Geopolitics Unraveled: Navigating Stock Market Turbulence with Insight

It’s no secret that How Geopolitics Affect Stock Markets can turn your investment green to red in a blink. As global dramas unfold, the ripples hit our wallets. Here, I slice through the complex dance between nations and your portfolio. We’ll tackle the big question: How do power plays on the world stage rock the silent numbers ticking on stock charts? From the tug-of-war in trade deals to sudden strife in oil-rich lands, I break down the chain reaction that can shake or shape your investments. Look past the headlines. Let’s dive into strategic moves for smarter plays in turbulent times. If you’re eager to learn how to stand firm when the geopolitical ground shakes, this insight-packed journey is for you.

Understanding the Ripple Effect: The Stock Market’s Reaction to Geopolitics

How International Relations Shape Financial Markets

Imagine a game of dominoes. Like those pieces, world events can knock into markets, causing waves. When countries get along, trade flows better, leading to happy investors and rising stock prices. But, when there’s trouble – think wars or tough talk between leaders – markets often react swiftly. Why? Because investors fear what might come next.

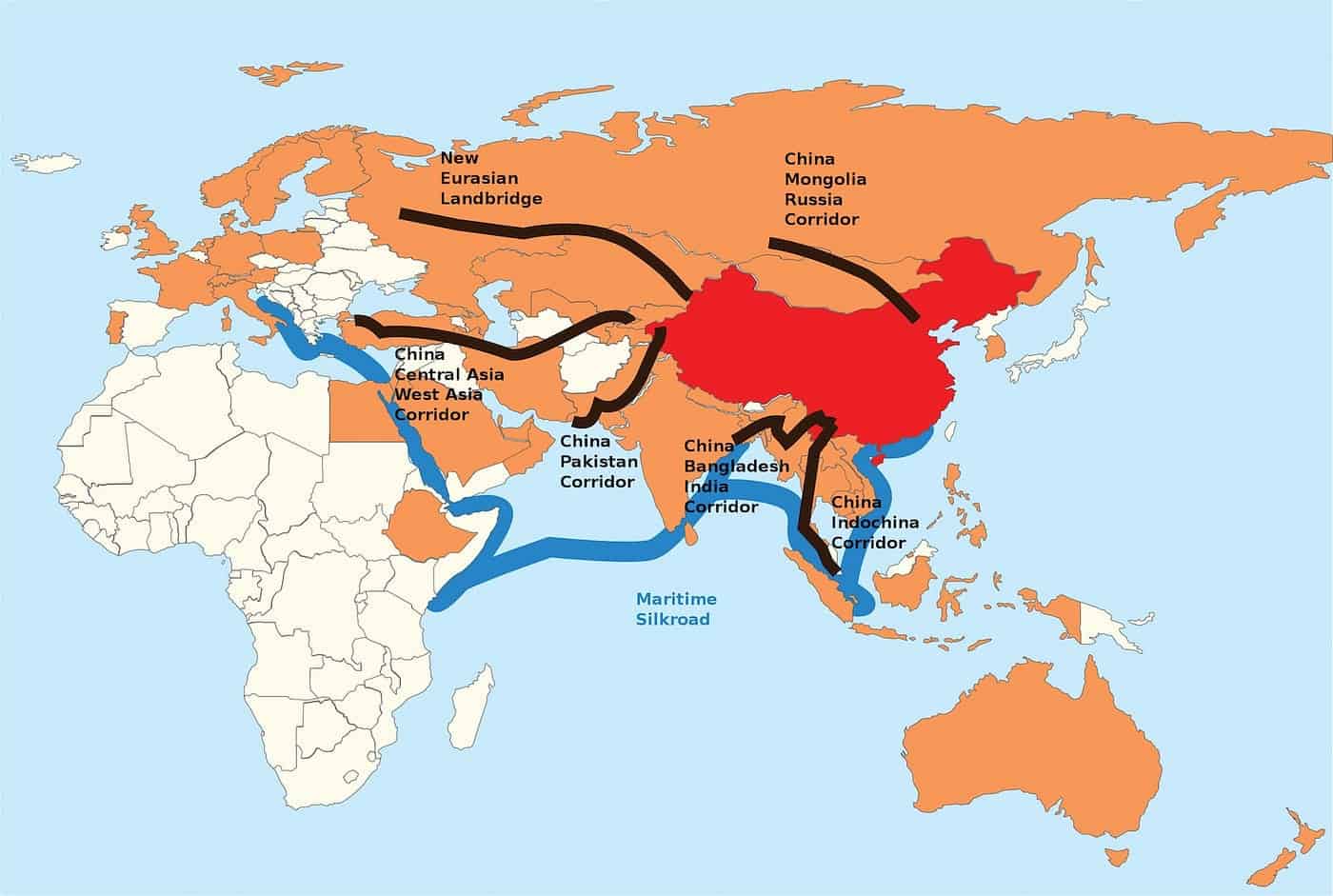

Countries talk and trade with each other daily. It’s a web of deals that tie everyone together. When two countries hit a rough patch, it can shake up this web. Let’s say a big country puts a ban on buying stuff from another. This ban can hurt both countries’ businesses and thus their stock prices.

Bad relations can lead to less trade, higher costs, and shaky investor trust. Good relations usually do the opposite. Keeping an eye on these ties can tell us where the stock market might head.

Tracking Global Crises and Their Immediate Impact on Market Volatility

Alright, let’s dive into crises and what they do to stocks. A global crisis is like a storm hitting the sea of the stock market. Boats (or stocks) might rock hard. Some might even tip over if the storm is bad enough.

Crises, be it wars or big upsets in a country, scare people. They also scare those who put money into stocks. Ever hear a scary noise at night? It makes you jumpy, right? Crises have a similar effect on the market.

Let’s talk oil now. Oil keeps the world going. When oil-producing regions get hit with tensions, prices can shoot up. This jitteriness over oil prices makes investors worry about costs everywhere – from flying planes to making plastic. When there’s trouble, even oil companies’ stocks can feel it.

Not to forget, if powerful countries argue or flex their military muscle, it can cause big moves in markets. This is because investors wonder if things might get worse, so they act quickly.

Every type of company, from tech to clothes makers, feels these ripples, though some more than others. Paying attention to such events is key for smart investing.

In a nutshell, watch how countries talk and act with each other. It shows how waves might hit our stock market ship. And in the world of money-making, we all want to sail smooth, don’t we? Keeping track of these often unseen ties helps us steer clear of rough waters and find the calm seas where our investments can grow.

Strategic Investing Amid Political Uncertainty

Weighing Geopolitical Risks in Investment Decisions

Investors must think about global events. These events can shake up stock prices. When a country faces trouble, it can hurt investments. Imagine there’s a big protest. Stocks in that place might fall. Money likes peace, not chaos. So, as investors, we stay alert to risks. Big changes in one spot can spread to the whole market. We always check where trouble might come next.

Risk is about what could go wrong. We look at things like wars, trade fights, and big changes in government. They all can change stock values. We decide what to do by how much risk we see. Sometimes we avoid places with lots of trouble. Other times we see a chance to buy at low prices. We balance the possible gains with the possible losses.

Foreign Policy Shifts: Navigating Equity Performance

Now, let’s talk about foreign policy. This means what one country decides to do with others. It can include things like making friends or starting fights. When these policies change, it can make stocks go up or down. Say one country puts taxes on goods from another. This can make stocks fall. But if countries agree to work together, stocks might rise.

If one big country starts a fight with another, it can scare investors. People may sell their stocks fast. This makes prices drop. But if those countries talk and fix things, prices can go back up. We use this info to choose which stocks to buy or sell. We look at how countries act and guess what they’ll do next.

Oil prices also move with these tensions. A fight over oil can make prices jump. So we watch how countries that have oil get along with others. This helps us know what might happen with oil stocks.

We also watch for fights over land or rules. These fights can hurt trade. If trade gets tough, companies may lose money. This makes their stocks less worth it. So we have to think about this when we pick stocks.

Elections can change things too. A new leader might change policies. This can make the market shake up. If we think the new person will help businesses, stocks may go up. But if we’re not sure, it can make the market swing.

Unrest in a place is risky for investing. If things are bad, it’s hard to tell if stocks will do well. So we look at countries with protests or fights with care. We need to know if putting money there is safe.

Defense stocks can be different. If a place is in a fight, these stocks may go up. But we have to think if this rise is short or for a long time.

The mood of the market changes with world news. So we listen and look at many sources. We want to catch the news that can move stocks. By doing this, we stay ready for anything the market brings. We use all this to help people make smart money choices. We want your stocks to grow, even when the world is uncertain.

Sector-Specific Shockwaves: From Defense to Energy

Military Movements and Their Influence on Defense Stocks

Military actions matter a lot to defense stocks. When armies move, stocks can leap. Why? Fear and safety mix in strange ways. People think, “If tanks roll, profits will too.” It’s not just about war. Even a hint of fight can send defense stock prices up.

Just picture a big country moving troops near a border. Spooked yet? So is the market. Defense companies make stuff like tanks, jets, and ships. They see more orders coming their way when things heat up. Money follows orders—more orders, more money. It’s a reflex.

Investments here hinge on peace or peril. A stable world? Defense stocks may dip. But rumble drums of conflict? They jump. It’s a tense dance between risk and return. Investors keep a sharp eye on global spats. They move cash fast, chasing the next hot—or not—conflict.

Oil Price Instability in Times of Geopolitical Tensions

Oil prices are a wild ride when global fights flare up. Countries spar, and oil markets quiver. Why do they care? Oil is power. It’s the blood of economies, fuelling cars to countries. When countries clash near oil, prices can spike. Everyone needs oil. So when supply lines look dicey, wallets open wider.

Take a country that relies on oil—a lot. If nearby trouble threatens its oil, things get real, fast. Big buyers panic. They stock up, pushing prices high. On the flip side, when peace talks bloom, prices often slip back, easy as a summer breeze. It’s a seesaw of nerves and relief.

Investors watch every oil-fueled tension. They guess the next twist in the saga. Up or down? Safe or sorry? Their choices shape our gas prices—no small thing. Just a hint of trouble can rock the boat. It’s why keen eyes stay locked on turbulent spots, ready to ride the next oil wave.

Economic Diplomacy and Market Movement

The Effect of Sanctions and Trade Wars on Investment Portfolios

When a country faces sanctions, stock prices often fall. This makes sense; sanctions hurt a nation’s economy. They can limit how much goods it can sell and buy from other places. Trade wars work the same way. They scare investors and can make stock markets go down. Think of trade wars like a big, scary bully. Everyone is nervous, not sure what they will lose. This can lead to less money in investor pockets.

But let’s dive a little deeper. Say one country doesn’t play nice, and others slap sanctions on it. This country might not sell its goods out. Other countries might not sell to it. Its businesses could hurt bad, and the stocks in these companies? They go down too. If you own stocks from this country, you might lose money.

What about a trade war? It’s like a fight over who sells what and where. Tariffs are like punches in this fight. They are extra costs on goods from another place. These costs can make goods pricier and harder to get. If two big countries are in a trade fight, it can shake up markets big time. Stocks don’t like this, they might drop because people get scared and sell off.

Investors need to watch for these signs. You might have to change what’s in your portfolio. You see, it’s all about risk. And when things get rocky, playing it safe can sometimes pay off. Having a mix of stocks, bonds, and cash might help. It can keep your money safer when times are tough.

Peace Treaties and Their Potential to Propel Market Uplifts

Peace is good, not just for people, but for stocks too. When countries make peace, it’s like the sun comes out after a big storm. Everyone is happy, and this shows in the stock markets as well. A peace treaty can make stocks go up because it takes away some big fears. Wars are expensive and risky, and they can wreck economies. But when there’s peace, money that was for fighting can help rebuild. New deals are made, and businesses can grow again.

But, what does this mean for you? When peace is on the news, it might be a good sign for your stocks. Countries that have been fighting might start trading again. This can be great for stocks in those places, and around the world too. If you’re wise and quick, you can use this news to make some smart moves.

In all, keeping your eyes on world news is key. It can tell you when to stick with your stocks or maybe when to switch them up. Peace or fights, sanctions or trade wars, they all make waves in the market. And if you surf these waves right, you can keep your money safe and sound.

In this post, we’ve explored how world events shake the stock market. We saw how politics can guide the rise or fall of the markets. From the impact of global crises on market swings to the role of defense and energy sectors in times of unrest, it’s clear that the international stage plays a big part in financial shifts.

We’ve also talked about smart investing when the political scene is shaky. Knowing how shifts in foreign policy can affect stocks is key. And let’s not forget the big waves that sanctions, trade wars, and peace treaties can make.

Remember, it’s all about staying alert and understanding the signs. Watch the news, think about how it links to the market, and make wise choices. That’s how you’ll stay ahead in the investing game, even when the world throws curveballs. Let’s keep our eyes open and invest smart!

Q&A :

How does geopolitics influence global stock markets?

Geopolitical events can significantly impact global stock markets as they contribute to uncertainty and risk. When political tensions rise, like during elections, conflicts, or trade disputes, investors may become cautious, leading to volatility. Geopolitical risks can also affect supply chains, currency values, and commodity prices, all of which can sway the direction of stock markets.

Can geopolitical uncertainty affect my investment portfolio?

Yes, geopolitical uncertainty can affect your investment portfolio. Stocks, bonds, and commodities can all react to events such as military conflicts, economic sanctions, or diplomatic relations changes. Diversification across different asset classes and geographic regions is a common strategy to mitigate the risk of stock market fluctuations due to geopolitical tensions.

What types of geopolitical issues have the most impact on the stock market?

The types of geopolitical issues that typically have the most impact on the stock market include wars and conflicts, terrorist attacks, trade wars, sanctions, and political unrest. These issues can lead to economic sanctions, supply chain disruptions, and shifts in global trade patterns, which can cause uncertainty and affect investor sentiment.

How should investors respond to geopolitical tensions?

Investors should respond to geopolitical tensions with caution and a long-term perspective. It’s important to avoid making impulsive decisions based on the latest headlines. Maintaining a well-diversified portfolio and keeping track of how these tensions could potentially affect market sectors or individual investments is advisable. Consulting with a financial advisor during such times can also provide tailored advice based on your risk tolerance and investment goals.

Are there opportunities in the stock market during geopolitical crises?

Yes, while geopolitical crises can create volatility and uncertainty, they may also present opportunities for investors. For instance, certain sectors such as defense, energy, or utilities may benefit during these times. Savvy investors may find undervalued stocks or other investment opportunities if they do thorough research and have a clear understanding of the potential impacts of the ongoing geopolitical crisis.