How Rising Inflation Affects Stock Prices

In the dance of dollars, nothing gets the floor shaking quite like how rising inflation affects stock prices. Picture your hard-earned money, now buying less. That bite that inflation takes? It’s not just from your wallet; it digs right into the stock market tree, shaking its branches, and sending prices tumbling down. You’ve seen those headlines, “Inflation jumps again!” That jump is more of a jolt, a spark that sets off a reaction right through those tickers and graphs you follow. And it’s not some random blip on the radar. There’s a deep link between those climbing costs and the way stocks sway. I’m here to guide you, step by step—why your dollars pack less punch and how that punch lands squarely on the stock market’s jaw. Buckle up; let’s decode the riddle of rising costs and falling stocks.

Unraveling the Inflation and Stock Market Correlation

The Relationship Between CPI Data and Equities

The Consumer Price Index, or CPI, shows how prices change over time. It’s like a shopping list showing if things cost more or less than before. When the CPI goes up, it means stuff got pricier, and this is what we call inflation. Now, why are stocks scared of inflation? Well, when things cost more, people can’t buy as much. So companies sell less and don’t earn as much money. This makes their stocks less appealing, and their prices can drop. So, the more the CPI climbs, the more uneasy stock prices become.

Interpreting Inflationary Trends and Stock Valuation

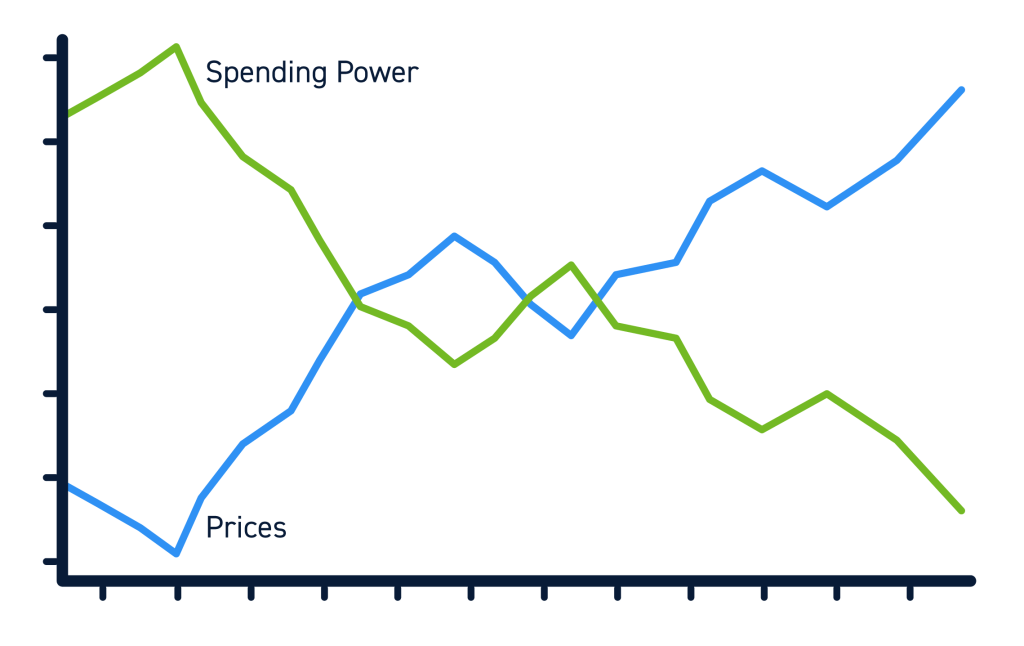

Look at inflation trends like clues in a game. Finding patterns helps us guess how stocks will act. High inflation often means lower stock prices. Companies face higher costs and might not pass them on to buyers. So, their profits can shrink, and investors might see lower returns. They might move their money to stuff that doesn’t lose value over time, like gold or inflation-protected bonds. This switch can also make stock prices fall. It’s like a tug-of-war – as inflation pulls up costs, stock value can be dragged down.

In short, when costs rise, people spend less, and companies earn less. This makes stocks less attractive. Investors then might look for safer places to keep their money from losing value. That’s how high inflation can shake up stock prices.

How Rising Inflation Sends Shockwaves Through Stock Prices

Inflation makes things pricier, even the stuff we need every day. It can eat up your money without you buying more things. Imagine you have a piggy bank full of cash. If prices jump up, what you could buy yesterday, you might not afford tomorrow. This is how your money loses its power to buy. It happens in the stock market, too.

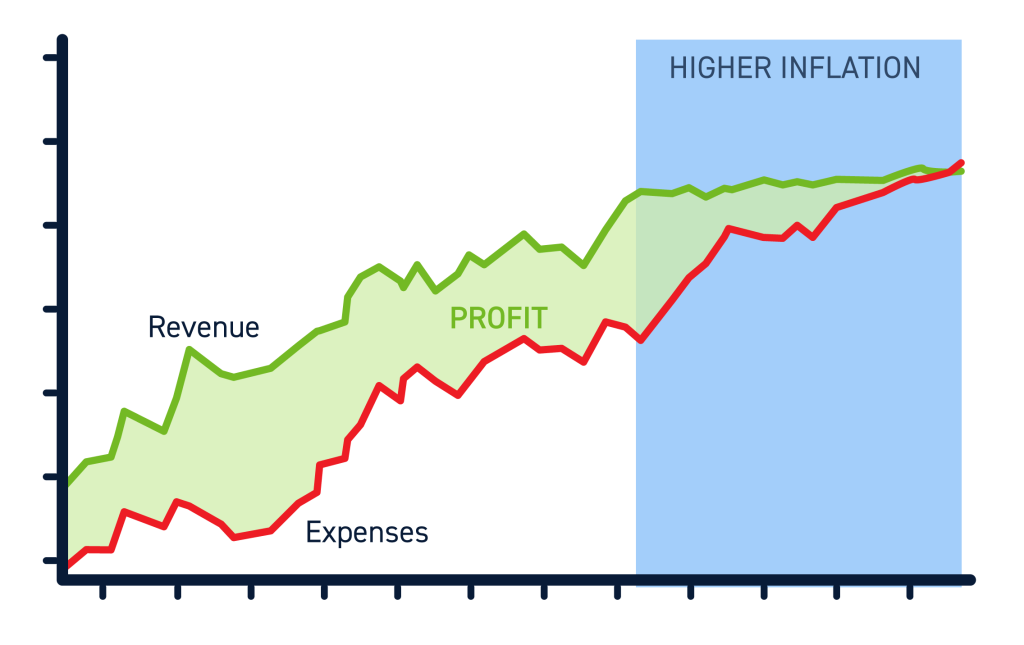

When costs rise, companies may spend more to make their goods. Let’s say a factory makes toys. If plastic gets more costly, it costs more to make those toys. Companies might charge more to keep their profits. But, if toys get too expensive, people might stop buying them. If a company sells less, they make less money. When this happens to lots of companies, it affects the whole stock market.

Stock prices also get shaky when the Federal Reserve steps in. They can change interest rates to control inflation. If they hike rates up, borrowing money gets more expensive. Then, people and businesses slow their spending. Sometimes, the stock market dips because investors worry about slower growth.

Think of the stock market like a boat on the ocean. When waters are calm, boats sail smooth. But if a storm comes, with big waves (like inflation), sailing gets rough. Stocks swing up and down.

People invest to make money in the long run, right? So when inflation climbs, they look for “inflation hedge assets”. These are investments that might not lose value even when prices go up. Real estate, gold, and some stocks can be good hedges. They might keep their worth better than cash when inflation rises. It’s like having a life vest in stormy market seas.

Smart investors pay close attention to the Consumer Price Index (CPI). It’s a big sign of inflation. If CPI numbers shoot up, it could mean inflation is getting hotter. This makes investors nervous and can shake stock prices.

During high inflation, some people change their game. They go for “rising cost of living investment strategies”. These might include stocks in sectors that fight inflation well. Think of brands you always buy, no matter what they cost. These might still sell well, even when prices spike. Energy, health care, and food are areas that can stand strong. They’re like sturdy boats that handle big waves better.

If you’re looking to invest during these wild times, think about where you put your money. Look for strong companies that keep making money, even when prices zoom up. And watch out for those that might struggle to pass higher costs to customers.

Inflation fears, like a storm warning, can rock the market boat. But with the right moves, you can keep your investments sailing smoothly. Remember, when it comes to your money, staying ahead of the wave could make all the difference. Keep your eyes on inflation, and adjust your sails as you go!

The Influence of Monetary Policy on Stocks During Inflation

Analyzing the Impact of Federal Reserve Inflation Measures

When prices rise, we all feel it. It hurts our wallets. But there’s more. It also shakes up the stock market. Why? Because the Federal Reserve steps in. They try to slow down these price hikes. How? Mainly by changing interest rates. When inflation is high, they often lift rates. This makes borrowing money pricier for people and businesses. If it costs more to borrow, folks spend less. Companies might slow down on growing or making new things.

When spenders pull back, it hits companies’ profits. Lower profits can lead to stock prices dropping. The Fed’s struggle with inflation can make stocks swing up and down. We call this stock volatility.

Interest Rates and Stock Performance Dynamics

How do interest rates connect with stocks? Let’s break it down. If interest rates go up, it can weaken stock prices, especially for growth companies. These companies need cheap money to grow fast. Higher rates can cut into their growth plans. Sectors like tech can get hit hard by these rate boosts.

But not all is bad in times of rising rates. Some sectors, like banks, can gain. Banks can earn more from higher interest rates on loans. It may seem complex, but it’s like a see-saw. Some stocks go down when rates go up, and others rise.

Investors worry about rising costs and how they eat into money’s worth over time. This fear can cause more jumps in the stock market. Here’s where strategy matters. Knowing where to put your money is key when everything costs more. Inflation-proof assets, like certain real estate or commodities, can help protect your investments.

Let me share some tips. Look for companies that can pass on higher costs to their customers. These can manage better in times of high costs of living. They can keep or even grow their profit margins. Also, keep an eye on the news. News about inflation can trigger market shifts. Inflation reports, like the Consumer Price Index (CPI), often move stock prices right after release.

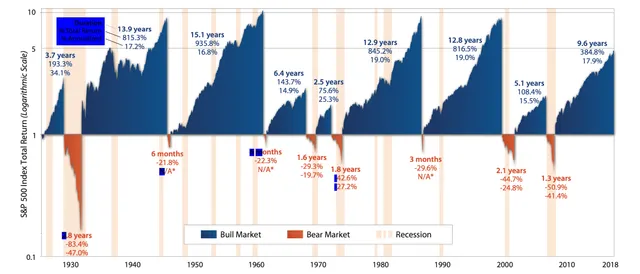

Lastly, past trends show us that stocks can still grow over time, despite inflation. But it can be a rough ride. So, it pays to be patient and not react too fast to the daily news churn.

In conclusion, inflation does touch your stock portfolio. The right moves can guard your investments. It’s about being smart and steady in your choices. Keep learning and watch how money policy shifts can guide your next investment step.

Asset Performance and Protection During Inflationary Times

Evaluating Dividend Stocks and Inflation Resilience

When prices rise, we call it inflation. It can eat away at your cash. You feel it at the store when bread costs more than before. Stocks can help you fight inflation. Some stocks give you dividends. These are like little thank-yous for owning the stock. Dividend stocks often stand up to inflation well. This is because they can grow their payments over time.

You want stocks that raise their dividends. They can help your money grow faster than prices rise. Look for companies that sell stuff we always need, like toothpaste or electricity. They keep making money, even when costs go up. Then they share that extra cash with you, the shareholder. This way, your income grows and can keep up with or beat inflation.

The Response of Fixed-Income Securities to Inflation Pressure

Fixed-income securities, like bonds, can be tricky in inflation. They pay the same interest over time. If inflation is high, your interest buys less. You lose purchasing power. This means your money does not go as far.

Imagine you have a bond that pays 5%, but inflation jumps to 6%. Your real return is now less than zero. You are actually losing money on that bond. That is not good. But there is a way around this. You can get bonds tied to inflation. They are called TIPS in the US. Their payouts rise with inflation.

In times of high inflation, like we see now, stocks can give better protection than bonds. Equity prices can go up over time. This can match or outrun inflation. But remember, stocks can drop fast too. It’s about balance. Make sure you own a mix of stocks and bonds. This way you have some safety from bonds and more growth from stocks. It helps to talk to someone who knows about this stuff. They can guide you based on what you need and want.

Inflation can be scary for your wallet and investments. But the right moves can protect your money. Dividend-paying stocks and some bonds are tools you can use. Always keep learning and stay aware of market trends. This is a big part of beating inflation.

In this blog post, we looked hard at how inflation links to stocks. We saw that as the CPI climbs, stocks often dance to a tricky beat. Smart moves like picking the right assets can guard your money when costs leap up. We also dived into how the Fed’s choices on inflation push stocks around. In times when prices rise, some stocks still pay well, and bonds can react in their own way.

To wrap up, it’s clear we need sharp eyes on trends and smart plans to stay ahead. When you know the game – how inflation messes with stocks and what the Fed does – you can play it better. Pick assets that stand strong or even gain with higher costs. Watch rates, and think about how they steer stocks. It’s all about staying on your toes, so your cash grows, no matter what inflation does. It’s your money, so make it count. Invest wise, and you can beat inflation at its own game.

Q&A :

How does inflation impact stock market performance?

Inflation often leads to increased interest rates as central banks attempt to cool down the economy, which can make borrowing more expensive for companies, potentially slowing down their growth and reducing their stock price. Additionally, investors may seek higher returns to offset inflation, causing them to rethink their current investments and possibly shift away from stocks that don’t offer inflation-beating growth.

Can rising inflation result in a stock market crash?

Although inflation alone isn’t typically the sole cause of a market crash, it can be a contributing factor. High inflation can lead to a decrease in consumer spending power and increased costs for companies. If these conditions persist, they can seriously strain the economy and lead to lower corporate earnings and stock prices, potentially igniting a broader market sell-off or crash.

Why do some stocks seem to do well during periods of high inflation?

Certain stocks, often referred to as “inflation-resistant,” may perform better during times of rising inflation. These are typically found in sectors like energy, commodities, and consumer staples, where companies can pass on higher costs to consumers. Furthermore, stocks of companies with strong pricing power, low debt, and robust cash flows might also weather inflation better because they can adapt more easily to the changing economic environment.

How should investors adjust their portfolios in response to inflation?

Investors might consider adjusting their portfolios to include assets that traditionally hedge against inflation, such as Treasury Inflation-Protected Securities (TIPS), real estate investment trusts (REITs), commodities, and stocks in sectors less sensitive to inflation. Diversifying investments and focusing on companies with solid fundamentals that can sustain growth during inflationary periods might also reduce the potential negative effect of inflation on their portfolio.

What indicators should investors monitor to predict the impact of inflation on stocks?

Investors should keep an eye on the Consumer Price Index (CPI) and the Producer Price Index (PPI) as primary indicators of inflation. Additionally, monitoring central bank policies, particularly interest rate changes, can provide insights into how the financial markets may respond. Economic growth data, employment figures, and wage trends can also provide context for how inflation is influencing the economy and, in turn, stock prices.