Banking is in a tight spot, and it’s all due to the impact of financial disintermediation on banks. Think about the last time you walked into a bank branch—it’s been a while, right? Tech-savvy firms and apps are cutting in, offering loans and savings options that once were banks’ bread and butter. But what does this shift mean for the giants of finance? Can they adapt, or will we see them fade into the background, replaced by peer-to-peer apps and digital wallets? This is not just about banks struggling to keep up; it’s about a seismic shift in how we manage our money. Let’s dive in to understand how banks are bracing for this blow and what their move might be to survive in a world where their role is shrinking.

Understanding Financial Disintermediation and Its Roots

The Rise of Fintech and Peer-to-Peer Lending

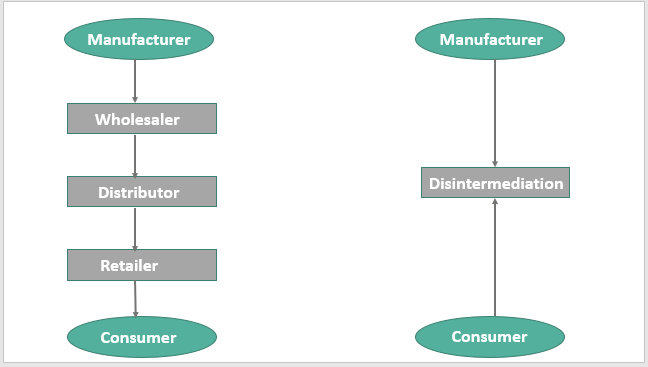

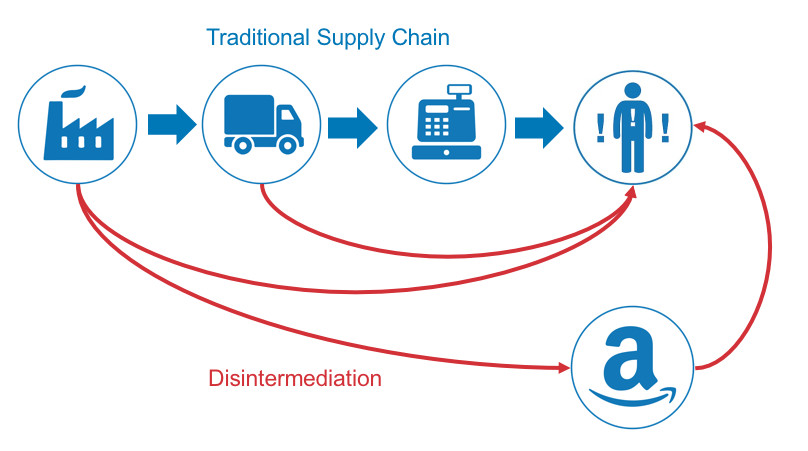

People save money. They often keep it in banks. Sometimes, they need to borrow money. In the old days, a bank was the middle person. The bank took your saved money and gave it to others as a loan. Now, this is changing fast. Companies that use technology to handle money, known as fintech, are shaking things up. They make it easy for people with money to lend it directly to people who need it. This is called peer-to-peer lending. It cuts out the middle man, the bank.

So, what’s this doing to banks? They are losing out on some of the money they used to make from loans. People who want to borrow are going to these new tech companies instead. They find it quicker and often cheaper than going to a bank. Plus, they can do everything from their phone or computer.

Blockchain’s Role in Transforming Banking Models

Next, let’s chat about blockchain. Think of it like a digital ledger. It keeps track of money but it’s not just for one bank. Everyone can see it and use it. That’s why it’s such a game changer.

Banks are worried because blockchain could change or even replace some things banks do. For example, sending money to someone else. Right now, banks help move the money and take a small cut for it. But with blockchain, you can send money straight to someone else’s digital wallet. Fast, cheap, and the bank is out of that loop.

This tech is still young, but it’s growing every day. Banks have to think hard about how they fit into this new world where everyone and anyone can be part of the money-moving process.

From lending to keeping money safe, banks are face-to-face with a big challenge. They need to figure out how to play along with fintech and blockchain. If they don’t, they could miss out on a lot of business. People like things easy and cheap, and technology is good at making that happen.

Banks are not giving up though. They are trying to use this new tech too. They want to stay important and keep their customers happy. But they have a long way to go!

Keep an eye on this exciting space. We’re just at the start of a big change in how we all handle our money. Whether it’s saving, lending, or paying – fintech and blockchain are shaking the tree. Banks are still there, but how they work and make money won’t be the same. Now, we’ll need to see how they change to survive in this new playground!

The Effects of Disintermediation on Traditional Banking

Assessing Bank Profitability Amidst Changing Market Dynamics

Disintermediation hits bank profits hard. Banks make money by lending it, simple as that. But now, picture your neighborhood without the local bank’s presence. No friendly tellers, no loan officers with a ready handshake. Why? Because the very ground banking stands on is shifting, thanks to technology and changing customer needs.

Peer-to-peer lending platforms are a big part of this shift. They link people with money directly to those who need it, cutting out banks as the middleman. As they catch on, banks see fewer people walking in for loans.

Next, take blockchain, the tech that powers Bitcoin. It offers a trusty way to send money without banks. This tech is knocking on banking’s door, promising safety and speed. Imagine sending cash across the globe in minutes, minus the fees. That’s blockchain for you.

Fintech companies are storming the market too. They’re clever, they’re quick, and they wield tech like a sword. Customers love them for it. They offer shiny apps and services that make banking seem old school.

So, banks are in a tough spot. They must fight to keep their profits up in a game that’s changing its rules by the minute. Bank leaders scratch their heads, trying to hatch plans, as profits feel the squeeze from all sides.

The Expansion of Shadow Banking and Its Consequences

Let’s talk about the shadow banking system. This isn’t about banks with shady deals. It’s a fancy term for business that’s like banking but doesn’t follow the same tough rules. Things like hedge funds, investment pools, and even some insurance companies. They all play a part.

These shadow banks give loans too, and sometimes, they do it cheaper. They don’t have brick-and-mortar branches that eat up money. Without the costs, they offer deals that are tough for regular banks to beat. This leaves traditional banks watching customers slip through their fingers.

The rub here is that these shadow banks aren’t as tightly watched by the government. This could lead to trouble if things go south. We saw some of it during the financial crisis in 2008.

Here’s how it circles back to you and me. As banks face these changes, they must adapt or risk fading away. They’re trying new things, getting tech-savvy, and changing their ways. Some partner with fintech companies, while others build their own digital tools.

But the big question remains: Can banks move fast enough to survive this tidal wave of change? Only time will tell. But one thing’s for sure, the days of banks as we know them are on the line. It’s adapt or face extinction — a real banking reality show we’re all watching unfold.

Consumer Behavior and the Shifting Financial Landscape

How Digital Currencies and Crowdfunding Are Reshaping Banking

Money is changing fast. Banks once had tight control over our cash. Not anymore. Now, anyone with internet access can join the banking game. Here’s the deal: digital currencies and crowdfunding are making waves. They are new kids on the block, mixing things up for banks.

Digital currencies are electronic money. They can zip across the globe in seconds. Bitcoin, for example, works without a bank in the middle. So, do we need banks when money goes digital? Banks need to think fast to keep up.

Crowdfunding is when people pool their money online for a project. It’s like passing a hat around to a million friends on the internet. This helps cool ideas get cash without a bank loan. For banks, this means less business the old way.

The Growing Influence of Mobile Banking and Online Payment Services

Phones are powerful. They’re not just for calls and games. Now, they’re wallets and banks too. Mobile banking means folks can check their money, pay bills, or send cash, all with a tap. It’s banking in your pocket, 24/7.

Online payment services are also big players. Ever heard of PayPal or Venmo? They let people pay for things or send money without touching their bank accounts. Quick and easy wins the race, and banks are lagging.

Every person who taps their phone to pay is a reminder. Banks must leap into the future or risk being left in the dust. It’s a whole new world where convenience rules. Banks have to figure out how to be part of people’s daily swipe and tap on their phones.

Banks are not facing extinction yet. But it’s clear they have to change and adapt fast. Technology makes it easy for us to manage our money without stepping into a bank. Banks have to make their move. They have to use tech to stay useful and relevant. It’s a race against time, and the clock is ticking.

The Strategic Response and Future Outlook for Traditional Banks

Navigating Through Reduction in Intermediation Margins and Loan Services

Today’s banks face a cash crunch. We know financial disintermediation cuts bank profits. But how? It lets folks skip banks for loans and savings, going to peer-to-peer lending or online platforms instead. This means banks lose out on fees they used to get for these services. And it’s not just a little bit—they’re seeing big drops in their bread-and-butter earnings.

Banks used to be the go-to for loans, but now there’s tough competition. Think lending platforms and credit unions. They offer loans without the same hassle. Banks are responding by slashing rates and improving service. It’s like a race where banks must wear heavy boots — tough, but not impossible.

Regulatory Challenges and Innovations in Asset Management

Banks also juggle a sea of rules. These rules try to keep the finance world safe. But they can make it hard to stay ahead. When banks must keep a lot of cash in hand, it’s tricky to make money. They must get creative, like with new tech. They’re diving into blockchain for faster, safer transactions.

Asset management is changing too. Banks once ruled, but now investors manage their own funds online. Banks are crafting new tools to help these investors. They’re blending advice, tech, and personal touch to stay in the game. It’s like they’re coaches, not just players.

With all these shifts, banks are morphing. They’re becoming tech-savvy and customer-focused. They’re trying hard to keep your trust and stay your number one money spot. It’s a battle they can win, but they must think fast and adapt quicker than ever.

Change can be good; for banks, it’s now or never.

We’ve explored how fintech and peer-to-peer lending have changed money matters. Blockchain tech is shaking up old banking ways. Banks must adapt as they face profit squeezes and new rivals from shadow banking. Digital cash and crowdfunding are rewriting rules, while mobile banking zooms ahead.

The land of banks and bucks is moving fast. We now use apps to pay and get loans from pals, not just banks. Banks are crafting new plans to keep up and stay safe in this bold new world. They’re facing tight rules and must think smart to handle money in fresh ways.

My final thought? Money talks, and it’s speaking a new language. It’s time we all pay attention and keep up.

Q&A :

What is financial disintermediation and how does it affect banks?

Financial disintermediation refers to the process where consumers or businesses bypass traditional banks and financial institutions to obtain financial services or capital elsewhere. This trend impacts banks as it can reduce their role in the financial marketplace, potentially leading to a decrease in deposit levels, lending opportunities, and fee-based income. As more individuals and corporations turn to alternative financial services such as peer-to-peer lending, crowdfunding platforms, or fintech solutions, banks may need to innovate and adapt to maintain market share.

How has the rise of technology contributed to financial disintermediation?

The advancement of technology, particularly the digital revolution and the fintech industry, has significantly facilitated financial disintermediation. With the availability of online platforms and mobile applications, technology has made it easier for consumers to access a wide range of financial services directly, without going through traditional banks. Technologies like blockchain and smart contracts also provide a secure and efficient alternative for conducting transactions, further driving the trend of disintermediation.

Can financial disintermediation be beneficial for consumers?

Yes, financial disintermediation can offer several benefits to consumers. It often results in lower costs and higher returns on investments, as the elimination of intermediaries reduces administrative and service fees. Consumers also gain more control over their financial decisions, access a broader range of investment opportunities, and benefit from more personalized services tailored to their specific needs. However, it is important to note that with these benefits also come increased risks and the responsibility of due diligence on the consumer’s part.

How do banks respond to the challenges of financial disintermediation?

Banks respond to financial disintermediation by adapting their business models and developing innovative strategies. For instance, they might invest in fintech companies, form partnerships with tech startups, or launch their digital platforms and services to retain customer loyalty and attract new clients. Banks also focus on enhancing their customer service experience and offering competitive financial products to differentiate themselves in the marketplace.

What future trends might we see as a result of financial disintermediation?

Future trends resulting from financial disintermediation may include the continued growth of decentralized finance (DeFi) platforms, increased use of cryptocurrencies for financial transactions, and further integration of AI and machine learning in financial services. We may also see more regulations being introduced to oversee the new financial ecosystem as it evolves. Additionally, traditional banks might further diversify their services, perhaps moving beyond financial services, to remain competitive and relevant in the changing financial landscape.