Ever wonder how the big money moves change your loan payment or savings growth? You’re feeling the effect of monetary policy on interest rates, whether you know it or not. I’ll let you in on a secret: it’s not just fancy financial talk; it guides how much cash you keep in your pocket. We’ll start by tackling what central banks do to tug and pull at the rates you see every day. Next, we dive into how your wallet gets thicker or slimmer when the Federal Reserve plays its cards. Don’t sweat it—I’m here to make sense of the jargon and show you how these high-up decisions trickle down to your neighborhood bank, affecting your monthly budget and future plans. Buckle up; we’re cutting through the noise and hitting the road to financial clarity.

Understanding Central Bank Actions and Interest Rate Dynamics

The Role of Central Banks in Setting Interest Rates

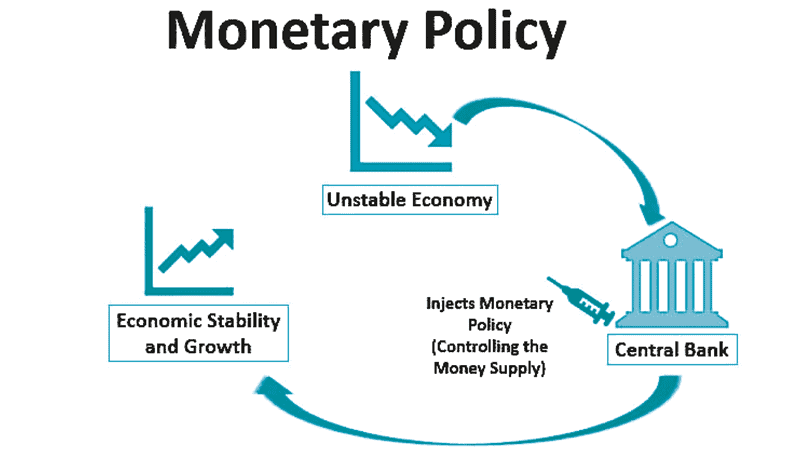

Central banks wield a powerful tool: they set key interest rates. Think of them as conductors of an orchestra, with each musician’s part critical for harmony. The central bank’s baton controls the flow of money and the beat of the economy. Picture a central bank like the Federal Reserve. It tweaks the federal funds rate, which is the rate at which banks lend to each other overnight. A lower rate means loans are cheaper. Banks can then pass on this cut to folks and businesses. This encourages spending and investing.

How Rate Decisions Impact the Economic Landscape

Rate decisions ripple through the economy. When a central bank drops rates, it’s like a green light for growth. People find loans and mortgages less costly. They buy homes or start businesses more freely. Conversely, when rates climb, the tap of available money slows. This dampens borrowing and curtails wild spending. It’s a delicate dance. Too much growth may spike inflation, while too little may stifle the economy. Each move aims to find a balance that promotes stable prices and job creation.

Deciphering the Federal Reserve’s Policy Effects

Interest Rate Trends Influenced by the Fed

The Fed uses a magic wand, not a real one, but it’s powerful! They call it monetary policy. This policy can make rates go up or down. Why does this happen? It’s like a game of tug-of-war. When the Fed worries about inflation – that’s when prices go sky-high – they hike up rates. This makes borrowing more costly. Spending slows, and so does inflation. Now, if the economy feels sluggish, and we need a boost, the Fed might do the opposite. They cut rates down, making it cheaper for people to borrow and spend. So, the Fed’s choices can steer where interest rates sail.

Anticipated Outcomes of Economic Stimulus Measures

When the economy is like a sleepy bear, hibernating deep in winter, the Fed can give it a nudge. They’ve got tools, like the economic stimulus, to wake it up. One tool belts out new money into the market. It’s called quantitative easing. Sometimes, they drop the rate banks use to borrow from each other overnight – the overnight lending rate. These moves get banks lending and businesses jumping; even those without much cash find doors opening. We all expect these nudges to push up growth and get people working and shopping again. But it’s a delicate dance, as too much money chasing too few goods can kick-start that inflation again.

Inflation Targeting and Quantitative Easing: A Dual Strategy

Assessing Quantitative Easing’s Effect on Long-Term Rates

Quantitative easing makes long-term rates drop. It’s a big move central banks use. When a bank does this, they buy lots of bonds. This leads to more cash in the economy. Banks can then lend more easily.

People ask, does this make rates fall for a long time? The answer is yes. When banks buy more bonds, prices of bonds go up. But the rate you get from a bond goes down. This is because the rate and price move in opposite ways. This means if you have loans or a mortgage, the interest might go less. That’s good for people who borrow but not always for savers.

The Interconnection Between Inflation Goals and Interest Rates

Central banks set an inflation goal to keep prices stable. They don’t want prices to go up or down too fast. If inflation is too high, things cost too much. If it’s too low, the economy may slow down. By setting this goal, banks can help control how fast prices change.

The link between inflation targets and rates is strong. When the bank wants to hit its inflation target, it might change the rates. If inflation is low, the bank might cut rates. This makes loans cheaper. People then spend more, and prices tend to go up. If inflation is too high, the bank might make rates go higher. This can cool down spending. Then prices may not rise as fast.

So the rate the central bank sets can steer inflation toward their target. This balancing act is tricky but keeps the economy running just right. It makes sure our money holds its value over time. And that’s important for everyone.

The Implications of Monetary Policy on Savings and Borrowing

How Policy Rate Changes Affect Mortgage and Loan Rates

Picture this: you’re at a game, and the central bank is the coach. When they change up their game plan, it can really mix things up for those playing – in this case, us, with our loans and mortgages. If the central bank cuts rates, borrowing gets cheaper. It’s like a sale at your favorite store, but for interest rates.

Now, let’s dig deeper. Say the central bank hikes up the policy rate. This move means banks will likely up their own rates for loans and mortgages. So, buying a house or starting a business costs more. On the flip side, if the central bank cuts the policy rate, banks often follow suit and cut their rates too. This can mean lower monthly payments for your house or business loan. Easy, right?

The Influence of Central Bank Strategy on Credit Availability and Savings Yields

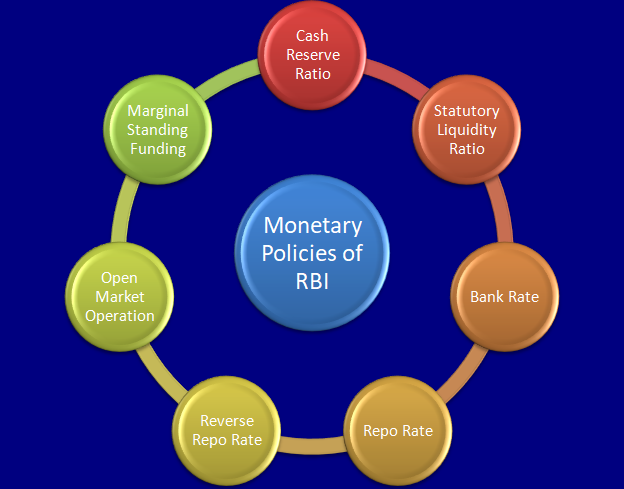

Next, let’s chat about how these big player moves impact your wallet, beyond just loans. The central bank has a toolkit to make sure there’s just the right amount of cash flowing. Tools like the reserve ratio and open market operations are like setting the rules for how much money banks need to keep in the vault.

When the central bank relaxes these rules, banks have more freedom to lend out money. This can mean it’s easier for you and me to get loans. However, if the central bank gets strict and ups these requirements, banks may tighten the purse strings. Loans can get harder to score.

Finally, all these changes can affect what you earn on your savings. A rate cut might feel nice when you borrow, but it can slim down what you earn on savings accounts. And when rates climb? Your savings might just fatten up a bit!

This game of interest rates has huge ripples in your day-to-day life. It shapes how much buying a house will cost, or if you can get a loan for a new set of wheels. It even decides how hard your saved cash will work for you while it’s sitting in the bank. Keep a sharp eye on the central bank’s next play – it might just be the time to make your move!

In this article, we explored how central banks impact interest rates and our economy. We explored their role, looked at how their rate decisions can change our economic world, and uncovered the effects of the Federal Reserve’s policies. Interest rates follow trends set by the Fed, and these trends have big effects on things like jobs, prices, and how much things grow or shrink in our economy.

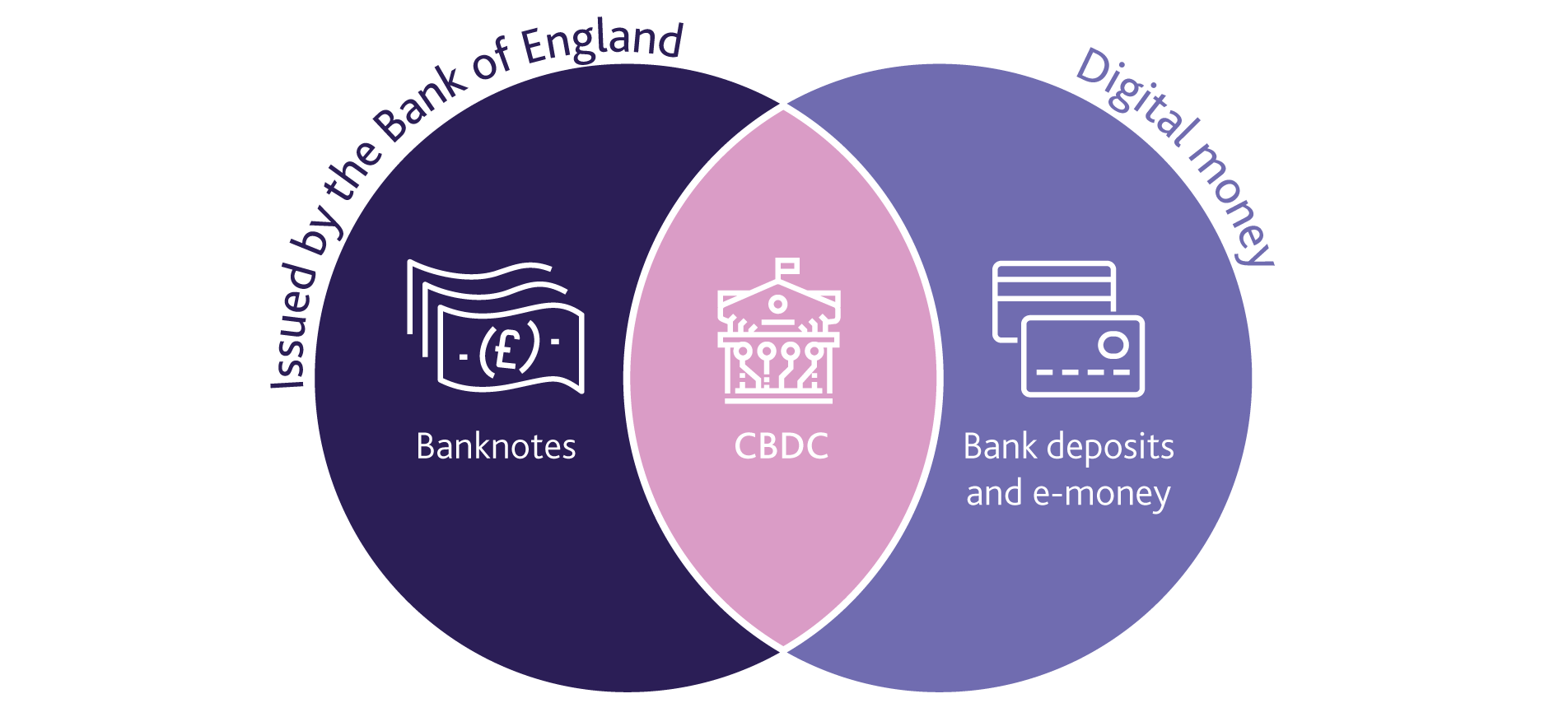

We also talked about big tools like quantitative easing and how these affect long-term rates and inflation goals. Last, we saw how changes in monetary policy reach into our own pockets, changing what we pay for loans and earn on savings.

So, what’s my final take? Smart central bank moves are key for a stable economy. They decide how much it costs to borrow and how much your savings can grow. Understanding these choices can help you make better decisions with your own money. Remember, every change in policy is a sign of a shift that could affect your wallet!

Q&A :

How does monetary policy influence interest rates?

Monetary policy, implemented by a country’s central bank, directly affects interest rates through its tools such as the setting of the discount rate, reserve requirements, and open market operations. When the central bank wants to lower interest rates to stimulate the economy, it may reduce reserve requirements or purchase securities in open market operations, thereby increasing the money supply. Conversely, to raise interest rates and combat inflation, it can increase reserve requirements or sell securities, reducing the money supply.

What are the key goals of monetary policy in relation to interest rates?

The main objectives of monetary policy include managing inflation, controlling unemployment levels, and achieving a stable and sustainable economic growth. Interest rates are finely tuned to attain these goals—lowering rates to encourage borrowing and investment during economic slowdowns, and increasing them to cool off the economy when there is a risk of inflation.

Can expansionary monetary policy lower interest rates?

Yes, expansionary monetary policy, which aims to inject more money into the economy, usually leads to lower interest rates. By increasing the money supply through purchasing government securities and decreasing the discount rate, the central bank encourages banks to lend more at lower rates, which can lead to increased economic activity.

How do interest rates respond to contractionary monetary policy?

Contractionary monetary policy is designed to reduce the money supply and can lead to higher interest rates. This is typically achieved by the central bank raising the discount rate and selling government bonds in the open market. The increased rates make borrowing costlier, which can dampen investment and spending, with the intent to bring down inflation.

What is the time lag between monetary policy implementation and its effect on interest rates?

The impact of monetary policy on interest rates does not occur instantaneously. There can be a time lag that varies depending on factors such as the state of the economy, the specific monetary policy tools used, and how institutions and markets respond. The lag can range from several weeks to even years in some cases, with short-term interest rates typically reacting quicker than long-term rates.