The Fed lowering interest rates for the first time after four years marks a pivotal shift in the financial landscape. This article dives into how this decision impacts consumers, businesses, and the economy. Read on to learn how the changes in rates might affect your loans, savings, and investments.

FED lowering interest rates for first time after four years

After a period of tight monetary policy, the Federal Reserve cut interest rates by 0.5%, lowering the benchmark rate to 4.75-5%. This is the first rate cut since 2020, aimed at reducing borrowing costs for consumers and businesses. The Fed believes inflation is stabilizing near its 2% target, with the U.S. Consumer Price Index (CPI) up 2.5% in August, significantly lower than the peak of 9% in 2022. The Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, has also shown signs of cooling for the past two years.

Immediate economic impacts on consumers

The rate cut will reduce borrowing costs for consumers. Mortgage rates, which exceeded 7% earlier this year, have now dropped to 6.29% as of September 2023. This lower rate could make homeownership more affordable, providing relief to buyers and those refinancing their homes. For example, refinancing a $400,000 mortgage from a 7% rate to a 6.3% rate could save around $400 per month.

In the auto loan market, new car loan rates averaged 7.1% while used car loans were at 11.3%. With the rate cut, borrowing costs for auto loans are expected to decrease, potentially driving more consumers to purchase vehicles.

For credit card holders, interest rates are currently at a record high of 24.92%. Although the Fed’s rate cut will offer slight relief, borrowers may want to consider balance transfers or personal loans to significantly reduce debt.

However, savers will see lower returns on high-yield savings accounts and CDs. Some banks had offered APYs up to 5%, but rates are expected to decline as the Fed continues to lower interest rates.

Long-term implications and whưat to expect moving forward

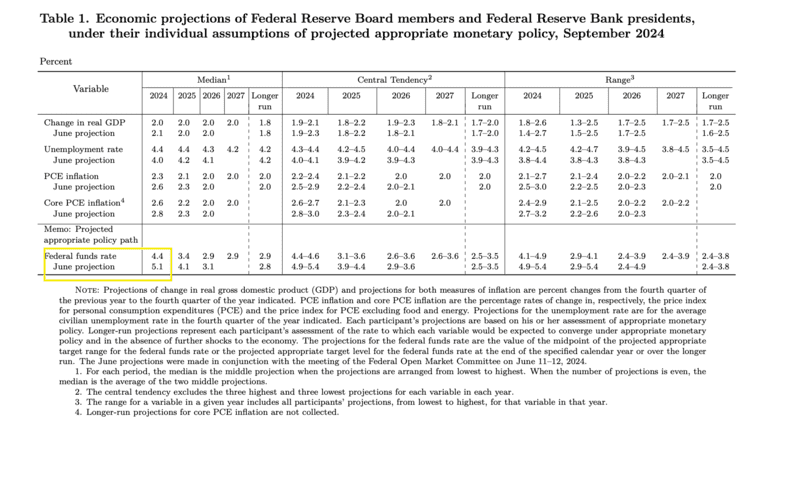

The Fed has signaled more rate cuts could be on the horizon. Economic forecasts indicate further reductions in 2024, with the benchmark rate potentially falling to 3-3.5%. This will likely lead to lower borrowing costs for both consumers and businesses, stimulating spending and investment.

However, the rate cuts will also impact savings returns. Savers who rely on high-interest accounts may see reduced APYs, making it advisable to lock in CD rates before further cuts.

Market reactions and financial sector outlook

The stock market responded positively to the rate cut, with indices like the S&P 500 and Dow Jones rising. Investors anticipate that lower rates will encourage borrowing and consumer spending, boosting corporate earnings and stock prices. However, bond yields declined as interest rates dropped, leading to lower returns on newly issued bonds.

The U.S. economy is expected to continue growing, with the Fed Atlanta projecting a 3% GDP increase in Q3 2023. Overall, the Fed’s decision to cut rates is poised to influence a broad spectrum of financial sectors, benefiting borrowers while posing challenges to savers.