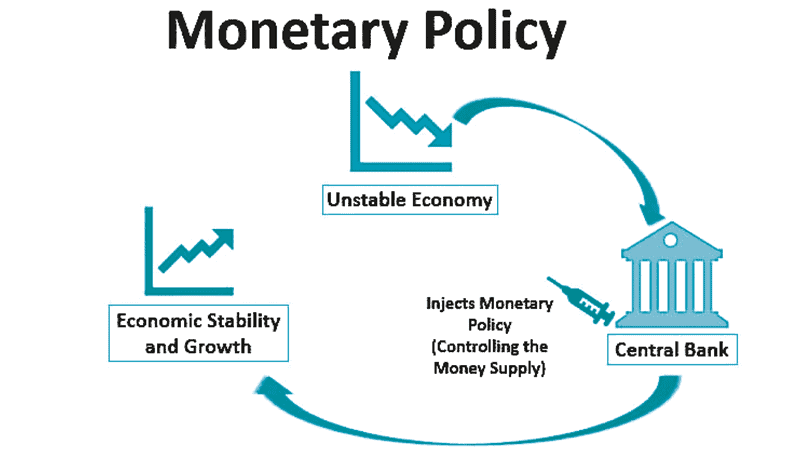

Monetary Policy Impact: Think of it like a roadmap for your cash. It’s not just political suits in a boardroom—it touches your wallet, too. Banks depend on it. They take cues to lend more or pinch pennies. We’re diving deep, figuring out the central bank’s playbook and how those interest rates shape your dough. Ready for a crash course in cash flow? Buckle up; we’re breaking down how big bank decisions are steering your financial ship.

Understanding Central Bank Decisions and Interest Rate Effects

The Role of the Federal Reserve in Economic Modulation

Central bank decisions are like a ship’s captain steering through rough seas. The Federal Reserve acts as this captain for the U.S. economy. It uses tools like interest rates to keep the economy stable. Picture the economy as a big, busy market. When the Fed cuts rates, it’s like they’re making it cheaper for shop owners to borrow money for their businesses. This can lead to more jobs and more stuff for people to buy.

Lower interest rates make it less costly to borrow. This encourages people and companies to spend and invest. It’s like having a big sale at your favorite store—you want to buy more. When folks spend and invest, it can help the economy grow. More jobs may pop up, and it puts money in people’s pockets.

How Discount Rate Adjustments Shape the Financial Landscape

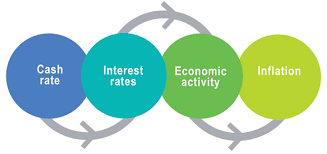

Now let’s talk about the discount rate. This is what banks pay when they borrow money from the Fed. Changes in the discount rate can rock the boat of our economic market.

If the Fed raises the discount rate, it’s like making borrowing more expensive. This can slow down spending and cool off an economy that’s heating up too fast. Sometimes, an economy can grow so fast that prices shoot up, which is called inflation. High inflation is like a storm that can push prices so high that people can’t afford stuff they need.

On the flip side, if the Fed lowers the discount rate, it opens the money taps. Banks can lend more easily, and businesses can get the cash they need to grow. It’s like planting seeds for new jobs and giving consumers more to spend.

So, when you’re looking at your own money, keep an eye on what the Fed’s doing. Their moves can change your loan’s interest or what you make from savings. As the captain of your own financial ship, you want to sail smoothly through whatever economic weather comes your way. Use these clues from the Fed to navigate your spending, saving, and investing.

Remember, central bank decisions and interest rate changes make waves. These waves move through the economy and touch everything from your job to your wallet. Understanding these moves helps you make smarter choices with your money. It’s a bit like being a weather-savvy sailor in the vast ocean of finance. So, stay alert and ready to adjust your sails.

Delving into Inflation Rates and Quantitative Easing

Analyzing the Balance Between Inflation Targeting and Economic Growth

What is inflation targeting? It’s when central banks fight to keep prices stable. They aim for a set inflation rate, which helps the economy grow without prices shooting up too fast. Central banks, like the Federal Reserve, change interest rates to manage inflation. When prices go up too fast, they raise rates to cool things down. But if prices barely move, they might cut rates to boost spending and growth.

Central banks decide the best inflation rate to help the economy grow without causing highs and lows that hurt people’s wallets. It’s like a captain steering a ship through rough seas—the goal is to keep it moving steadily without tipping over. Striking this balance is tough but crucial. It affects jobs, how much money everyone has, and how much stuff costs.

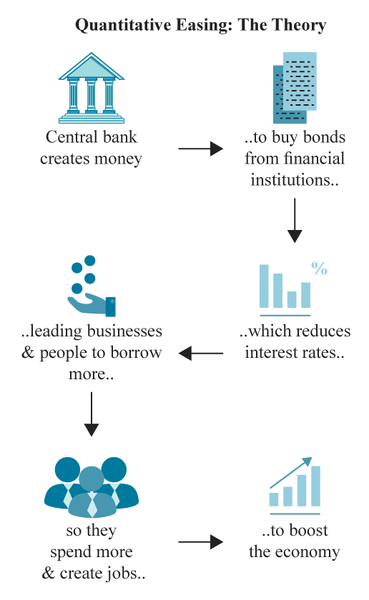

Quantitative Easing Consequences on the Consumer Price Index

Quantitative easing (QE) is when a central bank buys loads of bonds. This pumps money into the economy and can lower interest rates across the board. But, what does QE do to prices of everyday stuff, tracked by the Consumer Price Index (CPI)? When a central bank uses QE, it aims to boost spending and investing by making borrowing cheaper. If it works too well and people spend lots, prices might go up since there’s more money chasing the same amount of stuff.

Think of it like putting more air in a balloon—it gets bigger. But if you put in too much air, what happens? The balloon pops. That’s why it’s important to do QE just right. If the central bank gets it wrong, your money might buy less, and saving gets harder. On the flip side, if QE boosts the economy just enough, it can create jobs and make people happier since their money is worth more.

Finding the sweet spot with QE is key to keeping prices steady and the economy happy. It’s about knowing how much money to put out there and keeping a close eye on how prices react. If you’ve ever made a recipe and had to add just the right amount of salt, then you know what I mean. Too little, and it’s bland; too much, and it’s ruined. That’s like the central bank’s job with QE—they add money to the recipe of the economy to make it taste just right, making sure jobs and prices are well balanced.

The Intersection of Fiscal Policy and Monetary Instruments

Fiscal Policy Contrast with Central Bank Initiatives

Let’s talk money moves. Fiscal policy and central bank moves don’t dance to the same tune. Fiscal policy means the government’s plan for taxes and spending. When it cuts taxes or ups spending, you get more cash in your pocket. But central bank decisions, those big choices by folks like the Federal Reserve, focus on keeping prices stable and work getting people jobs. They might cut interest rates to make borrowing cash cheaper, so there’s more spending and hiring. Or they hike rates to cool things off when prices climb too high.

Now, why does it matter if they don’t match? Imagine fiscal policy hits the gas on the economy by reducing taxes, but the central bank taps the brakes with higher interest rates. You get mixed signals. One wants you to spend; the other wants you to save. It’s a delicate balance to strike.

Monitoring the Economic Stability Factors Amidst Policy Changes

Keeping an eye on stability in the economy is a bit like being a weather forecaster. We watch certain things to predict storms or sunshine in money matters. Interest rates effects, inflation rates, and unemployment rate changes are biggies — they tell us if we’re sailing smooth or hitting choppy waters. Changes here can mean our cash buys less or our jobs are shaky.

Quantitative easing is another tool: the central bank buys bonds to pump cash into banks and markets. It’s like an emergency medicine that kicks in when normal interest rate cuts don’t do the trick — it’s used to get the economy moving. But too much, and we risk prices shooting up (hello, inflation) or debts ballooning.

Keeping the economy singing along means walking a fine line between these factors. Too much sway one way can lead to a crash (think recession). The other way, we might get living costs that shoot up too fast (that’s inflation hitting your wallet).

The central bank’s got to time their moves right. If they hit the right notes, we see jobs, stable prices, and good growth. If they miss, we’re left with a mess — too many goods, not enough buying, or the other way around. It’s a dance of dollars and cents that affects your job, your mortgage, and what your money is worth.

It comes down to balance. A mix of smart tax moves and savvy central bank plays can keep our economy on a steady beat. It can put more cash in your hand and keep those price tags in check. And that’s the kind of harmony we all want in our wallets, right?

The Ripple Effects of Monetary Policy on the Economy and Investment

Evaluating Unemployment Rate Changes and Economic Growth Outcome

You might ask, “How do central bank decisions affect jobs?” Well, when a central bank changes interest rates, it can lead to more or fewer jobs. It’s like turning the heat up or down in your house. If a central bank lowers rates, businesses can borrow money more easily. This often leads them to hire more people. On the flip side, if the bank raises rates, borrowing gets harder, and businesses might slow down on hiring.

Lower interest rates often help the economy grow. Companies invest more because borrowing is cheap. People spend more cash too. But if rates are too low for too long, prices for things we buy every day can climb too high. That’s what we call inflation. So, the central bank tries to find a balance. They want enough growth to create jobs, but not so much that our money buys less.

Impact of Monetary Policy on Saving and Spending Behavior

Now, let’s talk about how these same interest rate moves hit your wallet directly. If a central bank drops interest rates, your savings in the bank won’t grow as much. This might make you think, “Why save? I might as well spend!” And when a lot of us think that way, the economy really gets a boost.

But it’s not all about spending. Sometimes, the central bank will raise rates to cool things down. This means you’ll get more money from your savings, so you might decide to save more instead of buying that extra toy or taking a fancy trip.

It’s a tricky balance. The central bank has to figure out when to push us to spend or save. It’s a big job that shapes our lives in ways we see every day. Whether it’s about how much our paycheck is worth or if it’s a good time to start a new project, these policies touch us all.

Remember, when you hear about the central bank and interest rates on the news, it’s not just fancy talk. It’s about the jobs we have, the things we can afford, and the decisions we make about our money every day.

In this post, we looked at how central banks control the economy. We saw the Federal Reserve uses rates to keep the economy steady. Lower rates can boost spending but may cause prices to rise. When the Reserve changes rates, your money feels it.

We dug into inflation and easing. We learned that aiming for just enough inflation supports growth. Easing can help, but may also push up prices.

We also explored how government spending decisions and central bank actions can clash or support each other. These policies not only affect the nation but also the stability we all rely on.

Lastly, we saw how these policies can change jobs and how much money we have for spending or saving.

So, what’s the takeaway? The decisions of central banks touch everything from your job to your wallet. It’s like a big machine with many levers – each move can lead to big changes. Keep an eye on these policies; they shape your economic world.

Q&A :

How does monetary policy affect the economy?

Monetary policy, primarily conducted by a central bank, affects the economy by adjusting the levels of money supply and interest rates. When a central bank implements expansionary monetary policy, it typically lowers interest rates and increases money supply, aiming to boost economic activity by making borrowing cheaper for businesses and households. Conversely, contractionary monetary policy involves raising interest rates and reducing money supply, with the goal of reducing inflation and slowing down an overheating economy.

What are the main objectives of monetary policy?

The main objectives of monetary policy usually include maintaining price stability (low and stable inflation), achieving full employment, and ensuring moderate long-term interest rates. Some central banks also aim to support sustainable economic growth and maintain the stability of the financial system. Central banks employ various tools such as interest rate adjustments, reserve requirements, and open market operations to meet these objectives.

How does monetary policy impact unemployment?

Monetary policy can impact unemployment through its effects on economic activity and aggregate demand. Expansionary monetary policy can lower unemployment by encouraging businesses to invest and hire due to lower borrowing costs. On the other hand, contractionary monetary policy may increase unemployment temporarily as it can lead to reduced investment by businesses and lower consumer spending.

Can monetary policy influence inflation?

Yes, monetary policy is one of the key tools used to influence inflation. By controlling the money supply and interest rates, central banks can either cool down an economy with high inflation by raising interest rates (contractionary policy) or stimulate an economy with low inflation by lowering interest rates (expansionary policy). The objective is to maintain price stability, which is often defined by central banks as keeping inflation at a specific target rate.

What are the limitations of monetary policy?

Monetary policy has several limitations including the time lag between the implementation of policy measures and their effect on the economy, which can make timely adjustments challenging. Furthermore, monetary policy is less effective when interest rates are already near zero, a situation known as the “liquidity trap.” Other factors, such as global economic conditions and fiscal policy actions, can also affect the effectiveness of a central bank’s monetary policy.