Imagine your money behind a digital fortress – that’s the importance of data security for digital payments. In the vast world of online shopping, mobile banking, and instant transactions, it’s vital to keep your financial details locked away from cyber thieves. Think about it: when you click ‘pay’, you want peace of mind, not panic. As we dive in, I’ll show you how to turn your online payments into an impenetrable fortress, safeguarding your hard-earned cash from hackers. From encryption to fraud prevention, let’s ensure your digital dough stays where it belongs – with you.

Understanding the Digital Payment Security Landscape

The Rise of Cybersecurity Threats in Online Transactions

What’s at stake when you tap to make a payment or shop online? A lot. Your private info could fall into the wrong hands if we’re not careful. That’s because as more of us shop or bank online, hackers work hard to steal our data. These bad actors use malware, phishing, or brute force attacks. They aim to access our digital wallets and bank accounts.

To stay safe, think of data security in e-commerce like a strong castle. You’d want your castle’s walls high and gate locked, right? That’s how we must guard our personal and payment info online. Cybersecurity for online transactions means building those digital walls. And as they say, the best offense is a good defense.

Encryption as the First Line of Defense in Payment Processing

Encryption scrambles your data so only those with the right key can read it. This helps fight fraud and protects info that moves through the internet. Think of it as a secret code. Without knowing the secret, your data looks like jumbled letters and numbers. This coded data can pass through the web and reach the right place safely.

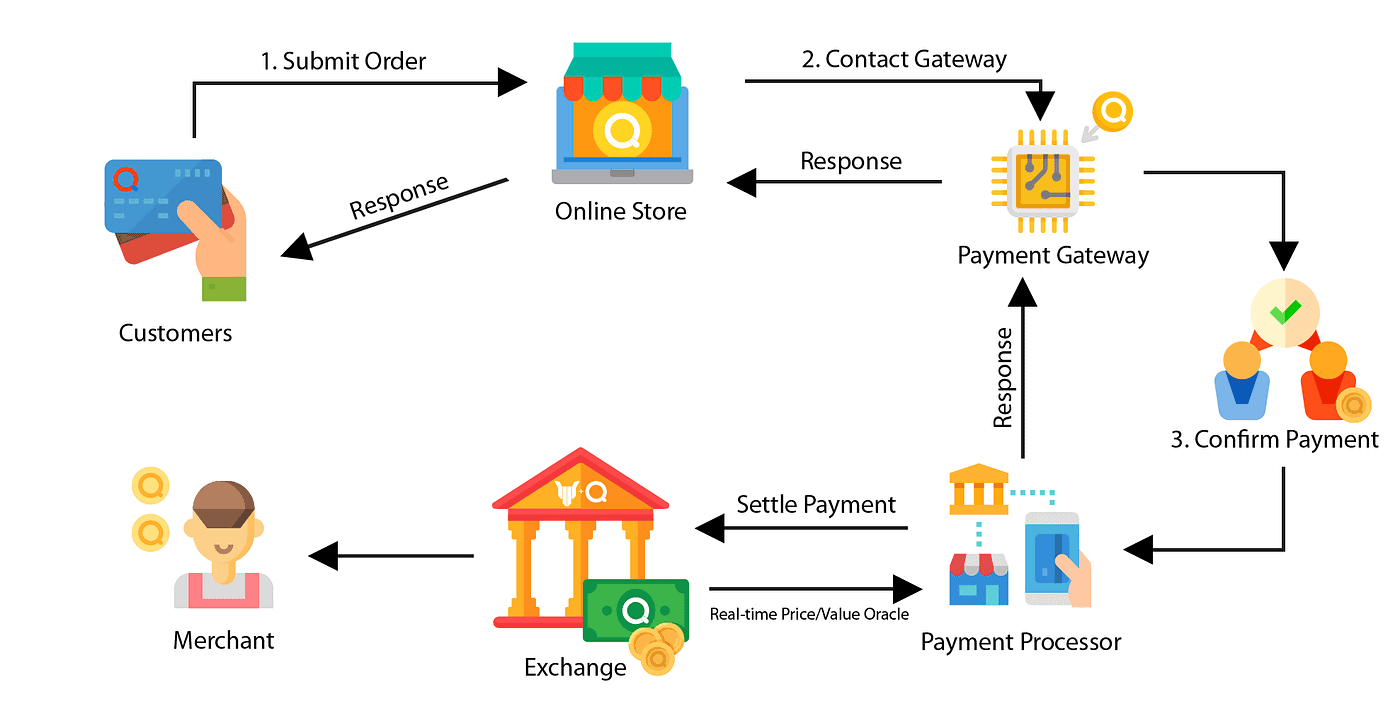

When you check out online, secure payment gateways with encryption keep your card data safe. For this, sites use SSL certificates. They lock data tight as it goes through. Even if someone gets their hands on it, they can’t read it – it’s all code to them.

Moreover, places like online shops must follow rules to handle your payment info. PCI DSS compliance ensures they meet security standards. So, every step of the payment process must be secure to prevent any leaks of your info.

In short, encryption for payment processing is a shield for your digital coins. It’s a must in today’s world where cybercrooks are just waiting to pounce. By scrambling data, they can’t make sense of it even if they catch it. With strong security in place, you can click ‘buy’ without fear. Your financial fortress online is unbreachable when we get encryption right.

Implementing Robust Fraud Prevention Mechanisms

The Role of Fraud Detection Software in E-Payments

When you buy online, you want to feel safe, right? To keep your money safe, we use special software. This software watches for signs of fraud in e-payments. It’s like a guard dog for your online shopping. It checks if a payment seems odd. If it does, it flags it. This means someone checks it out right away. The goal is to stop fraud before it hurts.

Here’s more on how it works. This software has smart ways to spot things that are not right. For instance, if someone tries to buy something but the details don’t match their usual pattern, the software notices. It’s built to learn and get better over time. This means the more it works, the better it gets at stopping bad guys.

It’s also vital for us to keep a step ahead of the tricks thieves use. We update the software with the latest info on fraud. This way, it is always ready to defend. Every time you tap ‘buy,’ our software is on the lookout. It shields your cash from sneaky tactics.

Multi-Factor and Biometric Authentication to Mitigate Risks

We all know one password isn’t enough. That’s where multi-factor authentication (MFA) steps in. It’s a way to prove it’s really you when you’re paying. Think of it like this: MFA asks you for more than one key to open your online money door. It might send you a code on your phone. Or it might ask for your fingerprint.

Biometric authentication is even cooler. It uses parts of you, like your fingerprint or face, to check your identity. It’s hard for bad guys to copy your unique features. That’s why biometrics are great at keeping your digital wallet safe. For every online pay, biometric checks mean peace of mind.

These protections are not just fancy tech. They’re armor for your wallet in a world where online thieves are real. They help us make sure the person spending your money is you and not a fraudster. When you use digital payments, MFA and biometrics keep a watchful eye on your funds.

At the end of the day, our mission is clear. We want you to shop and pay online with ease and trust. We use the latest and strongest ways to keep your money safe. Every step you take in the digital payment world, you’re covered. From smart software to high-tech identity checks, your financial fortress is fortified. With these tools at work, you can click ‘purchase’ without a pause. Your transactions are not just transactions; they are secure steps in your online journey.

Ensuring Compliance and Risk Management

Navigating PCI DSS and Other Payment Card Industry Standards

When making a digital payment, a safe checkout is what we all want. The Payment Card Industry Data Security Standard, or PCI DSS, helps with this. It’s a set of rules to make sure all companies that handle credit cards keep data safe. It’s like a guard who keeps your money safe when buying online.

We all have to follow the rules, and when it comes to protecting your payment info, these rules matter. They make sure that when you buy something, your card’s info is hidden and can’t be stolen. This means every time you use your card, the company has done a lot to keep your info out of the wrong hands.

But it’s not just about hiding card numbers. It’s also about keeping the whole system safe. Every part that handles your card, like where you enter the number or where the store keeps it, must be locked up tight. This is how they stop hackers from sneaking in and stealing info.

Strategizing Risk Management for Secure E-Payment Gateways

Now, let’s talk about keeping all payment ways safe. We can’t just lock our doors; we need a plan for all kinds of risks. This is called risk management. Like being a goalie in soccer, you must be ready for anything that comes your way.

So, what do we do? We wrap every transaction in a sort of digital armor, something called encryption. This way, even if a crook gets your info, it’s like a puzzle they can’t solve. We also watch for sneaky tricks, like phishing, where they trick you into giving your info.

We know phones are like mini wallets. So, mobile payment security is big too. We make sure each tap or scan is just as safe as online. It’s cool stuff like using your fingerprint instead of a password that adds more safety.

Think of it all as a fortress with many layers. The walls are the PCI DSS rules, and the guards are the tools we use to keep bad guys away. Every swipe, tap, or click is like a soldier on duty, fighting off risks to keep your money safe.

Sure, risks will always be there. But with smart planning and tools, we make sure your online checkout is a safe journey. When you buy that toy or book, peace of mind comes with it. Because we believe safety is the key to trust and happy shopping online.

Building Consumer Confidence in Digital Payments

Enhancing Mobile Payment Security for Consumer Trust

We carry our lives in our pockets. Our phones are lifelines, including how we pay for things. Imagine a lock, not just any lock, but one that only opens with your fingerprint. That’s biometric authentication for e-payments. It’s like a personal bodyguard for your financial information. By using fingerprints or facial scans, we make mobile payment security tight. It stops the bad guys in their tracks.

So, what makes you trust online payments with your hard-earned money? Safety, right? Imagine you’re texting money to a friend. Encryption scrambles your message into code. Only your friend’s phone can decode it. That’s encryption for payment processing. It’s like whispering a secret in a noisy room. No one but your friend can hear you. With this, you can rest easy that your data is safe in the noisy online world.

Fraud prevention in e-payments is our big goal. We fight fraudsters day and night. We check patterns and spot anything fishy. We install payment fraud detection software. It watches over your transactions like a hawk. No strange activity slips by.

When it comes to online payment data breaches, we work on two fronts. First, we armor-up the digital payment protection. Think of this as the castle walls. No one gets in or out without the right checks. Second, we train you, the user, to be on guard for cybersecurity for online transactions. Watch out for those phishing attacks on e-payments. If an email or link looks weird, it probably is.

Now, for the secret sauce: tokenization of card data. Imagine those movies where a painting gets swapped for a fake. The thieves think they won, but we tricked them with a decoy. Tokenization swaps your card details for a unique code, or ‘token’. The real data stays locked up tight. So even if the token gets stolen, it’s useless to the thief. Just like that fake painting.

These tools, along with SSL certificates for checkout, keep cyber threats away from our digital fortresses. Our secure payment gateways are like the drawbridges of our castles. They only let in those who know the secret handshake. Sticking to PCI DSS compliance ensures that everyone follows the same top-notch security protocols.

In essence, by bolstering mobile payment security, we lay the foundation for trust. Customers feel safe making those taps, swipes, and clicks that send their money across the digital world. And let’s face it, trust is the currency of e-commerce.

How End-to-End Encryption and Tokenization Protect Customer Data

But how do we keep the trust going strong? We construct a tunnel of trust with end-to-end encryption in e-payments. This means information is locked from start to finish. It’s like sending money in an armored car, guarded from your phone to the store’s register. Only you and the store can unlock it.

Tokenization adds another layer. It turns your card number into a unique, time-limited code. If hackers intercept this, it’s like grabbing a handful of sand. The code slips through their fingers, useless and changing again soon. This safeguard protects us even if they break through the outer defenses.

These two – encryption and tokenization – are the guardians of secure electronic payment systems. Contactless payment security benefits from this duo as well. It’s like having two locks on your front door – one key, one code. Both are needed for someone to enter.

These shields are part of a bigger battle plan. We need to defend against payment cyber threats, which are always changing. We learn about new hacking threats to online payments every day. However, our strategy stays firm: encrypt, tokenize, stand guard, and educate. That’s how we build a financial fortress online.

So, next time you tap, swipe, or click to pay, picture this fortress. Remember the unseen guards – encryption, tokenization, and good old vigilance. They team up to make sure your digital wallet stays safe, secure, and always ready for your next purchase.

In this post, we dove into keeping online payments safe. We saw how threats are growing and learned that encryption is key to guard our money online. We talked about tools that spot fraud early and how extra steps like codes or face scans can help. Then, we checked out rules like PCI DSS that guide us to handle risks and keep things in line. At the end, we explored how keeping phones safe and securing data from start to end can make folks trust digital payments more.

Always stay sharp about payment security, use strong safeguards and understand the rules. That way, we all can benefit from digital payments without worry. Trust comes when we know our cash is secure. Let’s keep it that way.

Q&A :

What are the main reasons data security is crucial for digital payments?

Data security is vital for digital payments because it protects sensitive financial information from theft, fraud, and unauthorized access. Ensuring robust data security helps in maintaining consumer trust, complying with legal and regulatory requirements, and preventing financial losses for both businesses and consumers.

How does data security impact consumer confidence in digital payment methods?

Strong data security measures directly influence consumer confidence in digital payment platforms. When customers feel their personal and financial information is safe, they are more likely to use these services. Conversely, a lack of adequate security can lead to a loss of trust and a decrease in the adoption of digital payment methods.

What are the most effective data security practices for safeguarding digital payments?

Effective data security practices for safeguarding digital payments include encryption of data in transit and at rest, multi-factor authentication, regular security audits, compliance with industry security standards like PCI DSS, and ongoing staff training in cybersecurity best practices to prevent phishing and other types of attacks.

How do data breaches affect digital payment systems?

Data breaches can have a severe impact on digital payment systems, leading to financial loss, legal penalties, erosion of customer trust, and damage to the brand’s reputation. They also necessitate costly recovery efforts, including strengthening security measures and compensating affected customers.

Can the adoption of emerging technologies like blockchain improve data security in digital payments?

The adoption of emerging technologies such as blockchain can significantly improve data security for digital payments by providing a decentralized, tamper-resistant ledger for transactions. This technology can enhance transparency, reduce fraud, and streamline secure payments without the need for traditional banking infrastructures.