Technical analysis strategies for day trading are your ticket to profit in the fast-paced world of the market. I don’t guess the moves; I chart them. With years spent in front of screens and graphs, I’ve distilled the essence of what works. If you want success by the closing bell, you’ll need more than luck. You’ll need a solid grasp on the chart patterns that forecast a win. From the spikes and dips to the shapes and shadows, every pixel can mean profit. It’s about spotting the right signals amidst market noise. I’m here to guide you through the charts that matter and the strategies that win. Keep reading and turn your day trades into paydays.

Unveiling Profitable Patterns: Best Chart Structures for Day Trading Success

Recognizing High Probability Chart Setups

Look at charts; they tell stories of price moves. The best chart patterns for day trading jump out at you. They scream, “Here’s where the money is!” But how do we spot these patterns? It’s about knowing what to look for—tools that highlight money-making chances. You must learn to see triangles, flags, and head-and-shoulders shapes. These are your bread and butter. They show where prices might jump or fall. It’s where smart day traders look to enter or exit.

Here’s what stands out: Triangles suggest a big move after a quiet time. Look for them. When prices wrap tight like a coil, they’ll soon pop. Flags are rallies or drops with a flat line after. If you see one, get ready. The next move could mirror the first. Head-and-shoulders? It’s a rally then dip, rally to a peak, dip and rally to a lower peak, and fall. Spot this, and a drop is likely next.

Recognized right, these setups can make your day profitable.

Candlestick Formations: Timing Your Trades

Candlestick analysis for quick trades is potent. They look simple, just a box and some lines. But they offer deep market wisdom. A candle tells you so much—where prices opened, peaked, dipped, and closed. Learn a few key shapes. A ‘hammer’ is a candlestick that looks like a T or an upside-down T. This one whispers, “Trend might flip.”

An ‘engulfing’ pattern has one candle’s body swallowing the next one’s. It shouts, “Get set, new trend starting!” And when a ‘doji’ appears, where open and close are nearly the same, it murmurs, “Pause. The market’s unsure. Something could change.”

And what do all these shapes mean for day traders? They’re clues. Drop or rise, these candles hint at future price swings. And for us, that’s where the profit is. So, we use candlesticks to time our trades—that’s the ticket to quick wins.

Trading isn’t guesswork. It’s about watching and reading the market’s clues. That’s what sets apart day traders who make it and those who don’t. The best chart patterns for day trading are those that offer clear signals—like a flashlight piercing the dark.

Seeing a pattern is just the start. Know what it means, what it suggests about what’s next. Move with the market’s rhythm. Get this down, and you’re in the zone. Then trading feels less like random bets and more like a skilled dance.

You want to spot these patterns and shapes like a pro. Study charts. Practice spotting patterns until they stand out clear as day. When they do, you’re ready to make your day trading count. And trust me, when you nail this, it feels great! Every chart is a puzzle, and you’ll hold the pieces.

Remember, markets move fast and so should you. Use these insights to jump on trades at just the right time. With the right patterns, you’ll spot the start of runs or drops. That’s your cue to act. With quick and well-timed trades, day trading can really pay off.

Now, onto the tools that help spot these moments quicker. Let’s talk indicators.

Harnessing Technical Indicators for Swift Intraday Action

Moving Averages and Bollinger Bands: Perfecting the Scalp Strategy

When we talk about scalping in day trading, I get excited! Why? It’s like a fast-paced game, grabbing quick profits throughout the day. For this, we rely on tools like moving averages crossover strategy and Bollinger Bands scalping. Let me show you how these tools can work for you.

First, imagine moving averages as a simple traffic light system on your chart. When a short-term moving average crosses over a longer-term one, it’s a green light. Time to buy! When it dips below, that’s your red light. Time to sell! This system keeps things clear and simple.

Then, there’s Bollinger Bands. Think of them as elastic bands for prices. When prices push the bands, it’s usually time to jump in for a quick trade. These bands help us grasp when prices might bounce back, so we can scalp small gains.

MACD and RSI Divergence: Identifying Momentum Shifts

Now let’s get into the thick of momentum shifts with MACD indicator for intraday trading and RSI divergence in day trading. These indicators work like a sixth sense. They tell you what you can’t see on the surface.

MACD gives us a picture of momentum. We look for times when price goes one way, but MACD goes another. This is a divergence. It signals a possible shift ahead. It’s like seeing clouds gather before a storm—it tells you something’s up.

RSI, or Relative Strength Index, does something similar. It measures speed and change of price moves. When you see RSI moving opposite to price, it warns you that the current trend might be running out of steam. This can prep you for a quick decision.

Combining these strategies—moving averages for trends and MACD with RSI for momentum—gives you a sharp edge. Your trades become more about smart moves than guesswork. Each tool confirms the others, letting you cut through market noise.

We use volume analysis as well for an extra layer of confidence. More traders diving in can mean stronger signals. Trading is all about the best odds, and this combo puts odds in your favor.

By mastering these techniques, you can swoop in, scalp your profits, and jump out before the market flips. It’s about being nimble and quick, just like in a game of tag. You want to be the one doing the tagging, not the one running away at the last minute.

Remember, practice makes permanent. The more you use these tools, the quicker you can spot those precious scalp trades. Keep at it, and you’ll see those small wins add up—a fantastic way to build your day trading success.

Mastering the Art of Precise Market Entry and Exit

Implementing Fibonacci for Surgical Strike Positions

Fibonacci retracement levels are your secret weapon. When stocks take wild swings, these levels act like magic. They show where the price could turn around. So, how do you find these levels? First, pick a high and low point on your chart. Then, watch as these Fibonacci levels pop up between them. Prices often change course at these lines.

To nail your entries and exits, get in near these levels. Look for other clues the market gives, like high volume or a candlestick pattern. Combine them all, and you’ve got a powerful mix for day trading.

But why do these levels hook traders? They tap into the trader psychology, the crowd behavior, which often drives market moves. And when you see prices hovering near Fibonacci levels, you know that others are watching and acting on these same cues.

Volume and Volatility: Confirming Your Market Moves

Volume and volatility are critical. They give you the green light to trust your trade. Say the volume shoots up as the price hits a Fibonacci level. It’s a sign that traders care about this price point.

And volatility? It’s the wind in your trade’s sails. With your volatility indicators, you can spot the perfect moment for market entry. Volatility jumps mean big price moves are brewing. You want in on the action, right at the sweet spot.

But it’s not just about jumping in. Knowing when to get out is just as important. Imagine catching a ride on a big wave. You don’t want to wipe out when it crashes. You want to ride it, then hop off with your profits before it’s too late.

Watching volume peaks alongside spikes in volatility can guide these decisions. This combo can show you the best spots to set up shop or pack your bags.

Keep this in mind: strong volume plus a push from volatility is like a day trader’s compass. Follow where they point, and you’re on your way to day trading success. Remember, you’re not trying to predict the market’s every move. You’re surfing the waves it makes. And by riding these waves with precision, using tools like Fibonacci levels, and checking the weather with volume and volatility, you’ll carve out profits, trade by trade.

Now, you’ve got the drill. Spot your chart setup. Check your Fibonacci jewels. And confirm with volume and volatility. Do this right, and you’ll master precision trading – your ticket to profits in the day trading arena. Keep practicing, and soon enough, you’ll be the one calling the shots in this game of fast wins and quick thinking.

Advanced Tactical Playbook for the Seasoned Day Trader

Utilizing Ichimoku and Keltner for Cutting-Edge Trend Analysis

When I watch charts, my eyes track trends. I use Ichimoku Cloud for this a lot. It shows me where the market might head. The cloud’s color flips? That tells me buyers or sellers are taking control. Talk about a heads-up!

I pair the Cloud with Keltner Channels to confirm trends. Think of Keltners as a trend’s fence. If the price breaks the fence, it could run free in that direction. Both tools help me find strong trends before I trade.

Harmonics and Heikin Ashi: Refining Trade Execution

Now, for a smooth chart, I turn to Heikin Ashi. It’s like regular candlesticks but cleaner. It filters the market’s noise and shows me clear trends. This helps me spot buy or sell moments faster. Less noise means fewer mistakes.

I love harmonics for their precision. They are patterns that repeat and can predict price moves. I look for these shapes on my charts to pick my spots. It’s like knowing a secret chord that makes the market sing.

So why use these tools? To spot the best trades before they happen. That’s the edge every trader needs.

In this post, we dived into the best chart patterns for smart day trading. Starting off, we looked at high-probability setups and timed trades with candlesticks. Then, we talked about using technical tools like moving averages and Bollinger Bands, along with MACD and RSI to spot momentum changes.

We also covered how to nail your market entries and exits using Fibonacci, and checked volume plus volatility to confirm market moves. Lastly, we explored advanced tactics, including Ichimoku and Keltner for trends, and Harmonics with Heikin Ashi for fine-tuning trades.

My final thoughts? Master these strategies to turn charts into a treasure map of smart moves. Stay sharp; practice makes perfect!

Q&A :

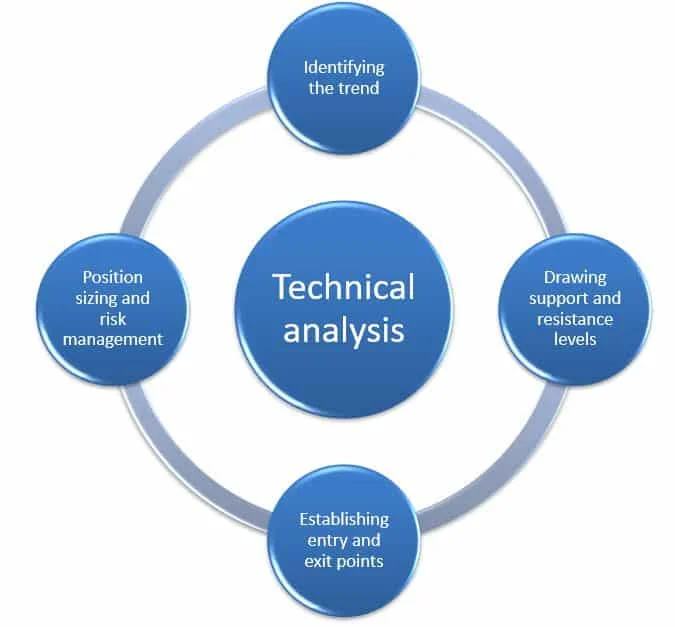

What are the most effective technical analysis strategies for day trading?

Day trading involves a myriad of technical analysis strategies that aim to capitalize on short-term market movements. Among the most effective strategies are Trend Following, using moving averages to identify the direction of the market trend; Mean Reversion, which relies on the assumption that price levels will revert to their average; and Momentum Trading, which looks for securities moving in one direction on high volume. Other notable strategies include Breakout Trading, where traders enter a position as the price breaks through predetermined resistance or support levels, and the use of Relative Strength Index (RSI) to identify overbought or oversold conditions.

How can you identify the best entry and exit points for day trading?

Identifying the best entry and exit points when day trading is crucial and can often be determined through technical analysis tools and indicators. One common approach is to use support and resistance levels to spot potential reversals in the market. Traders may also employ chart patterns, like triangles or flags, to predict price movements and determine strategic entry and exit points. Additionally, technical indicators such as moving averages, Bollinger Bands, and oscillators like the Stochastic or RSI can provide insights on when to enter or exit a trade. It’s essential to have a disciplined approach and a set of rules to guide these decisions.

Which technical indicators are most reliable in day trading?

In day trading, the reliability of technical indicators can vary based on the market conditions and the trader’s strategy. However, some of the most popular and reliable indicators include the Moving Average Convergence Divergence (MACD), which helps to spot trends and momentum; Volume, to assess the strength behind market moves; and the Stochastic Oscillator, used to determine overbought or oversold conditions. Additionally, many traders use the Average True Range (ATR) to gauge market volatility and manage their risk accordingly. It’s important for traders to understand how these indicators work and to use them in conjunction with other analysis methods for optimal results.

Can technical analysis strategies be applied to all financial markets for day trading?

Yes, technical analysis strategies can be broadly applied to different financial markets such as stocks, forex, commodities, and even cryptocurrencies. However, it is important to understand that each market has its unique characteristics and volatility profiles. While the core principles of technical analysis like chart patterns, trend lines, and indicators are universal, the specifics of how they are applied can differ based on the liquidity, trading volume, and the timescale of the particular market. It’s recommended that traders adapt their strategies to reflect these differences and conduct thorough backtesting for each market they trade in.

Is it possible to automate technical analysis strategies for day trading?

Automation of technical analysis strategies for day trading is not only possible but is becoming increasingly common with the advancement of trading software and algorithms. Traders can use platforms that offer algorithmic trading options to create custom code or use pre-built trading bots that follow specified technical analysis rules.

This approach can help to execute trades at a speed and precision that would be impossible manually. However, it is crucial to continuously monitor automated strategies to ensure they are performing as expected and to make adjustments in response to changing market conditions. Additionally, traders should be aware of the risks associated with trading automation, including system failures and over-reliance on algorithmic predictions.