Is Financial Disintermediation Unraveling Traditional Banking?

Picture this: a world where we no longer need banks as we know them today. That’s the buzz around is financial disintermediation a threat to banks? New tech is cutting out the middleman and shaking up the cozy spot banks have held for so long. We’re tossing coins into the online pot through things like peer-to-peer lending and crowdfunding. We’ve even got robots advising us on stocks! Banks are feeling the heat as profits wobble and business plans scramble to keep up. Join me as we dive deep into this banking shake-up.

Understanding Disintermediation and Its Expansion in Finance

Peer-to-Peer Lending and Crowdfunding Models

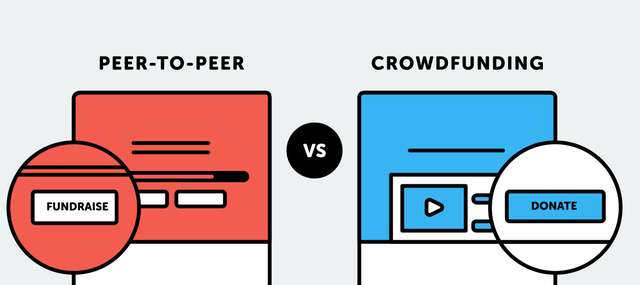

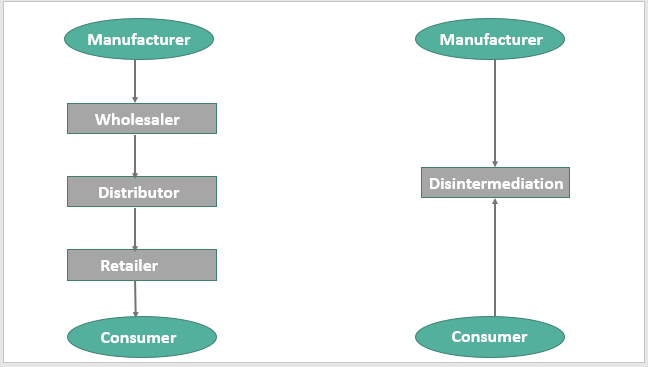

Let’s dive right into the heart of finance today. There’s a big word I want you to know: disintermediation. It’s when folks skip the middleman, like a bank, to do finance stuff. With this, anyone with a phone or computer can lend money or get a loan. This is what we call peer-to-peer lending. It’s cool because it’s like helping your neighbor out, but through an app.

Now, what about crowdfunding? Go online and you see people raising money for all sorts. Some are launching gadgets, while others help communities. It’s amazing how this lets people support each other’s dreams and needs without a bank’s help. But, as cool as this sounds, there are risks. Sometimes, loans don’t get paid back, or projects fail. Borrowers and lenders must be careful.

The Rise of Online Investment Platforms and Robo-Advisors

Next up are online investment platforms. Think of them as video games for your money, but smarter. They let you pick stocks and bonds, and throw your cash into them from your couch. You can start with just a little bit of money and grow it over time.

Robo-advisors are like having a robot buddy who’s good at math. They look at what you have and what you want, and they help you make smart money moves. This all sounds like science fiction, but it’s real, and it’s changing how banks work. They have to think hard about how to keep up. Banks used to be the gatekeepers, but now there are many keys to the gate.

So, will all these fancy tech things push banks away? Not quite yet. Sure, banks are sweating. They have to get creative or lose out. But there’s still a lot they do that’s tough for tech to copy, like giving solid advice to customers face to face.

Banks are strong, but fintech—the mix of finance and technology—is like the new kid on the block, challenging them to a race. It’s not about who’s fastest, but who can keep up without tripping. Fintech is here to stay, so banks are learning new tricks. They hire tech whizzes and shake hands with startups to keep you happy as a customer.

It’s a thrilling time for money folks. Whether we stash our cash under our mattresses, in banks, or let a robot invest it, change is here. And that, my friends, is the low-down on why everyone’s talking about the big shake-up in finance.

The Direct Impact of Financial Disintermediation on Banks

Changes in Bank Profitability and Business Models

People once went to banks for all their money needs. But not anymore. Now, they can lend and borrow money without setting foot in a bank. This is financial disintermediation. It’s huge for banks. They’re losing out on cash they used to make.

What is financial disintermediation? Simply, it means cutting out the middleman. In finance, that middleman is often the bank. New tech makes it easy for folks to manage money without banks. Things like online platforms, peer-to-peer lending, and digital wallets. They connect people directly with money services.

This shift leads to banks making less money. Before, if you wanted a loan, you’d go to a bank. They’d lend you the cash, with interest. That interest was big money for banks. Now, with direct lending from non-banks, folks skip the bank. They get loans through other services, like peer-to-peer lending.

So, banks see smaller profits. Their business models also have to change. Banks used to be the go-to for loans and savings. Now, they fight to keep customers. They face competition from all sides. Tech companies in finance, online investment platforms, crowdfunding. These are just some ways people handle money without banks. It’s a rough time for old-school banking.

To adapt, banks must rethink their role. They need new strategies. Maybe focus more on things that tech can’t replace, like personal customer service. Or, look into ways to work with fintech, not against it.

Response Strategies for Banks Facing Fintech Competition

What can banks do against fintech rivals? They must fight back or get left behind. It’s evolve or die.

Fintech vs. banks – it’s a hot topic. Fintech, short for financial technology, does what banks do, but often better. Faster, cheaper, and more convenient. Banks can’t just keep doing business as usual.

So, how do banks respond? They have a few cards to play. One big move is to make friends with fintech. By teaming up with tech whizzes, banks can offer cooler services. Think mobile apps that let you pay bills with a click, or better ways to check your account.

Another response is getting smart with money advice – robo-advisors. These use algorithms to offer investment help. They’re cheap and draw in folks who don’t want to pay much for advice.

Banks are also looking into blockchain. Yes, the same tech behind Bitcoin. It’s not just for cryptocurrencies. Blockchain can make banking smoother and more secure. But banks need to be quick. The blockchain train is moving fast.

Overall, banks are in a big battle with fintech. But it’s not all doom and gloom. Some banks are getting creative. They’re finding new ways to stay useful and make money. They’re embracing the tech that once seemed like a threat. If they get it right, they stay big players in the money game. If not, well, we might just wave goodbye to some old bank names. Change is here, and adaptation is the name of the game.

The Role of Blockchain and Decentralized Finance in Banking

Assessing Blockchain as a Potential Threat to Traditional Banking

Blockchain is shaking things up in the banking world. This tech lets people share money like a text message, quick and easy. It’s cutting out the middleman – the banks. Everyday folks and businesses start to use blockchain for money matters. They’re moving away from regular banks. This means banks could lose out on handling cash and keeping track of it.

The impact of disintermediation on traditional banking is no joke. It means less control for banks over our money. Plus, banks make less dough when people go straight to others for loans or to stash their cash. This is where peer-to-peer lending risks come into play. When you borrow from or lend to someone online, there’s no bank to say if it’s safe. Mistakes could happen. Money could get lost, and there’s less backup if things go south.

Decentralization and the Emergence of Non-Traditional Financial Services

Now let’s chat about decentralization. It’s all about spreading out who’s in charge of finance. We’re talking new players like online investment platforms and mobile banking apps. These aren’t your grandpa’s banks. They’re fresh, fast, and they’re shaking up the game.

One key player is direct lendingby non-banks. Companies that aren’t banks are stepping in to lend money directly. This means quick cash for people and businesses, but banks miss out. Financial technology advancements are making it easier for tech companies in finance to rise up, too. They’re bringing new ideas and services that banks didn’t even dream of.

But it’s not all doom and gloom for banks. Even with the crowdfunding impact on banks and the rise of digital wallets, banks still play a big part. They hold a ton of experience and trust with money. Still, bank profitability and disintermediation are in a tug-of-war. Banks gotta stay on their toes and mix into the new finance scene.

So, how do they handle non-traditional financial intermediaries? They adapt. Banks look into their own versions of these cool tools. They might partner up with fintech companies or even offer some of these new services themselves. It’s like banking is getting a makeover.

There’s one thing you can bank on – finance is changing, fast. Blockchain and decentralization are just the start. Banks are picking up the pace to keep up. They’re molding themselves to fit what we want – quick, easy, and in our control. After all, the future relationship between banks and fintech will be about who can serve us better. That’s a win for us, the customers.

Proactive Measures: Banks Embracing Fintech Innovations

Adoption of Digital Wallets and Mobile Banking Solutions

Banks are swinging into action. They see how tech shakes up finance. They’re not sitting ducks. They know that to stay in the game, they’ve got to move fast. So, what’s their move? Hello, digital wallets and mobile banking.

Digital wallets let people pay with a tap on their phones. No more cards or cash. And mobile banking? It means managing money on the go. Pay bills, send cash, check balances—all from a phone.

You might think, aren’t these tech things? Yes, but now banks are making their own. They’re putting banking right in your pocket. Pretty smart, right? This way they stay close to customers. They offer what folks want—all without leaving the bank.

Collaborations Between Banks and Fintech Companies to Enhance Services

Here’s where it gets cooler. Banks are teaming up with fintech firms. You know, those companies that make finance all techy and easy. They’re joining forces to bring you better services. Think of it like a buddy movie. The smart tech and steady bank working together.

These collabs mean more than good vibes. They mix bank know-how with tech innovation. The results? Faster loans, smoother payments, and top-notch money tools. For you, that means less headache and more control of your dough.

It’s not just happening in one or two places. It’s a big trend. Banks worldwide are getting into fintech. Why? They see the writing on the wall. Work together or get left behind.

Now, let’s not sugarcoat it. Banks face tough times with all this fintech jazz. It’s a race to keep up. But by adopting digital wallets and joining with fintech stars, they’re not just surviving. They’re getting a chance to lead the pack.

So, is financial disintermediation unraveling traditional banking? It’s pushing banks, for sure. But many are pushing back—with tech as their new best friend.

We’ve explored how tech shakes up finance, from peer lending to robo-advisors. Banks aren’t just watching—they’re changing how they work and teaming up with fintech to stay in the game. Blockchain’s stirring the pot too, leading to a fresh breed of finance that doesn’t rely on old-school banks. My take? The future of money is exciting and full of change. Banks are wise to jump on the fintech train to keep us all moving forward.

Q&A :

What is financial disintermediation and how does it affect banks?

Financial disintermediation is the process by which consumers or businesses bypass traditional banks and financial institutions to invest or borrow directly from the source. This trend is facilitated by technology companies, peer-to-peer lending platforms, and other non-bank entities. It affects banks by reducing their role in the financial market, cutting into their profits and potentially leading to a decrease in customer base.

How are banks responding to the threat of financial disintermediation?

Banks are actively responding to the threat of financial disintermediation by modernizing their services. They are investing in digital technologies, improving the customer experience, and partnering with fintech companies. Some banks are also setting up their own fintech branches or digital platforms to compete directly with new players in the financial industry.

Can financial disintermediation be advantageous to consumers?

Financial disintermediation can be advantageous to consumers as it often results in lower transaction fees, higher returns on investments, and more competitive lending rates due to the removal of the ‘middleman’ in financial transactions. Additionally, the increased competition can lead to more innovative financial products and services.

What are the risks associated with financial disintermediation?

While financial disintermediation offers several benefits, it also comes with risks. Participants might face increased credit risk, lack of regulatory protection, and potentially higher volatility. Furthermore, the absence of traditional financial intermediaries could lead to a lack of professional financial advice and the potential for market inefficiencies.

What future trends might affect financial disintermediation’s impact on banks?

Future trends like the growth of blockchain technology, the evolution of artificial intelligence in financial services, and changing regulations could significantly affect the impact of financial disintermediation on banks. Banks may need to continually adapt to stay relevant, perhaps by incorporating these technologies themselves or by revamping regulatory strategies to maintain a competitive edge in the new financial landscape.