Sustainable Investing Regulations: It’s like exploring uncharted lands in the realm of finance. Think of it as setting sail on the green seas, where each wave is a policy or rule that shapes how we invest for the future. We’re not just tossing coins into a wishing well—our choices now have to sync with the planet’s health and society’s well-being. I’ll guide you through this jungle of guidelines and show you how to swing from the vines of regulations without getting tangled up. Whether it’s the EU’s playbook for green activities or the broad reach of the SFDR, we’re decoding the rules that will shift your green dollars into truly impactful investments. Welcome to the new frontier, where aligning your portfolio with Mother Earth is not just smart; it’s the law.

Understanding the Global Landscape of Sustainable Investing Regulations

Grasping the EU Taxonomy for Sustainable Activities

The EU has made a big move with its new finance rules. These rules help money get to green projects. They’re part of something called the EU taxonomy for sustainable activities. It’s a list of what counts as an eco-friendly investment.

Let’s say a company makes power without hurting the earth. This company meets the EU’s green rules. Now, investors can put money there and know it’s good for the planet. It’s like a green light saying, “This investment is earth-friendly!”

But it’s not just about being green. The EU checks that these investments don’t harm people or the earth. It’s about keeping a balance between making money and caring for our world. This balance is what we call environmental criteria in finance.

The Increasing Scope of SFDR and Its Implications

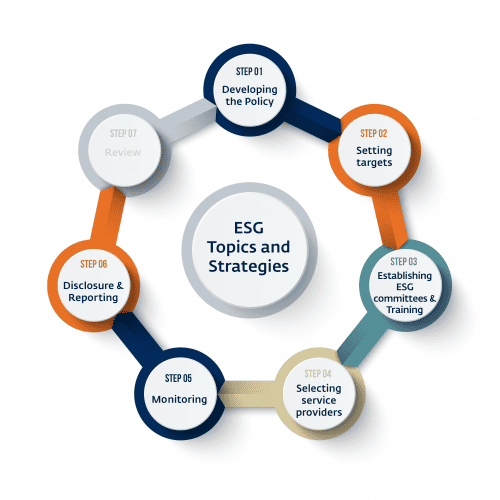

Another set of rules is the SFDR – short for sustainable finance disclosure regulation. This tells funds how to talk about their green side. If a fund follows SFDR, they must say how they use ESG criteria. ESG stands for things that care for the earth (E), treat people right (S), and run a tight ship (G).

Now, this is getting big! More funds have to follow SFDR. This means they have to be more open about their impact on our world. It forces them to show how they help or hurt the earth and people.

Imagine you’re in a store full of toys but you want the best, safest one for your kid. SFDR is like a label that helps you find that toy. But instead of toys, we’re talking about investments. It’s all about making sure your investment is safe and sound for the world.

The world of money is changing fast. Folks who manage money must now think about the planet and its people, not just profit. They must show how their investments make a positive mark.

This includes how they manage risks related to the weather and climate. You hear about floods and fires more these days, right? Well, these can mess with investments too. So, there are these new rules to help money managers be ready for such risks.

Understanding these rules isn’t just for the big shots. It’s for anyone who cares where their money goes. Whether it’s the EU’s green list or SFDR’s clear info, it’s about more than cash. It’s about making a mark and funding a better future.

So, as money rules get greener, we all get to play a part. We can put our money where our values are. Stick with me, and I’ll guide you through this green financial frontier. Together, we’ll find out how to do well for ourselves and do good for our planet.

Integrating ESG Into Investment Decisions: A Compliance Perspective

Aligning Portfolios with UN Principles for Responsible Investment

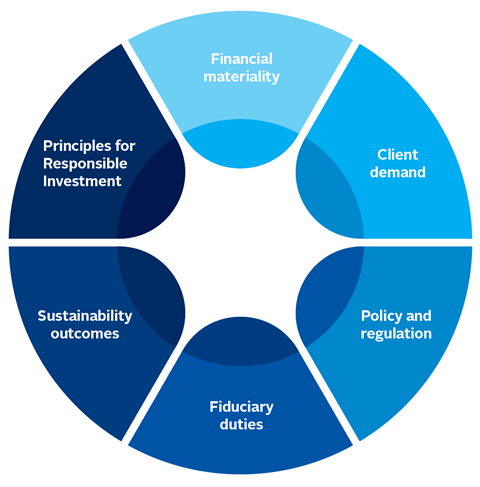

When I look at any investment plan, I bring out my ESG magnifying glass. The first lens zooms in on the UN Principles for Responsible Investment. These are not just fancy words on a page. They’re a pledge to make the world a bit better with every dollar.

The Principles cover a broad scope. We start by including ESG issues into decision-making. Think of the planet, people, and fair play. Next, we own up to owning shares. We use our voice to steer companies toward good ESG practices. We also buddy up with others. Why? To raise our power and push for ESG together. Standing alone is tough. Standing together is strong.

Following the rules is a must. We keep an eye on how firms do business. We support their good moves. We shout out when things go wrong. Mix these actions and we get an ESG investment strategy that ticks all the right boxes. It’s hard work, but the gains mean a win for both our pockets and the planet.

Managing Climate Risk Disclosure in Line with TCFD Recommendations

Now, I flip the lens to climate risks. We live in a world that’s getting warmer. This heat brings risk to investments. So, I lean on insights from the TCFD, or the Task Force on Climate-related Financial Disclosures. They give a map to follow when sharing info on climate risk.

Investors want the full picture. They get it through clear climate risk disclosure. We must show how risks and green moves might affect profit and loss. Secrets don’t make friends. Full disclosure does. Keeping info clear and straight means trust grows and money follows.

Guided by the TCFD roadmap, we can gear up for a climate-smart future. We check carbon footprints, cut them down, and swap dirty energy for clean. It’s a big jigsaw puzzle of finance and climate. Each piece must fit just right. And when it does, we’ll see a picture of a future that’s both green and growing.

No fluff, no puff. Just an honest, straight shot at making investment work for the planet. This is what we do, with ESG rules lighting the way. We stay on track and hold fast to what’s right. And you know what? It pays off. Not just in cleaner air and happier people. But in real dollars and cents, too.

Legal Frameworks Facilitating Ethical Investments

Examining the Legal Implications of Green Bond Principles

Green bonds are like magic beans for funding earth-friendly projects. They help raise money for projects that fight climate change or protect our environment. Think of building wind farms or making buildings use less energy. But how do we know the money from these bonds goes to the right place? Here’s where the Green Bond Principles come in.

These principles are a set of rules that guide what green bonds can fund. They make sure the money helps the earth. They also make sure folks who buy these bonds know what their money is doing. Things like how the project helps the air we breathe and the water we drink.

Now, if you’re putting money into these bonds, you want to be sure it’s doing good, right? You can sleep well knowing these principles focus on transparency, disclosure, and reporting. This means those selling green bonds must tell you how they use your money. They’ve got to show you proof that it’s funding real green projects.

Deciphering Fiduciary Duties in the Context of ESG

Let’s now dive into fiduciary duties. It’s a big word that means trust. In finance, it’s about making sure someone who is managing your money is doing it in your best interest. When we throw ESG into the mix, it gets even more interesting.

ESG stands for environmental, social, and governance. These are things an investment must care about if it wants to call itself ‘responsible’. So if you’re trusting someone with your money, you want them to look at these ESG things, right?

They should care about not hurting the planet, treating people fairly, and running a tight ship. If they don’t, they’re not taking care of your money the best they can. That’s not following their fiduciary duty. They need to think about these ESG factors when they decide where to put your money.

Today, many laws are popping up that say your money minders have to think about ESG. That’s because these things can make or break where you invest. If a company ignores them, they might face big risks like breaking laws that protect our air or having unhappy workers.

By focusing on ESG, those who manage investments can better dodge risks that could hurt your money’s growth. Global rules are also changing to make sure they do just that. This goes hand in hand with keeping Earth and its people safe now and in the future.

So, when we talk about laws and ethical investments, we’re really talking about trust. We trust that when our money goes into investments, they do what’s right by us and by the world. Whether it’s through green bonds that fund earth-loving projects or making sure ESG is at the heart of money management, these legal frameworks are here to guide a brighter future.

Trends and Tools in ESG Investment Strategy

Leveraging ESG Data Quality for Investment Excellence

Let’s talk about getting better at ESG investing. It’s like putting together a winning sports team. You need top players, right? In the investment game, that means having good ESG data. This is all about the environment, fair play in business, and making sure leaders are on the up and up. Now you might ask, what makes ESG data good? Precision, for one thing. We want data we can count on, as close to perfect as we can get.

Good data helps us avoid foul play. It’s like a ref in a game making the right call. When we get the numbers right, we can pick investments that do well by doing good. But there’s a tricky part. Everyone sees ESG data differently. Some care more about clean air, others about happy workers or honest bosses. So we have to check the data, just like you check your team’s stats. We look at reports and scores from different places to see what’s best.

Now let’s dive deeper. Social governance factors, they’re about treating folks right. We’re talking fair pay, health, and making sure everyone gets heard. The environmental criteria? Think clean water, air, and using less stuff that hurts the planet. When you nail this combo, you score big in investing. To win, stay up-to-date with rules like the EU taxonomy for sustainable activities and SFDR. These are like the rulebooks of ESG.

Navigating New Developments in Renewable Energy Investment Regulations

Wind farms, solar panels, you know them, right? They’re all the rage, and for a good reason! We’re charging into new rules for clean energy funding laws and renewable energy investment rules. This is the lay of the land where money meets Mother Earth. It’s changing fast, and here’s the play-by-play.

The team’s gotta play by the rules, or it’s game over. We’re looking at laws that push for a greener planet. Things like how much pollution can your investment make? Not so much anymore! That’s what these new rules are telling us. They’re guiding where the money flows, all into cleaner energy.

And don’t forget the fans — the people investing. They want to see a win for the earth, too. We’ve got shiny new ways to make sure everyone plays fair, like SEC climate disclosure rules. They’re like telling your fans the strategy before the game. Be clear, and they’ll cheer for you.

There are big wins out there for those who get the game right. To score, you need a game plan that meets these new green finance rules. Be smart, and your investments could make money while powering a future we’d all want to live in. It’s a tough play, but hey, that’s how you win championships in the ESG league.

In this post, we’ve explored the key areas shaping sustainable investing today. We discussed the EU’s approach to eco-friendly activities and the changing world of SFDR. We also looked at how investors are using the UN’s principles to make smart choices and tackle climate risk through TCFD.

We then dived into the legal side, examining how green bonds work and what ESG means for those in charge of others’ money. Finally, we tackled the latest trends and tools, stressing the importance of good ESG data and renewable energy rules.

My final take? The world of investing is not just about money anymore. It’s about making sure our planet and society thrive. Staying on top of these regulations and strategies isn’t just smart; it’s a must for those who want to lead in the financial world. Keep learning, keep adapting, and you’ll be part of a future that’s not only richer, but also healthier and fairer for all.

Q&A :

What are the latest regulations impacting sustainable investing?

In recent years, various regulations have been put in place to encourage and manage sustainable investing. One key regulation is the EU Sustainable Finance Disclosure Regulation (SFDR), which requires financial market participants to disclose sustainability risks and impacts. In the US, the Securities and Exchange Commission (SEC) has proposed rules to enhance and standardize climate-related disclosures for investors. It’s essential for investors to stay informed about the latest developments to ensure their practices are aligned with current requirements.

How do sustainable investing regulations affect individual investors?

Sustainable investing regulations aim to ensure transparency and help individual investors make more informed decisions. These regulations can affect individual investors by increasing the availability of ESG (Environmental, Social, and Governance) data, facilitating the comparison of sustainable investment options, and ensuring that the funds labeled as sustainable are managed according to stated principles. Individual investors stand to benefit from these regulations as they are designed to protect their interests and promote sustainability objectives.

How can investors ensure compliance with sustainable investing regulations?

Investors can ensure compliance by staying informed about the evolving regulatory landscape and integrating ESG factors into their investment analysis and decision-making processes. Additionally, they should work closely with experienced financial advisors who have a good understanding of both local and international sustainability standards. Regular audits and reviews of investment portfolios against sustainability criteria are also critical for maintaining compliance.

What impact do sustainable investing regulations have on financial institutions?

Financial institutions are heavily affected by sustainable investing regulations, as they often necessitate changes to investment strategies, reporting practices, and product offerings. These regulations push financial institutions to implement robust systems for ESG evaluation and to provide detailed and accurate sustainability-related information to their clients. As a result, they may incur additional costs for data collection, analysis, and reporting but also have opportunities to innovate and create products that meet the growing demand for sustainable investments.

In what ways do sustainable investing regulations promote ethical practices?

Sustainable investing regulations promote ethical practices by requiring transparency in investment policies, strategies, and practices related to environmental and social issues. By demanding that investment managers consider ESG criteria in their due diligence processes and decision-making, these regulations help to align investments with societal values. This pressure to disclose ESG factors and impacts encourages investment firms to adopt more principled and ethically responsible practices in their operations.