Navigating the twists and turns of the stock market can seem like a complex quest. Yet, the key lies in mastering how to do financial market analysis—a process as crucial as the investments themselves. This definitive guide breaks down the art and science behind savvy market analysis into bite-sized, actionable steps. Get ready to lay the groundwork, from knowing your analysis types to diving deep into the data that moves markets. Skip the guesswork and anchor your strategy with robust qualitative and quantitative insights, as we lead you one step at a time towards investment prowess. Whether you’re eyeing stocks, bonds or beyond, embark on this journey to unveil the secrets that can help turn market whispers into resounding success.

Laying the Groundwork for Financial Market Analysis

Understanding the Types of Financial Analysis

First, know the two main types of financial analysis: qualitative and quantitative. Qualitative market analysis explores the less concrete factors. These include company leadership, brand strength, and market trends. They cast light on the “why” and “how” behind market moves.

Quantitative market analysis, on the other hand, deals with numbers. It looks at share prices, financial ratios, and other hard data to find investment chances.

Grasping the Fundamentals of Market Data

Getting to grips with market data is key. This includes understanding technical and fundamental analysis basics. Technical analysis basics involve looking at charts and past price actions to guess future moves. Fundamental analysis principles go deeper, checking a company’s financial health with things like balance sheets and earnings reports.

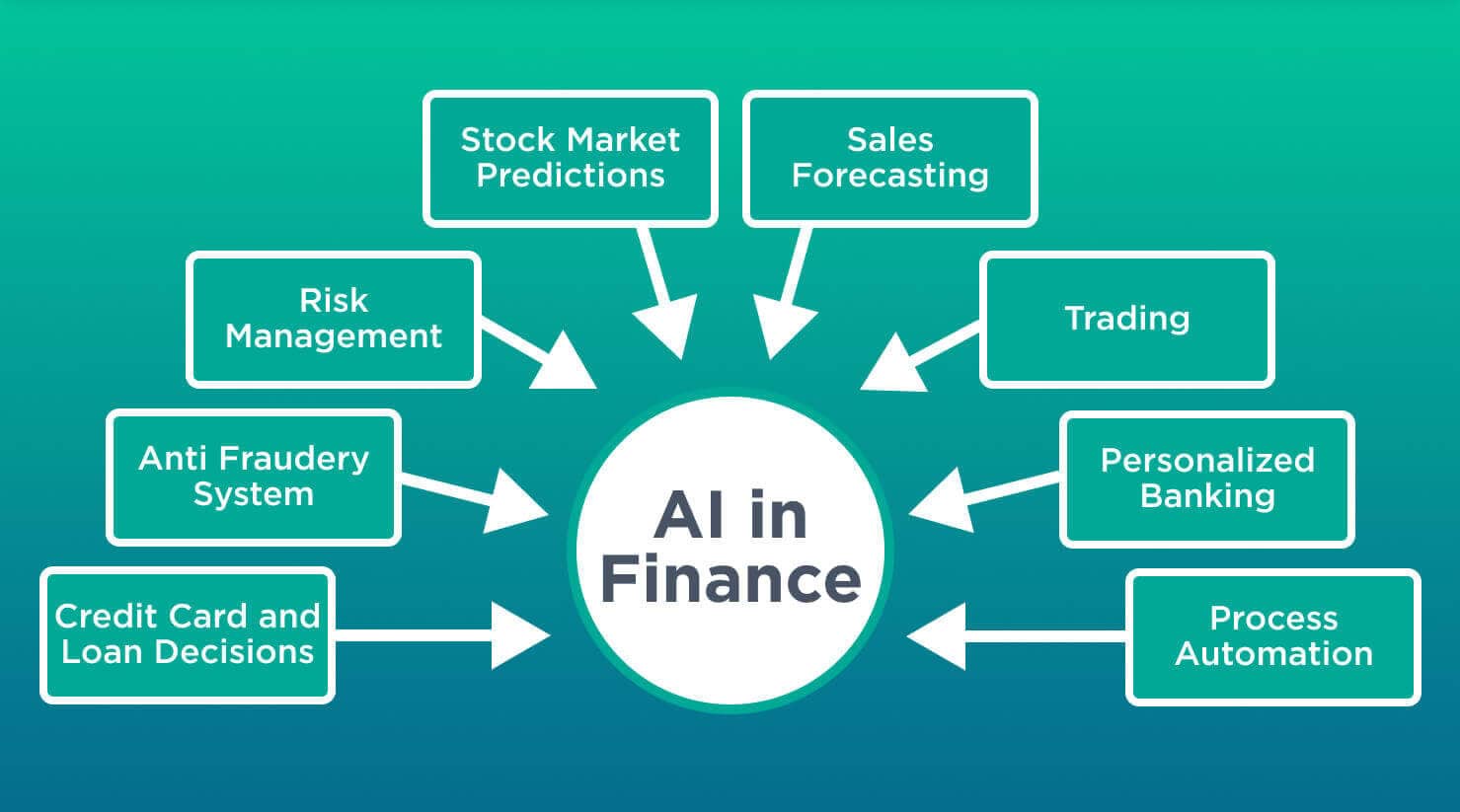

Solid financial market analysis guide work begins with knowing these basics. To do this well, you must track many parts not many people see. Factors like bond market evaluation, equity research strategies, and trading data interpretation are all vital.

Analyzing stock markets isn’t just about where prices are now. It also means keeping an eye on how the whole picture fits together. Economic indicators impact what happens in the markets. This includes how dabbling with the interest rates effect markets or how policy changes on markets can swing prices.

When you’re doing investment portfolio analysis, you’ll also dive into stock valuation methods. You’ll need to know cash flow assessment to see if a business can keep going long-term. Market volatility understanding is about seeing how much prices bounce around, showing you how much risk you’re taking on.

Then there’s investment risk evaluation. It’s about measuring what could go wrong with your choices. Could new rules or a shaky economy knock your investments down a notch?

You can’t ignore central bank policies review either. When banks change their rules, it can mess with currency market study results and commodity prices tracking. These shifts often offer big clues on what’s next for investors.

And it’s big news when we talk about economic cycle stages. They give us hints about where we stand in the market’s rise and fall. This helps us pick the best spots for our cash.

Sector performance analysis involves looking at groups of companies. It tells us who’s winning or losing, which can guide our choices. Emerging markets exploration pulls us into newer, less explored areas. They can yield big rewards for those who get in early.

Market analysis tools, like software for charting and data analysis, help put your plans into action. So does interpreting financial statements; they’re like health reports for companies. Balance sheet analysis and profit and loss examination get under the hood, showing us the real deal on a firm’s condition.

It’s not an easy task. We juggle lots of plates when watching market trends. Yet, all this digging helps us uncover the right moves to make with our money. It’s about making educated guesses, backed by solid proof, ready to stand tall against market winds.

Delving into Qualitative and Quantitative Analysis

Mastering Qualitative Market Analysis Techniques

Ready to dive into market analysis? First, we need to talk about types. Two big ones to know are qualitative and quantitative. Think of qualitative analysis as checking the quality of something, like how strong a brand is or what leaders run a company. It’s about the less number-focused parts of market analysis. Still, it’s mighty.

To get it done, you first look at a company’s team. A strong leader can push a company far. Then there’s the business model. Ask, “Is it good? Will it last?” Brand strength also matters a lot. A known brand can win more sales with ease.

But how do you learn all this stuff? You talk to people, read news, and study reports. This helps you feel what the market thinks and wants. That’s called analyzing market sentiment. For this, we also use a special tool, SWOT. It stands for strengths, weaknesses, opportunities, and threats. It’s like a map for a business’s future.

Harnessing Quantitative Methods and Tools

Now, let’s switch gears and talk about number crunching! Quantitative analysis is all about data. You’ll look at things like cash flow, profits, and the debt a company has. Why? It shows how healthy a company is, like a check-up at the doctor’s.

First up is financial ratios analysis. Ratios can show you many things. Like, is a company selling enough compared to what it owns? We call that sales ratios. Or, can it pay its short-term bills? That’s liquidity ratios.

To make sense of the data, you use tools like Excel or special software. They can store, sort, and make sense of loads of numbers. And with these tools, you start to see patterns, trends, and maybe even guess what comes next. That’s why this method is key for anyone doing financial market analysis.

You don’t just look at one company, though. You must check the whole market. How? Use things like index fund analysis or track overall market trends. And don’t forget, analyzing bond markets is also a part of the bigger picture. Bonds can tell you loads about how the market feels.

And here’s a pro tip: Keep an eye on central bank policies. They can move the whole market up or down. So can big world events—like politics or natural disasters. For that, we watch interest rates and other big changes.

So there, you’ve got your guide to jumping into market analysis. Mix these tips with your own smarts, and you’ll start to spot golden chances in the market. Happy hunting!

Advanced Techniques: Technical and Fundamental Analysis

Decoding Technical Analysis Basics

Technical analysis is like a secret code. It helps us guess where prices may go. Charts and patterns are clues in this money game. They show if a stock is liked or not. When shares go up and down, these patterns tell us a story. To start, you look at past prices and trading volumes. This shows you trends. Trends tell you if it’s the best time to buy or sell stocks.

Applying Fundamental Analysis Principles

Fundamental analysis is like being a detective. It’s about digging deep. You look at a company’s health through its profits, debts, and more. You ask: Does this company make money? Will it keep doing well? Things like news or the economy can affect it, too. This helps decide if a stock is cheap or too costly. It’s about getting the full picture before you put your money in.

When you mix both analyses, you become a market pro. Use patterns from technical analysis to find the right timing. Use company details from fundamental analysis to pick strong stocks. It’s a winning combo for smart investing. You look at many things to know what a stock could do next. This way, you stand a better chance to make money and not lose it.

In the stock market, it’s important to keep learning. Always check on new info and keep an eye on the market mood. Use all the tools you have to stay ahead in the game of stocks and bonds. Remember, no guess is sure. Always be ready for surprises. That’s what makes the market thrilling and tough at the same time.

Evaluating Risk and Potential in Diverse Markets

Scrutinizing Market Volatility and Investment Risks

Money markets can be like roller coasters. Up, down, fast, slow – always moving. To ace market analysis, you’ve got to get risk. Risk tells you how bumpy your ride might be. Think about stocks going up or down. That’s market volatility. Now, picture your cash in those stocks. Feels risky, right? We measure this with numbers called volatility indexes.

But here’s a secret—risk isn’t bad. It’s just a part of the deal. Smart investors look at likely gains and risks. They ask, “Is the chance of winning worth the risk of losing?” To decide, they check past price swings and news that might shake the market.

Now, let’s talk types. There’s the risk of losing cash, yes. But also, the chance of missing out on profits. Fear can scare us from smart chances. So, we use tools like beta, which shows how much a stock might move against the market. A high beta means more risk, but maybe more reward too.

We also gaze into the future. How might things change? What events could toss the market? This asking of “what if” helps us prep for sudden jumps or drops. Always remember, good risk study means better sleep at night.

Performing Sector Performance Analysis and Exploring Emerging Markets

Let’s switch gears. Sectors! The market’s big pizza, with slices like tech, health, and energy. Each sector dances to its own beat. Tech might jump while energy dips. So, what’s hot, what’s not? We find out with sector analysis. It’s about spotting the strong and weak players.

Watch the news, check reports, and dig into earnings. Or use ratios like price-to-earnings (P/E) to see if a sector’s stock is priced right. If the number is low, the stock might be a deal. If high, it could be too pricey.

Next stop, the new kids—emerging markets. Places like India or Brazil. They’re growing fast and can bring in big bucks. But, there’s a twist. They can be wild cards with unexpected turns. So be sharp. Look at their growth, laws, and money health. A strong, stable place can mean a goldmine for your cash.

Before jumping in, though, get real about what you know and can handle. New sectors and places can be exciting but do your homework. Learning the lay of the land means fewer surprises.

In these risk-filled adventure lands, tools and brains team up. Packing your investor’s toolbox means less worry and more power in your market dance. Whether it’s a calm waltz or a wild tango, you’re set to groove with confidence.

We’ve come a long way! We started by setting the stage for how to study the money scene. You now know the key types of financial sleuthing and the nuts and bolts of market info. We dove deep into the tricks of both qualitative and numbers-based tactics. I shared how to be a pro at things like spotting trends and diving into the nitty-gritty of a company’s health. We even explored the high-level skills of technical and basic money analysis. I showed you how to predict risks and spot chances in all sorts of markets.

Remember, whether you’re looking at zigzags on charts or deep in reports, it’s about making smart choices. By using what you’ve learned, you’ve got the tools to make sense of the market buzz. Keep sharp and stay open to learning. That’s how you win at the money game!

Q&A :

What are the core steps in conducting financial market analysis?

Financial market analysis involves a thorough understanding of various economic indicators, market trends, and financial instruments. Here are the core steps you should follow:

- Define your objectives: Establish what you want to achieve with your analysis, whether it’s assessing investment opportunities, tracking market trends, or evaluating financial risks.

- Collect relevant data: Gather quantitative data such as price/volume information, earnings reports, economic indicators, and qualitative information like political events or company news.

- Choose your analysis method: Decide between fundamental, technical, or quantitative analysis, each with distinct methodologies and data needs.

- Analyze the data: Use statistical tools and models to examine the data. Look for patterns, correlations, and insights that could inform your financial decisions.

- Interpret the results: Draw conclusions from your analysis, taking into account the context of the current market environment and your investment goals.

- Make informed decisions: Based on your findings, develop an investment strategy or make specific financial recommendations.

How can technical analysis help in financial market analysis?

Technical analysis is a method used in financial market analysis that evaluates securities by analyzing statistics generated by market activity, such as past prices and volume. It can help in several ways:

- Identify trends: Technical analysis helps in identifying short-term, intermediate, and long-term trends which can guide investors on when to enter or exit the market.

- Spot patterns: Recognizing chart patterns and technical indicators can suggest future price movements.

- Support/resistance levels: Technical analysts use support and resistance levels to determine when to buy or sell.

- Market sentiment: It can offer insights into the psychological and emotional state of the market, which influences decision-making.

By understanding and applying technical analysis, investors and traders can make more educated guesses about where prices might be headed.

What role does fundamental analysis play in financial market analysis?

Fundamental analysis is a cornerstone of financial market analysis, focusing on the intrinsic value of a security to determine if it is undervalued or overvalued. Here’s how it’s integral to market analysis:

- Evaluate company performance: It involves looking at financial statements, management effectiveness, earnings, and growth potential to gauge a company’s health and profitability.

- Assess economic factors: Analysts consider the overall economy, industry conditions, market cycles, and political climate, which all impact security prices.

- Long-term perspective: Fundamental analysis is especially useful for long-term investment strategies, as it aims to determine the sustainable performance and growth prospects of a security.

Investors who utilize fundamental analysis are typically more concerned with the potential for long-term growth rather than short-term market trends.

What is quantitative analysis, and how does it differ from other techniques?

Quantitative analysis involves the use of mathematical and statistical techniques to evaluate financial markets and securities. Unlike fundamental and technical analysis, quantitative analysis relies heavily on numbers and often uses complex models to predict price movements. Here are its differentiating factors:

- Model-based approaches: It involves constructing financial models that can sift through large datasets to find investment opportunities.

- Objective data: Quantitative analysis focuses on measurable factors, such as price and volume, bypassing subjective assessments of value.

- Risk management: Incorporates extensive use of risk and return models to optimize portfolios and mitigate potential losses.

Quantitative analysis can be considered more scientific in its approach, and is particularly favored by hedge funds and institutional investors.

Can financial market analysis predict stock market crashes?

Financial market analysis involves assessing various indicators that can suggest an impending market downturn, but it cannot reliably predict stock market crashes. The complexity of market dynamics and the influence of unpredictable external factors mean that exact timings of crashes are very difficult to forecast. However, analysts can:

- Identify warning signs: There can be indicators such as economic downturns, overly-inflated asset prices, or high levels of market leverage.

- Analyze historical patterns: By studying past crashes, some patterns might suggest the likelihood of future ones.

- Use risk indicators: Analysts use certain metrics, like the VIX (Volatility Index), to measure market risk and investor sentiment.

While analysis can provide insights, investors must acknowledge the inherent uncertainties present in the stock markets and invest accordingly.