Fastest growing emerging economies 2024: it’s the buzz phrase on every investor’s lips. Who’s on top in this global race? This year, we’re witnessing a shift in the power balance. As global trends shake the market’s core, new stars rise. I’ll guide you through the indicators lighting the way for growth and show you how these trends mold which markets come out ahead. You’re in for a trip across continents—from Asia’s unexpected power players to Africa’s under-the-radar gems set for a boom. Get ready for a deep dive into the sectors ripe for investment and learn how to weigh the potential against the pitfalls. Stay tuned as we unravel the forces propelling these economies into the fast lane. Let’s find out together which emerging economies are leading the charge in 2024.

Assessing the Economic Landscape for 2024

Economic Indicators Fueling Growth

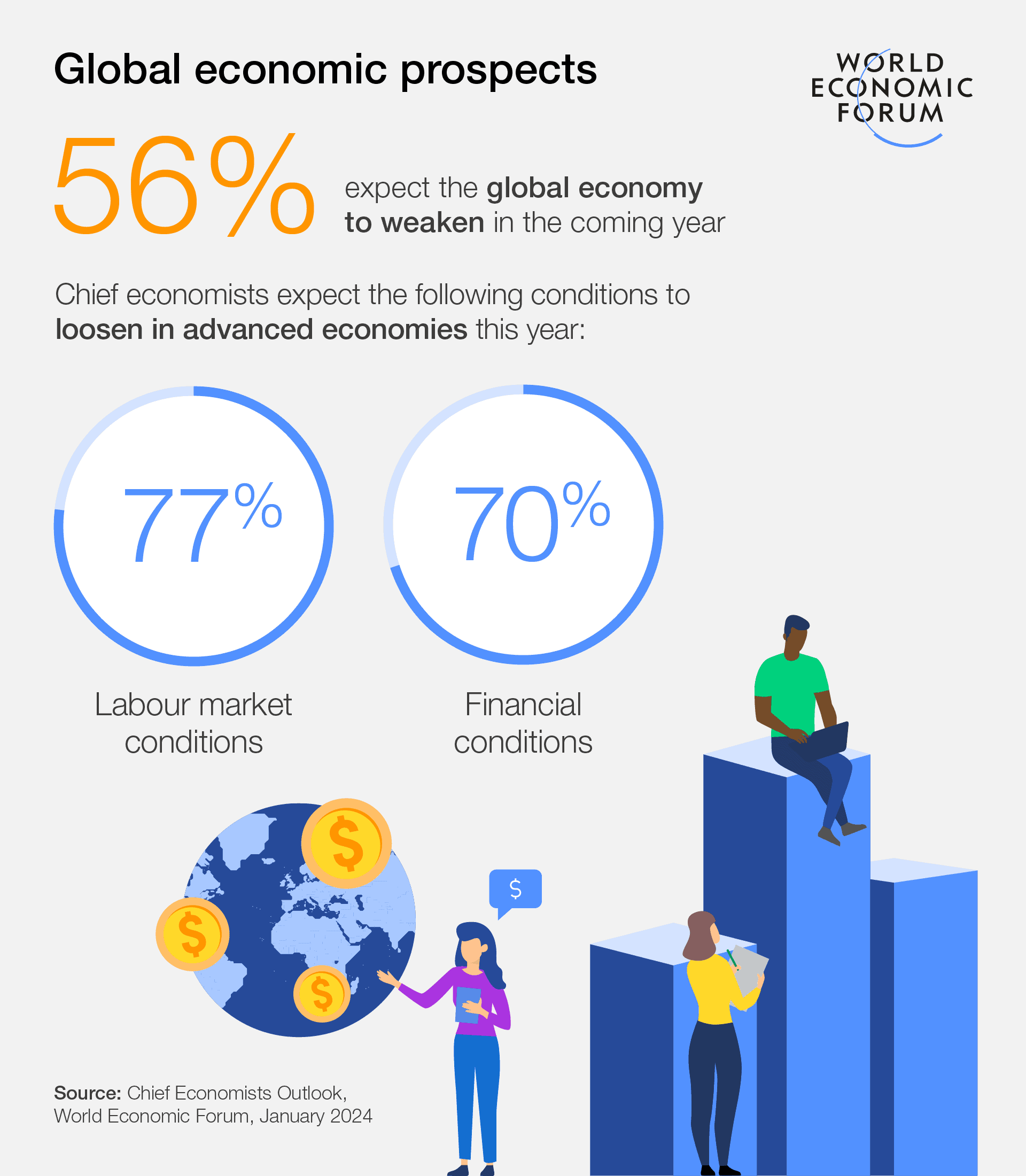

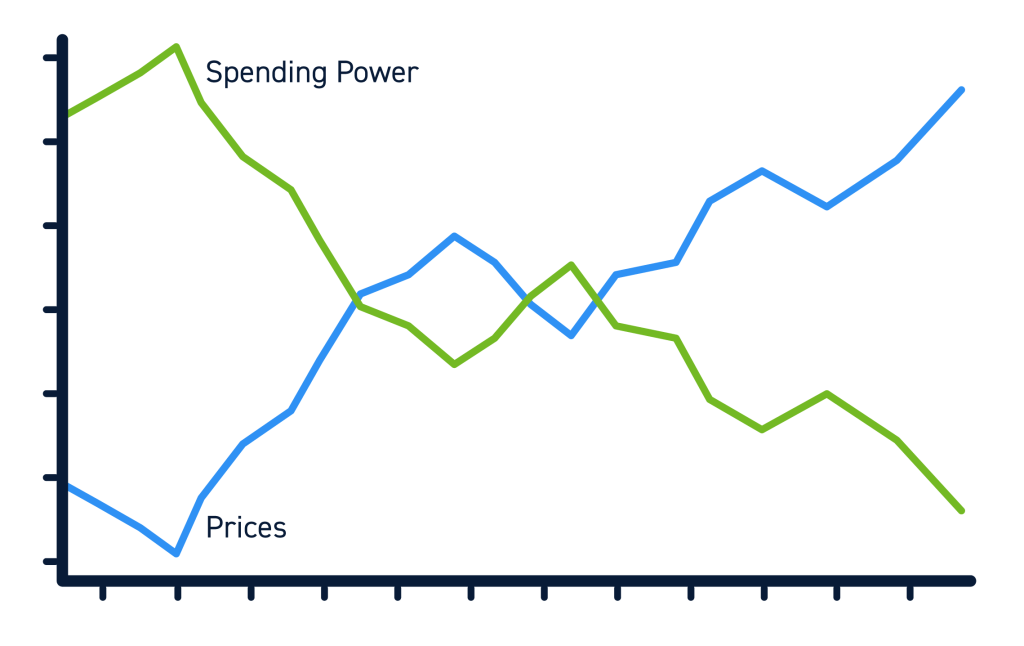

Big growth comes from many places in an economy. Take a look at the goods a country makes and sells. More goods often mean more growth. Money flowing in and out of a country matters too. It can tell us if an economy is strong. We also check how much people can buy. This gives clues about market health.

Low debts and stable prices help economies grow big and strong. When people have jobs, they can spend. This spending helps everyone. We see new businesses pop up. They make money and create even more jobs. This makes the economy bigger and better.

In 2024, look for nations with these healthy signs. They might just be the next big winners in the world’s market.

Impact of Global Trends on Emerging Markets

Now, let’s talk about the big world out there. The things happening all around us can hit markets hard. Like a game of dominoes, one tip can set off a chain. Take tech, for example. It’s changing everything. Countries that grab onto new tech can leap ahead. They might be where the next cool thing starts.

People moving to cities is another big change. It makes new chances for jobs and businesses. And don’t forget the young. Lots of young people can be great for an economy. They have fresh ideas and can work hard.

We must also think about the earth. Countries need to grow without hurting our home. Green ways to make power and do business are key. They can be good for the planet and the pocket.

These global shakes can be good news for quick thinkers. So, what’s next? Let’s keep our eyes and minds open for the fast climbers of 2024. They might surprise us.

2024 looks bright for some. These nations are hooking their stars to the right trends. They have what it takes to grow fast and rise high. Watch this space. The next economic giants could be making their move.

Spotlight on High-Performing Emerging Economies

Asian Phenomena: Beyond the Asian Tigers

Let’s talk about the Asian scene first. You’ve heard of the Asian Tigers, right? Countries like South Korea and Singapore thrived, big time. But now, look a bit further! In 2024, we’re seeing new players. Vietnam, the Philippines, and Indonesia are showing their might. These places are not just strong; they are some of the fastest growing emerging economies.

In Vietnam, factories are bustling. Investors see it as a gold mine. It doesn’t just stop there. Tech is booming! Startups in Ho Chi Minh City are showing the world what they’ve got. And why is this growth? A young, tech-savvy crowd is pushing things forward. Phones, apps, and online services are their playgrounds.

But why do these countries grow so fast? Great question! A mix of low costs, smart people, and reforms are doing the trick. Add in a sprinkle of foreign money looking for the next big thing, and there you have it.

And it’s not just the economy. These countries are crafting a future where their kids can dream big. Education, health care, and jobs are priorities. They want growth that will last, and they’re working hard for it.

Africa’s Rising Stars and Their Growth Trajectories

Now, let’s swing over to Africa. It’s brimming with energy and promise. Names like Rwanda, Ethiopia, and Ghana pop up. Why? They are the African countries with fast growth in 2024.

Rwanda is a tech hub on the rise. The government’s Vision 2020 is in full swing. It focuses on creating a knowledge-based economy. It’s working. Investors are watching Rwanda closely.

Ethiopia, the land of long-distance runners, is now racing in growth. It has one of the quickest developing economies. Why? Massive projects! Dams, railways, and factories. These are changing the game.

And Ghana. It’s the star of West Africa. Peace helps it shine. With stability, Ghana invites business. It’s rich in resources and rich in culture. That’s a combo that’s hard to beat.

These African gems are joining the race. They’re not just promising; they are delivering. With every step, they edge closer to becoming the next economic giants.

And what’s boosting their speed? Key drivers are many. Peace and security top the list. Add to that better laws, more schools, and less red tape. Put them together, and you get growth that turns heads. T

Each of these emerging markets offers a unique flavor. Tech in Asia, resources in Africa. More than that, they offer a canvas for growth. They show us that under the right conditions, with the right care, economies bloom. They are fast movers, fast shakers. They give their all to build better lives for their people.

So, when you think of high-growth economies in 2024, cast your eyes wide. From Asia to Africa, new heroes are rising. We’re watching an economic shakeup that rewrites the future. These nations are not just players. They are the future powerhouses of the global economy. Keep an eye on them. They’re just getting started.

Investment Horizons in Emerging Markets

Pinpointing Lucrative Sectors and Opportunities

In the quest for rich investment fields, many eyes turn to emerging markets. The growth forecast for emerging markets in 2024 shows promise. Investors seek hot spots in high-growth economies. Sectors with rapid expansion include tech, green energy, and e-commerce. They attract cash with their potential and innovation. These areas often lead in developing nations’ GDP growth.

Tech booms in emerging markets, driven by smart young minds. Digital hubs are forming in places once overlooked. This paves the way for the startup ecosystem in these regions. Investors gain by getting in early on these tech waves.

Green energy also shines bright on the investment map. As the world seeks cleaner options, these sectors offer a sustainable future and profits. Emerging economies take giant leaps in green solutions. This shift to sustainability can mean steady growth and smart investments.

In retail, e-commerce changes how people buy and sell. In countries with young, tech-savvy folks, online shopping grows fast. This growth opens doors for investors to ride the digital wave.

Navigating Risks and Rewards of Frontier Market Investments

Frontier markets offer a mix of risk and reward. They can make your heart race but hold big prizes for the brave. Risks include unstable politics or laws that change on a whim. Markets also feel global shocks more than rich countries. Still, rewards in frontier markets might beat those in settled ones. High risks can lead to high rewards.

Investors must watch for signs of strong or weak spots. Look for places with smart reforms and stable growth. A sound pick is a nation making good changes to help business grow. Clear rules and less red tape attract money and build trust.

Next, consider how a young population can push an economy up. More young workers can mean more folks making and buying things. They can fill cities, lifting urban development and demand for homes and shops.

Lastly, keeping tab on global vibes is key. Big world events can shake or shape these markets quick. Smart investors stay ahead of the news to know what’s coming.

Investing in these markets takes guts, but the future could be bright. When picking where to place your bets, look for balance in risk and reward. Be bold, do your homework, and you might just find a gold mine in these dynamic lands.

Remember, while investing in emerging markets can be exciting, it’s not for the faint of heart. But for those who navigate these waters well, the horizon could be glittering with opportunities.

Driving Forces Behind Rapid Expansion

Key Reforms Shaping Economic Outcomes

Big changes are making waves in fast-growing lands. Leaders are choosing smart moves. They are fixing old rules and making new ones. This opens doors for business and money-making chances. Look at the short list of next economic giants for 2024. Here, new ideas are pushing up numbers like never before.

Countries that stand out? Watch the BRICS and Asian Tigers. They’re not new to the game, but they still surprise us. Africa is full of life, too. Young people and busy cities fuel its growth, making it a place to look at for big gains. The big deal? These places are working on how they run. They’re making it easier to trade, set up shop, and grow wealth. It’s pulling in people with money to invest. This wave of change is shaping a future where these lands could lead the world.

Technological Advances and Digitalization Effects

Tech is changing the game. It’s the engine behind the fastest expanding economies of 2024. Digital shops and startups are popping up everywhere. They’re the new cool kids on the block. In emerging markets, phones and the web are bringing new chances to make, sell, and buy stuff. More people can join in, even from far away places. This means more money, more ideas, and more growth.

Look at Southeast Asia. They’re jumping ahead with tech and making money from it. Latin America is doing the same. They have huge ideas for their tech future. The young crowd loves tech. It’s their way to shine and shake up old ways. They’re making new things and finding new ways to use tech. And they’re doing it fast. It’s like a shot of energy for these places, pushing their names to the top of the list.

Let’s not forget about cities getting bigger and people wanting more stuff. This makes tech even more important. It helps make and move things people want. Big cities mean many mouths to feed and many people buying stuff. Tech helps get the job done.

In all this, staying green is key. Smart tech helps us do more without hurting our world. This is what we call sustainable development. It’s a must for keeping our planet safe while we grow.

Now, let’s get real. Not all that shines is gold. New tech brings new troubles. Some worry that fast moves may leave some behind. Others think about robots taking jobs. These are big things to look at.

But here’s the thing. These young lands are doing something big. They’re changing the rules and riding the tech wave to grow fast. This is our peek into how they’re running ahead. It’s an exciting time, and we’ve got front-row seats to watch it all unfold. We’ll see the real impact of their moves and the stories of chance they write for 2024 and beyond.

In our trek through the 2024 economic landscape, we’ve seen the signs of growth and felt the pulse of global trends. We watched the Asian and African economies rise, full of potential. We eyed sectors ripe for investment in these vibrant markets, all while weighing the balance of risk and reward.

Here’s the takeaway: Emerging markets are buzzing with activity. Reforms are setting the stage for robust economic tales, and tech leaps are fueling expansion like never before. As I wrap up, think on this: Our world is knit closer with each digital stride, and with the right moves, we can all share in these emerging stories of success. The road ahead is wide open — let’s drive forward with eyes wide to opportunity.

Q&A :

What are the fastest growing emerging economies to watch in 2024?

Emerging economies often become the talk of the town for their rapid growth and potential for investment opportunities. As we approach 2024, it’s essential to identify which countries are expected to lead the way. Keep an eye on updated economic forecasts and analyses from recognized financial institutions for the most current insights.

Which sectors contribute most to the growth of emerging economies?

Typically, manufacturing, services, and technology are key sectors driving the economies forward. In 2024, pay attention to how these sectors are adapting to global trends like digitalization, sustainability, and innovation to ensure continuous growth in the emerging markets.

How does political stability affect emerging economies’ growth projections for 2024?

Political stability can significantly impact an emerging economy’s ability to grow. It influences investor confidence, policy continuity, and the effectiveness of government measures to stimulate the economy. In 2024, those countries maintaining a stable political climate are likely to be more attractive to investors.

What role does foreign investment play in the growth of emerging economies for 2024?

Foreign investment is a crucial driver for growth in emerging economies by providing necessary capital for development projects, technology transfer, and job creation. In 2024, the landscape of foreign investment might shift, with more emphasis on sustainable and responsible investing practices.

Can technological adoption propel emerging economies to faster growth in 2024?

Absolutely. Emergent tech such as AI, 5G, and renewable energy solutions can leapfrog traditional development stages. In 2024, those emerging economies that are quick to adopt and integrate new technologies within their industries could experience expedited growth rates and improved global competitiveness.