How to Secure Digital Payments: Bulletproof Your Online Transactions

Worrying about your online shopping? You’re not alone. Discover how to secure digital payments. It’s essential today. I’m breaking it down. Easy, clear steps are what you need. Let’s talk about turning encryption into your digital shield. Then, I’ll guide you through multi-layer security that’s easier than you think. Next up? Checkout processes that lock down your data tight. And don’t miss our tips to beat the newest online threats. Read on to make your online transactions as safe as houses.

Understanding Encryption for Payment Security

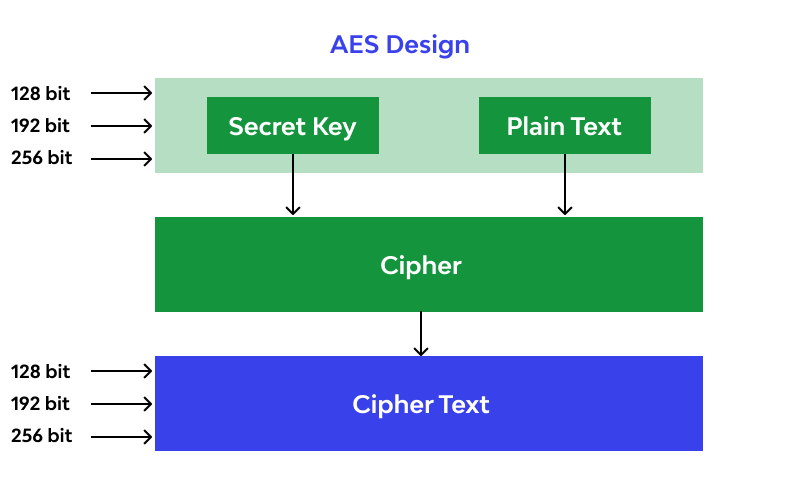

The Role of Advanced Encryption Standards (AES) in Online Transactions

Picture this: You’re buying a gift online, putting in card details and clicking ‘pay’. Ever ponder over what keeps that ultra-private info safe from hackers? That’s AES at work! AES, short for Advanced Encryption Standards, fortifies your card data turning it into a secret code. It’s like a virtual lockbox that only the right key can open.

How does AES help you? Simple. When you pay online, AES scrambles your data. Only the seller’s secure system can unscramble it. It’s how your shopping stays between you and the store. AES is a boss in the security world. It’s super tough for baddies to crack. Trust me, it’s crucial for protecting online transactions.

Next time you check out online, think AES. This encryption powerhouse is working 24/7 to shield your precious card numbers from the bad guys. It’s the hero securing every byte of your payment info.

Implementing SSL Certificates for Enhanced Payment Protection

Let’s dive into SSL certificates – another hero in our online security saga. SSL, or Secure Sockets Layer, is your web convo’s bodyguard. It makes sure your chat with a website is in a no-eavesdropping zone. SSL guards the tunnel your data travels through, so no sneaky peeks from cyber thieves.

Have you seen a padlock icon in your web address bar? That’s SSL in action! It shows a website’s safe to share secrets with, like your card number or password. When an online store uses SSL, it’s like having a VIP escort for your data. They walk it safely from your PC to the store’s checkout, no intruders allowed.

Adding SSL to a website isn’t just smart; it’s vital for a secure checkout process. It blocks peeping Toms and data robbers dead in their tracks. Keep an eye out for that padlock next time you’re buying online to ensure you’re in a hacker-free zone. Remember, SSL certificates turn your payment journey into a secure expressway, driving your sensitive details safely home.

Multi-factor Authentication and Other Security Measures

Integrating Two-Factor Authentication for Transaction Verification

When you shop or bank online, keeping your money safe is key. One way to do this is with two-factor authentication (2FA). What is it? It’s a way to check if it’s really you when you’re trying to pay or log in. How does it work? It asks for two proofs of who you are. It could be something you know, like a password or PIN. Or something you have, like a phone or key fob. Or even something you are, like your fingerprint.

This means even if someone steals your password, they can’t get into your account. They need the second proof, too. Many banks and shops now offer 2FA. It’s a strong step in protecting online transactions. By adding this extra layer, you make it much harder for bad guys to sneak in. You can usually set it up in the security settings of your account. So take that step – it’s a smart move!

The Importance of PCI DSS Compliance in Securing Payment Gateways

Now, let’s talk about keeping payment gateways safe. These are the ways your payments go through when you buy online. The Payment Card Industry Data Security Standard (PCI DSS) is what businesses follow to keep these gateways secure. It’s a set of rules to make sure they protect your credit card info.

Think of PCI DSS like a guard. It watches over your info when it moves from one place to another. This guard makes sure no one who shouldn’t see your info can get to it. Every place you shop at should be following these rules. That way, you know they’re taking good care of your card details.

Following PCI DSS means a business is serious about your safety. They put up strong walls – like firewalls – around your data. They make sure they have good locks – like passwords – that are hard to guess. And, just like a bank has cameras, they watch to see if anyone is trying to break in.

PCI DSS is all about keeping your payment info out of the wrong hands. So when you shop, make sure the site says it follows PCI DSS. It’s like a badge that says, “We’ve got your back!” It means they’re using payment security measures to keep your shopping safe. And when you feel safe, shopping online is more fun and worry-free!

Using these tools – multi-factor authentication and PCI DSS compliance – helps to build a shield around your financial data. Always look for them when paying online. It’s like putting on a seatbelt in a car. It doesn’t mean there won’t be bumps, but it sure helps keep you secure. Remember, staying safe isn’t just about one big lock. It’s about lots of smart steps that add up to a strong defense. So, be picky about where you shop and bank. Make sure they care about security as much as you do. Your money deserves the best guards around!

Best Practices for a Secure Checkout Process

Strengthening Payment Gateways with Anti-Fraud Software and Techniques

Making sure your checkout is safe is a must. Start with anti-fraud software. This software stops bad guys in their tracks. It watches for odd actions during payment. If it sees a red flag, it alerts you. This can help you catch theft before it happens. It’s like having a guard dog for your online cash register.

For online payment security measures, encryption is your best friend. Every bit of info gets scrambled up. Think of it as writing a secret note in a language only you and the person you’re sending it to can understand. Only those who need to see the data can unscramble it.

Two-factor authentication (2FA) adds another check. It’s like asking for a secret handshake after a password. You might get a code on your phone or answer a security question. It’s another step, but one that keeps your money safe.

Payment gateway security is not just about locks and alarms. It’s also about being aware. Keep an eye out for news on how to fight fraud.

Utilizing Credit Card Tokenization to Protect Customer Data

We’ve all heard the scary stories of stolen credit card details. But tokenization can turn these details into something useless for thieves. Here’s how:

Credit card tokenization takes your card number and swaps it for a random set of numbers, known as a “token”. It’s like swapping your house key for a mystery box. The box is useless without knowing what’s inside. These tokens go through online systems safely, hiding your real details.

If a thief gets the token, they can’t do much with it. The real card details stay locked away. It’s like a safety deposit box for your card data.

This method is part of a secure checkout process. It helps you shop without worry. You know your info stays safe, even if bad guys try to sneak in.

Next time you buy online, check for tokenization. It’s an important way of protecting online transactions. And it’s a sign that the store cares about keeping your info safe.

Remember, when you keep your payment info safe, you also protect your hard-earned money. Always use secure online payment methods. Keep an eye on your bank statements, too. If you see anything weird, act fast.

Stay safe by finding a good balance. Use smart tech and stay alert. This will help you and your customers stay clear of threats. It’s all about building a fortress around your online cash. Keep learning and updating your defenses. It’s the smart way to fight off the bad guys.

Staying Ahead of Emerging Threats in Digital Payment

Adapting to New Payment Technologies: EMV Chips and Digital Wallets

EMV chips and digital wallets are changing how we pay. You may wonder, what are EMV chips? They are smart chips in credit cards that make payments safe. Unlike the old swipe cards, EMV chips create unique info for each transaction. This means if someone steals the data from one buy, they can’t use it again.

Now, let’s talk digital wallets. These are apps where you store payment info on your phone. When you pay with a digital wallet, your card number is not shared. This shields you from fraud. But remember, keep your phone safe just like you would your wallet.

Educating Businesses and Consumers on Phishing Attack Prevention and Safe Online Shopping Habits

Next, we can’t skip phishing attacks. What is phishing? It’s when scammers trick you into giving them your private info. They might send you a fake email that looks real. It may ask you to click a link or open an attachment. Don’t fall for it! To stay safe, always check who the email is from. And never share your info if you aren’t sure it’s safe.

For safe online shopping, stick to sites you trust. Look for a padlock icon by the web address. This means the site has SSL protection. It’s like a safety belt for your data. Always use a strong password. And think about where you are shopping from. Avoid public Wi-Fi when you’re buying stuff online. Public networks can be risky! It’s like sharing your credit card number out loud.

For both businesses and buyers, using secure payment platforms is key. These have tools like firewalls and fraud alerts to watch your back. They should follow PCI DSS rules. What’s PCI DSS? It’s a set of rules to make sure all companies that deal with card payments keep them safe.

To sum it all up, always keep an eye out for new ways to protect your cash online. Use EMV chip cards, digital wallets, and follow good habits online. Do these things and you can shop and sell without fear!

We’ve covered a lot about keeping online payments safe. Let’s recap! We talked about encryption, like AES, which keeps your card details secret. We also went over SSL certificates that add an extra shield to payment sites.

Then, we hit on multi-factor authentication. This is like a double-check to ensure it’s really you trying to pay. And, we can’t forget about PCI DSS rules that make sure payment sites are locked down tight.

For store owners, we shared tips to make checkouts safe. Anti-fraud tools and something called tokenization keep your info out of the wrong hands. Lastly, we can’t lag behind bad guys with new tech like EMV chips and phone wallets. Learn the signs of phishing, ask questions, and shop with care.

To wrap it up, staying safe with online payments is a big deal. It’s all about using the right tools and smarts. Keep these tips in mind, and you’ll make it tough for anyone to mess with your money. Stay safe out there!

Q&A :

How can I enhance the security of my digital payment transactions?

Ensuring the safety of digital payments involves adopting a multi-layered approach that includes using strong, unique passwords, enabling two-factor authentication, and utilizing secure networks for transactions. Regularly updating software on your devices also helps in keeping security tight, as updates often include patches for security vulnerabilities.

What are the best practices for securing online payment methods?

To safeguard online payment methods, opt for reputable and well-established payment gateways with a strong security track record. Always keep a close watch on bank statements for any unauthorized transactions and consider the use of virtual credit cards which offer a disposable number for extra security. Educating yourself on the latest phishing scams and fraudulent activities is also essential.

Is it safe to store my credit card information on my favorite shopping sites?

While storing credit card information on shopping sites offers convenience, it may increase the risk of security breaches. If you choose to store card details, ensure the site has robust security measures such as SSL encryption. It’s also wise to check the site’s privacy policy and understand how your data is protected before saving any sensitive financial information.

What measures do financial institutions take to protect digital payments?

Financial institutions employ a variety of measures to protect digital payments: encryption, fraud detection systems, and secure socket layer (SSL) protocols are standard. They also use tokenization to replace sensitive account details with unique identifiers to add an extra layer of security. Keeping an ongoing dialogue with your bank to monitor for any potential security alerts is advised.

Can using public Wi-Fi affect the security of my digital transactions?

Conducting digital transactions on public Wi-Fi can make you vulnerable to cybersecurity threats. These networks often lack stringent security and leave your financial data exposed to interception by hackers. Always use a virtual private network (VPN) or a personal hotspot when performing financial operations on public networks to enhance security.