The future of digital payment platform security is shaping up, and it’s looking like a multi-layered shield against cyber threats. Picture a world where every transaction is not just a simple swipe or tap but a carefully guarded exchange in an impenetrable financial fortress. We’re moving beyond basic PINs and into an era where your unique features are the key to your cash. Let’s dive into the evolution, cast a glimpse at biometric breakthroughs and blockchain technology, and size up the regulations keeping our money matters locked down tight. Stay with me as we unravel the secure future we’re all banking on.

The Evolution of Payment Security and Its Trajectory

Tracing the Advancements: From PINs to Biometric Verification

Remember when we just had PINs to secure our cards? Those days are fading fast. As a security consultant, I’ve seen amazing leaps forward. Now we unlock our funds with a simple touch or glance. Biometric verification isn’t just cool; it’s our financial shield.

Biometrics now secure over half of all digital wallets. This means your unique features, like fingerprints or face, protect your money. No two people are alike, making biometric checks very safe. Fingerprints, once just for crime shows, now guard our most precious asset: our bank accounts.

Digital identity checks harness this power for every transaction. When you tap your phone, a scanner checks your unique features. If it matches, bingo, you’re in. No match, no access. It’s as simple as that, yet incredibly effective.

More security layers make it even tougher for bad folks. Multi-factor authentication (MFA) means multiple checks must pass before access is granted. This could be a face scan plus a passcode, adding extra walls around your funds.

But this tech isn’t just about stopping fraud; it’s about trust. People feel safer when their phones know it’s really them. Plus, it’s speedy. No more fumbling for cards or forgetting PINs. It’s a huge leap in both security and convenience.

Forecasting the Integration: AI, IoT, and Quantum Computing

Now, let’s peer into the crystal ball. What does the future hold for payment security? Well, artificial intelligence (AI) is the big game-changer, spotting fraud before it happens. It learns your buying habits and flags anything odd. Think of AI as a super-smart watchdog for your wallet.

The Internet of Things (IoT) is weaving into banking too. Your fridge might order and pay for milk soon, securely, with your okay. Secure payment technology is vital here. It ensures that only your fridge, not the neighbor’s, orders milk on your tab.

We’re also glimpsing the dawn of quantum computing in payment security. Quantum computers think in ways that dazzle us, solving complex puzzles in seconds. This could be how we outfox the smartest cybercriminals who try to crack our codes.

As we move forward, digital wallets will get even smarter. We’re talking space-age innovation in your pocket. Encryption standards and tokenization in finance will evolve, making your data as safe as gold in Fort Knox.

Fraud prevention methods go hand in hand with these tech marvels. Every new gadget means a new way to block the bad guys. I’m talking lightning-fast systems that shut down fishy activities, keeping your cash safe.

In all, the future of payment security is looking as bright as a supernova. We’re building a financial fortress with tech that’s not just smart, but also trusted.(mutex)/(motive)

Biometric Innovations: A New Era for Digital Wallets

The Proliferation of Fingerprint and Facial Recognition Technologies

Your finger tap or face scan can guard your money now. That’s right! Digital wallet advancements use your unique body features to keep your cash safe. This is biometric verification. It’s like a secret handshake that only your body knows. Banks and shops are loving this tech. It fast-tracks their work and cuts the risk of tricky folks stealing your money. Fingerprint and facial id are leading this change. You might have seen these in spy movies, but now they are in your pocket, protecting your hard-earned money. Simple, fun, and kind of cool, right?

With a touch or a glance, payments are smooth and fast. But it’s not all about speed. It’s about tight security too. Think of it like a tough guard that never tires. Every time, he double-checks it’s really you. So, when you buy those amazing headphones online, or grab a burger on the go, you’re safe. It’s becoming a must-have in mobile payment innovations.

Here’s the thing. Your fingerprint and face are keys that can’t be lost or guessed like a password. They are part of you! And that’s why they work so well. They are with you all the time, making sure it’s always you who enters your digital wallet. This rocket-like rise in biometric tech shows no sign of slowing down. Each tap or look is part of the future of payment security and is getting better every day.

Balancing Convenience with Biometric Data Privacy

But hold on! There’s a small wrinkle in this superhero tale. Using bits of you to guard your money raises a big question. How do we keep those bits of you private and safe? It’s a puzzle, but not without answers.

When your body becomes a key, privacy matters a lot. We must be smart to stay in control of our biometric data. This is a serious chat we need to have about privacy concerns in mobile payments. How do we keep your face and fingerprint from becoming public? Shops, banks, and app makers are on it. They are working hard to make sure no one can snatch your biometric details.

They must follow some tough rules too. These rules are called data protection laws, and they are like a strong fence around your personal info. Multi-factor authentication is another shield they use. It’s like a secret club that needs two secret words instead of one. To get into your wallet, someone might need your face and a code you know by heart.

It’s a careful walk on a rope. On one side is the handy, quick pay with just a tap. On the other side is keeping your personal details locked up tight. It’s a balance, like a seesaw. But as your guide in this tech jungle, I can tell you the balance is getting better every day. Your biometric details are becoming the heroes of secure online transactions. This seesaw is tilting toward a safe space where payments are quick but your privacy stands tall and strong.

Blockchain and Cryptography: Pioneering Secure Payment Frontiers

Deploying Blockchain for Transparent and Immutable Transactions

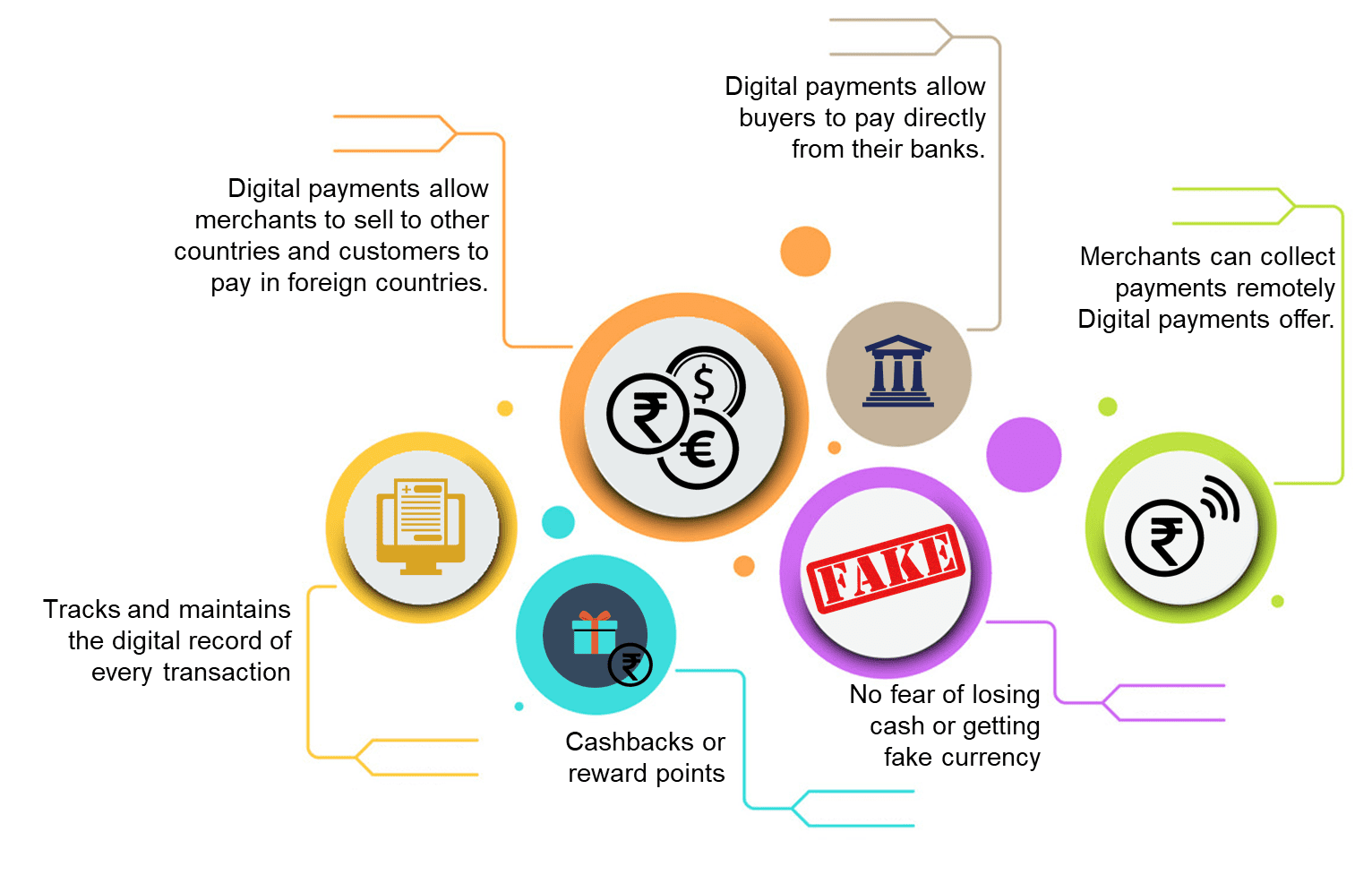

You might wonder, how safe are your online payments? Quite safe, if blockchain is in the mix. Blockchain makes sure every transaction gets locked in, where no one can change it. It’s a digital ledger that everyone shares but no single person owns. This means fairness and safety in online money deals.

Think of it like a game where every player keeps score. If one tries to cheat, the others will see. Blockchain works the same. It prevents fraud by letting everyone involved check transactions. This is vital for trust in digital payments. Each deal adds a “block” to the “chain”, creating a long history that’s hard to mess with.

Advanced Encryption and Tokenization Techniques

But what about sneaky thieves who try to spy on your transactions? This is where encryption and tokenization step in. They scramble and swap out your details with unique codes. So, even if a hacker grabs your data, they get gibberish instead of gold.

Encryption is like a secret language only you and the recipient know. Tokenization replaces your sensitive data, like card numbers, with a random code. These tools are superheroes for digital safety. They fight off cyber villains who try to steal your info.

As we chat about digital wallet advancements, these technologies are key. They make sure that when you tap to pay, it’s not just easy but also secure. This is what shapes a future where your money’s safety is locked up tight.

Your digital wallet now may use cool stuff like face scans or thumbprints. This is biometric verification, and it’s getting big in the secure payment tech game. Combined with blockchain and encryption, it builds an almost unbreakable shield for your digital cash.

As we dive deeper into future payment security trends, it’s clear. Mobile payment innovations will keep coming. But safety overshadowing convenience, not always. The challenge is to secure online transactions without slowing you down.

Encryption standards and tokenization in finance are leading the charge. These methods keep your cash safe right in your pocket or even on your wristwatch. As we look forward, the marriage of top-notch security with ease is the goal. Contactless transaction security is not just a buzzword; it’s a promise.

In summary, while the world of digital payments gets more advanced, so does security. From the block-by-block trust built on blockchain to the data disguising duo of encryption and tokenization, your financial fortress is growing stronger. So tap, swipe, and click with confidence, friends. Your money’s guardians are always at work.

Regulatory and Compliance Frameworks: Safeguarding the Financial Ecosystem

Navigating PSD2 and Global Security Standards

The world of digital payments is always moving. Laws must keep up. Europe’s PSD2, or the Second Payment Services Directive, shapes the future of payment security. This law makes banks open up. It leads to safer and more innovative digital payments. How does PSD2 affect you? Simply put, your money is safer, and your payment choices grow.

PSD2 makes sure businesses protect customer info. It makes banks share data with financial technology start-ups. But only after you say it’s okay. It’s big for mobile payment innovations. It paves the way for better apps to handle your money. Experts say it brings a wave of new, safe ways to pay.

Global standards also play a key role. They set the bar for what’s safe and what’s not. They keep a check on how companies guard our money. Standards like PCI DSS ensure that your card details stay private during a transaction. With these rules, trust in digital wallet advancements grows.

Fraud prevention methods tie in closely with these standards. This means constant watch over risks and quick action when things go wrong. Companies must follow the rules and use tech like encryption and tokenization to protect you.

The Impact of Regulatory Changes on Digital Payment Platforms Security

New laws mean digital wallets must be very secure. We’re talking about multi-layer shields for your cash. What does this look like? Think about walking through a door. What if you need a key, a code, and your fingerprint? That’s how multi-factor authentication works. It’s one way digital identity verification is getting tighter.

Regulatory changes also push for more secure online transactions. They force companies to be very careful with your info. New laws might ask for stronger hacking countermeasures in finance. They ensure your details do not slip through the cracks. Hacks can be big problems. So, better protection is always the goal.

Privacy concerns in mobile payments are high on the list too. Laws must balance our privacy with the need for security. As digital payment platforms evolve, so do their defenses. But they must not forget about keeping your personal details private.

Encryption standards have to be top-notch. Bad people out there want to break in. Good encryption is like a strong wall they can’t climb over. Tokenization is another hero in this story. It hides your card details when you buy stuff online. These methods, powered by artificial intelligence in fraud detection, make sure scammers have a hard time.

Regulatory compliance in financial technology isn’t just red tape. It’s about keeping your digital life safe. For sure, it’s a lot to take in. But it’s also why we can trust the tech we use every day. The end goal is always clear: To safeguard every penny you own—online or off.

We’ve walked through the incredible journey of payment security, from simple PINs to high-tech biometric checks. This evolution shows how our transactions grow safer every day. We looked ahead, too, imagining a world where AI, IoT, and even quantum computing play roles in our purchases.

Next, we saw how our own features, like our fingerprints and faces, are becoming keys to digital wallets. Sure, these techs make life easier. But we must keep our personal details safe. We can enjoy quick buys without risking our privacy.

We explored fresh ground with blockchain and advanced cryptography. These tools are changing the game, making sure every transaction we make is solid and safe.

Lastly, we tackled the maze of rules and laws meant to keep our money secure. It’s a lot, but these standards help keep our digital dollars safe from harm.

So, what’s my final thought? Staying safe while spending online or with our phones is a big deal. But with new tech and smart rules, we’re in good hands. Let’s keep the conversation going and keep our eyes on the future—it’s looking bright and secure.

Q&A :

How is digital payment platform security evolving to address future challenges?

With the rapid advancement of technology, digital payment platform security is constantly evolving to address new and more sophisticated cyber threats. Security measures include the implementation of biometric authentication, end-to-end encryption, tokenization, and AI-powered fraud detection systems. These technologies are being refined to enhance security without compromising user convenience.

What are the emerging trends in securing digital payment platforms?

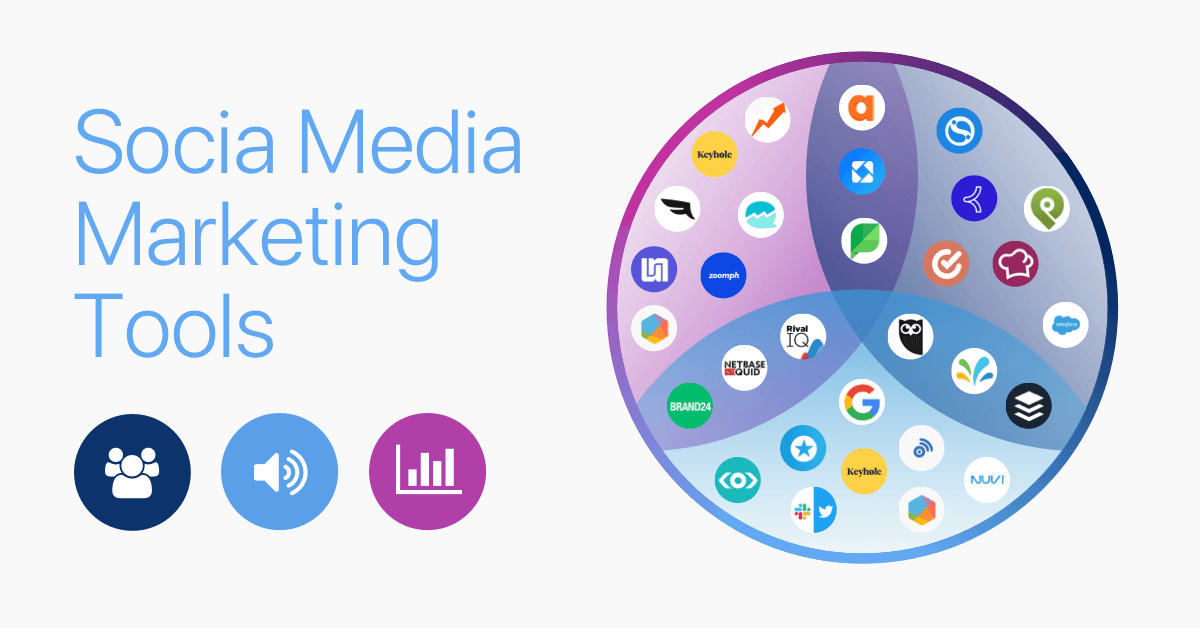

Emerging trends in securing digital payment platforms focus on increasing layers of security while maintaining user-friendliness. Trends include the use of blockchain technology for tamper-proof transactions, the adoption of two-factor authentication (2FA) and multi-factor authentication (MFA), the integration of machine learning algorithms for behavioral analysis, and the shift towards mobile payments with built-in security features like Near Field Communication (NFC) and contactless payments.

How will advancements in AI affect digital payment platform security?

Advancements in AI are poised to greatly affect digital payment platform security by providing more agile and adaptive systems capable of detecting and responding to fraudulent activities in real-time. AI technologies can analyze vast amounts of transaction data to identify patterns of normal and suspicious behaviors, allowing for immediate action to prevent fraud. AI will also improve biometric authentication methods, making security checks more robust and less intrusive.

What role will regulatory standards play in shaping the future of digital payment platform security?

Regulatory standards play a crucial role in shaping the future of digital payment platform security by establishing minimum security requirements and encouraging industry-wide best practices. As digital payments continue to grow, governments and regulatory bodies will likely introduce more stringent regulations, such as the General Data Protection Regulation (GDPR) and Payment Services Directive 2 (PSD2) in Europe, which mandate strong customer authentication and secure open-banking ecosystems.

How can individual users ensure their security on digital payment platforms?

Individual users can ensure their security on digital payment platforms by adopting good cybersecurity habits. This includes creating strong, unique passwords, refraining from sharing sensitive financial information over unsecured networks, regularly updating software to patch security vulnerabilities, enabling two-factor or multi-factor authentication, and being vigilant against phishing attacks and other forms of social engineering. Users should also monitor their accounts for any unauthorized transactions and report them to their service provider immediately.