments faster and cheaper. With banks, sending money abroad is a pain. It’s slow and costs too much. Blockchain can send money across the world in minutes and for less cost.

The future of banking looks exciting with blockchain. We’ll see faster payments, better security, and less reliance on big banks. This is what drives decentralized finance trends. People want control over their money without a bank telling them what to do.

The Role of Smart Contracts in Automating Financial Processes

Ever heard of smart contracts? They’re like regular contracts but run on blockchain. These are small programs that do tasks automatically when conditions are met. Let’s say you’re lending money to someone. A smart contract can manage this loan, release funds, and ensure payback without a bank.

Smart contracts are changing how we do finance. They can cut costs, reduce mistakes, and make things quicker. This is big for fintech innovation. Companies are building online platforms for investing that use smart contracts. This means faster and more reliable services for you.

As we see more peer-to-peer payment systems and alternative funding platforms, automation in finance will grow. Smart contracts will handle loans, investments, and insurance claims. They save time, and that’s important. It means business can happen 24/7, with no breaks.

The future of banking will have more AI in financial decision-making, too. It’ll be a mix of smart contracts, AI, and blockchain. This trio can learn patterns, make decisions, and act on them. It’ll help everyone make better money choices.

So, blockchain tech will make payment systems better and add security. Smart contracts will let us do financial tasks without a bank. This mix is powerful and will make the future of banking a whole new world.

As we move more into this era, expect to see the reduction in bank intermediaries. Big banks might not be as central to our daily money needs anymore. Instead, we’ll use tech, like blockchain and smart contracts, to take control. The impact of blockchain on banking will be massive.

In conclusion, the evolution of payment systems and the role of smart contracts are key in reducing banks’ influence. These advancements in financial technology make it an exciting time for us all. The world of finance is at the start of a big shift, and we’re leading the way.

The Growth of Alternative Funding: P2P Lending and Crowdfunding

Analyzing the Expansion of Peer-to-Peer Lending Platforms

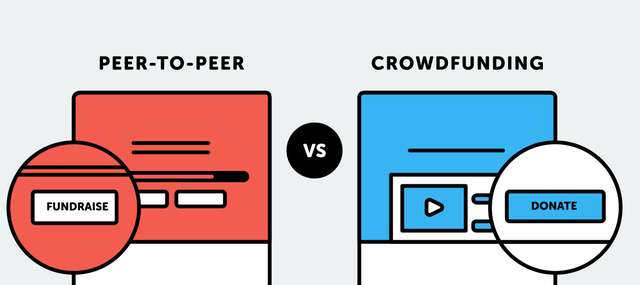

Peer-to-peer (P2P) lending is reshaping how we borrow money. No banks, no long waits, just a straightforward loan from one person to another. This direct funding path cuts out traditional banks. As an expert watching this field, I see families and small businesses benefiting the most. They get faster loans. Often, P2P lending offers better rates than those found at banks.

The platforms are user-friendly, making borrowing simpler. They also bring people together from all corners of the world. Investors now have a more personal way to grow their money. They can choose who they help. It’s no wonder that the peer-to-peer lending growth is at full throttle.

P2P platforms use tech to match a lender to a borrower. This efficiency means less overhead, translating to better interest rates for everyone. The rise of digital currencies and blockchain also influences P2P lending. They offer safer and faster transfers across borders. But it’s not all roses. P2P lending does come with risks, like potential for default. Yet, as fintech innovation advances, new ways to assess and manage these risks emerge.

Crowdsourced Funding and Its Future in the Financial Landscape

Switching gears to crowdfunding, it’s the all-star for startups and creative projects that need cash. Here’s a fun fact: you pitch an idea online, and complete strangers can fund it, not just banks or venture capitalists. Neat, right? Crowdfunding platforms have become a hotbed for innovation. They’re where dreams find wings through others’ support. Just look at all the cool, quirky products that started as funded projects on these platforms.

What’s really exciting is the crowd-sourced funding future. We’re not just talking about more money for new gadgets. We’re talking about huge shifts in how big ideas get off the ground. These platforms are even tackling bigger challenges, like aiding communities after disasters.

With more people online, the pool of potential backers grows every day. Plus, regulations are changing. They now allow everyday folks to get a piece of the action in startups. It’s not just a donation anymore; it’s an investment.

But, as with P2P lending, crowdfunding has hurdles like fraud and failed projects. It’s crucial that backers understand this. Crowdfunding isn’t shopping. It’s a gamble on innovation with no sure bet. Yet, the impact of blockchain on banking and crowdfunding could be a game-changer. It offers more security and transparency in transactions.

So, we’re looking at a future where your neighbor down the street or someone across the ocean could back your next big idea. How cool is that? Forget the suits and the boardrooms; alternative funding platforms are the new giants, and I, for one, am all about rooting for them.

The Integration and Impact of Digital Currencies

Digital Currencies and Their Effect on Monetary Policy and Banking Operations

Digital money is changing the game for banks and how we use cash. In this new world, our phones become wallets. We can send money across the world, fast and cheap. Banks are racing to keep up, as digital cash can move without them.

Central banks are getting in on the action too. They’re exploring their own digital currencies. This could make paying for things safer and simpler. When banks use digital cash, we won’t need to wait days for checks to clear. You can forget about those pesky fees too.

Cryptocurrency, like Bitcoin, is a big player in this shift. It’s shaking up how we think about money. Now, anyone can send or get cash, without a bank in the middle. This is huge for people who don’t have easy access to traditional banking.

But this new money world isn’t without its bumps. Banks and authorities are scratching their heads. How do they control something that moves so fast and needs no permission? They’re working hard to figure out rules to keep our money safe.

Cryptocurrency in Financial Services: Investment and Regulation Challenges

Cryptocurrencies are like roller coasters. Exciting, a bit scary, and full of ups and downs. People want a piece of the action, hoping to make big money. But it’s not all fun and games. There’s serious stuff to think about, like keeping your digital coins safe.

Investing in cryptocurrencies is a bold move. The prices jump up and down like kids on a trampoline. This can make people nervous, but also offers chances to make money for the brave.

Governments and big money experts are trying to catch up with rules. Everyone wants to make sure that playing with digital money is fair and square. They’re figuring out how to protect folks and crack down on the bad guys.

Some banks are playing it cool, taking small steps into cryptocurrency. They’re trying to offer new services that mix old-fashioned banking with the crypto world. This helps customers who want the best of both worlds.

As an expert watching all this unfold, I see a bright future. I think cryptocurrencies will become as normal as using debit cards. We’re all part of this change. It’s like we’re building a new money world, one digital coin at a time.

And as we move forward, we’ll see even more change. Banks might start to look more like tech companies. They’ll use new tools to keep money flowing smoothly. Things like AI, big data, and blockchain will help make better money choices.

We’ll see more online platforms bubble up too, helping us invest and grow our cash. These are exciting times, and it’s just the start. So, buckle up! We’re on a journey to a future where our cash is smart, quick, and directly in our control.

In this post, we’ve dived into Decentralized Finance (DeFi) and its huge impact. We looked at why DeFi’s on the rise and how it compares to regular banking. We explored blockchain’s big role, like making payments safer and smart contracts making things automatic. We also saw how people are funding dreams through P2P lending and crowdfunding, no bank needed.

And we can’t forget digital currencies! They’re changing how money works and making us think hard about investing and rules.

So, here’s the deal: Finance isn’t just banks and cash anymore. It’s apps, the internet, and tech mixing to make money matters easier and in our control. It’s exciting, a bit scary, but mostly full of chances for all of us. Let’s keep our eyes open and be smart as we step into this new money world.

Q&A :

What is financial disintermediation and how does it impact the future of finance?

Financial disintermediation refers to the process when borrowers bypass traditional financial intermediaries, such as banks and credit unions, to secure funding directly from the source. This trend has been bolstered by the rise of financial technologies that facilitate peer-to-peer lending, crowdfunding, and other direct lending platforms. As we look to the future, financial disintermediation is poised to reshape the financial landscape by increasing competition, lowering costs for borrowers, and providing investors with access to a broader range of investment opportunities.

How are technological advancements influencing the future of financial disintermediation?

Technological advancements play a pivotal role in the future of financial disintermediation. Innovations like blockchain, artificial intelligence, and mobile banking have made it easier for individuals and businesses to access financial services directly, without going through traditional financial institutions. This evolution is expected to continue, potentially leading to more efficient financial markets, personalized financial products, and greater inclusion for unbanked or underbanked populations.

Will financial disintermediation lead to the end of traditional banking?

While financial disintermediation is changing the way in which many financial services are delivered, it’s unlikely to lead to the complete end of traditional banking. Traditional banks are adapting by integrating new technologies, collaborating with fintech companies, and revamping their service models. They still play a crucial role in areas such as regulation compliance, risk management, and providing a safety net for savers. Instead of disappearing, banks may evolve alongside new financial services to remain relevant in the future financial ecosystem.

What are the risks associated with financial disintermediation?

Financial disintermediation carries certain risks, including the potential for increased financial fraud and cyber threats due to less regulated platforms. Additionally, the lack of traditional financial intermediaries could mean that consumers and investors may not be adequately protected. Market volatility may also increase, as non-traditional financial instruments and services can be less stable. Regulators are faced with the challenge of adapting to these changes in order to safeguard the financial system and protect consumers.

How can consumers and businesses prepare for a future with greater financial disintermediation?

Consumers and businesses can prepare for a future with greater financial disintermediation by becoming more educated about the financial technologies and services available to them. It’s vital to understand the associated risks and benefits of non-traditional financial alternatives. Furthermore, staying informed about regulatory changes and maintaining sound security practices can help individuals and organizations navigate this evolving landscape safely. Building and maintaining a diversified portfolio is also key, as it spreads risk across different investment instruments which may now be more directly accessible.