Impact of Data Breaches: Are Your Digital Payments at Risk?

The impact of data breaches on digital payments can’t be ignored. Think it won’t affect you? Think again. Every swipe, every click to pay could be a hacker’s gateway to your cash. I’ve seen it firsthand – the global shift to digital wallets and online shopping paves the way for more risk, leaving your dollars dangling on a digital tightrope. Too often, the security we trust cracks and our private info spills into the wrong hands. As we navigate the maze of modern money handling, I’ll break down what keeps your digital dough from danger and what you must do to protect it. Let’s dive in and shore up your defenses.

Understanding the Landscape of Digital Payment Security

The Evolution and Current State of Digital Payment Methods

Buying things has changed a lot. Remember when cash was king? Now, tapping a phone or clicking “buy” online is normal. Digital payments are quick and easy. But they need to be safe, too. We carry tiny computers in our pockets. We use them to pay for almost everything. This change happened fast.

Recognizing Common Digital Payment Security Issues

When we talk about keeping money safe online, it’s big deal. Cyber security in financial technology is all about this. Banks and shops work hard to keep things secure. But problems like data breaches or credit card fraud can happen. All it takes is a hacker finding one weak spot.

Let’s set a picture in our mind. You’re shopping online. You find that perfect thing you want. You add it to your cart and go to check out. You type in your card number. And there it is. The risk. Maybe there’s a hacker spying. Maybe the shop’s cyber wall has holes. Your card number could get stolen. That’s a digital payment security issue.

Hackers are smart. They try to trick systems to get into your digital wallet. We hear about cyber attacks on payment gateways. This can scare people from buying things with their phones or online. So, what are shops doing? They use stuff like multi-factor authentication. It’s a way to check if it’s really you. Think of it like a secret handshake. It keeps your payments safer.

There are rules for how to keep card details safe. PCI DSS compliance is the name. It stands for Payment Card Industry Data Security Standard. It’s like a list of must-dos for anyone taking card payments. If they don’t follow the rules, bad things can happen. Data breaches can lead to big fines and loss of trust.

Keeping your payment info safe is huge. It’s all about building layers of safety. Think of a castle. It has walls, a moat, and guards. Protecting consumer payment information is like that. Layers help stop bad guys from getting in. Encryption in digital payments is one layer. It scrambles your card details into a code. Only the right key can unscramble it.

Banks and shops must work together to keep things tight. They need to spot any funny business. Detecting payment fraud is about staying one step ahead. But if a hacker does get in, they need to know what to do. That’s incident management. It’s a plan for how to handle things when they go wrong.

So what does this mean for you? When you buy stuff online, you want it to be simple and safe. But behind the simple click, there’s a lot of work to keep your money safe. And it’s getting better every day. Shops and banks aren’t just sitting back. They’re always looking for new ways to build stronger walls around our digital cash.

We’ll keep using our phones and the web to buy things. And as we do, the walls around our digital money will get higher and stronger. That makes it tough for hackers to climb over. It’s all about staying safe in this new world of tapping, clicking, and buying.

The Aftermath of a Data Breach on Financial Transactions

Financial and Reputational Damage to Consumers and Businesses

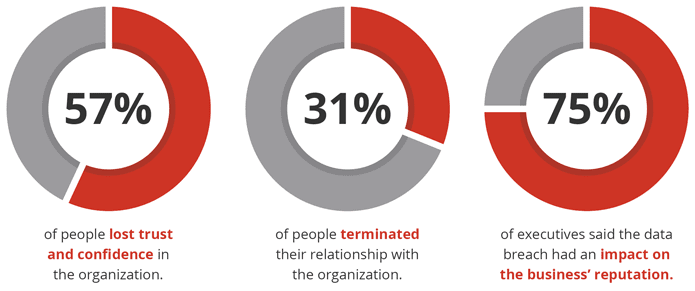

When a data breach hits, it’s like a storm passing through. People lose money fast. Your private card details can get stolen. Shops may lose your trust. Even after all is fixed, some folks may not come back to shop again. That’s how tough it is for businesses and customers.

For example, if your card gets used without your okay, you might have to fight charges. This is scary. It steals your time and your peace of mind. And for businesses, they lose buyers’ trust if card details get out. It can also cost a lot when they fix the mess and pay fines.

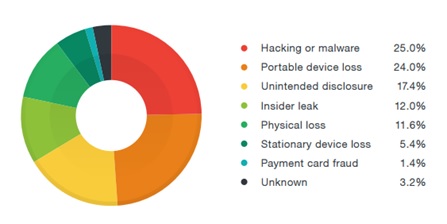

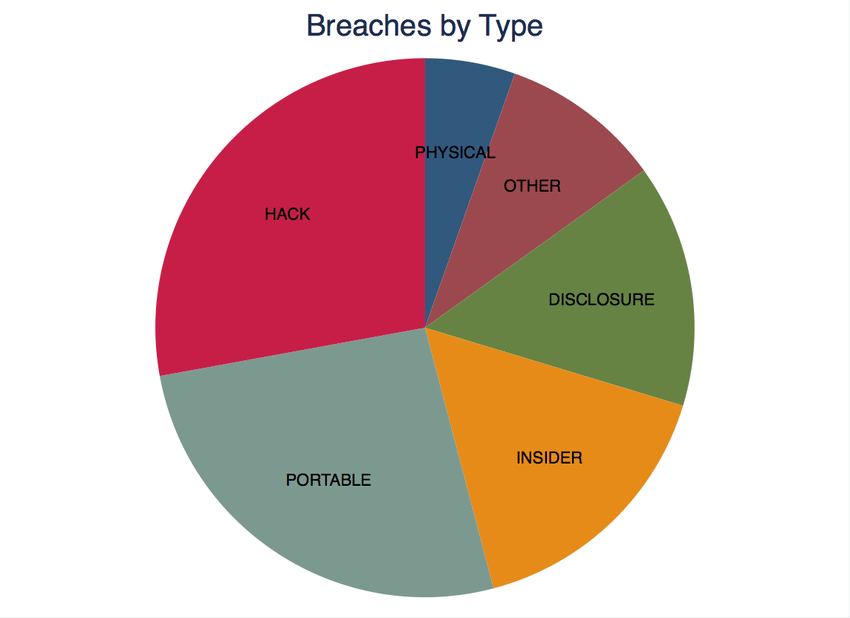

Analysis of Recent Payment Card Industry Breaches

Breaches in the payment card world have been a big headache. They show the issues with cyber security in financial tech. Just think, in 2020, a huge company was hit and more than 10 million folks had their card info at risk. Reacting fast is key. So is telling people about what happened. People need to stay in the know to keep their trust.

This gets us to another critical point. Securing info is a must. Encryption in digital payments helps. It scrambles your card details so they can’t get read by the wrong eyes. Multi-factor authentication is also a big help. It’s like a double-check system, asking for more than just your password when you buy stuff.

Sometimes though, even the best walls can fall. When fraudsters trick the system, credit card fraud can follow after a breach. This means buying stuff with your name but not your okay. That’s bad news for you and the shops, as they may need to give that money back. And if identity theft occurs, it’s a long road to fix it all. So, cyber attacks on payment gateways are serious. It’s a wake-up call to always be ready and watch out.

Preventing these online transaction risks is also about knowing the rules. Say hello to PCI DSS. It’s a set of rules for anyone dealing with card payments. These rules aim to protect card info and keep your money safe. By following these, shops and banks show they take your security to heart.

But what if a breach does happen? It’s about moving fast. Shops and banks need to close the gap and fix any weak spots. For you, it means checking your accounts and maybe getting new cards.

In the end, keeping finance data safe is not a maybe, it’s a must. Shops need to do their part, and so do you by staying alert. And as we keep looking for smarter ways to shop, like using blockchain or fancy chips in cards, let’s not forget the basics. Staying safe online means being careful every step of the way.

Strengthening Defenses: Prevention and Response Strategies

Best Practices in Implementing Multi-Factor Authentication

Let’s talk multi-factor authentication (MFA) for online payments. This is how you keep bad guys out. Think of MFA like a superhero team. Each hero—or factor—has a power. When you use more than one, it’s harder for villains—or hackers—to win. First, you have something you know, like a password. Next, comes something you have, like a text with a code. Last, there’s something you are, like your fingerprint. Alone, they’re strong. Together, they’re almost unbeatable.

For online shopping, having just a password isn’t safe anymore. MFA is your go-to move. You want that extra layer of armor. It’s one of the best ways to fight off cyber attacks. Here’s the deal: the more layers, the better. Add that code from your phone, and bam! You just leveled up your security. Now, bad actors have a tough time breaking in. They can guess a password, sure. But getting your fingerprint, too? Not so much.

Ensuring PCI DSS Compliance and Beyond

Now, let’s dig into PCI DSS—Payment Card Industry Data Security Standard. If you’re dealing with credit cards, PCI DSS is your rule book. Think of it as the golden rules for keeping payment data safe.

It covers stuff like making sure card data is locked up tight through encryption. This jumbles up the data so only the right people can read it. It also talks about protecting data when it’s sent across the internet. If someone tries to grab it, they just get gibberish.

But it’s not just about following the rules. The trick is to go the extra mile. You have to keep an eye out for any strange activity on your accounts. And if you spot a bad guy, you need to be ready. That means having a plan for when stuff goes wrong. It’s like having a fire drill—you’ve got to practice, so you know what to do.

Also, keep talking to the experts, the ones who make sure these rules work. They’re always coming up with new ways to stay ahead of hackers. They’ll help you set up defenses that are tough as nails. And they can guide you through what to do after a data breach, to win back trust.

So remember, online money stuff can be risky. But with MFA and PCI DSS, you’re building a fortress around it. Get those things right, and you’re doing a lot to keep the bad guys at bay and your money safe. It’s about staying sharp and always being ready. That way, you keep trust as solid as a rock, and the dollars keep flowing.

Innovations in Securing Transactions and Building Trust

The Role of Blockchain Technology in Payment Security

Ever had your card info stolen? It’s scary, isn’t it? But, hey, there’s good news. People are working super hard to stop this from happening. Let’s talk blockchain. It sounds complex, but it’s pretty simple. Think of it like a digital ledger that’s super safe. Why? Because changing any info needs approval from everyone. Now, that’s a tough nut for hackers to crack!

Blockchain is a game-changer in cyber security for financial tech. It keeps your digital money safe because it’s tough to mess with. Every transaction gets a unique code. So, if a bad guy tries to sneak in, we’ll spot it fast. No sneaky business here!

Plus, it’s not just about one-time safety. What blockchain does is secure every step of your money moving online. It’s like giving your digital cash a bulletproof vest! But even cooler, you can see all transactions. This means you can check if your money’s safe 24/7.

Safe money equals happy customers. And when people feel good about their online shopping, they buy more. So, blockchain doesn’t just lock down safety, it’s great for business too!

Rebuilding Customer Confidence Post-Data Leak

Data leaks can shake our trust in online buying. But I’ll let you in on a secret: trust can be rebuilt. After a leak, companies must step up. They should tell you ASAP and help out anyone who’s had their details taken.

Imagine if your friend lost your favorite toy. You’d want them to say sorry and help find it, right? It’s the same with companies. Saying sorry and helping makes us trust them again. It shows they care about keeping our card info safe.

They also need to make everything super secure. This way, we can feel at ease using our cards online again. One way to do this is with something called multi-factor authentication. It’s a fancy term for a simple idea. Before you buy anything online, the site checks it’s really you in different ways.

What about shops and banks? Well, they have rules they need to follow to keep our cards safe. There’s a set called PCI DSS. Think of it as a rule book for keeping card info locked down tight.

When bad things happen, good people come together. They find ways to fix things and make them better. So, when our card details are in danger, we need to work hard. We must make sure it’s tough for thieves. We have to rebuild trust so everyone feels good about buying things online once more.

Feel safer now? Blockchain and smarter rules are turning the tide on data breaches. It’s all about keeping your shopping trips online fun and worry-free. Remember, safe digital payments mean you can shop till you drop – no worries.

In this post, we dug into digital payment security. We looked at how payment methods have changed and the key safety issues. We also explored damage caused by data leaks in finance. This shows how vital security is for both shoppers and businesses.

We shared ways to make your defenses strong. Things like using multi-step checks when people log in helps a lot. And you must follow rules set by the payment card industry.

Lastly, we talked about new tech like blockchain. It can help keep payments safe. We also talked about getting back trust from customers if a data leak happens.

To wrap up, keeping digital payments safe guards your money and reputation. Use the latest tech and follow strong security practices. This keeps customers happy and protects you and your business.

Q&A :

How do data breaches affect consumer confidence in digital payment systems?

Data breaches can severely impact consumer trust in digital payment platforms. When sensitive information is compromised, customers may hesitate to continue using electronic methods due to fears of financial loss or identity theft. This can result in a decrease in the adoption and usage rate of digital payments and potentially drive customers back to more traditional payment methods.

What are the financial implications of data breaches on businesses providing digital payment services?

When a data breach occurs, the financial repercussions for businesses can be significant. They may face direct costs such as fines, legal fees, and compensation payouts, along with indirect costs like increased cybersecurity measures and insurance premiums. Additionally, they may experience a loss of revenue due to disrupted services and damaged reputation, which can lead to a decline in customer base and transaction volumes.

Can data breaches in digital payments lead to regulatory changes or sanctions?

Yes, data breaches often trigger regulatory scrutiny and can lead to tighter regulations and sanctions. Governments and financial authorities may impose stricter data protection standards, compliance requirements, and hefty penalties to prevent future breaches and to ensure the security of consumer information in the digital payments arena.

What steps can consumers take to protect themselves from data breaches in digital payments?

To safeguard against data breaches, consumers should employ strong, unique passwords for their digital payment accounts and enable two-factor authentication where possible. They should also monitor their account activity regularly, set up alerts for unusual transactions, and update their devices and applications to the latest security standards. Educating themselves about phishing scams and secure online practices is also critical.

How do data breaches in digital payments influence the wider financial ecosystem?

Data breaches in digital payments can have ripple effects across the financial ecosystem. Banks and financial institutions might tighten their security measures and screening processes, potentially making it more difficult for consumers to open accounts or execute transactions. Additionally, the increased focus on cybersecurity may spur innovation in the form of more secure payment technologies and protocols, influencing the overall landscape of digital financial services.