Security of fintech payment platforms isn’t just a fancy phrase; it’s a vital shield for your money in the digital world. As financial tech takes giant leaps, knowing how to navigate this digital safe haven is essential. Here, we’ll break down the nuts and bolts of making sure your cash stays locked tight and fraudsters stay out. We’ll dive into rock-solid encryption, smart biometrics, and the latest fraud-fighting tech. Get ready to learn how industry pros keep your transactions super secure and your financial data under wraps.

Understanding the Crucial Elements of Fintech Payment Security

Modern Encryption Techniques in Payment Technology

When you use fintech platforms, they must keep your money safe. This means using strong tools to protect your payment info. One key tool is encryption. Encryption scrambles data so that only people with the right key can read it. It’s like sending a secret letter that only your friend can decode.

We use encryption when you pay or check out online. This keeps your card details safe from hackers. In today’s fintech world, we’re always finding new ways to make encryption even better.

The Role of Biometric Authentication in Enhancing Fintech Security

Have you ever used your fingerprint or face to unlock your phone? That’s biometric authentication. It uses your body’s unique features to prove it’s really you. Now, we’re using biometrics to make fintech payments safer too.

When you use fingerprints or facial scans, it stops others from using your account. Even if they steal your password, they can’t copy your fingerprint. Banks and fintech apps are using biometrics more and more. It’s a strong way to check identity and keep your money safe.

Biometrics make sure that you alone access your account and money. It’s a simple step that adds a huge layer of safety to your financial dealings. And in the world of fintech, this kind of safety is what we aim for every day. It’s all about keeping your money and your trust in top shape.

Preventing Fraud with Advanced Fintech Features

Implementing Two-factor Authentication for Financial Transactions

When we talk about keeping money safe, two-factor authentication (2FA) is key. Think of it like a double lock. You need your password, sure. But then, you need a second key, like a code from your phone. This two-step check is a strong guard against bad guys who might want to steal your money.

How does 2FA work? First, you put in your password. Easy. Next, your bank sends a unique code to your phone. You type that in, and bingo, you’re in! Simple, right? Even if someone has your password, they can’t get into your account without that special code. It’s a strong wall that keeps your cash safe.

But why is it so important in finance? Money matters are big targets for crooks. They try all kinds of tricks to grab your cash. With 2FA, we throw a big wrench in their plans. Your bank account becomes way harder to crack. It’s like having a watchdog that barks only if the right person comes to the door.

Leveraging Blockchain Technology for Ironclad Payment Security

Now, let’s dive into blockchain. You might ask, “What’s that?” Picture a chain of blocks. Each block is a record that’s locked tight. Put together, they make a list of all deals that ever happened. It’s a public ledger that everyone can see but no one can mess with. That’s blockchain.

Why is it so tough for bad guys to beat? Once a deal is made, that info is locked. To change one block, you’d have to change all blocks on all computers at once. That’s as hard as it sounds. This makes blockchain a super-strong lock for online money moves.

In fintech, blockchain means we can send cash without worry. It’s safe from sneaky tricks and false moves. No one can fake a deal, and everyone can see the deals that were made. This trust builds a safe space for our money to move and grow.

Remember, 2FA and blockchain aren’t just cool tech. They’re shields for our wallets. They keep our money locked up tight. With these tools, we can fight back against fraud and keep our hard-earned cash safe. They’re the heroes in our pockets, guarding every cent with care.

Adherence to Regulatory Standards and Compliance in Fintech

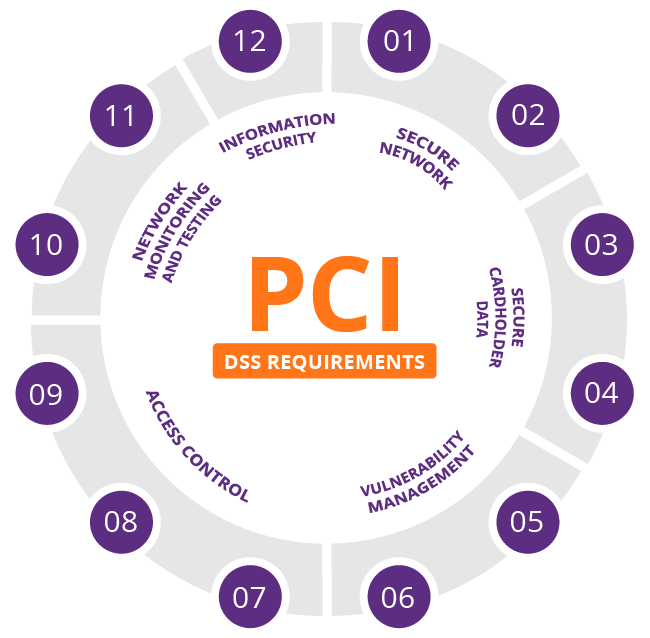

Navigating PCI DSS Requirements for Online Payments

When we buy things online, we want to know our money is safe. That’s where rules like PCI DSS come in. It means Payment Card Industry Data Security Standard. This is a big deal for keeping payment cards safe from bad guys.

What is PCI DSS compliance?

It’s like a secret code for safety. It has rules that shops must follow to protect card info.

Why do fintech platforms need to meet PCI DSS standards?

They need it because it helps stop thieves from stealing your money.

Shops on the Internet must lock up your card info like it’s treasure. This means using tough security to guard your data against hackers. They scramble your card numbers into a secret code. This way, even if bad guys get it, they can’t use it. That’s what we call encryption in payment technology.

But locks and codes are not enough. Imagine your card info like a castle. Now, consider PCI DSS as the castle’s walls, moats, and guards. They all work together to keep the castle safe.

Understanding this can help us feel good when we shop online. We trust safe sites because they follow these rules.

PSD2 and Its Impact on Payment Security and Data Protection

Now, let’s talk PSD2 – Payment Services Directive Two. It’s a law in Europe that changed the game for online money.

What does PSD2 do for payment security?

It makes banks share your info safely with other payment services if you say it’s okay.

How does PSD2 protect our financial data?

It creates tough rules for how to handle and share your money info safely.

PSD2 also says, “Hello, you need to check who’s asking to see the money!” This means using things like fingerprints or text codes for checks. That’s what they call two-factor authentication in finance.

So what’s so cool about PSD2? Well, it means that new ideas for how we pay can grow. It helps startups and banks to work together to invent ways to pay without worry.

They also have to check how they do things regularly. This makes sure they keep up with new ways to keep money safe. This is risk assessment in digital payments. It’s like a health check for your money.

And guess what? PSD2 and the laws like it help us all. They make sure that when we tap or click to pay, our money doesn’t just walk away.

Remember how online shops must be like a locked-up castle? Well, PSD2 helps make sure that only you have the key to open the gate.

In fintech, secure digital wallets and third-party payment processors follow these rules, too. This means that they are like trusted friends who help keep your money safe.

So that’s the scoop on how laws and rules help keep our money safe online. By following PCI DSS and PSD2, fintech is building a safe place for our cash in the digital world. And that’s something we can all get behind.

Staying Ahead: Fintech Response to Emerging Cybersecurity Threats

AI and Machine Learning in Fraud Detection Tactics

Fintech is like a house that needs a strong lock, and AI is that lock. AI stands for artificial intelligence, and it helps stop bad guys from stealing online. Think of AI as a smart guard that learns and gets better at catching thieves. It’s always on watch, looking for things that don’t seem right with money moves.

AI can spot patterns from data that humans might miss. This keeps your money safe. It also speeds up how fast we find fraud, making things safer, quicker. It’s like when superheroes team up to stop crime faster!

Let’s dive a bit deeper. When you buy something online, AI can tell if it’s really you or someone pretending to be you. It looks at how you usually spend money and stops fraudsters in their tracks. This tech learns from what happens each day to get smarter. Just like you learn from mistakes, AI does too. It keeps your money safer every day.

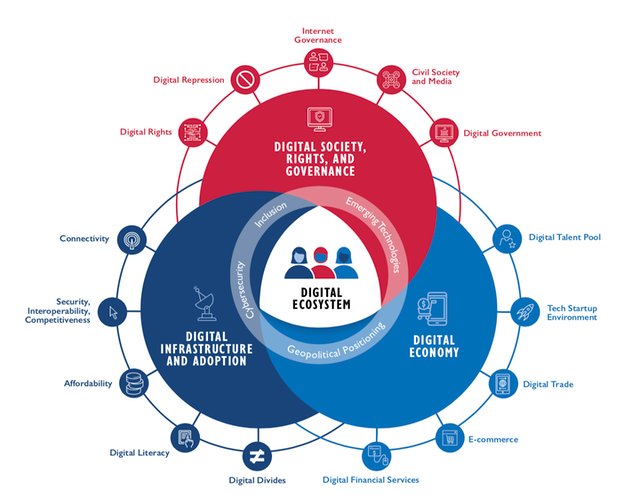

Building Secure Payment Ecosystems for the Digital Age

Now, let’s build a safe space for our money in this digital world. We need tools to keep our money talks secret between just us and the bank. Encryption is one of those secret tools. It scrambles our money talks so nobody else can understand them.

Another cool thing is two-factor authentication, or 2FA. This is like a double-check system. You need two keys to open your money safe, so it’s tougher for thieves to get in. Maybe it wants your password and then sends a code to your phone. You need both to get in.

We want our payment world to be a place where everyone can trust it’s safe to move money. Risk assessments are also important. It’s like having a map that warns of danger spots, so we can be careful. We check everything, from how we make and get money, to who we’re dealing with. We make sure to step safely with each money move.

We also hook up with laws that keep us in check, so you know we play by the rules. This means we do stuff like PCI DSS, which is like a big rule book to make sure we protect card info right.

A key thing is making sure you are who you say you are. Digital identity verification is our buddy, confirming it’s really you. It’s like a secret handshake that only you and the bank know.

Our payment space must be strong and tough against leaks. End-to-end encryption is like wrapping your money in armor during its journey. And for our friends who like tapping their phone to pay, you’re covered too. Contactless payment security has got your back!

We link all these cool tools with our finch family tree. We keep checking up, fixing any weak spots, and making sure everything is tight. It’s an ongoing battle against cyber bad guys, but as fintech guards, we’re always suited up and ready. We’re committed to keeping our digital haven safe for all.

In this post, we’ve explored key parts of fintech payment security. We covered how modern encryption and biometric authentication keep your money safe. We also saw how two-factor authentication and blockchain can help fight fraud. Plus, we learned about important rules like PCI DSS and PSD2 that businesses must follow.

We know hackers keep getting smarter. But fintech is staying one step ahead with AI and secure systems. Remember, staying safe with your money online means making sure your financial services use these top-notch security methods. Always check for these features and stay informed about new changes. Your financial safety is worth it!

Q&A :

How do fintech payment platforms ensure transaction security?

Fintech payment platforms adopt multiple layers of security to ensure safe transactions. These often include encryption to protect data in transit, secure socket layer (SSL) technology, tokenization to replace sensitive account information with unique identifiers, two-factor authentication for user access, and ongoing fraud monitoring to detect suspicious activities. They also comply with industry standards such as PCI-DSS to provide added security assurance to users.

What are common security risks associated with fintech payment platforms?

Some common security risks in fintech payment platforms include identity theft, phishing attacks, unauthorized access due to weak user authentication, malware, and man-in-the-middle (MITM) attacks. Fintechs must constantly update their security protocols to address the evolving nature of these threats.

Are fintech payment platforms safer than traditional banking payment methods?

Fintech payment platforms utilize advanced security measures like biometrics, AI, and real-time fraud detection, which can make them as safe, if not safer, than traditional banking methods. However, the overall safety also depends on the security practices of individual users. It’s important for users to follow good cybersecurity habits regardless of the platform to minimize risks.

What is PCI-DSS compliance, and why is it important for fintech payment platforms?

The Payment Card Industry Data Security Standard (PCI-DSS) is a set of security standards designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. Compliance with PCI-DSS is crucial for fintech payment platforms as it helps prevent security breaches and protects cardholder data, further gaining trust from consumers and stakeholders.

How can consumers protect their data when using fintech payment services?

Consumers can protect their data on fintech payment platforms by creating strong, unique passwords, enabling two-factor authentication, regularly monitoring their accounts for any unauthorized activity, and only using secure networks for financial transactions. They should also be cautious of phishing attempts and keep their software and apps updated to the latest versions.