Integration of ESG into Traditional Investing: A Smart Investor’s Blueprint

Think money can’t mix with morals? Think again. The Integration of ESG into Traditional Investing is reshaping how we put our cash to work. It’s not just about what you earn, but how you earn it. You’ve got to know the ESG game – the rules, the players, the scores. And I’m here to coach you through it. We’ll tackle the pillars of ESG investment strategies first, then we’ll nail the steps to align these with your investment goals without missing a beat. We’re not just playing for today; we’re setting up a win for our future. This is the smart investor’s way: you stay ahead of the curve, weigh the risks, and look after your pocket and the planet all at once. Ready to step up your game? Let the playbook begin.

Understanding the ESG Landscape in Investment

The Pillars of ESG Investment Strategies

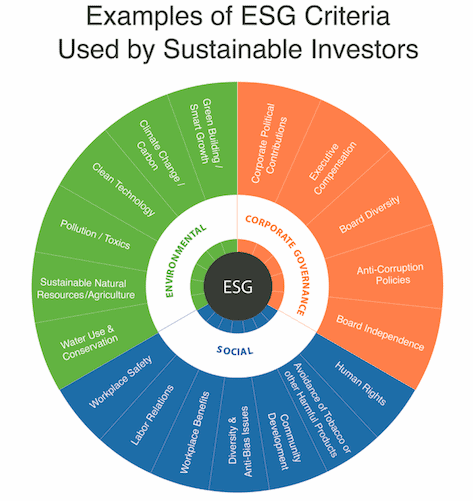

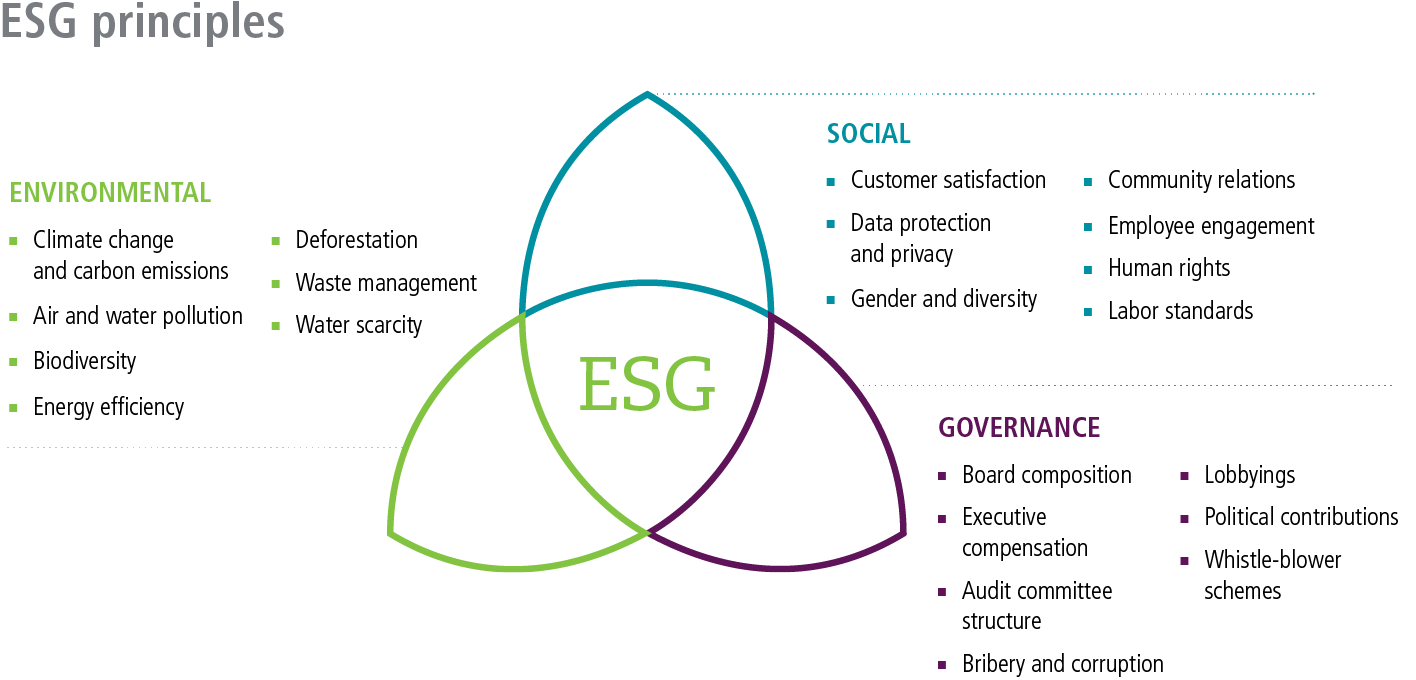

Think of how a strong house stands on solid beams. ESG investment strategies have three key beams: environmental, social, and governance. My job is often about helping folks use these to make money in ways that help our world. I look at how a company takes care of the planet. Do they pollute a lot? How much energy do they use? Then, I check how they treat people. Do they keep their workers safe and happy?

Governance is how a company runs itself. Are their leaders fair? Do they tell the truth about their money? We need to make sure the companies we invest in act right. Picking stocks and funds with strong ESG scores can lead to good money and a better world.

Let’s dig in a bit. Environmental impact funds and green bonds are like special tools for this job. They put money into things that are good for the earth, like clean air and water. Socially responsible investing (SRI) is about being fair to workers, customers, and neighbors. And governance? It makes sure bosses don’t cut corners or cheat.

We don’t just guess here. We use clear rules to pick which companies make the cut. It’s like being a detective. We look at their history and plans. We even talk to leaders and workers. Then we decide if they are good for your wallet and the world’s future.

Navigating ESG Risk Assessment and Metrics

When we talk about bean-counting, investing’s full of it! But we count special beans: ESG risk assessment and metrics. It’s a fancy way to say, “How risky is our money if we ignore the planet, folks, and fair play?” We keep a close eye on these.

As if ESG wasn’t cool enough, there’s CSR – companies doing good on purpose. They go out of their way to be kind to people and the earth. We give those companies gold stars. And the more gold stars, the better for investors and everyone else.

Now, this isn’t about just feeling good. We have real tools to measure this stuff. ESG metrics and measurements are like rulers and scales for investors. They show if a company is doing what it should. That’s ESG data analysis – digging into the numbers to find the truth.

We also look at the big picture, like climate change and portfolios. Companies that pollute a lot could be a big risk. We might say “bye-bye” to dirty energy like fossil fuels. This makes sure future troubles don’t mess with our money.

And don’t forget, folks want to know what they’re supporting with their dollars. ESG reporting standards make companies share their scores. It’s like a report card for grown-ups. If they’re doing well, they can brag about it. If not, they’ve got work to do.

We stick to tools and facts to build investments that last and do good. It’s a smart move that pays off for you and the planet. We’re in this for winning over the long haul, and ESG is our ace in the hole.

Aligning ESG Criteria with Investment Portfolios

The Role of ESG Due Diligence in Traditional Investing

When we mix ESG with regular investing, it’s like a recipe for success. We check how companies do in ESG areas before we invest. We look at how they treat the planet and people, and how they run their business. This is ESG due diligence. It’s key in making sure our money works for us and for the world.

Let’s dive deeper into what ESG due diligence is in investing. It’s when analysts research how well a company does in environmental, social, and governance areas. This helps investors like us make better choices.

Here’s how it works. First, analysts gather lots of info on a company’s actions and impacts. They look at data on how much waste a company makes or how it treats its workers. They also check if the company has good leaders and fair practices.

Next, they use this info to score companies on ESG points. They give high points to those doing the right things and low points to ones that fall short. This lets investors pick companies that are not just making money but also doing good.

Finally, it’s more than just ticking boxes. ESG due diligence means really getting to know what a company is about. It’s making sure they’re honest and caring for our future.

Creating Long-term Value through Sustainable Asset Allocation

Now, let’s talk about how ESG helps us build value over time. Sustainable asset allocation is like planning a garden. You pick plants that grow well together and last through seasons. In investing, we choose assets that not only grow wealth but also help the planet and people.

Sustainable asset allocation takes into account things like clean energy, fair labor practices, and strong company leadership. It’s more than short-term gains. It’s about investing in areas that will stay important as the world changes. These areas could be things like green bonds or companies cutting out fossil fuels.

Assets that fit ESG criteria tend to do well over time. That’s because they are ready for big changes, like new laws to protect the environment. They can adapt and keep growing. When we focus on ESG, our investments help build a better world while also caring for our future wealth.

So, what’s in it for us as investors? When we choose these ESG-friendly assets, we’re ready for the long run. We create good for the world and good for our pockets. We also set a trend that other investors will likely follow. This can lead to a big shift in how everyone invests.

In simple terms, sustainable asset allocation puts our money where our values are. It decides where to invest based on how it helps the planet, society, and good company leadership. This kind of investing doesn’t just look for quick wins. It builds lasting wealth by supporting things that matter for our future.

ESG’s Impact on Financial Returns and Market Trends

ESG and Corporate Governance: Weighing Investor Responsibilities

Think of ESG like a friend guiding you to invest smartly. It tells you how good a company behaves. It looks at how firms manage money, treat people, and protect nature. When firms do well in these, they often do well in the market, too.

Assessing ESG Financial Performance in Modern Portfolios

So, you want to know if ESG investments make money? Yes, they can. Smart investors look at ESG scores to pick winning stocks. Funds that focus on ESG can do as well or better than others. It’s smart money moves meeting good values.

Analysts check a company’s ESG score, kind of like a report card. Good scores can mean fewer risks and better returns. Bad scores? Watch out. They can point to trouble ahead.

People now want their money to build a better world. They put cash into things that help like green bonds and impact funds. These investment vehicles are like seeds for both money trees and real ones!

Green bonds help pay for clean energy and other earth-friendly projects. Interest in these is growing fast. They’re a good deal for folks wanting to fight climate change.

If you care about where your money goes, ESG data can be your GPS. It helps you avoid the bumpy roads. Firms that ignore big problems, like pollution or unfair work stuff, might not last.

Companies that score high for ESG often use money wisely. They keep an eye on risks and plan for a changing world. This can mean more stable cash flows and better growth over time.

We’re seeing a shift, with more investment products popping up. These cater to folks who want to do good and make money. How cool is that?

Looking ahead, we expect more action here. Companies will tell us more about their ESG ways. We’ll see clearer rules on what it means to be ‘ESG strong’. And we’ll get better tools to measure it all.

Money talks. Through shareholder activism, investors can nudge firms towards good. By voting with their dollars, they tell companies what’s important. Smart investing isn’t just about the green in your wallet anymore. It’s also about keeping the planet green.

To sum up, mixing ESG into your investments isn’t just a trend. It’s becoming a must for those who want to see their cash grow and make a difference. As an expert on mixing money with morals, I can say it’s not just feel-good. It’s also about being good with your finances. Choose wisely, invest kindly, and let’s make a world that’s worth living in, while also making a profit.

Practical Steps for Investors Embracing ESG Integration

From ESG Reporting Standards to Shareholder Activism

Smart investors know money talks. It can also make change happen. So let’s dive into ESG reporting and shareholder power. First thing’s first, get the facts straight. What are ESG reporting standards? They are rules companies follow to tell us about their work in areas like clean energy, fair worker pay, and honest management.

Why care about this as an investor? Good ESG scores can mean a company is safer to put money into. Less risk from bad news like oil spills or unfair work conditions. In fact, firms with high ESG ranks often do better over time. And when they slip up, that’s where you come in – that’s shareholder activism.

As one holding power in a company, you have a voice. When things go sour, speak up! You can vote for better practices or team up with other investors for change. It’s like being a superhero for your wallet and the world! Businesses listen when their investors talk, especially about ESG.

Adopting ESG Investment Policy and Compliance Measures

Now, let’s talk policy. What’s an ESG investment policy? In simple words, it’s a game plan that says how you’ll stick to ESG rules when choosing where to put your money.

The first step: make a clear policy. It should say how you pick good-for-the-earth companies, like those creating clean power or treating their staff right. And it’s not just talk – you’ve got to walk the walk, so make sure there’s a way to check everything lines up with your plan.

Here’s where ESG due diligence comes in. Think of it like detective work before you buy. Ask questions. Is the company helping or hurting the planet? What kind of boss are they to their workers? Answers to these mean a lot for risk and how the business will do long-term.

Let’s not forget about the law. Keep up with ESG disclosure rules. Companies need to share their ESG moves honestly and fully. That way, everyone stays on the same page and plays fair.

In short, smart ESG investing is about being prepared. Know the ESG ground rules. Use your power as an investor. Make a solid ESG plan and check it twice. And always stay sharp on laws and the real scoop on companies. That’s how you make money moves that matter for you and the whole planet.

We’ve covered a lot to grasp the ESG scene in smart money moves. We broke it down into key parts, like ESG pillars and risk scores. We saw how to mix ESG checks into usual money picks and ways to make cash last with green assets.

We also checked how ESG affects cash flow and market shifts. We looked at how bosses deal with this while keeping cash goals. We learned about ESG’s real deal on your wallet in today’s money mix.

Last, we dug into real steps for money pros getting into ESG. We touched on standards for ESG news and ways to stand up as a share owner. We also looked at how to stick with ESG rules in your money plan.

So, think of this as your map to mix ESG with smart investing. It’s your guide to stay sharp and make smart cash choices that last. Keep these tips close to steer your money right with ESG. Let’s make moves that count for your wallet and our world.

Q&A :

How does ESG integration impact traditional investment strategies?

Integrating Environmental, Social, and Governance (ESG) criteria into traditional investing has significant impacts on investment strategies. By considering ESG factors, investors can gain insights into non-financial risks and opportunities that could affect a company’s performance. This can lead to more sustainable and potentially less volatile investments, as it aligns investor goals with broader societal and environmental objectives.

What are the methods for integrating ESG into an investment portfolio?

There are several methods for ESG integration:

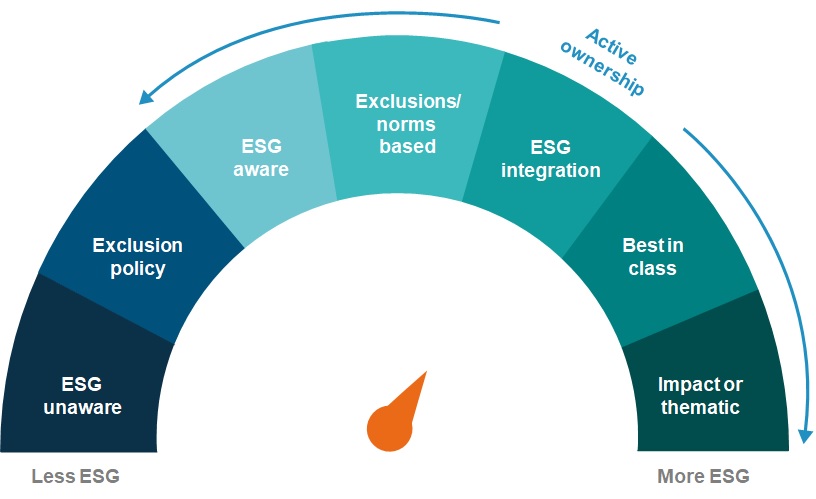

- Negative Screening: Excluding certain sectors or companies based on specific ESG criteria,

- Positive Screening: Selecting companies with favorable ESG performance relative to their industry peers,

- Thematic Investing: Focusing on investments tied to certain ESG issues, like clean energy or social impact,

- Shareholder Engagement: Using an investor’s position to influence corporate behavior in a positive way,

- Integration: Systematically incorporating ESG information into traditional financial analysis.

Investors can employ one or a combination of these methods to integrate ESG factors into their portfolios.

What are the challenges of integrating ESG into traditional investing?

The challenges of ESG integration into traditional investing include:

- Data Quality and Availability: Inconsistent and non-standardized ESG data can make it difficult to compare and assess companies effectively.

- Integration Complexity: Effectively incorporating ESG factors into the traditional financial analysis can be complex due to the subjective nature of some ESG metrics.

- Short-Term vs. Long-Term: Balancing short-term financial returns with long-term ESG goals can be difficult for investors.

- Regulatory Environment: An evolving regulatory landscape can affect how ESG factors are reported and integrated.

- Perception of Performance: There’s a misconception that ESG investments may lead to lower returns, which is increasingly being challenged by research.

What are the benefits of ESG integration for investors?

Investors can experience numerous benefits from ESG integration, such as:

- Risk Management: ESG metrics can provide vital information on potential risks that may not be evident from traditional financial analysis alone.

- Performance: Studies have shown that ESG integration can potentially lead to better investment performance over the long term.

- Reputational Advantage: Investing in companies with strong ESG practices can boost an investor’s reputation and appeal to a broader range of stakeholders.

- Impact: Through ESG-integrated investments, investors can have a positive impact on social and environmental issues.

Are there any specific tools or metrics for measuring ESG integration effectiveness?

Yes, there are several tools and metrics that help measure the effectiveness of ESG integration in an investment portfolio:

- ESG Ratings and Scores: Provided by specialized agencies that evaluate companies based on their ESG performance.

- Sustainability Indices: Such as the Dow Jones Sustainability Index or the FTSE4Good Index, which track the performance of companies with strong ESG practices.

- ESG Reporting Standards: Like the Global Reporting Initiative (GRI), which gives a framework for companies to disclose their ESG impact.

- United Nations Principles for Responsible Investment (UNPRI): A set of six principles that provide guidance for incorporating ESG issues into investment practice.

- Portfolio Carbon Footprint: Measures the carbon emissions associated with investments, which is particularly relevant for monitoring environmental impact.