How are ESG Funds Performing? It’s the big question on every impact-driven investor’s mind. You want to know if your green dollars are just doing good or also doing well. Let’s dive into the nitty-gritty. Are these funds keeping pace with traditional benchmarks? Can they adapt and thrive in a volatile market? I’ve got the know-how to unpack the numbers and trends. Stay tuned; we’re about to peel back the layers on ESG fund performance.

Analyzing the Recent Performance of ESG Funds

ESG Investment Returns vs. Traditional Benchmarks

Are ESG funds beating the old guard of investing? In some cases, yes! ESG investment returns often shine. We see this when stacking them up against traditional benchmarks. Why? They focus on forward-looking, sustainable practices. This approach can lead to steady, long-term gain.

Still, it’s not a clear win across the board. Some traditional funds outdo ESG ones in the short burst. Yet, it’s the race, not the sprint, that counts here. Long-term matters because that’s when ESG’s benefits can really show. For instance, a company that cares for the planet might do better over time. Why? Its ways won’t harm its future chances to succeed.

Green Funds Success Rate and Market Adaptability

How are green funds holding up? Pretty well, I’d say. The green funds success rate sparks interest. People see them as future-proof bets, and that’s gold in the market. They adapt fast to the changing tides of customer wants and rules. Green funds are not just about being green anymore. It’s also how they fit into our ever-changing world.

But they are not without their challenges. The market’s a tough crowd to please. It’s a space where only the strong survive. And survive they must, in a world where green is becoming the norm. How they change with the times is key.

The market asks, “Can you stay green and still make me money?” Green funds have to prove they can. And so far, many have done just that. They’ve shown they can duck and weave through market ups and downs. They keep a steady pace, even when times get tough.

In the dance of supply and meet, where green meets growth, adaptability is king. It’s not enough to slap on a green label. The green funds that win are the ones that really get what people and the planet need. They’re spreading their roots deep into the world of smart money moves.

When we look at ESG mutual funds track record, we notice something cool. They hold their own quite well, thank you. Why is this? Because smart folks like you and me care where our money sleeps at night. We want it resting with the good guys, the green giants, the ones looking ahead.

It’s a journey, you see. We’re riding with ESG towards a better future, in profits and in planet. So let’s take the wheel and steer towards that green horizon. It’s not just a fad. It’s the track we’re laying for a world that keeps on spinning, sustainably. And that’s the ESG bet. It’s where doing good and doing well walk hand in hand, into a future worth investing in.

How are ESG Funds Performing? Unveiling the Impact-Driven Investment Results

Evaluating ESG Impact on Portfolio Construction

When we pick stocks, we look at ESG scores just like we look at price. Let’s dig into how that works.

ESG investment performance is a big deal for people who want their money to do good. You might ask, “Do ESG funds hold up against others?” The short answer is yes. In recent years, ESG funds have matched or even outperformed traditional funds. This is not only in profit but also in how they handle risk. It seems that doing good can also mean good business.

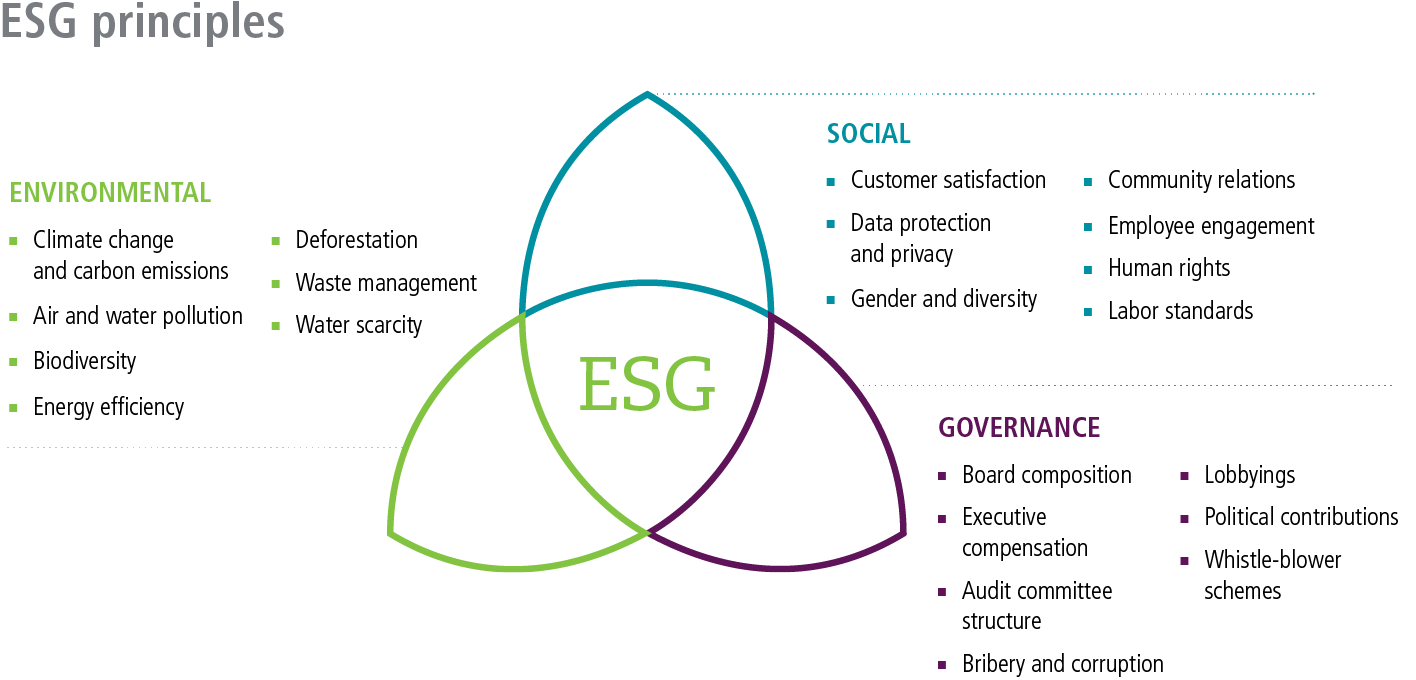

Let’s break that down even more. ESG funds focus on companies that care about the environment, look after people, and are run well. The idea is simple. Companies that do right by the planet and its people are better for the long run. They often have fewer scandals and are ahead of new laws on environmental care. So they can avoid fines and losses that others might face.

Also, people are placing more trust in businesses that stand for something beyond just profits. When people trust a company, they’re more likely to buy from it and invest in it. So good ESG scores can lead to better sales and more stable stock prices.

The Role of ESG Rating Systems in Fund Selection

Now, how do we know if a company is good on ESG? Rating systems! These systems check how companies do on ESG stuff and give them a score. Think of it like a report card that tells us if companies are being good citizens of the world.

Choosing the right ESG fund means looking at these ratings. They help us see which funds take their ESG game seriously. Funds with high ESG ratings often invest in companies that care about their impact. That can lead to money growing in a way that feels right.

But, it’s not just about feeling good. There’s money in these funds too. Funds that do well on ESG ratings have shown they can bring in the cash. This is true when markets are smooth and even when they’re wild.

So, ESG funds and ratings are about answering two big things. “Is my investment doing good?” and “Is my investment doing well?”. Turns out, the answer to both questions can be a strong yes.

If you’re thinking about where to put your money, ESG funds are worth a look. They’re not just about the warm fuzzies. They mean business. And they’ve got the scores to prove it. Remember, it’s about your values and your value. That’s the new way to build a portfolio that’s fit for the future.

As your guide in the ESG landscape, I see a future where our investments reflect our ideals. Where green is not just the color of money but the color of our conscience in action. ESG funds are not a passing trend. They’re a new standard in making money mean more. So, when we talk about the impact of ESG on portfolios, we’re talking about a change in how we define success. It’s about profit with a purpose. And it’s reshaping the investment world one dollar at a time.

Trends in ESG Fund Growth and Asset Management

Sustainable Funds’ Results and Investor Demand

People want to invest in what’s good for the world. That drives ESG fund growth. Many ask, “Are ESG funds doing well?” In short, yes. Sustainable funds often match or beat others in returns. They show us that doing good can also mean good profits.

Long-term Performance and Viability of ESG Investments

ESG investments are here to stay. We look at how they perform over years. Many ESG funds keep growing in value over time. They show that responsible investing can be smart for the long run. This means that putting money in ESG could be good for your future.

In our world today, money talks. And the voice of those dollars is becoming increasingly clear when it comes to environmental, social, and governance (ESG) investments. Even if it feels like a buzzword, ESG is making a massive impact on portfolios worldwide. Think of it as a force of nature reshaping the investment landscape. Now let’s dive into sustainable funds’ results and the investor demand driving their growth.

The success of sustainable funds isn’t based just on good stories or morals; their results speak volumes. These funds look at companies that care about the world – like those cutting pollution or treating people fairly. When we check how these funds have done, we see they stack up well, often on par or even better than traditional options. It’s no wonder they’re pulling in more cash.

Alongside firm financials and market trends, investors look for green, clean, and ethical choices. ESG funds have been effective at drawing this kind of interest. They’re not a niche anymore; they’re a choice for the smart investor. Socially responsible funds show strong growth, proving that making money and making a difference aren’t mutually exclusive.

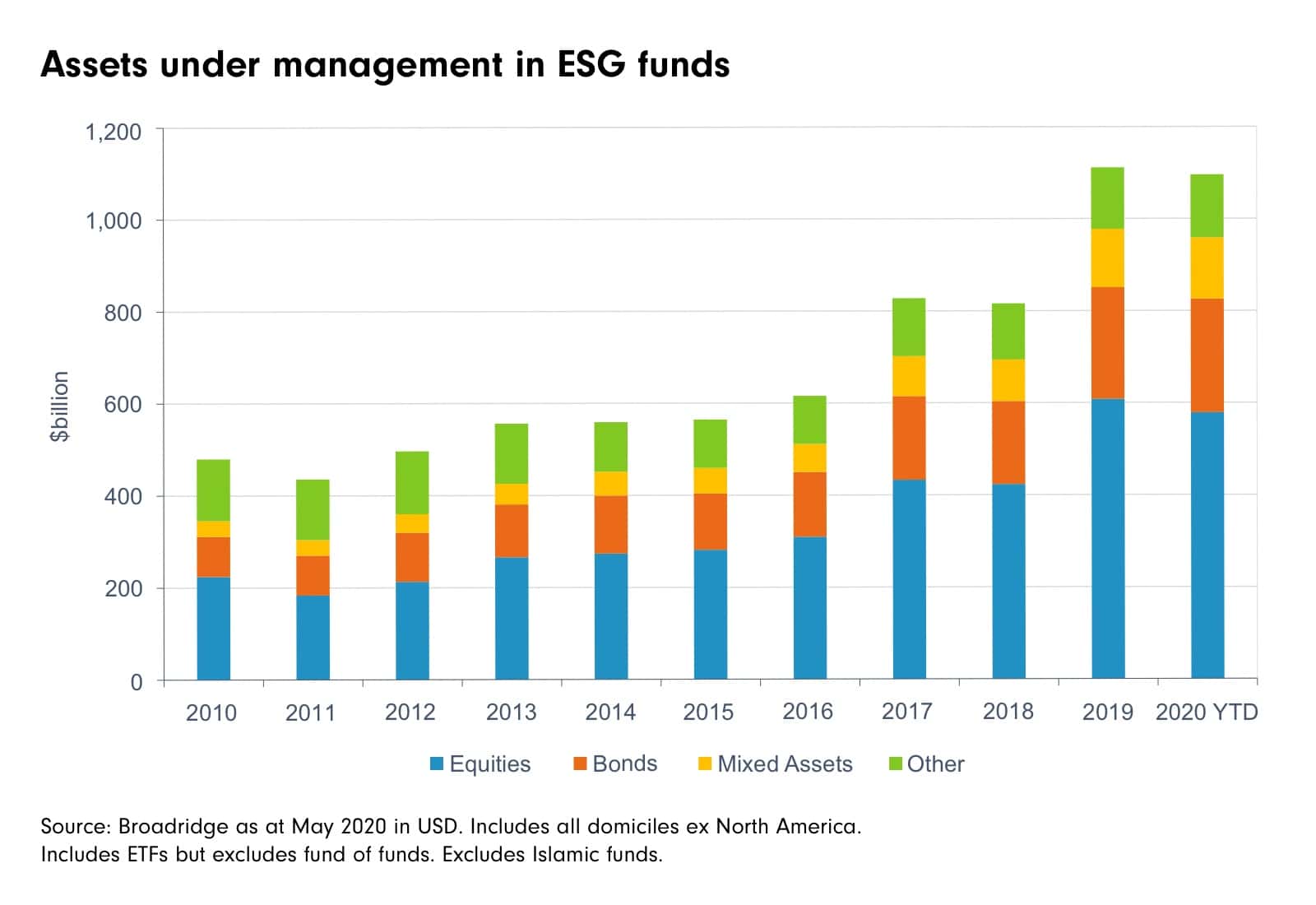

Now, walking hand in hand with returns is the growth of ESG assets under management. These funds are ballooning as more investors want in on the action. Companies who get high ESG ratings often see their stocks rise. More dollars fly their way as investors hunt for a blend of ethics and earnings.

I’ve seen portfolios swerve and shift toward ESG equities. These stocks offer a twofold benefit: they make an impact and can boost your bottom line. The robust track record of ESG mutual funds underlines how they’ve become heavy hitters in portfolios.

Now, let’s gaze into the crystal ball – long-term performance and viability. We know investing is a marathon, not a sprint. It’s all about how your funds fare over years, not days. ESG investments tick this box too. Their steady growth, driven by solid ESG criteria, confirms that they’re no passing trend.

And when you tally up the annual returns? Many ESG funds clock in impressively. It’s all about strategy, where ESG-focused asset allocation ties together purpose and profit.

Ethical investment profitability is not a myth; it’s a reality I’ve witnessed firsthand. Guiding clients through ESG portfolio management strategies has shown me the potential gains. Clients who once eyed ESG funds with skepticism now nod with understanding at their quarterly statements.

The essence of good ESG investment performance is strategic balance. You weave in climate awareness, social responsibility, and sharp governance. This bundle leads not only to green lights on the dashboard of current returns but also paves the way for a sustainable financial future.

ESG Risk Assessment and Compliance in Current Markets

ESG Investment Risk Assessment Practices

Analysts say that ESG funds are doing well. But how? Let’s break it down. Fund experts look at risks. They weigh ESG factors against possible harm to returns. They ask: Will this green fund grow? Can it handle a hard market hit? By measuring this, they aim to pick stocks that both do good and do well money-wise. Smart, right?

The process starts with screening. They sift through companies, keeping those with high ESG scores. It’s like picking the best apples from the bunch. Then they analyze deeper. They ask hard questions. Are these companies really green, or just look it? They check policies, power use, and how they treat workers. Every bit counts.

Once they have the good ones, it’s about balance. Too much in one area can risk the mix, like too many eggs making the cake too heavy. They spread the investment, across wind power, water, tech, and more. The goal? A strong, diverse group that can face market storms.

Next, comes the review – the homework check. Is the fund meeting its goals? Are the companies inside keeping promises? They look at both the numbers and the news. Success isn’t just in dollars earned but in harm avoided. It’s a tough job but key to keeping ESG funds on track.

In short, it’s all about being careful, picking stocks that help the earth, society, and governance. That way, investors can feel good and maybe make good money too. It’s not easy, but with the right tools and sharp eyes, they find paths to profit with a purpose.

Aligning ESG Strategy with Financial Returns and Compliance

Here, we connect the dots. ESG isn’t just about being good; it’s about smart money moves too. Funds must follow rules to make sure they’re on the level. They must prove they’re true to their word on ESG. Show me, don’t just tell me – that’s the idea.

For example, a fund says it’s all about clean air. The law might say, prove it. So they show investments in firms that cut emissions, that make our air cleaner. That’s proof. It’s walking the talk. And the win-win? If they choose well, they might see profit as these companies grow.

It’s a fine line to walk. Go too far in one direction, risk drops – but so could returns. Lean too hard the other way, make more money – but at what cost? This balance is what they’re after. This keeps investors coming back, knowing their cash is doing right and being wise.

As for laws and rules, they keep the playing field fair. They stop greenwashing – when a fund looks good outside but is not inside. Rules make sure funds tell the truth, keep promises, and stay on course.

Managing ESG funds is a mix of caring for the world and smart investing. It’s about being good citizens, all while eyeing that bottom line. And let’s face it, that balance? It’s not just nice to have, it’s a must-have, now and in times to come.

In this post, we took a hard look at ESG funds and how they stack up. We saw that these funds often match or beat old-school investments. The green funds know how to roll with market changes, pretty cool! We also dug into how ESG scores shape where money goes. Smart fund picks use these scores to build strong portfolios.

We watched how ESG funds are getting bigger and pulling in more cash. These funds are not just a flash in the pan; they’re here to stay and keep growing. Lastly, we covered how to balance ticking the ESG boxes while still making money.

ESG is changing the game. It’s more than a trend – it’s smart money that does good and performs well. Keep your eye on ESG; it’s not going anywhere soon. Stick with it and make choices that count for your wallet and the world.

Q&A :

How Do ESG Funds Compare to Traditional Funds in Terms of Performance?

Environmental, Social, and Governance (ESG) funds are gaining traction among investors who seek not just financial returns, but also a positive impact on society and the environment. When it comes to performance, studies have shown that ESG funds can compete with—and sometimes outperform—traditional funds. This is partly because ESG considerations may lead to better risk management and more sustainable long-term investment strategies.

What Are the Prospects for ESG Funds in the Current Market?

The prospects for ESG funds look promising given the growing emphasis on sustainability and social responsibility amongst both consumers and corporations. With policies supporting greener economies, particularly in Europe and increasingly in other parts of the world, ESG funds are expected to attract more capital. Moreover, as more companies improve their ESG practices, the universe of investable assets for ESG funds is expanding, which bodes well for their future growth.

What Impact Has the COVID-19 Pandemic Had on ESG Fund Performance?

The COVID-19 pandemic has brought social and governance issues to the forefront, highlighting the importance of investing in companies that prioritize stakeholder welfare and robust governance structures. During the pandemic, many ESG funds have demonstrated resilience, and in some cases, outperformance compared to their non-ESG counterparts. This resilience is attributed to their focus on companies with sustainable business practices that are better equipped to handle crises.

Are There Any Specific Sectors Where ESG Funds Are Seeing Better Performance?

ESG funds that focus on sectors such as technology, healthcare, and renewable energy have seen particularly strong performance. These industries are often aligned with the principles of ESG investing, as they contribute to sustainable development and can have positive social impacts. Furthermore, these sectors are also growth areas in the economy, which aids in the potential for higher returns.

How Should Investors Approach Analyzing the Performance of ESG Funds?

Investors should approach ESG funds with due diligence, much like any other investment. This includes examining the fund’s investment strategy, ESG criteria, performance history, fees, and how it compares to benchmarks and peer funds. Investors should also consider their personal investment goals and risk tolerance, and understand that the ESG integration approach can vary widely among funds, impacting performance outcomes. It is crucial for investors to look beyond the ESG labels and assess the actual practices and performance metrics of the fund.