Future of digital economic platforms is a game changer. Think buying, selling, trading – done faster, smarter, safer. Imaging waking up to a world where every deal, dime, and data point moves through a net of new tech. It’s already rolling out. And it’s wild. From the rise of DeFi to tapping into AI, this tide won’t just shift how we click and cash out. It’s rebuilding the whole shop. Want a sneak peek at this revolution? Dive in as we unpack it all, piece by nifty piece.

Adapting to an Evolving Digital Marketplace

Emergence of Decentralized Finance Platforms

Think about your own money. You save it in a bank, right? You get a card to spend it. But what if I told you there’s a new way to handle money without banks in the middle? That’s what decentralized finance, or DeFi for short, is all about. It’s like a big online market where you can save, trade, and borrow money directly with other folks using technology.

DeFi platforms run on blockchain. This tech records every deal in blocks of data that are tough to change. This makes sure that your deals are safe and open. These platforms don’t need a bank to work. They use something called smart contracts. Like deals we make in everyday life, but these run by themselves when certain things happen.

DeFi is still growing. Some say it’s risky because it’s new and not many rules are in place. But others love it for the freedom it gives. They like having control over their money and making quick trades. It changes how we think about money and could be huge for business and everyday folks alike.

Influence of Blockchain Technology on Market Dynamics

Now, let’s dive into blockchain tech. Imagine a chain where every link is a record of a deal made online. Once a link is there, it’s hard to change without everyone seeing. This is how blockchain works and it’s shaking up the market big time.

Blockchain is behind Bitcoin and other cryptocurrencies. Cryptocurrency is like online money that can go up or down in value quickly. People use it to buy things or as an investment. It’s changing how we think about cash.

Businesses use blockchain beyond just money, too. They track items from start to finish, making sure they’re real and haven’t been messed with. It’s great for keeping everyone honest and building trust online.

Also, think about doing business with people in different countries. Blockchain makes it easier and safer to move money across borders. You don’t have to worry as much about exchange rates or banks taking a big cut.

The real cool thing about blockchain is it has room to grow. More businesses are starting to use it every day. It’s being looked at for voting, keeping health records safe, and more. So, it’s not just for money; it’s a whole new way to keep track of things that matter.

We’re seeing big shifts in our digital world. With DeFi and blockchain, we’re moving to a place where we have more power over our money and info. This could change everything, from shopping to saving for the future. It’s not all smooth sailing, though. There are bumps along the way, like new rules and making sure it’s all safe. But one thing’s for sure – we’re not just talking about tomorrow’s world anymore. It’s happening right now, and it’s pretty exciting.

Harnessing Technological Advancements for Economic Efficiency

Integrating Artificial Intelligence in Digital Wallets

Imagine paying with ease, any time, anywhere. This is what AI brings to digital wallets. Artificial intelligence now powers online wallets. It makes payments smart and secure. Got a question? Just ask! AI can give quick help with wallet issues.

But how does AI help digital wallets? AI studies how we spend to keep our money safe. It checks for strange spending that may be fraud. It also makes payment faster with fewer steps. Your phone can soon pay without you touching a button. That’s handy, right?

Accelerating Financial Transactions with 5G Technology

Speed is key in our fast-moving world, and 5G tech makes finance fly! 5G tech means super quick internet for all our devices. Why does this matter? Because it lets us buy and sell in a flash. No one likes to wait when they’re getting things done.

5G helps digital trading platforms run smooth. It cuts delays to almost zero. This means you can trust that your trade or payment will go through fast. Quicker internet from 5G also makes sure the whole world can join in, even in far-off places.

To sum up, using AI and 5G tech, we’re making online money tasks quick and easy. This helps us all, from small buyers to big sellers. In the end, it’s about keeping up with tech for a better tomorrow.

Fostering Inclusivity and Sustainability in the Gig Economy

Challenges and Opportunities in Online Economic Systems

Today’s gig economy is big! It’s the future of work. People love the freedom to choose jobs that fit their lives. But this freedom can come with issues. One big problem? Not all gig workers have the same rights as regular employees. They often miss out on health care, job security, and more. We need to find ways for gig jobs to be fair for everyone.

We can do this by making rules that protect gig workers. And, by designing tech that helps them get better jobs. There’s a chance here to make the gig economy work better for all. Think about all the apps we use to get a ride or order food. These apps can teach us how to make gig work safe and rewarding. They can tell us how to keep gig workers happy and loyal.

Ensuring Platform Economy Sustainability Through Policy and Innovation

Now, let’s talk about keeping the gig economy strong and lasting. We can use tech like AI and blockchain to make sure gig workers and customers can trust each other. Apps can now make paying for a gig job as easy as sending a text. This change means more people can join the gig economy without worry.

Making smart platforms also means caring for our world. We can design systems that help gig workers find jobs close to home, cutting down on pollution from travel. Tools like digital wallets and mobile pay can lower the need for cash and help the planet, too.

But we must think ahead. New rules and laws are needed to keep gig jobs safe and fair for everyone. That means talking about hard topics, like the taxes companies pay and how to help workers when jobs change.

In short, the gig economy can be great for everyone, with some smart thinking and new ideas. We’ve got the tech. Now we need to make sure it’s used in the right ways. This way, gig work will stay strong and help us all.

Navigating Regulatory Frameworks and Cybersecurity

Balancing Innovation with E-commerce and Digital Currency Regulation

We live in a world where buying and selling online is normal. But it’s not always safe. People worry about hackers and their money being safe. So, we have rules. These rules help everyone play fair. When we talk about e-commerce, think of it like a big digital mall. Each store in it follows rules. Now, add digital money like Bitcoin to this mix. We need new rules for this too. We call them regulations. They help keep your money safe when you buy stuff using digital coins.

In this space, kids and adults alike need to know two things. First, online shops and digital money must follow the rules. Second, these rules may change as new things happen. Like when a new video game comes out and they add a new level. Think of it like that.

Regulations of digital currency are like game rules. They make sure no one cheats. This includes making sure no one makes fake money. It’s not fun if someone cheats, right? So, we use smart contracts in blockchain tech.

These contracts are lines of code that make sure deals are fair. They are like the referees of online deals. They’re part of a data-driven economy. It’s an economy that uses information to make things better for everyone.

Data Privacy Laws and the Future of Cross-Border Transactions

Imagine if your secret diary was read by someone without asking. That wouldn’t be cool, right? It’s the same with your personal data online. Data privacy laws make sure your secrets are safe. They are like a lock for your data. They protect your info when you buy from another country.

Cross-border transactions are like pen pals trading stickers. But you want to make sure no one else takes your stickers, right? That’s where data privacy laws come in. They’re like a secret code you and your pen pal have.

These laws are super important when we talk about things like AI in finance or decentralized finance, which means more people can get in on the money game without big banks. This may sound like grown-up stuff, but it’s like making sure you have the same chance at winning a game as everyone else.

IoT, which is short for Internet of Things, helps this by letting gadgets talk to each other to make buying things smoother. And, predictive analytics is like guessing what toy will be popular before everyone else knows. It helps companies get ready for what customers want. In our case, it helps keep our money talks with other countries safe and fair.

So, as we shop more online and use cool tech, these rules and protections will help us all have fun and be safe. Just like rules in a game. It all sounds serious, and it is, but it’s also about making sure everybody can join in the game and play fair. Whether you’re a kid saving up for a new game, or a grown-up buying stuff from around the world, these rules are for all of us.

In this blog, we dove into the fast-changing world of digital markets. We saw how DeFi, or Decentralized Finance platforms, are shaking things up and how blockchain is changing how markets work. We looked at how smart tech like AI in e-wallets and 5G are making money moves quicker.

We talked about the gig economy too—its ups and downs and how smart rules and new ideas can keep it fair. And lastly, we tackled the big stuff: laws on e-commerce and online cash, plus keeping your details safe.

My final take? Staying smart about these changes won’t just help you keep up; it’ll set you up for success. Let’s use tech gains to make our work smooth, fast, and secure. Always play by the rules and keep your data locked down tight. That’s how we win in this digital space!

Q&A :

What are digital economic platforms and how are they shaping the future?

Digital economic platforms refer to online systems that facilitate economic activities such as digital marketplaces, sharing economy services, and fintech solutions. They are shaping the future by driving innovation, providing new employment opportunities, and transforming traditional industries through technology.

How will digital economic platforms impact traditional businesses?

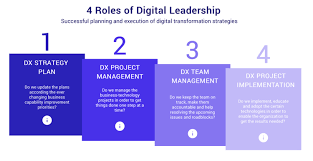

Digital economic platforms are expected to significantly impact traditional businesses by introducing more competition, changing consumer behaviors, and accelerating digital transformation. Traditional businesses will need to adapt by embracing digital strategies and forming partnerships with these platforms to remain competitive.

What role will AI play in the future of digital economic platforms?

Artificial Intelligence (AI) will play a pivotal role in the future of digital economic platforms by enhancing personalization, improving user experience, and streamlining operations. AI can provide insights for decision-making, automate processes, and create more efficient platform ecosystems.

What are the challenges facing the growth of digital economic platforms?

Key challenges facing the growth of digital economic platforms include regulatory hurdles, data privacy and security concerns, and the digital divide. Overcoming these challenges will be essential for the sustainable growth and acceptance of digital economic platforms.

How can businesses leverage digital economic platforms for growth?

Businesses can leverage digital economic platforms for growth by using them to reach new markets, streamline operations, and foster innovation. They should focus on building robust digital strategies, utilizing data analytics for informed decision-making, and engaging with platform users to create value.