Monetary Policy Decisions: How Interest Rates Shape Your Finances

Money talks, and so do monetary policy decisions and interest rates. They shout, really, straight into the heart of your wallet. Dive with me into the world where big bank moves set the stage for your financial health. From the cash in your pocket to the size of your home loan, each pulse by the central bank sends ripples through your finances. Ready to swim through the ebb and flow of rates and what they mean for you? I’ll make it simple – no jargon, just straight talk on how every interest rate hike or dip can reshuffle your budget right here, right now. Let’s decode this financial buzz and turn it into your strategy for winning with money.

Understanding Central Bank Policies and Your Wallet

The Role of Central Banks in Shaping Interest Rates

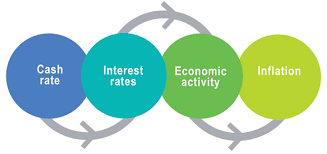

Let’s talk about how central banks, like the Federal Reserve, make big choices that touch our lives, especially our wallets. When the folks at the central bank meet, they decide whether to raise or lower interest rates. Imagine it’s like setting the price for borrowing money. They do this magic through something called open market operations, which means they buy or sell government bonds to set the pace for other rates.

When central banks cut rates, they want people and businesses to borrow and spend more. But when they hike rates up, they’re saying, “Let’s slow things down a bit.” They’re trying to stop prices from rising too fast, which is what inflation targeting is all about.

Your loans and savings are tied to these interest rate moves. Lower rates can mean cheaper loans, so maybe it’s easier to buy a house. But if you’re saving money, lower rates can be a bummer because you earn less interest.

How Federal Reserve Actions Influence Personal Finance

Okay, so the Federal Reserve goes into action when it feels the economy needs a nudge. With federal reserve actions, they can do things like quantitative easing, which is like pouring water on a thirsty plant. They buy stuff, like bonds, to pump cash into banks. This helps keep the borrowing costs low so people keep spending and businesses keep growing.

But there’s also the flip side, called contractionary monetary policy, which is when they put the brakes on by raising the federal funds rate. That’s the overnight rate that banks charge each other. It’s the base rate that impacts what you and I pay on loans or earn on savings. So, when the Fed acts tough to fight inflation, loans can get more expensive. Credit card rates and mortgage rates can climb up, which means your monthly payments can, too.

And then there’s the prime interest rate. That’s tied to the federal funds rate and affects a lot of different loans. When it goes up, so do your loan rates. When it drops, your loans could get cheaper.

Central bank governors have many tools like setting the cash reserve ratio or using the liquidity adjustment facility. These can make it easier or tougher for banks to lend money.

Now, let’s wrap our heads around this: when central banks pull off these policy rate adjustments, they give us clues on where the economy is heading. Got a loan or looking to save? Keep an eye on what they’re doing. It can make a difference to your dollars. So, next time you hear about a Fed meeting, listen up. It’s not just financial jargon – it’s about the cash in your pocket and dreams in your wallet.

Navigating a World of Changing Interest Rates

The Dynamics of Inflation Targeting and Borrowing Costs

When central banks aim to keep prices stable, they’re inflation targeting. They want to stop things from costing a lot more each year. Think of it like a game where the score should not go too high or too low. To keep score right, central banks change interest rates.

Why does this matter to you? Well, when inflation goes up, interest rates usually rise too. This means borrowing money for a house or car gets more expensive. Let’s say you want to buy a home. If interest rates go up, your mortgage could cost you more each month.

On the flip side, if you’re saving money, higher rates could be good news. Your savings could grow faster because banks give you more interest.

Central bank policies like raising the federal funds rate can make it costly for banks to borrow money. Banks then often charge you more for loans. This is how those big central bank decisions reach your wallet.

The Real-World Effects of Quantitative Easing and Contractionary Policies

Now, let’s talk about quantitative easing. It’s a tricky phrase but a simple idea. When times are tough, central banks buy stuff like government bonds to put more money out there. This helps keep the money flowing and can lower interest rates. That’s good if you need a loan.

What about contractionary policies? These are the opposite. They take money out of the economy and happen when the economy is hot, and there’s too much money chasing too few goods. Central banks raise rates to make it harder to borrow cash. They want to cool things down and stop prices from rocketing up.

Imagine central banks as doctors for the economy. When the economy has a cold and is slow, they give it medicine in the form of low rates. This is like the economic stimulus measures. But when the economy has a fever from too much money heat, they use higher rates to chill it out.

And, you guessed it, all these changes affect you.

Low rates can be great for borrowing but not so great if you’re saving. High rates help savers get more but can make borrowing too expensive.

Central banks also use the base lending rate and open market operations for these money moves. These tools help them control how much cash banks have and how much loans or saving will cost you.

As these rates change, so do your finances. It’s like riding a bike. When rates go up, it’s like pedaling uphill – hard work if you owe money. When they go down, it’s like coasting downhill – a breeze if you want a loan.

In short, whether central banks are pushing the economy’s pedals harder or easing them up, it’s a ride that affects us all. Keep an eye on their moves; they’ll steer financial markets, which in turn, steer your own money matters!

The Ripple Effects of Monetary Policy Decisions

Discount Rates and Their Impact on Savings and Loans

Think of the discount rate like a faucet. Central banks can turn the faucet to control the flow of money. When they turn it on, money flows more easily, and interest rates usually go down. This makes loans cheaper. You might think, “Great, it’s time to get a loan for a house!” But it’s not just home buyers who get excited. Companies can borrow more too, to grow their business or hire more people. So, more money moves around the economy.

But what about savings? Low rates make saving money less appealing. You get little back from your bank for your saved cash. This tiny reward can push people to spend or invest instead. It’s like a nudge from the central bank saying, “Don’t just sit on your money — use it!”

Interpreting Monetary Policy Committee Announcements and Market Reaction

When the monetary policy committee speaks, markets listen. They’re the decision-makers for the central bank. If they hint at raising rates, people think, “Prices might go up.” They’re talking about inflation. Keeping inflation just right is like Goldilocks not wanting her porridge too hot or too cold.

But if rates might rise, others think, “Time to save more money!” Higher savings rates mean your saved cash could earn more. They also could mean borrowing costs go up. So, businesses might say, “Let’s wait before we borrow money to grow.” How markets react can be quick. Prices for things like stocks might change before you finish your coffee. It’s all about guessing what will happen next with the economy and getting ready for it.

Interest rates aren’t just numbers. They’re powerful tools that shape how much you save or spend. They affect your plans for a home loan and your business ideas. Thinking about what the central bank does can help you make better money choices. So, keep an ear open for what they say next. It could be the hint you need for your next big move.

Forecasting the Future: Interest Rates and Economic Indicators

Utilizing the Yield Curve to Predict Financial Trends

You’ve heard of experts using a “yield curve” to forecast stuff. It’s like a crystal ball for predicting money moves. The yield curve shows what interest rates are doing over time. When it points up, long-term loans cost more than short ones. It can mean good things for the economy. But if it flips and points down, watch out. It could signal a downturn. Knowing this helps you understand what your savings and loans might do in the future.

Central banks, like the Federal Reserve, watch this too. They adjust their policies to keep our money world stable. When they change the federal funds rate, the effects ripple out. These ripple effects, in simple terms, are what you pay to borrow money and what you earn on your savings.

For example, when the Fed hikes up rates to control inflation, it can make loans more costly. This cools down spending and slows down inflation. It’s a way to keep the money’s buying power in check. This sort of action is a contractionary monetary policy move.

How Consumer Price Index Movements Affect Interest Rates and Your Money

Now, let’s talk about the Consumer Price Index (CPI). It’s a basket of common goods people buy, like bread and clothes. The CPI gives us a peek at what prices are doing. If the CPI number climbs, it means things are getting more expensive – that’s inflation. If it falls, stuff is cheaper, hinting at deflation. Why should you care about these ups and downs? Because they steer what central banks do next.

When inflation is high, central banks may push up interest rates to slow things down. The costlier borrowing can cool off too much spending. But if the CPI drops and deflation sets in, they might cut rates. This makes borrowing cheaper. It hopes to spark more spending, stirring the economy to life.

So, each move by central banks, each rise or fall in CPI, matters to you. It shapes the interest rates you get on savings or pay on loans. A small change up or down can mean more or less money in your pocket.

To sum it up, the yield curve and CPI are tools that signal where money is heading. They help forecast if interest rates will rise or fall. And those rates decide how easily you can buy a house, grow your savings, or expand your business. They also guide how central banks act to keep our economy on track. Understanding this, you’re better equipped to plan for your financial future.

In this post, we looked at how central banks shape our world. We saw how they set interest rates and how these rates change our personal finance. We learned about inflation targeting and how it affects our loans. We also explored quantitative easing and what it means for us. We delved into discount rates and how they impact our savings and borrowing. We deciphered bank announcements and their effects on markets.

Then we talked about predicting the future using economic signs like the yield curve and the Consumer Price Index. These tools show us where interest rates might go.

Here’s my final take: understanding how central banks work can save you money and lower stress. Keep an eye on their policies. It pays to know about interest rates, inflation, and market news. This knowledge puts power in your hands. So, use it to make smart money choices and stay ahead. That’s it. Now you’re set to navigate the tricky world of finance and come out on top.

Q&A :

How do monetary policy decisions affect interest rates?

Monetary policy decisions made by a central bank, such as the Federal Reserve in the United States, play a pivotal role in determining the interest rates in an economy. When a central bank decides to tighten monetary policy by raising short-term interest rates, it can cause borrowing to become more expensive, which may slow down inflation and economic growth. Conversely, if the central bank decides to implement a loose monetary policy by lowering rates, borrowing becomes cheaper, potentially stimulating investment and spending.

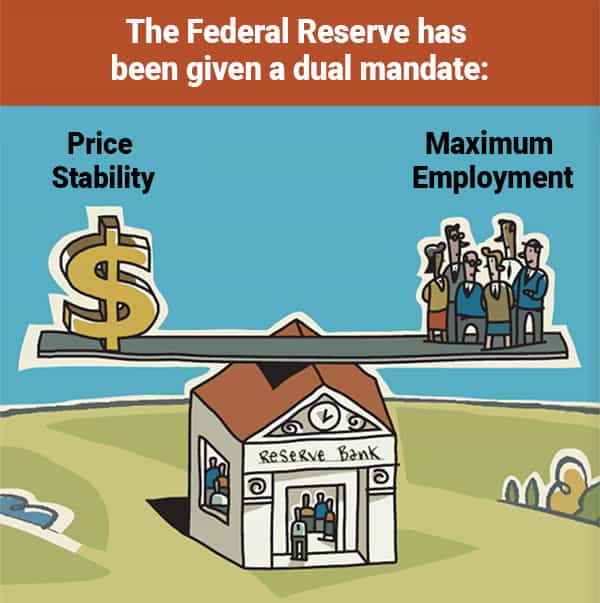

What are the main goals of monetary policy adjustments?

The primary objectives of adjusting monetary policy are to manage inflation, stabilize the currency, and strive for full employment. Central banks aim to keep inflation within a target range, preventing both excessive inflation and deflation. Adjusting interest rates is one of the tools they use to achieve this balance. Additionally, sound monetary policy fosters favorable conditions for sustainable economic growth.

How often do central banks review and adjust monetary policy?

Central banks review and adjust monetary policy at regular intervals, which may vary by country and the prevailing economic conditions. For example, the Federal Reserve typically meets eight times a year at its Federal Open Market Committee (FOMC) meetings to discuss and make decisions regarding monetary policy. European Central Bank (ECB) Governing Council also meets regularly to assess economic developments and make policy decisions.

What is the impact of interest rate cuts on the economy?

Interest rate cuts can have a stimulating effect on the economy. They lower the cost of borrowing for individuals and businesses, which can lead to increased spending and investment. This uptick in economic activity can boost employment and production. However, if interest rates are too low for an extended period, it could lead to an overheated economy, leading to high inflation.

Can monetary policy decisions predict economic trends?

Monetary policy decisions often reflect a central bank’s outlook on the economy and are based on a wide array of economic indicators. While these decisions are informed by current data and projections, they also signal the central bank’s expectations for future economic trends. However, predicting economic trends solely based on monetary policy decisions can be challenging as multiple factors influence the economy.