Understanding the ever-changing landscape of the global economy can be like navigating a maze. It’s complex, ever-shifting, and sometimes, downright daunting. That’s why keeping you afloat on the Latest Developments in Global Financial Crisis is crucial. You’ve likely seen the headlines chock-full of economic downturns and stock market tremors. But what does it all really mean for your wallet?

Let’s dive into the heart of the current financial turmoil—no fluff, just the hard facts that matter to you. From recession indicators and unemployment rates to central banks’ reactions and the stability of financial markets, I’ve got the insights you need. Stick with me to make sense of the money maze—we’ll dissect the scary stuff and uncover the silver linings together.

Understanding the Current Global Economic Downturn

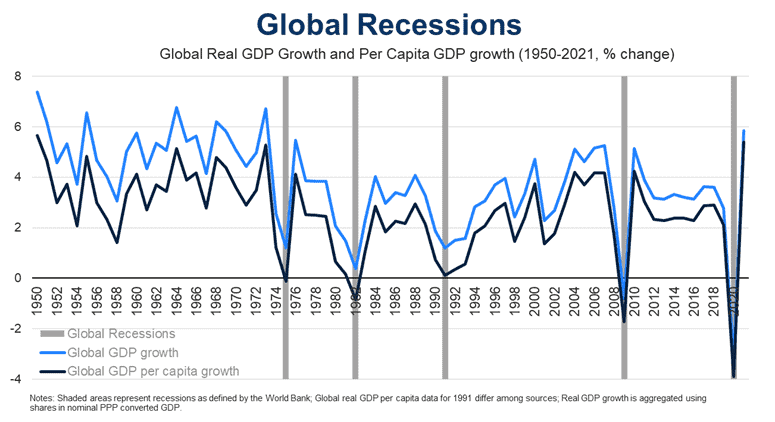

Identifying Key Recession Indicators of 2023

We’re seeing some loud alarm bells in the economy this year. To know how deep we’re in, we watch for signs — recession indicators. One sign is when goods at the store cost more, which we call inflation. Then, there’s the stock market going up and down like a scary rollercoaster. We also look at how many people can find good work. Or worse, the number of folks losing jobs. All these signs together tell us if we’re facing a recession.

So, what’s happening now? Prices of things we use every day are on the rise, making living more expensive. This inflation is squeezing wallets everywhere. Then, we peek at the stock market, and it’s not looking good. It’s all over the place, making investors nervous. Plus, some people are having a tough time finding jobs that pay the bills. We’re watching these things closely because they hint at what’s coming.

Analyzing Unemployment Rates as a Global Phenomenon

Unemployment rates can tell us a lot about the world’s financial health. They tell us how many people are out of work and looking for jobs. High unemployment is bad news. It means fewer people are earning money to spend on things. This can slow down how much stuff gets made and sold, which is bad for businesses too.

Globally, many countries are facing this issue right now. It’s not just here or there; it’s spread wide. Different places have different reasons, whether factories closing or shops selling less. What we see is that when a lot of folks can’t find work, it hurts everybody. So we keep an eye on these rates to see if things might get better or if we’re in for more tough times.

One thing’s clear: unemployment isn’t just about numbers; it’s about people. And when it goes up, it’s a sign we all need to buckle up for a bumpy economic ride. But remember, just knowing about these problems is a step towards fixing them. We can’t solve what we don’t understand. So, we learn, we watch, and we prepare — together.

The Response to Financial Adversity

Evaluating Central Bank Policies and Actions

Central bank policies are key in fighting a financial crisis. These banks lower interest rates to make borrowing cheaper. They hope more people will spend and invest. This can help a struggling economy.

But low rates can also lead to more debt. If rates stay low for too long, this can be a problem. Some fear it could fuel a debt crisis later on. Central banks also buy assets to pump money into the economy.

Some call this “quantitative easing” or QE. This can cut interest rates even more. QE can boost spending and confidence. But it may make it hard for prices to stay stable. Inflation can creep up. This means stuff costs more. So central banks must balance their actions to keep growth steady without letting inflation get out of hand.

We’re now seeing banks respond to the global economic downturn of 2023. They’re using these tools in hopes of preventing a recession. But some worry about the long-term effects of these policies.

Efficacy of Economic Stimulus Packages in Different Regions

Economic stimulus packages are like a cash boost. They aim to kickstart spending and growth. Governments give out money or cut taxes. This is to get people to spend or invest. Some packages help businesses or those out of work.

Each region does it a bit differently. Some give out lots of money, some not so much. And the effects can vary. If done well, stimulus can create jobs and help people keep spending. It can also ease the financial crisis impact on trade. But if it’s too much, it could add to the global debt crisis.

Places like the United States have announced big packages. They hope to boost their economy. In Europe, they’re also trying stimulus. But some worry that without smart spending, debt could rise too much. This could hurt economies in the future.

In Asia, countries like Japan and South Korea use stimulus too. They aim to keep their businesses going and people working. But not everyone agrees on how much to spend or on what.

It’s tough to say for sure who has it right. But stimulus packages are a big deal. They could help us avoid a deeper crisis. Or they could pile on more debt. We must wait and see if they lead us to a global economic recovery.

In the end, banks and governments are trying hard. They want to guide us through this money maze. But only time will tell if their actions will lead us out or further in.

Financial Markets under Stress

Stock Market Trends Amidst Economic Uncertainty

We’re in tough times, folks. The stock market feels like a roller coaster. Believe it or not, this chaos has a lot to do with the 2023 global economic downturn. Keeping up with the latest in financial crisis updates is critical. Stocks go up and down more than kids on a playground. These swings are clear signs of trouble. They say, “Hey, a recession might be coming!”

So, what makes stocks tumble like blocks? A lot, really. Jobs are hard to come by, and that’s a biggie. When folks struggle to find work, they can’t buy as much. Companies make less money, and boom, stock prices drop. Another punch comes from bailouts and government measures. We all hope they help, but there’s no guarantee.

When news is gloomy, people worry. They think twice before investing their hard-earned money. That hits the stock market like a ton of bricks. Plus, banks get nervous too. They tighten up on giving out money, known as the credit crunch effects. So, businesses have a tougher time getting loans to grow or just keep the lights on.

To sum it up, these stock market trends we’re seeing? They’re like a big red flag for our wallets and the economy.

Banking Sector Stability and Credit Crunch Effects

Now, let’s talk banks. They’re supposed to be as solid as a rock, right? But even they feel the heat in times like these. When the economy’s shaky, banks get shaky. The banking sector stability is at risk when folks start to worry about their dough. Banks play it safe then. They don’t lend money as freely. They fear they won’t get paid back.

This isn’t just tough on the banks, but on everybody. When cash is tight, businesses can’t grow. They might even lay off more people. These are the credit crunch effects in action. And then there’s the central bank. They try to cool things down by changing their policies. Think of it like a financial fire brigade. They cut interest rates or print more money, hoping to make things better.

But there’s also a monster called the global debt crisis. This beast is the total money owed by countries, and it’s massive. It gets scarier when money is tighter. Then, inflation joins the party. Prices of everything go up when money doesn’t buy as much. This can make a financial crisis turn into a nightmare quickly.

Friends, here’s the bottom line: Banks are like the heart of our money world. If they’re not beating right, the whole system feels sick. Whether it’s the stock market or neighborhood banks, what happens there makes waves. These waves can splash all over us, from our job to our grocery bills. Keeping an eye on these trends helps us ride out the storm. So let’s stay sharp and smart during these wild financial times.

Prospects and Risks in Recovery

Global Debt Crisis and the Role of the International Monetary Fund

Right now, we’re in a tough spot with global debt. Countries owe more than ever before. But the International Monetary Fund, or IMF, steps in to lend a helping hand when times are rough. They give loans to countries to get them back on track. This is super important to stop debt from getting worse.

The IMF helps countries not fall deeper into debt. They check a country’s plans for spending and saving, then offer money and advice. They want to make sure countries can pay back loans. The IMF’s role is like a coach for countries that need money discipline.

Sometimes the IMF asks for changes before they give a loan. They might say, “Cut back on spending” or “Make your tax system better.” This is to improve how the country uses money. Doing what the IMF suggests is like hitting the gym for money health. It can hurt, but it makes you stronger.

Fiscal Policy Changes and Investor Confidence Levels

Fiscal policy is how the government spends and gets money. When they change these rules, it can shake things up. Think of it like a game where the rules suddenly change. Players might get worried.

Investors watch these changes closely. They need to feel good about where they put their money. If governments spend well and keep debt low, investors are more likely to stay chill and confident.

When investors are confident, they put money into businesses and projects. This helps everyone, because it can create jobs and make the economy grow. But if they’re worried, they might take their money away. No one wants that, because it can lead to job losses and less money in our pockets.

So, seeing investors happy is key for recovery. It’s like a thumbs-up that things might get better. Governments have to find the sweet spot with spending and saving to make this happen.

We’re treading through a tricky path in the world of money. Paying attention to how much countries owe, and how comfortable investors feel, is crucial. The IMF works to prevent a full-blown debt disaster. And how governments manage their cash affects whether investors will stick around. Both these pieces play a huge part in how well we bounce back. It’s a big money maze, for sure, but we’re all in it together to find our way out.

In our walk through the tough times of today’s economy, we’ve seen how key signs warn us of a downturn. We looked at job numbers across the world and saw how unemployment tells part of the story. Next, we dove into how big banks and governments are stepping up, trying their best to soften the blow with policies and money boosts. Not all regions are the same; some find ways to bounce back faster.

We can’t ignore the troubles in the stock market and with banks either. These areas feel the pinch too, signaling stress that we all feel in our wallets. Lastly, dealing with global debt is a giant task where the International Monetary Fund tries to help. Government decisions can make or break the trust of folks who invest their hard-earned cash, aiming for a safer tomorrow.

Wrapping this up, I hope you’re now more clued in about our economic roller coaster. We’re in a spot where every move by those in charge can tip the scales toward recovery. Let’s stay alert, keep learning, and support smart choices to get us all on steadier ground.

Q&A :

What are the current trends in the global financial crisis?

Understanding the latest trends in a global financial crisis involves examining recent shifts in international markets, regulatory changes, and economic indicators. Governments and financial institutions are continually adapting to mitigate risks associated with high debt levels, unstable markets, and unpredictable economic growth.

How are central banks responding to the ongoing financial instability?

Central banks around the world play a crucial role in managing economic uncertainty. Their responses have ranged from adjusting interest rates to implementing quantitative easing measures. Tracking these responses can provide insight into the strategies devised to stabilize economies during financial instability.

What impact is the global financial crisis having on emerging markets?

Emerging markets are often hit harder by global financial crises due to their developing economic infrastructures and reliance on foreign investment. The impact can include currency devaluation, inflation, and a slowdown in economic growth, leading to increased scrutiny on how these markets manage financial turbulence.

How has the global pandemic influenced the financial crisis?

The global COVID-19 pandemic has had a profound effect on the world economy, exacerbating existing financial issues and creating new challenges. Job losses, business shutdowns, and a decrease in consumer spending have all contributed to the financial crisis, prompting governments to provide unprecedented levels of fiscal support.

What strategies are investors adopting in light of the latest financial crisis developments?

Investors have had to adapt their strategies to navigate the complex changes brought about by the latest financial crisis. This includes a higher focus on diversification, risk management, and looking into alternative investments that may be less affected by volatile market conditions.