Impact Investing Surge: Why It’s Dominating 2023’s Financial Trends

Money talks, but now it’s starting to do some good too. Growing Popularity of Impact Investing is more than just a buzzword—it’s changing the game. This year, it’s why smart money is moving with purpose. You’re looking for profit, sure, but what if your cash could also tackle global issues? From climate action to social equality, investing is not just about the bottom-line anymore. In 2023, it’s about making waves—a financial splash with a ripple effect of benefits. Dive in as we ride the surge and show you why doing good with your dollars isn’t just possible; it’s profitable.

The Rise of Impact Investing in 2023

Understanding the Surge in ESG Investment Growth

Impact investing is making huge waves this year. But what’s driving this growth? People want their money to do good. They’re choosing investments that help our planet and society. It’s no fad – ethical investment is here to stay.

In 2023, we see money flow into funds that favor clean air, good jobs, and fair pay. Investors no longer settle for just making profit. They seek both financial returns and social impact. This shift shapes how companies act. Businesses aim for a triple-bottom-line: people, planet, profit. They find that doing good is good business.

Why care? ESG can lead to gains and a better world. Funds with high ESG scores often lower risks and can perform well. People, especially young ones, put passion into their portfolios. They look for companies aligning with issues they care about. For example, clean energy or education. These choices send a clear message to the market.

Ethical Investment Strategies Driving Change

Now let’s dive into ethical investment strategies. These methods mix profit with improving society. But can money really create change? You bet. Take green bonds, for example. They fund projects like wind farms and green buildings. Investors grab these up, knowing they help fight climate change.

Investment firms now offer portfolios tailored to moral values. They screen out bad actors and support progressive ones. What’s the result? Companies are pushed to act right. Impact investing isn’t just for the rich or for charity. It’s a real choice for anyone saving up.

Impact investing platforms rise, too. They let people with less to invest join in on the action. These platforms are a game-changer. They connect small-scale investors to major global projects. It’s a win for all – small investors, big projects, our world.

Ethical investment doesn’t stop with the market. It flows into all kinds of business areas. For instance, social venture capital. These funds back new companies aiming to solve social issues. Success means more than cash back. It’s about seeing real change in communities and beyond.

To sum it up, people today urge for investments that mean more. They want to see their money work toward a world they believe in. ESG growth isn’t just numbers on a screen. It’s about cleaner air, better jobs, and stronger rights. And in 2023, this mindset is more popular than ever. It’s reshaping finance for the better. It’s all about investing with purpose.

Investors used to ask, “How much?” Now they also ask, “What for?” And when we look at where our money can go, the reasons are clear. We have a chance to make a difference. That’s why impact investing not only grows but thrives. It’s because we all share one wish – to leave things better than we found them. And if we can make a profit while doing that? Well, that’s just smart investing.

The Financial and Social Returns of Sustainable Investments

Balancing Financial Returns with Social Impact

Impact investing is hot in 2023. Why? People and profit now join hands. Investors don’t just want money back; they want to improve the world too. For real! Socially responsible investing blends good deeds with smart money moves.

We see this play out every day. Folks invest in companies that care for people and the planet. This isn’t a nice-to-have. It’s a must-have. And the cool part? It pays off. Ethical investment strategies are big in the finance world right now. They prove you can earn cash and do right by the world. Triple-bottom-line investing checks this box—it covers profit, people, and planet.

Imagine this. You put money in a firm that fights pollution. Over time, the company grows because clean air wins. Your pocket grows too. You score cash while air gets clean. Win-win! Investors like these plays. They hunt for these chances. They want their money moves to mean something more.

The Role of Green Bonds Expansion in Portfolio Diversification

Now let’s talk about green bonds. They’re a huge part of this new trend. Green bonds pour cash into clean energy, public transport, and more. They’re like a power-up for your portfolio! By investing in green bonds, you mix it up. Not all eggs in one basket, right?

What makes green bonds cool? They help the Earth and they’re safe bets. If you’re looking to diversify, green bonds are golden. They give organizations funds to fight climate change and they give you stability.

Sustainable investments are more than just trends. They’re the new norm. ESG investment growth is proof. People are all in. They mix their goals for a better world with their money smarts. Social venture capital and community development financial institutions get this. They funnel funds to help society. We all know money talks. Here, it talks for good.

Let’s not forget the UN Sustainable Development Goals finance. These goals give us a clear map. They show us where money can make a real impact. When we team up cash with these goals, magic happens. We tackle hunger, improve health, and boost clean energy.

Being an expert in this realm, I see the change firsthand. Big funds are now impact investment funds. That’s a win for our future. Investors crave not just financial returns but social impact too. It’s not just about feeling good. It’s about making actual change. This isn’t a passing cloud. It’s here to stay. And it’s changing the way we think about our money and our morals.

Who Are Today’s Impact Investors?

Profiling Socially Conscious Investors

Impact investing speaks to those who want their money to matter. Who are they? They are individuals who want to see their investments bring about social or environmental change, all while still making a profit. Traditionally, it was thought that only the wealthy or philanthropic individuals took part in impact investing. Today, this isn’t the case. It’s a diverse group, from young professionals to seasoned investors who are reshaping what it means to invest.

Millennials and Their Pivot Towards Investment with Purpose

Millennials are greatly behind the wave of impact investing. They are saying ‘yes’ to sustainability and ‘no’ to investments that harm our world. By 2030, they will inherit over $68 trillion from the Baby Boomer generation. This wealth transfer might further boost social responsible investing. Why? Because millennials are picking stocks and funds that align with their values. They prefer triple-bottom-line investing, which looks at social, planet, and profit factors.

They are not just about making money; they care about the stamp they leave on the world. They are turning the tide, pushing companies towards ESG investment growth. They believe they can make a difference in solving world challenges, like poverty or climate change. Their choices put the spotlight on ethical investment strategies. They value transparency in how companies operate and the impact they have on society.

Millennials are rewriting the rulebook for investing. They are saying ‘show me how my investment is improving society’, not just how much it earns. They want financial returns with social impact, and they are willing to seek out and support the funds that can offer this. Impact investment funds are rising to meet this demand, offering opportunities to invest in areas like education, health, and clean energy.

Social venture capital is also gaining traction among millennials. They’re drawn to startups with a mission to solve pressing social issues, using innovation and market solutions. This is part of why green bonds expansion is gaining momentum. Bonds that fund projects with environmental benefits are appealing because they combine the security of fixed income with positive planetary impact.

To sum up, today’s impact investors, led by millennials, are more than just investors. They’re change-makers. They care about ethical investment strategies and improving society through their investments. They’re the driving force behind the impact investing surge, transforming how we think about wealth, success, and business responsibility. They believe in the power of their money to push companies towards sustainable practices and to effect real, measurable change both in the market and in the world at large. The future of finance might just be in their hands, pushing all of us towards a more sustainable and equitable world.

Measuring the Effectiveness of Impact Investments

Tools and Metrics for Measuring Impact in Investing

When it comes to impact investing, the big question is, “How can we tell it’s working?” We want to see clear signs that our money is doing what we hope — making a real difference. The way to see this is by using certain tools and checking specific metrics.

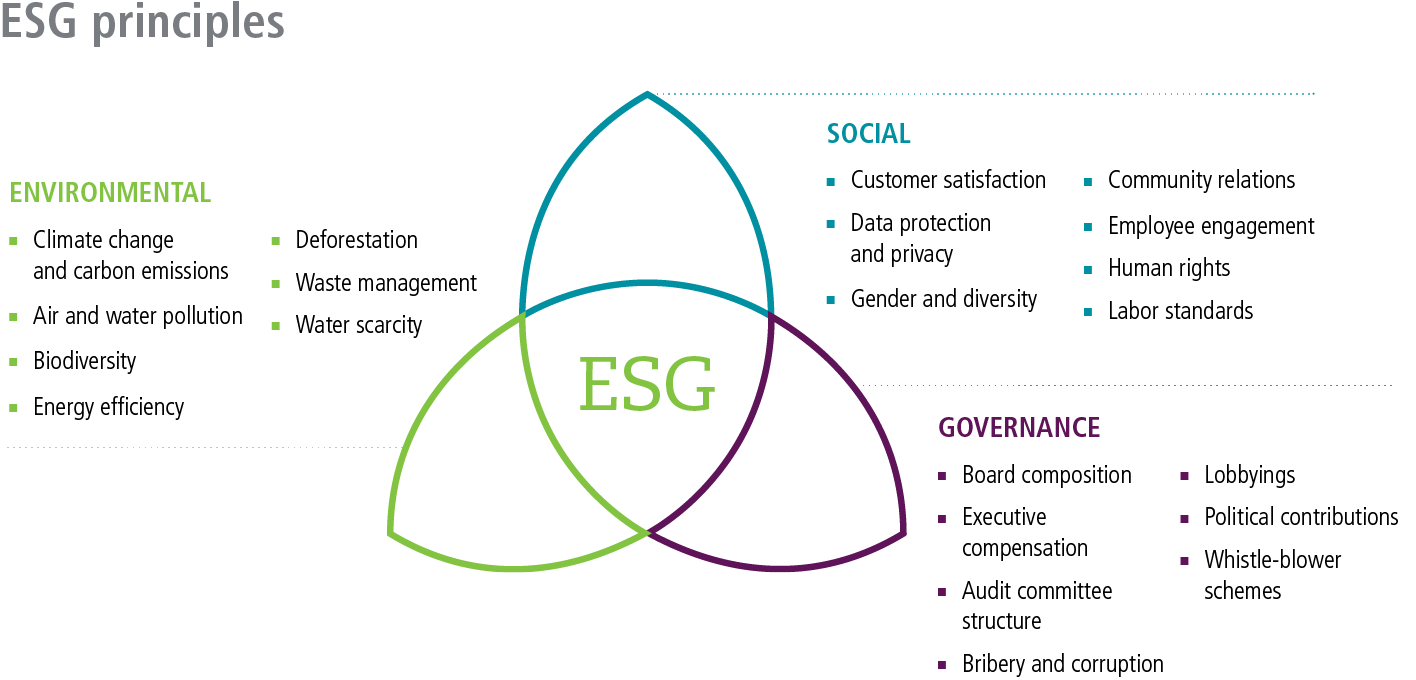

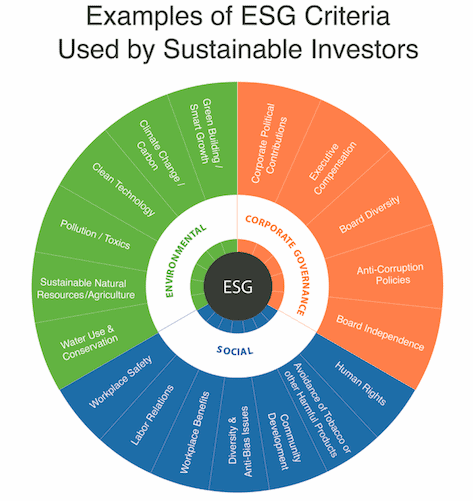

One critical tool is ESG reporting. It tells us how a company we invest in performs on key areas like caring for the planet and treating people fairly. These reports show a company’s inner workings, like how much they pollute, if they’re fair to workers, or if they do business honestly.

But we need more than just reports. We also use impact investment benchmarks. These are like measuring sticks for success. They compare impact investments to regular ones. The aim is to see which investments help the world more while still making money.

For instance, the UN has its Sustainable Development Goals (SDGs). These goals guide us toward a better world for all. Investment funds that align with these goals can say, “Look, we’re not just making money, we’re also helping achieve something big, like zero hunger or good health.” It’s a powerful way to show impact.

We also have environmental impact metrics. These metrics help us see how an investment affects nature. They can measure anything from how much clean water gets saved to how many trees get planted.

What’s great about impact investing is that it’s not just about giving. It’s also about making a smart choice with your money. Good impact funds give financial returns while fixing real problems. Think about it like this: It’s money that grows, and as it does, it helps people and the planet.

Aligning Investments with Global Goals and Positive Change

Impact investing is more than making money. It’s a way to join in solving the world’s big problems. By picking investments that match the UN’s goals, we’re putting our money into a brighter future for everyone.

It’s not only about the big players. Everyone can help shape the market by demanding these types of investments. When we choose to put our money in companies that care, we send a message. We tell businesses that how they act in the world matters to us as investors.

For example, when we buy green bonds, we’re putting our money to work in projects that protect our planet. That’s something to feel really good about. And it’s not just a nice idea — green bonds are growing fast, and they’re showing they can keep up with other types of bonds in making money.

Knowing that our investments are making a positive change is a win-win. And let me tell you, there’s a lot of pride in seeing your investment make a difference. It’s about more than just profit; it’s about being part of a cause bigger than ourselves.

This wave of change shows no sign of slowing down. In fact, with every year, more people want their investments to reflect their values. We’re measuring what matters, and by doing so, we’re creating a new era of investing — one where doing well by doing good isn’t just a slogan, it’s reality.

In this post, we dove into impact investing’s big leap in 2023. We looked at why ESG investing is on the rise and how ethical strategies are making waves. We also explored how sustainable investments can balance making money with doing good, and how green bonds help spread out investment risks.

Next, we uncovered who’s putting their cash into these investments today. It turns out, millennials are leading the charge, seeking profits that also serve a purpose. Lastly, we reviewed how to tell if impact investments are really hitting their marks, tying them to global goals for a better world.

As an expert in field, my final take is this: Investing with your values doesn’t mean giving up gains. It’s clear that impact investing is not just a trend; it’s a powerful way to shape our future while also aiming for strong financial returns. So, think of your investments as tools for positive change, and watch them work wonders for your wallet and the world.

Q&A :

What is impact investing and why is it gaining traction?

Impact investing refers to investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. This approach to investing is gaining traction as more investors seek to align their investment choices with their values and desire to contribute to tangible positive change in the world.

How does impact investing differ from traditional investing?

Traditional investing primarily focuses on achieving the highest financial returns, often without considering the social and environmental impact. On the other hand, impact investing aims for both a financial return and a deliberate and measured contribution to social or environmental good, adding an extra layer of purpose to the investment process.

What are some common areas of focus in impact investing?

Common areas of focus in impact investing include renewable energy, sustainable agriculture, healthcare, education, and social housing. Investors may target specific UN Sustainable Development Goals (SDGs) or seek out companies and projects that demonstrate a commitment to positive change in any of these sectors, among others.

Can impact investments also be financially profitable?

Yes, impact investments have the potential to be financially profitable. Many impact investors seek competitive returns and believe that companies with sustainable practices are better positioned for long-term success. A well-strategized impact investment can offer similar or, in some cases, better returns compared to traditional investments.

Who typically engages in impact investing?

A diverse group of investors engages in impact investing, including individual investors, family offices, foundations, pension funds, and private equity firms. The common thread among these investors is a shared commitment to achieving social and environmental outcomes along with financial returns.