How to Choose a Digital Payment Platform: Your Ultimate Guide

If you’re on the hunt for how to choose a digital payment platform, I’ve got the lifeline you need. Forget the technical jargon and endless options that make your head spin. Here, it’s all about a clear-cut path to pick a platform that ticks your boxes. Think about your biz goals and what your customers dig. Costs? Yeah, they’re key. We’ll sniff out the sneaky fees and the upfront ones. Security is a no-brainer – we’ll lock that down tight. And let’s not forget all the payment types and how they fit into your game plan. Stick with me, and you’ll nail this down with zero fuss.

Assessing Your Payment Platform Needs

Aligning Business Goals with Payment Features

When choosing a payment processor, your business goals should lead the way. Ask yourself, what do I want to achieve? Maybe you’re aiming for fast growth or you might focus on service quality. Each goal points you to different payment features. For fast growth, seek out platforms that can handle many transactions at once. If quality is key, look for ones with top-notch customer support.

To find the right payment platform, list the features that fit your plan. Do you need to take payments from different countries? That’s where multi-currency support comes in. Perhaps you aim for a smooth shopping experience. You’ll then need a platform with easy setup and quick payment processing. Secure, reliable API options are a must for seamless integration with your e-commerce site.

Understanding Your Customers’ Payment Preferences

Knowing your customers’ payment likes and dislikes is vital. It can shape their shopping experience and stickiness to your brand. What payment methods do they trust and use often? For younger folks, digital wallets might be the way to go. In some places, cash on delivery still reigns. If you miss the mark on their preferences, you might lose sales.

Dig into your customers’ habits. Do they shop on mobile? If so, mobile payment solutions are a must. They will look for easy, tap-and-go options. Your choice must handle this smoothly. Otherwise, they’ll go elsewhere.

Have chats with your customers. Use surveys or feedback forms. It helps understand their needs. Once you get this, you can pick payment methods that they’ll love. This ramps up trust and loyalty to your brand. It also means fewer hiccups at checkout, as they can pay their way.

Always remember, the easier it is for your folks to pay, the more they’ll buy. It’s all about blending their needs with your business goals. And in a sea of payment gateways, these insights help you pick a winner.

By combining what’s best for your business and what your customers crave, selecting payment processors becomes a breeze. Remember, criteria for payment platform selection is not about choosing the most popular one. It’s about finding the glove that fits your hand the best, taking into account ease of use, security, and cost-effectiveness.

Don’t skip over the importance of security in online payments either. Customers trust you with their money, so show them you care. Look for gateways with strong fraud protection and insist on PCI DSS compliance. It’s a big part of digital payment compliance and regulations.

In the end, the backbone of your e-commerce success lies in the hands of the payment platform you stand by. With the right one, you’re setting your business up for a smooth sail. It’s never just about taking payments—it’s about growing your brand and winning customer hearts. Keep that at the core, and you’ll align your business for success.

Evaluating Costs and Fees

Comparing Transaction Fees Across Platforms

When you look for a payment platform, comparing fees is key. Think about how much you pay each time someone buys something. Every platform has different fees, so you must check them out. Less fees mean more money in your pocket.

Some platforms charge a flat rate per sale. Others take a percentage. Make sure the fees fit your sales amount. High fees on small sales can eat into profits. Websites can help compare fees across many platforms.

Think of this like shopping. You want the best deal. Nobody likes overpaying, right? So, find a platform that offers good service for less. Look for low fees but also make sure they offer what you need. Low fees are no good if the service is bad.

Uncovering Hidden Costs in Payment Services

Now, let’s talk about hidden costs. They’re sneaky and can surprise you. You might see “no fees” and think it’s great. But read the fine print. There might be fees for things like refunds, chargebacks, or even customer service.

There can also be monthly fees or costs for using certain cards. If you need special features, like accepting different currencies, there could be extra costs. So, ask companies what the total cost is. Ask about each thing you’ll need.

It’s like when you buy a phone. The price tag shows the cost for the phone. But, it doesn’t include the plan, insurance, or taxes. Those are extra. The same goes for payment platforms. What looks cheap at first might not be when you add everything up.

Think ahead, too. If your business grows, will the fees change? Choose a platform that can grow with you. If you start small but get big fast, you don’t want fees that skyrocket.

Choosing a payment platform that fits your needs is like finding the right tool for a job. So, be careful and pick one that won’t let you down or cost too much. The right choice means you won’t worry about fees. Instead, you can focus on making your business great.

Ensuring Security and Compliance

Prioritizing PCI DSS Compliance for Payment Security

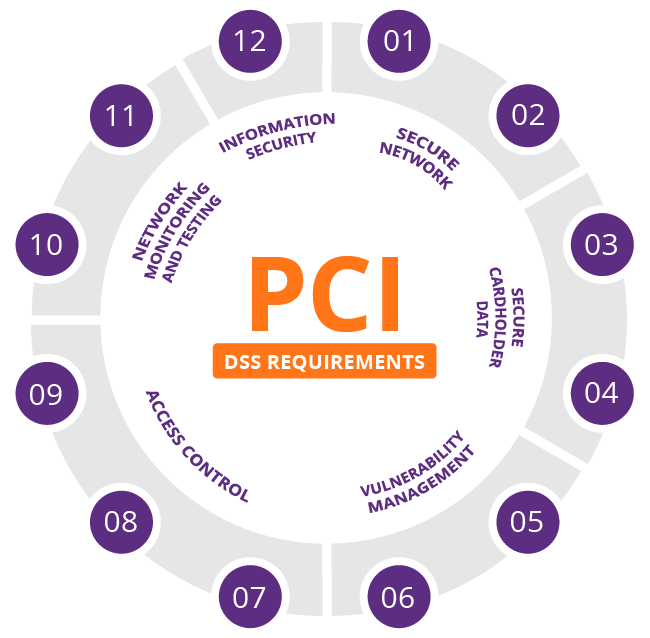

When you’re selecting payment processors, you must check for PCI DSS compliance. This stands for Payment Card Industry Data Security Standard. It helps protect card info against theft and fraud. Platforms that follow this standard keep your data safe.

You might ask, “Why does PCI DSS compliance matter?” Well, it’s all about keeping your customer’s payment info locked down. If a payment platform ticks this box, it means they’re serious about security. They make sure all card information is super safe. This is a must-have in your criteria for payment platform selection.

Let me break it down further. Imagine you’re at a store buying your favorite game. You wouldn’t just give your card to anyone, right? It’s the same deal online. You want to make sure that the e-commerce payment requirements include top-notch security. That way, you can relax, knowing your info is protected.

Enhancing Fraud Protection Measures

Now onto fraud protection. Sadly, the online world has its share of bad guys. Fraud protection in online payments is your shield. Good payment gateway features include ways to spot sketchy activities before they harm your wallet.

A solid platform catches suspicious transactions fast. They use smart tech to protect you from cheats and scams. “How good is their fraud protection?” This is a question you should ask when looking at digital payment platform reviews. Better safe than sorry, right?

This isn’t just for big businesses. Even if you’re just starting out, you’ve got to think about security in online payments. By the way, don’t forget about mobile payment solutions! With folks using phones to pay more than ever, security there is super important too.

Another neat thing is API for payment systems. This lets all sorts of software talk to each other. It also needs to be secure to keep hackers out. When APIs are involved, you’re talking about things like how fast payments go through. You want speed, but never at the cost of safety.

To sum it up, when picking a platform, always ask:

- “Is it PCI DSS compliant?”

- “Does it have strong fraud protection?”

- “Are the security features up to 5-star standards?”

These matters can seem tough to get. But once you do, you’ll feel like a superhero keeping your stuff safe. Remember, if you’ve got a question about how all this works, it’s cool to ask. That’s what customer support in payment platforms is there for. They should be ready to answer your questions and get you on track.

Looking ahead, also think about scalability of payment systems. You’ll want your payment security to grow with your business. So, when you check out a platform, make sure it can handle more customers over time. It’s like picking a good pair of shoes. They should fit well now and have room for you to grow.

And that’s the rundown on keeping things secure and following the rules. Whether you’re a shop selling goods or a pro offering services, paying attention to security and compliance is the key. It keeps your money safe, your customers happy, and stress levels way down.

Integrating and Supporting Multiple Payment Options

Navigating Multi-Currency and Cross-Platform Payments

When picking a payment platform, think about different money types and cross-platform options. You must ask, “Does the platform let my customers pay in their local currency?” A simple yes or no tells you a lot. If yes, you’re on the right path. This is key for selling to folks far away. You make it easy for them by showing prices in a way they know. They’re more likely to buy when they see familiar numbers.

Next up, check if the platform works on all devices. Your customers might shop on phones, tablets, or computers. Make sure they can pay anytime, with no trouble. The best payment platforms make sure your customers can shop and pay with no hiccups, no matter the device.

Choosing Platforms with Robust Mobile Payment Solutions

Mobile payments are big now. Most folks have smartphones and like to use them to buy stuff. So, look for payment processors with strong mobile pay options. This means they can handle a tap-to-pay or an app without a second thought. It’s not just about being trendy. It’s practical. Mobile pay needs to be fast, simple, and secure.

Think about criteria for selecting the best platform. Security is a big deal. You want a platform that keeps your customers’ info safe. Also, it should work well with your online shop or app. Nobody likes to restart or lose their cart because the payment bit is clunky.

Let’s talk about money. Hidden fees? That’s a no-go. It should be clear what you pay for using the service. And how much it costs when folks buy from you. No surprises. This keeps you and your wallets happy. A solid platform breaks down every charge so you know what you’re in for.

Think about growth too. Today you might be small, but one day you could be the next big thing. Will the payment platform grow with you? Check reviews. See what other businesses say about scaling up. You want one that won’t hold you back when your sales take off.

In the end, your choice in payment software should make life easy. Easy to set up, easy to sell stuff, and most importantly, easy for folks to buy what you’re offering. A smooth user experience in payments can turn a one-time buyer into a regular.

So, remember these key points:

Choose a platform that says “yes” to multi-currency support. Look for positive customer support reviews, especially about multi-currency help. Go for payment systems that play nice with all the places you sell: online, mobile, and in-store. Be sure your processor supports a bunch of payment methods. Credit cards are great, but don’t forget digital wallets and contactless pay. They matter too.

Make sure it’s a fit for where you are now and where you dream to be. Your future self will thank you for thinking ahead.

To wrap things up, let’s go over what we talked about. First, we matched your business goals with the right payment features. Remember, knowing what your customers like to use to pay is key. Next, we looked at costs. We learned to spot transaction fees and sneaky extra charges. Don’t forget that security is a big deal, so we covered sticking to PCI rules and stopping fraud. Lastly, we dived into the need for different payment options, like dealing with many types of money and making payments easy on phones.

Here’s my final take: Picking a payment platform is a big decision. You want one that grows with your business, doesn’t break the bank, keeps your customers’ info safe, and offers lots of ways to pay. Take your time, do your homework, and choose smart. Your business and customers will thank you for it.

Q&A :

What factors should be considered when selecting a digital payment platform?

When choosing a digital payment platform, there are several factors that need to be considered to ensure that the platform you select fits your needs. Usability and user experience are important, as you will want a system that is intuitive and easy to navigate. Security features are crucial to protect financial data and transactions. Additionally, payment options should be diverse to accommodate various customers’ preferences. It’s also vital to think about the fees associated with transactions, currency support for international payments, integration capabilities with existing systems, and the quality of customer support from the platform provider.

How do security measures vary among digital payment platforms?

Security measures can differ significantly among digital payment platforms, ranging from basic encryption to advanced fraud detection algorithms. Some platforms may only offer Secure Sockets Layer (SSL) encryption, while others might provide end-to-end encryption, two-factor authentication, compliance with Payment Card Industry Data Security Standard (PCI DSS), and additional layers of security measures. It’s vital to assess the level of security offered by a platform, including how it handles data breaches and the protections it provides for both the business and its customers.

Are there significant differences in fees and costs between digital payment platforms?

Yes, fees and costs can vary widely between different digital payment platforms. These can include transaction fees, monthly or annual service fees, chargeback fees, and fees for international transactions or currency conversion. Some platforms may offer fee-free transactions up to a certain limit or provide subscription models with different tiers of service. It’s important to compare the pricing structures of various platforms to understand the total cost of using each service relative to the benefits provided.

How does the choice of a digital payment platform impact the customer experience?

The choice of a digital payment platform can have a significant impact on the customer experience. A platform with an easy-to-use interface and quick processing times can lead to a smoother checkout process, thereby increasing customer satisfaction. On the other hand, a platform that is difficult to navigate or that frequently experiences downtime can frustrate customers and potentially lead to abandoned shopping carts. Additionally, offering multiple payment options, such as credit cards, e-wallets, or bank transfers, can cater to different customer preferences and boost the perceived convenience of the platform.

In what ways can the integration of a digital payment platform affect my existing business systems?

Integrating a digital payment platform with your existing business systems, such as accounting software, e-commerce platforms, or inventory management systems, can streamline operations and reduce manual data entry. However, compatibility and the ease of integration should be carefully evaluated. The right digital payment platform should offer APIs or plugins that fit seamlessly with the business’s technology stack and not require extensive custom coding or adjustments to the current systems. Furthermore, good integration can provide better data insights, improve financial reporting accuracy, and enhance overall efficiency.