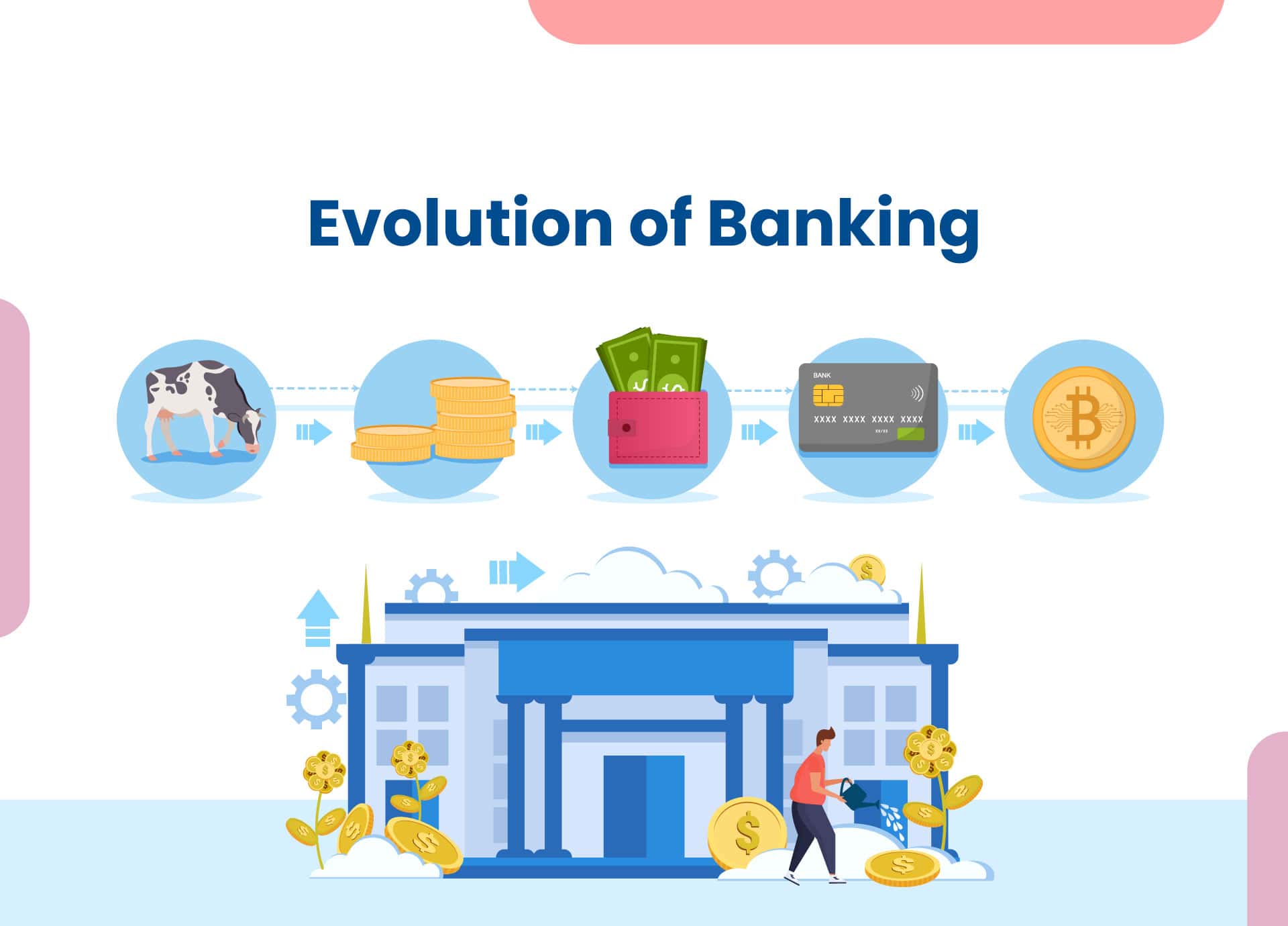

Online banking vs traditional banking—which is shaping the future of finance? As an expert who’s seen the banking world evolve, I’ll take you on a tour of this transformation. We used to stand in long lines at the bank, but today, a few taps on our phone can achieve the same results. This shift is not just about comfort; it’s about leaps in accessibility and innovation that redefine how we manage our money. You’ll discover why and how the banking landscape is changing, and what this means for your wallet. Let’s dive into the world where digital financial services are becoming king, and understand what’s at stake for your financial well-being.

Understanding the Shift from Traditional to Online Banking

The Rise of Digital Financial Services Innovation

We live in a time where digital banking is soaring. But why is it so popular? Digital banking brings many perks. You can check your balance, pay bills, and even apply for loans from anywhere, any time. This wasn’t the case with traditional banking, where a visit to the bank during working hours was a must.

Now, let’s talk about the ease of mobile banking. You carry a bank in your pocket. Lost your credit card? Freeze it with a tap on your screen. Want to transfer money to a friend? Done in seconds, without writing a check or visiting an ATM.

Digital banking benefits are not just about ease. They also include better online savings account interest rates. Compared to traditional checking accounts, internet bank accounts often have lower fees and higher interest rates. It’s a win-win for your wallet.

Brick-and-Mortar Bank Limitations vs. 24/7 Online Banking Accessibility

Let’s face it, brick-and-mortar banks can’t keep up with the 24/7 demands of our busy lives. They have operating hours, they close on holidays, and sometimes you have to wait in long lines. With online banking, these limitations vanish. At 2 AM or on a Sunday, your banking needs are met with just a few clicks.

Sure, some might miss face-to-face banking. I get it, sitting down and talking with someone can be reassuring. Yet, times are changing. More people are trading this classic banking experience for the flexibility and freedom of online banking. But how about keeping money safe? That’s where cyber security in banking comes into play.

Cyber security is top of mind for internet bank accounts, which is why there are robust online bank safety measures. Banks invest in technology to protect your money and personal info, making online banking not just convenient but also secure.

Think about the last time you needed cash. With online banks, ATM access is often fee-free. They don’t need their own ATMs, as they partner with ATM networks. Gone are the days when you had to stick to your bank’s ATMs or face fees.

In a world where technology moves fast, banks aren’t just banks anymore. They are tech companies pushing financial tech advances. Today, depositing checks digitally or accessing bank comparison tools is common, all thanks to the technological impact on banks.

To wrap it up, the switch from branch banking to web banking is driven by our need for more control over our financial lives. Online banking software, financial services availability, everything is designed with one goal in mind – to make managing our finances easier, quicker, and better. Digital wallets, mobile banking apps, they’re all making the classic wallet stuffed with cards nearly obsolete.

And the big question – will online completely replace physical banks? Maybe not completely. There’s still a need for bank location convenience. But one thing is certain – the banking industry evolution is geared heavily towards online and mobile, and it’s not looking back.

Navigating Financial Products: Traditional Checking vs. Internet Bank Accounts

Comparing Online Savings Account Interest Rates

People often ask which one is better, an online savings account or a traditional one? Online savings accounts usually offer higher interest rates than traditional bank accounts do. This means you make more money just by storing it in the account. So, if you want to grow your savings, online might be the way to go.

Online banks can give more because they spend less on stuff like buildings and staff. Without those costs, they pass the savings to you with better rates. It’s essential to check and compare these rates, though. They can change and vary from one internet bank to another.

Online vs Conventional Loan Offerings

Now, what about when you need to borrow money? It’s helpful to know that online banks often have lower loan rates than traditional banks. You might also find that applying for a loan online is quicker. Plus, you can apply anytime from home, which is a big plus.

Conventional banks sometimes offer deals for their long-time customers, though. They also have staff who can help you face-to-face if you have questions. But, for speed and often better rates, online banks have the edge. They cut through the red tape faster, making it simpler for you to get the loan.

When you’re thinking about loans or where to put your savings, consider what you need most. Is it the sweet face-to-face service of a physical bank or the always-open, often more profitable world of online banking? Both have their plusses, but it’s all about what works for you.

Enhancing Banking Experience Through Technology

The Integration of Digital Wallets and Mobile Banking Apps

Digital wallets and mobile banking apps change the game. They bring the bank to your pocket. You can pay bills, check balances, and transfer money anytime, anywhere. It’s about making your life easier.

What’s a digital wallet? It’s an app that holds your payment info. You can use it to pay without cash or cards, just your phone. With digital wallets on the rise, you can pay fast and stay organized. Think about buying a snack or splitting dinner bills – tap your phone and you’re done!

Mobile banking apps also keep your money close. They let you manage your cash on-the-go, cut down time spent at banks, and they’re secure. You can deposit checks with a picture, and see your spending any time. This is mobile banking convenience at its best.

Cybersecurity Measures in Protecting Online Bank Accounts

When banking online, safety is key. Cyber security in banking is a big focus. Banks work hard to protect your money and info online.

How do they do it? They use tough passwords, monitor for strange activity, and protect data. They teach you to spot scams, too. Banks must keep up with online bank safety measures. It keeps trust strong.

Extra steps like two-factor authentication add to security. You may get a code on your phone or email to use when you log in. This makes sure it’s really you. Security is not just about the bank’s systems but also how you use them. Always log out and be careful on public Wi-Fi.

Tech has changed the way we bank. Moving from branch banking to web banking means we do more on our screens. We want banking to fit in our lives, not the other way around. It’s about being fast, safe, and smart with our money and time.

The Economic Impact of Online Banking on the Financial Industry

Reducing Bank Transaction Costs with Remote Banking Services

We all like to save money, right? Well, online banks help us do just that. They cut down on big costs that come with running physical bank branches. This includes rent, utilities, and salaries. By cutting these costs, online banks pass on the savings to us. They have fewer fees and often better interest rates than traditional banks. This is a win for our wallets. With just a few clicks, we can do most of our banking from anywhere. This is great for busy lives.

With the rise of apps and web services, sending money has become quick and easy. We can now transfer funds, pay bills, or deposit checks using our phones. This is mobile banking at its best. It’s handy, and we don’t need to visit a bank or ATM.

Remember though, fewer branches can mean less face-to-face help. If we run into an issue, we might miss having a chat with someone at the bank. But, many online banks have awesome customer service over the phone or web. So, we’re not entirely on our own.

Financial Technology Startups and Banking Industry Evolution

Financial tech startups are shaking things up. They’re inventing new ways to manage money all the time. These startups focus on what we, the users, want. They bet on making banking super user-friendly. They want us to get what we need fast and without fuss.

Startups often lead with cool features, like easy-to-use digital wallets. These let us pay with a phone instead of carrying cash or cards. They’re also behind the secure tech that keeps our money safe when banking online.

While they’re new kids on the block, they often join hands with big banks, too. This helps bring new tech to more people. It also keeps those big banks on their toes. They have to keep up with the cool stuff that startups do.

For us, this partnership means we get the best of both worlds. We can enjoy new tech and still have the trust we put in big, classic banks. With new ideas coming from startups, and trusty banks adapting, banking is only getting better. It’s an exciting time to watch, use, and benefit from these changes.

So, online banking is not just a trend. It’s changing the game of finance. It makes things cheaper and more convenient for us. It’s also pushing banks and money experts to think out of the box. They’re all working to make managing our money a breeze. Plus, they’re crafting ways to keep every dollar we earn secure. The next time you click to check your balance or zip money to a friend, think of all the folk who made it that simple. Let’s keep our eyes peeled. With every passing moment, banking is shaping a cooler financial future for all of us.

In this post, we’ve looked at the big move to online banking. We saw how tech makes banking easy and always open, compared to old-school banks. We checked out how internet bank accounts, with better rates and different loans, stack up against regular checking accounts. We also dived into how tech, like digital wallets and strong security, improves our banking game. Plus, we saw how online banking is changing the money world, cutting costs, and shaking up the industry.

So, what’s the takeaway? Online banking is here to stay. It’s making life easier, saving us cash, and keeps getting better. Embrace the change and make the most of your money. Happy banking!

Q&A :

What are the main differences between online banking and traditional banking?

Online banking, also known as internet banking or web banking, typically refers to the process of performing financial transactions digitally via a bank’s website or mobile app. This includes tasks like transferring funds, paying bills, and checking account balances. Traditional banking, on the other hand, usually involves visiting a physical branch for services, speaking with bank personnel directly, and completing transactions in person or via paper forms and postal mail.

Which is safer: online banking or traditional banking?

The safety of banking largely depends on the protocols and security measures implemented by the bank, whether online or traditional. Online banking employs multiple layers of security, including encryption, two-factor authentication, and frequent software updates to protect customer data. Conversely, traditional banking has its physical security measures such as vaults, security personnel, and surveillance systems. Both methods carry risks, such as potential digital breaches for online banking and physical theft or forgery in traditional banking, but when security protocols are followed, both can be considered safe.

Can I perform all banking activities online that I would do in traditional banking?

Most common banking activities can indeed be performed online, including fund transfers, bill payments, applying for loans, opening new accounts, and depositing checks using mobile deposit features. However, more complex services, like certain types of account management or notary services, may still require a visit to a traditional branch, although this gap is continuously narrowing as online services expand.

How does the convenience of online banking compare to traditional banking?

Online banking is typically seen as more convenient because it allows customers to handle their finances from any location at any time, without the need for physical travel or adherence to bank branch operating hours. It provides instant access to accounts, real-time transactions, and digital customer service options. Traditional banking usually requires visiting a branch within its limited business hours, which might not always align with customers’ schedules.

What impact has online banking had on the traditional banking industry?

Online banking has forced the traditional banking industry to evolve and adapt. Banks now increasingly offer online banking services in addition to their conventional offerings to meet the changing customer preferences. This digital shift has led to a reduction in physical branch numbers and encourages financial institutions to improve their technology and overall customer service. It has also sparked the rise of completely digital banks, known as neobanks, which operate without any physical branches.