The Future of Digital Payment Platforms: The Next Transaction Revolution?

Imagine a world where buying and selling happen with a tap, no cash required. That’s the future of digital payment platforms, and it’s closer than you might think. With each tap, click, or swipe, the ways we exchange money are evolving fast. From blockchain shaking up how we see security and transparency to biometrics ensuring that only you can access your funds, payment tech is advancing in leaps. In this dive into digital dollars, we’ll explore how up-and-coming tech might make us forget the feeling of paper bills in our wallets. Get ready to glimpse a life where your payments are faster, safer, and smarter than ever before.

The Rise of Blockchain and Cryptocurrency in Digital Payments

Implementing Blockchain for Secure and Transparent Transactions

Hey there! Let’s dive into how digital payments are changing. First off, blockchain is big news. It’s making our online buys safer and clearer for everyone. It’s like a digital ledger that everyone checks. This means we can trust our money is safe when buying stuff.

Now, you might ask, “What is blockchain in digital transactions?” Simply put, it’s a way to keep a record. With it, no single person can claim they didn’t get that cool new toy or book. Each step is recorded and anyone can check it. It cuts the chance of tricks or mix-ups.

When we use blockchain, each payment gets its own unique code. Think of it like a secret handshake that only you and your friend know. This code gets added to the big digital book for all to see. Now, this doesn’t show your private stuff, just the deal details. Smart as this is, it’s the future for buying things online or with a tap of your phone.

This brings us to the magic of digital wallets security. Wallet apps can now keep your money in a digital form. They are getting safer as blockchain steps in. Imagine locking your piggy bank with a puzzle only you can solve. That’s what it’s like!

And not just that, blockchain is pals with another cool tech – cryptocurrency. These digital coins are using blockchain to make trades safe as houses. They make sure no one is printing money in their basement. Every coin is checked and accounted for.

So, what’s coming next? We’ll see even more payment platforms integration. This means no matter where you shop or who you bank with, you can use your digital cash. The world is like one big store, and your money is good everywhere. Fast, safe, and easy – that’s the goal.

The Integration of Cryptocurrency Payment Gateways in Commerce

Moving on, let’s chat about cryptocurrency payment gateways. These are like bridges between online stores and your digital money stash. Think of it as a train that carries your crypto coins right to the seller’s door.

Businesses are now joining the crypto train. Why? Well, it’s fast, it’s global, and it skips a lot of the usual bank hassle. Have you ever waited days for a check to clear? With crypto, it’s like snapping your fingers and poof, the transaction’s done.

Folks using these gateways can shop around the world without worry. Currency exchange rates? A thing of the past. Plus, this helps a heap with cross-border payment innovations. It means less wait and fuss for stuff from far off lands.

The more shops accept crypto, the more we’ll need good gateways. They turn your crypto into what the shop needs, be it dollars, euros, or yen. And it happens faster than a rabbit in a race – almost at lightning speed.

In the end, we are all heading towards a world where you can tap, click, and buy anything, anywhere. Cool, right? Remember, with blockchain and crypto, we’re not just spending. We’re stepping into a bold, new digital shopping world. So, stay tuned and keep your virtual wallet close – it’s about to get even more exciting!

Evolution of User Experience in Digital Payment Systems

Biometric Verification and AI-Enhanced Security Features

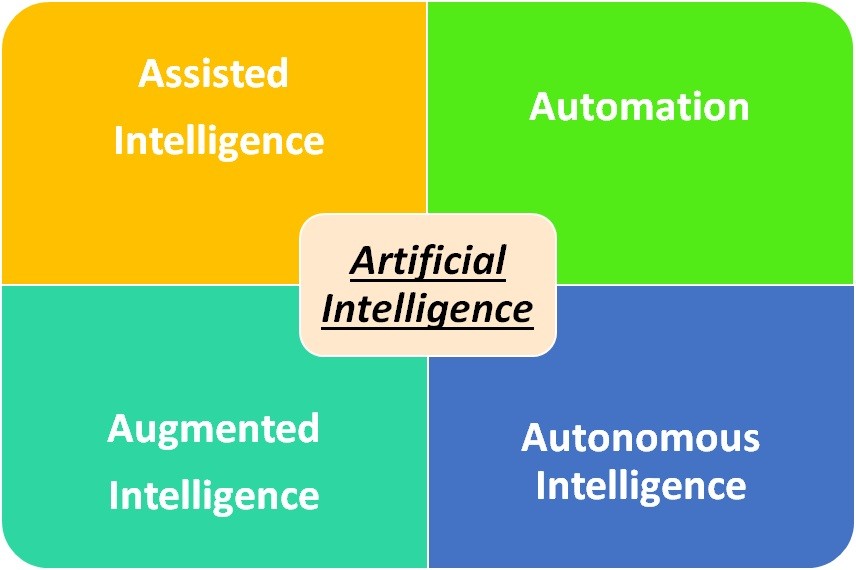

Paying for stuff is changing fast, and it’s all thanks to tech. Fingerprints and face scans are not just for spy movies anymore. They keep your money safe when you buy stuff. This cool stuff is called biometric verification. Your unique body features can make sure it’s really you. No one else.

Now, mix in AI – that’s artificial intelligence. It’s like having a super-smart guard checking every payment. The AI learns what’s normal for you and spots anything odd. This way, it stops fraud before it happens. It keeps getting smarter, too. Every time you buy something, it learns. So, it keeps getting better at keeping your cash safe.

Online shopping should be easy and fast, right? That’s where biometrics come in handy. And with the power of AI, even if a tricky hacker gets your card number, the AI will be like, “Nope, not going to happen.” It can tell it’s not you trying to buy that fancy bike from halfway across the world.

From Real-Time Processing to Seamless Checkout Experiences

Remember waiting days for a payment to go through? Well, those days are gone. Payments now can be super quick. We’re talking seconds. That’s real-time processing for you—this means no more twiddling your thumbs. Now, that’s handy when you’re in a hurry.

This fast paying thing doesn’t stop there. Imagine walking into a store, grabbing what you need, and just walking out. No lines, no waiting. That’s a seamless checkout experience. It’s like magic, but it’s all tech.

Your phone can do it all. Pay for a taxi, buy a snack, or send money to a friend. With a tap or a click, things happen – zap! And the cool part? All these smart folks keep making it better and better. We’ve got bright minds thinking up new ways to make paying for things the easiest thing ever. Like, what if you could pay by just talking to your phone? They’re working on that, too.

Businesses big and small are jumping on the digital train. They know it’s the future. You get happy, they get happy. It’s a win-win. And guess what else? This stuff keeps things fair. Anyone with a phone can join the party—no fancy bank account needed.

So, get ready. Paying for stuff is only going to get cooler and easier. And while it’s doing that, know that it’s also going to stay super safe and fast. That’s the future we’re heading into – full speed ahead!

The Drive Towards a Cashless Society: Innovations and Impacts

Contactless Payments and NFC Technology: Leading the Charge

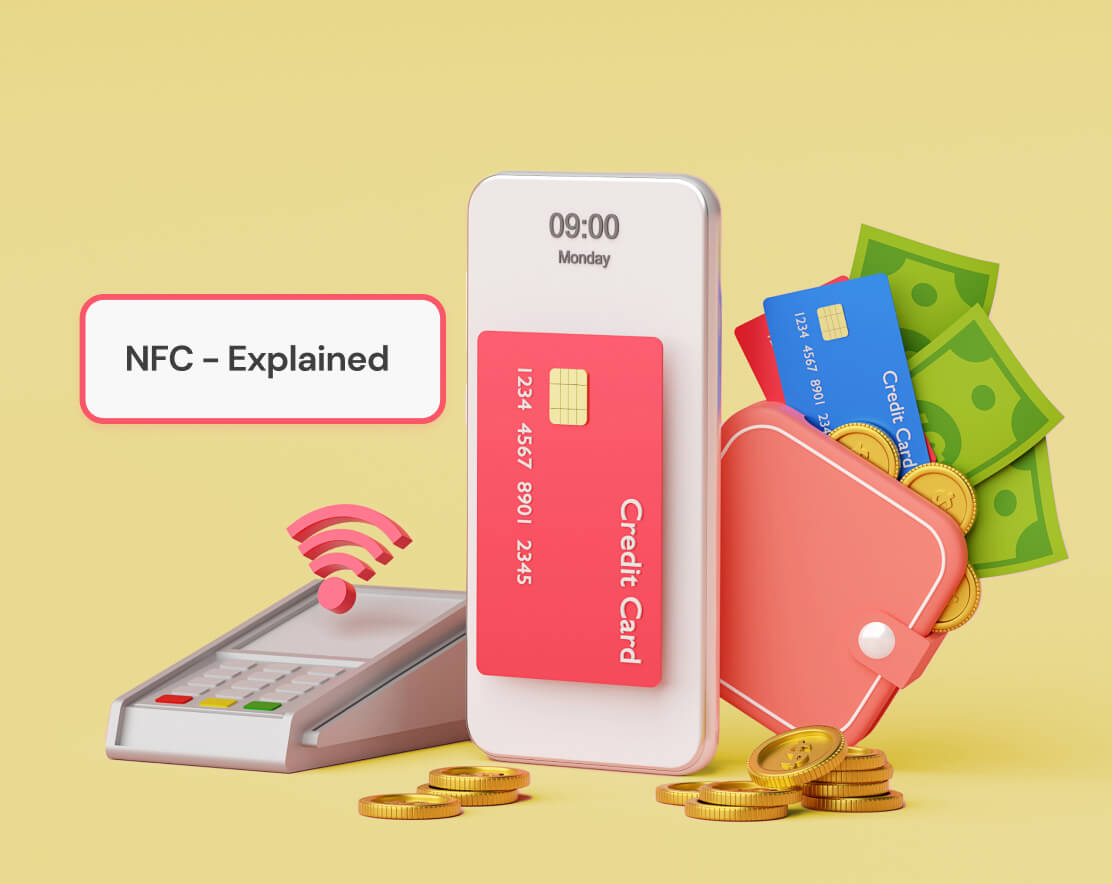

Remember waving a magic wand and things just happen? That’s NFC! It’s like magic for payments. Just tap your phone and bam, you’ve paid! NFC stands for “near-field communication.” It lets our phones talk to payment machines, quick and easy. No more digging for cash!

Contactless payment adoption is growing fast. In stores, on buses, and even vending machines, it’s everywhere. With NFC, you just tap your phone or card and you’re done. It’s safe too. Your info stays with you, so don’t sweat.

But why is NFC winning the game? It’s fast. Who has time to wait in line? With a quick tap, we’re on our way. It’s also safe. It uses a special chip that keeps our card details secret. That chip only talks to the payment machine when it’s super close. So, only the machine you’re paying knows your details.

This magic also works because our phones are now digital wallets. Just add your card to your phone, and leave that bulky wallet at home! Plus, with digital wallets, we’ve got extra security. They need your fingerprint or a code before you pay. Thieves can’t just take your phone and go on a shopping spree.

The Role of CBDCs in Shaping Future Financial Ecosystems

CBDC, short for central bank digital currency, is a big deal. Just like paper money, but digital and from the central bank. Imagine having dollars or euros, but they’re just numbers in an app. That’s CBDC!

How does it change things? It makes money flow like water in a stream. Straight from the central bank to us. No need for a middleman. This means we can get money faster and business can move quicker too!

CBDCs also shake up the game by being super reliable. Since they come from the central bank, they’re as real as the cash in your hand, maybe even safer. They can’t get torn, lost, or left in your other pants. It’s money made for our phones and computers.

But the coolest part? CBDCs can help everyone, not just folks with bank accounts. People all around the world, even in far-off places, can tap into banking. Just with a phone, they can join the party.

Financial inclusion is the name of the game. It’s about giving everyone a fair shot. With digital dough like CBDCs, more people can save, spend, and get in on the action. It can help lift folks up, because when everyone can play, the whole world wins.

So what’s the takeaway? NFC makes paying fun and fast; a tap here, a beep there, and you’re set. CBDCs are like your digital piggy bank, safe and sound in your phone. The future’s looking cashless and that’s pretty cool. It’s all about making life easier, safer, and more open for everyone. Keep an eye out, ’cause this is just the start of the payment revolution!

Navigating Regulatory and Security Challenges in Payment Platforms

Enhancing Digital Wallet Security Through Tokenization

Tokenization is making our money safe in digital wallets. It turns real card numbers into random numbers. These random numbers are called tokens. They are useful because they keep our card details secret. Hackers can’t do much with these tokens. So, if someone tries to steal them, our real card number is still safe. Tokenization is now a big part of mobile pay apps and online shopping.

When you tap your phone to pay, tokenization is at work. It’s the magic that happens in the background. Each time you pay, a new token is made. This means your info changes every time, making it hard for bad guys to copy it. Want a fun fact? Even if you pay at the same place, the token is never the same twice! Pretty clever, right?

Regulatory Adaptations for the Progressive Payment Landscape

Laws are changing because of new tech in money. We have things like mobile pay and buying stuff with just a wave of our phone. The people in charge need to make rules to keep this safe. They check on businesses to make sure they follow the rules. This is important so that no one gets tricked and our money stays safe.

Some new rules are about checking who you are when you make online accounts. This helps to stop folks from pretending to be you. Other rules are about keeping your data out of the wrong hands. And there are even rules for new things like paying with a watch or glasses!

The world of paying without cash is growing. So, people in charge have to think fast to make good rules. They work hard to balance keeping things safe and not making it too hard for us to use cool new ways to pay.

Mobile wallets and touch-free paying are on the rise. To keep them safe, there’s a push for rules that match the tech’s speed. So next time you buy a toy or a snack with your phone, remember, there’s a lot going on to keep your buy a smooth and safe ride!

In this post, we dived into how blockchain and crypto are changing how we pay. These techs make deals safe and clear. Shops are now taking crypto, which is big news.

We also looked at how paying for stuff has gotten better. Things like thumb prints and smart tech keep your money safe. And paying is fast and smooth now.

Plus, we saw how we’re moving to not using cash. Paying without touching and new digital money by central banks are big steps.

Lastly, we talked about staying safe and following rules with these new payment ways. Making digital wallets safe and new rules are important.

I think these changes are huge! They make life easier and safer for all of us. Let’s keep our eyes open for what comes next in paying for things.

Q&A :

What is the expected growth of digital payment platforms in the next decade?

The growth trajectory for digital payment platforms is incredibly promising. Experts predict a continued surge in adoption and usage, with factors such as the acceleration of e-commerce, advancements in fintech, and a shift towards contactless transactions driving growth. Over the next decade, increased smartphone penetration and technological innovations are expected to further boost the global market, making digital payments even more seamless and secure.

How will emerging technologies shape the future of digital payments?

Emerging technologies like blockchain, artificial intelligence (AI), and the Internet of Things (IoT) are set to revolutionize digital payments. Blockchain promises enhanced security and transparency, while AI is improving personalization and fraud detection. The IoT enables new payment scenarios through connected devices. These technologies are anticipated to streamline the payment process, reduce costs, and offer unprecedented convenience to users.

What trends are expected to dominate the digital payment landscape?

Several key trends are likely to shape the future of digital payment platforms. This includes the rise of mobile wallets, the increasing use of cryptocurrencies for transactions, the growing importance of real-time payments, and the potential widespread adoption of Central Bank Digital Currencies (CBDCs). Additionally, user experience is expected to remain a critical focus, with platforms continuously innovating to provide frictionless payment solutions.

Can digital payment platforms replace traditional banking?

While digital payment platforms are growing rapidly and offer many conveniences, they are unlikely to completely replace traditional banking in the near future. Banks are integrating digital technology to offer similar conveniences, and regulatory factors often necessitate a role for traditional banking. However, digital payment platforms will continue to coexist and increasingly collaborate with banks to provide a comprehensive suite of financial services.

Are digital payment platforms secure enough for widespread adoption?

Security is a top priority for digital payment platforms, and significant resources are devoted to ensuring transactions are safe. Technologies like tokenization, encryption, and multi-factor authentication contribute to robust security frameworks. While no system is entirely foolproof, continuous advancements in cybersecurity are making digital payments safer than ever, boosting consumer confidence and paving the way for wider adoption.