Fundamental analysis strategies for long-term investing aren’t just buzzwords; they’re your ticket to profit in the marathon of the market. You’re likely here because you are determined to make your investments count over the long haul. My job? To arm you with the savvy strategies you need to thrive. Let’s cut through the noise and zero in on the essentials: how to dissect financial statements, why price to earnings ratio matters, and what really gives a stock its value. And trust me, it’s not just about the numbers. We’re also diving into the art of qualitative assessment—because understanding the DNA of a potential winning company goes beyond the balance sheet. Ready to become the investor who stands out? Let’s get started on transforming your portfolio with smart, fundamental choices that endure.

Grasping the Fundamentals: Equity Research for Long-term Gains

Understanding Company Financial Health through Financial Statement Analysis

To win at long-term investing, we must be health detectives for companies. Think of financial statements as the vital signs of a business. A solid look at these could spell out the difference between making a fortune and losing your shirt.

First up is the balance sheet. It’s a snapshot of a company’s financial health—what it owns and owes at a point in time. Assets are things of value like cash or buildings. Liabilities are debts, what the company must pay to others. We want a company with more assets than debts.

Next is the income statement. It tells us how much money the company made or lost over time. We look for sales growth and check if expenses aren’t eating up all the earnings. Strong profits can mean a thumbs-up for our investment.

Lastly, the cash flow statement is a record of cash in and out. It shows us how well a company manages its cash to fund operations and grow. More cash coming in than going out is a green flag.

Intrinsic Value Calculation: EPS Significance and Price to Earnings Ratio (P/E)

Every stock has a fair price, its intrinsic value. It’s what we believe the stock is truly worth. To figure this out, we use some tricks.

One trick is finding the EPS, or earnings per share. It’s the profit for each stock slice. A higher EPS usually means the company is making good money. That’s what we like to see.

Then, we look at the P/E, or price to earnings ratio. It shows if a stock’s price makes sense compared to its earnings. Think of it as the price tag of a stock’s earnings. A lower P/E may mean the stock is on sale – a bargain!

By breaking down financial health and calculating intrinsic value, we set ourselves up for smarter, better-informed investment choices. These steps keep our investments growing over the long haul, helping us reach our money goals with a bit more peace of mind.

The Art of Financial Statement Dissection: Balance Sheets and Beyond

Balance Sheet Evaluation for Investing

Let’s dig into the balance sheet first. This tells us about a company’s assets and debts. It’s like a snapshot of its financial health. Think of it this way – if you wanted to see how rich someone is, you would ask: “What do you own, and what do you owe?” That’s what a balance sheet shows for a company.

We look for assets – these are things the company owns like cash, buildings, and products. The more they have, the better. But we also have to check debts or what they owe. Less debt means less risk for you as an investor. We want a good balance between what a company owns and owes. This gives us a clue about its strength.

Income Statement Assessment and Cash Flow Analysis in Stocks

Now for the income statement. This is where we see if the company is making money. It lists sales and expenses over time. We want to see sales growing and costs in check. If a company sells more but spends too much, it won’t have much profit. Strong sales with controlled costs usually mean good profits.

Cash flow is another big piece. This shows actual cash the business gets and uses. We care because even if a company shows a profit, it might not have cash. That’s a warning sign! A business needs cash to keep going, so we want lots of positive cash flow.

Let’s sum it up. We use financial statements to judge if a company is doing well. We check how much it owns and owes, if it’s making money, and if it has cash. All this helps us decide if a stock is a smart buy for the long haul.

Quantitative Meets Qualitative: Deciphering Investment Potential

Quantitative Financial Analysis: ROE and Debt-to-Equity Ratio Importance

When we talk about numbers, we want them to tell us a story – the story of a company’s success or struggle. Return on Equity (ROE) is like a health check. It shows how good a company is at making money from its net assets. A higher ROE? That’s a company putting its money to good use. We love to see that when we’re after long-term wins.

Now, let’s not forget the debt-to-equity ratio. It’s pretty much how much a company is leaning on loans to fuel its growth compared to what it owns. You see, too much debt can be risky. But if it’s just right, it can fuel growth without burning the bank. We keep an eagle eye on this ratio.

Qualitative Investment Appraisal: Competitive Advantage Assessment and Management Team Evaluation

Here’s where things get interesting. Numbers don’t tell you everything. That’s why we dive into the real heart of a company. We look at its edge over others. We call it the competitive advantage. It’s like being the only store in town that sells magic wands. Everyone will come to you!

And the folks driving the ship – the management team? They matter, a lot. We comb through their history, their decisions, their wins, and losses. Great leaders can steer a company through thick and thin.

It’s a blend of art and science, this business of picking winners for the long haul. We mix the cold hard facts with the story behind the scenes, all to make sure your investment sails smooth.

Sector and Cycle Savvy: Anchoring Your Long-Term Investment Strategies

Industry Analysis for Investors and Economic Moat Identification

Let’s dive into understanding sectors and why they matter for your money. When you pick stocks, you’re not just picking a company. You’re picking a part of the economy. Each part, or sector, has its own kind of pulse. Some beat fast, think tech companies. Others, like utilities, more steady. Smart investors check this pulse. This is why sector analysis is a big deal in fundamental analysis in investing.

What makes a company stand out in its sector is something called an ‘economic moat’. Think of a moat around a castle. It keeps enemies out. A company’s moat does the same with competitors. It could be a patent, a powerful brand, or something only they can do. This moat helps them last long and make money. That’s what we want as investors. We want companies that can fight off competition and still make a profit.

Analyze companies in the same sector to see who has the strongest moat. Look at their products, cost to make them, and how they sell them. Good moats make good picks for long-term investing. Remember, profit is key. Companies should not just make money but make more over time. We call this ‘growth potential’. We also look for smart leaders. They steer the company and defend the moat. These elements help your investments ride through tough times.

Market Cycle Considerations and Investing in Blue Chip Stocks

Now, let’s chat about market cycles. Just like seasons change, markets do too. There are ups and downs. You’ve got to know where you are in the cycle to pick the right stocks. Cycles affect sectors in different ways. Some do well when the economy is booming. Others hold strong when it’s not. Long-term investment techniques consider these cycles.

When it comes to stable investing, blue chip stocks are the gold standard. Why? Because they are big, well-known companies. They’ve been around. People trust them. They make products we use every day. And they pay dividends, a share of their profit. That’s money in your pocket.

Investing in blue chip stocks is part of sector performance analysis. They’re like the kings of their sectors. And they usually have wide economic moats. They’ve built a strong fortress that’s hard for others to storm. These stocks won’t grow as fast as new tech stocks. But they offer stability and steady growth. That’s great for long-term gains.

Let’s recap. To anchor your investment strategies, get to know the sectors well. Look for companies with strong moats. And remember the market cycle. It always comes back to what’s solid. Blue chip stocks, with their track record and dividends, can be a safe harbor in your investment journey. They are like the big, old trees in a storm. Not as flashy as the flowers, but they stand strong, year after year.

We dove deep into equity research to help you make smart, lasting investment choices. We kicked off by examining financial health with statement analysis and knowing a stock’s true worth through EPS and P/E ratios. I showed you how to pick apart balance sheets and understand income statements and cash flow. Then, we meshed numbers with a company’s story by looking at ROE, debt levels, and what makes a company stand out with its team and edge. Last, we put it all in context, analyzing industry trends and where we stand in the market cycle.

By understanding these concepts, you’re set to spot top stocks. Remember, investing is part art, part science. Use these tools to build a portfolio that stands the test of time. Stick with this guide and you’ll pick winners that deliver real gains, not just now, but for years to come. Keep learning, stay patient, and invest wisely!

Q&A :

What is fundamental analysis and how is it applied in long-term investing?

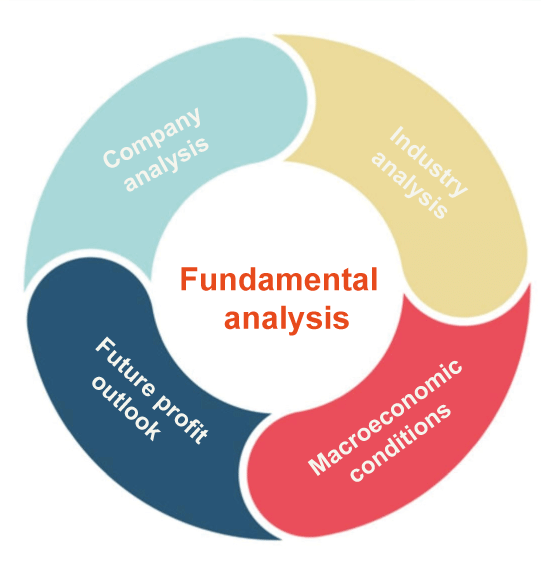

Fundamental analysis involves evaluating a company’s financial health and underlying value by analyzing various quantitative and qualitative factors, including earnings, expenses, assets, and liabilities, in addition to leadership, competitive position, and market conditions. For long-term investing, this method is critical as it seeks to ascertain the intrinsic value of a stock to determine if it’s undervalued or overvalued compared to the market price, and thus whether it represents a good investment for the investor’s time horizon.

Which key metrics are crucial in fundamental analysis for selecting long-term investments?

When using fundamental analysis for long-term investment strategies, several key metrics are especially revealing. These include the price-to-earnings (P/E) ratio, which helps investors determine if a stock is over or under-valued. The debt-to-equity (D/E) ratio provides insights into a company’s financial leverage. Return on Equity (ROE) indicates how efficiently a company is generating profits from its equity. Additionally, looking at the company’s earnings growth, dividend yield, and free cash flow can give a broader perspective on its financial health and potential for sustained growth.

How does understanding industry and market trends benefit long-term fundamental analysis?

A thorough understanding of industry and market trends allows investors to contextualize a company within the broader economic landscape. When trends are favorable, even average companies can perform well, while strong companies can thrive during challenging times if they have competitive advantages. For long-term investors, being able to identify which industries have favorable long-term prospects and which companies are best positioned to capitalize on these trends can significantly impact the success of their investment strategy.

What are the differences between technical analysis and fundamental analysis in long-term investing?

Technical analysis and fundamental analysis are two different approaches to selecting stocks for investment. Fundamental analysis is concerned with analyzing a company’s actual business performance including financial statements, management, and competitive position. The focus is on the intrinsic value of a stock. On the other hand, technical analysis focuses on patterns within stock charts, trading volumes and price movements, under the assumption that these factors can predict future movements. For long-term investing, fundamental analysis is generally considered more appropriate as it looks at the factors that affect a company’s ability to generate profits over an extended period.

Can fundamental analysis help predict stock market crashes or corrections?

While fundamental analysis is a powerful tool for evaluating individual stocks, predicting market crashes or corrections involves a complex array of factors and is extremely challenging. Fundamental analysis can help identify overvalued stocks or sectors, which could be a precursor to a market adjustment, but timing the market is notoriously difficult. Long-term investors tend to focus more on finding undervalued companies with solid fundamentals that are likely to do well over time, rather than trying to predict short-term market movements.