ESG Integration: Revolutionizing Mainstream Investment Strategies

I’m here to show you how ESG in Mainstream Investment Strategies is no passing fad. It’s the force redefining how we pick our winning stocks and bonds. Think of it as your investment compass, guiding you through risks to find real value. Up ahead, ESG’s role grows vast and its potential, even more so. Let’s not just chase profits; let’s aim for impact, sustainability, and the kind of growth that we, and the world we live in, truly need. Buckle up; we’re on the road to the future of finance!

The Growing Imperative of ESG in Investment Strategies

Understanding ESG Criteria in Contemporary Finance

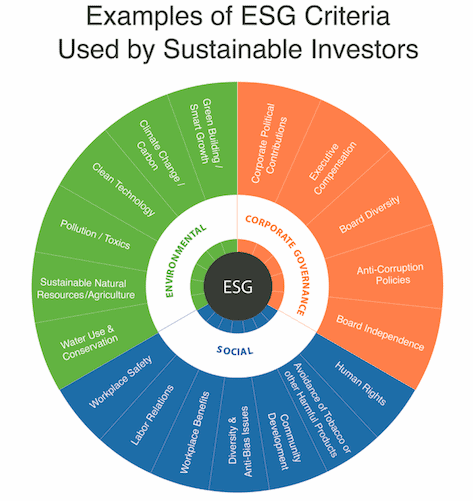

When we talk about ESG, we’re digging into how companies perform in key areas. ESG stands for Environmental, Social, and Governance. These three broad categories help us figure out if a company is being good or bad for our world. Think about it like a report card that looks at more than just profits.

People used to just care about how much money they could make from their investments. Now, they are also asking, “Is my money doing right by the planet and its people?” That’s where ESG criteria come in, telling us about a company’s carbon footprint, how it treats workers, and how clean its leaders play.

The Link Between ESG Factors and Investment Performance

Do ESG factors really make a difference when you invest? The answer is yes. Companies with strong ESG practices often avoid big troubles that can cost a lot of money. They also tend to last longer and do better than companies that don’t care about ESG.

For example, let’s say a company cares a lot about the ‘E’ in ESG, which is the environment. This means they use less water and energy, which saves them money. They also avoid fines for polluting the planet. That’s good for both the planet and their pockets.

Good ‘S’ practices are about being fair and just. Companies that treat their workers well have happy teams who work hard and stay loyal. And ‘G’ means having rules in place so that the company is run in a good way. This avoids scandals that can make it lose trust and money.

We see investor demand for ESG growing fast. People more and more want their money to back up what they believe in. This is why we are seeing green investing strategies take off.

Ethical investment policies and ESG compliance mean that asset managers are now expected to consider these factors. They have to make sure the money they look after is put into companies that match up with ESG values.

Let’s not forget about ESG-themed investment funds. These funds group together lots of ESG-friendly investments. They let people put their money into good causes without having to pick out each investment by hand.

To wrap it up: ESG isn’t just nice to have anymore. It’s critical for smart investing that looks after our future. By understanding ESG criteria and how they touch investment performance, we can make choices that help our wallets and our world.

Measuring Success: The Role of ESG Performance Metrics

Leveraging ESG Data for Comprehensive Investment Analysis

Measuring success in finance today means looking beyond dollars and cents. We must include the good a company does for the world. This is where ESG performance metrics come in. They help us see which firms are great citizens of the world.

But what are ESG metrics? They gauge how firms do in caring for the earth, treating people right, and running their business well. These scores help us pick the best firms to invest in and track how they do over time.

Investors today want to put their money in firms that match their values. ESG criteria help them do just that, leading to a rise in ethical funds and green strategies. Firms with high ESG scores often do better over time and draw more investors.

Now, let’s talk data. When we dive into ESG scores, we look at many pieces of info. This includes how much energy a firm saves, if they treat workers fairly, and if they have good leaders calling the shots.

There’s no doubt, you’ll want firms that score well on ESG in your portfolio. They often manage risks better and are set for the long haul. High ESG scores can also mean better returns for your money. This makes them a win for both the world and your wallet.

The Importance of ESG Reporting Standards and Compliance

Are all ESG reports created equal? Sadly, no. This is why having solid ESG reporting standards matters. These rules make sure all firms report their ESG deeds in the same way. Clear and true reports let us compare firms fairly. They also help us trust that we are investing in truly good firms.

Let’s not forget laws and rules. Different places have different rules on how firms report their ESG efforts. Firms need to follow these rules to keep out of trouble. Good ESG reporting means sticking to these rules, so investors can trust the data they see.

We also must chat about why rules and compliance count so much. When firms stick to ESG rules, they show they are serious about doing the right thing. This builds trust with investors, who then feel better about putting their cash there. As trust grows, so does the money flowing into funds that focus on doing good.

The upshot? Clear, true data on firms’ ESG deeds help investors make smart choices. It brings together those who want to make money and those who want to do right by the world. ESG scores are how we track if investing in good deeds pays off. Spoiler alert: It often does.

In the end, knowing the ESG scores helps you side with firms that care. It turns green talk into green walks. And in a world that needs a bit more care, isn’t that something worth investing in?

Implementing ESG Principles in Portfolio Management

Strategies for Integrating ESG into Asset Allocation

Today, many folks want their money to do good in the world. This means investing in companies that care about the planet, treat people right, and are run well. Let’s dive in to see how smart folks are adding ESG criteria into finance.

The first step is easy: folks pick their favorite ESG factors that matter most to them. They might care about clean air, water, and fair work conditions. Each investor has their own mix of these ESG elements that they care about. This careful picking is called ESG criteria in finance. It’s like choosing what goes into a salad to make it just right.

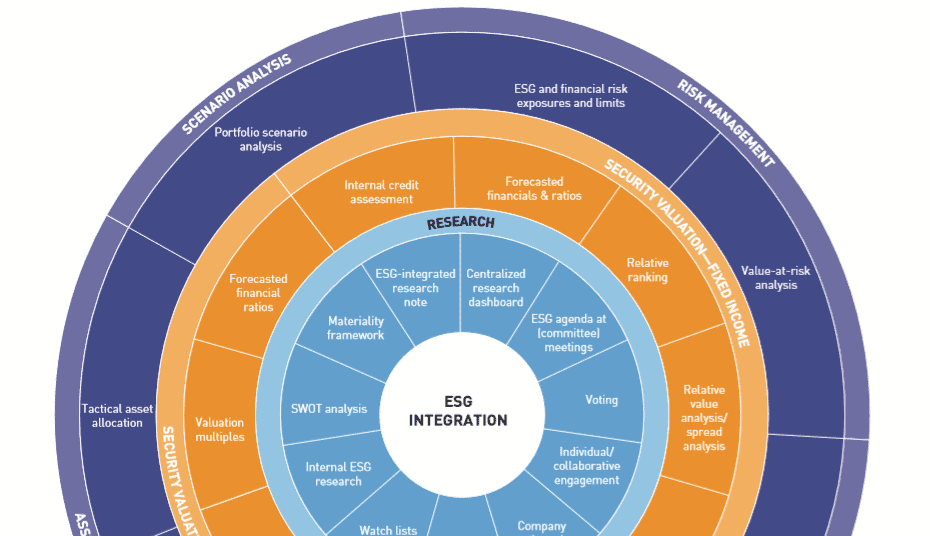

I’ve seen how ESG data analysis helps point investors to the right choices. There are tools that track how companies are doing on ESG. This scorecard helps investors pick the best ones that match their values. Just as a coach picks the best players for a team, investors use these scores to pick the best companies for their money.

Navigating Risks with ESG Risk Management Practices

But it’s not all sunshine and rainbows. Investing is risky. Companies might not always do what they say they will. That’s where ESG risk management in portfolios comes in. It’s like having a safety net when walking a tightrope.

We keep a keen eye on those ESG performance metrics to see where the risks might be. It’s a bit like keeping an eye on the weather. If a storm’s brewing, investors can steer clear. Just as someone might bring an umbrella if they expect rain, savvy investors use ESG info to avoid getting soaked in bad investments.

To stay ahead of the game, folks also watch trends, like how the world is fighting climate change. Green investing strategies are all about backing up companies that help our planet. When investors put their dollars into these businesses, they’re part of the global team tackling big earth stuff. It’s like joining a sports team that’s playing for much more than just a trophy.

Remember back in the day when old-school investors only counted cash? Nowadays, ESG and investment returns are like dance partners. They step together to the beat of ethical investment policies and can lead to a more secure future, not just for the investors but for everyone.

Letting ESG guide where money goes can make a big difference in how the world works. It helps folks feel great about where their money sleeps at night. And I think we can all agree, sleeping soundly, knowing your money’s doing good, is a pretty neat trick.

The Future of Investing: ESG-Driven Assets and Funds

Exploring ESG-Themed Investment Funds and Their Returns

The world of money is changing. People now want their investments to do good for the world. Not just make money. They look for funds that match their values. ESG-themed investment funds offer just that. They mix the goal of making money with the desire to help the planet and its people.

What are ESG-themed investment funds? In short, they are pools of money, invested in ways that are kind to the earth, good for society, and run by smart bosses. These funds check companies for green actions, how they help people, and if their leaders are fair and honest. When you put money into these funds, you’re voting for a better world.

Now, do these funds make money? Yes, they often do! Many times, they perform as well as other funds. Sometimes, they do even better. When companies care about ESG, they think long term. And long-term thinking can mean better money-making over time. So yes, investing in ESG can be good for your wallet too.

Investing in ESG also means you know where your money is going. You can be proud that it’s being used right. It’s not just about the cash you get back. It’s also about feeling good that your money helps fix problems like pollution or unfair work.

It’s not all easy, though. Picking the right ESG fund takes work. You have to look at ESG scores and know what they mean. You also have to see how these funds work over time. This way, you can choose the best place for your money.

Innovative ESG Asset Classes: Green Bonds and Social Impact Bonds

Okay, we’ve seen ESG funds, but there’s more to ESG investing. Let’s talk about green bonds and social impact bonds. These are special ways to help the earth and people by investing.

Green bonds are used to fund projects that help the planet. Think clean energy or clean transportation. They tackle big problems like climate change. You lend money, and it gets used for green projects.

What about social impact bonds? They focus on helping people. For example, they might pay for programs that help with jobs, health, or housing. You lend money, and it gets used for projects that make life better for people.

These bonds can still give you good returns. Just like normal bonds. But they do more. They help build a world we all want to live in. Plus, more and more, folks want to invest in them. As demand grows, so too can the money you make.

Putting your cash into ESG is not just smart. It’s also right. It shows you care. About the air, the land, the water, and people everywhere. And as more people join in, companies and governments will take notice. They’ll change to meet this new demand.

So, when you think about your next investment. Think about ESG funds, green bonds, and social impact bonds. Your dollars can do a lot. They can grow for your future. And they can help the planet and its people right now. That’s the power of ESG investing. It’s the future of how money works.

In this post, we’ve covered the big role of ESG—environmental, social, governance—in smart investing. First, we talked about what ESG means in money matters today. Then, we saw how these ESG parts can help us guess how our investments might do.

Next, we looked at how to tell if investments are doing well with ESG. This includes using ESG data and following the right reporting rules.

We also talked about how to make ESG part of choosing where to put our money and how to deal with possible ESG risks.

Lastly, we checked out the new types of funds and bonds focused on ESG, seeing how they can both do good and make money.

To wrap it up, putting ESG smack in the middle of our investment choices is smart. It’s not just a trend; it’s the future. By mixing value with values, we can aim for rich rewards while making a positive mark on the world. Let’s make money the right way—with ESG leading the path.

Q&A :

What does ESG stand for in investment strategies?

ESG is an acronym that stands for Environmental, Social, and Governance. In investment strategies, it refers to the evaluation of companies based on their conscientiousness about environmental protection, social justice, and internal management and leadership. Emphasizing ESG factors within mainstream investment strategies is becoming increasingly prevalent as investors seek not only financial returns but also positive societal change.

How does integrating ESG into mainstream investment impact financial performance?

Integrating ESG into mainstream investment strategies can have various impacts on financial performance. While some studies suggest a positive correlation between high ESG ratings and financial performance, others highlight the risk management and long-term value associated with considering ESG factors. By focusing on companies with strong ESG practices, investors may mitigate risks and tap into opportunities tied to sustainability and ethical business practices.

Are ESG investments becoming more popular in mainstream markets?

Yes, ESG investments are gaining traction in mainstream markets. Investors are showing increasing interest in supporting companies that prioritize ecological sustainability, social responsibility, and strong governance principles. This shift is reflected by substantial growth in ESG-focused mutual funds, exchange-traded funds (ETFs), and other investment vehicles that cater to this demand.

What are the challenges of ESG investing in mainstream portfolios?

One of the challenges of ESG investing in mainstream portfolios is the lack of standardized metrics and definitions for what constitutes an ESG-compliant investment. This can lead to challenges in measuring and comparing the ESG performance of different companies and funds. Additionally, the varying degree of commitment to ESG principles across organizations may make it difficult for investors to gauge the genuine impact of their investments.

How do investors screen for strong ESG profiles within mainstream investment strategies?

Investors screen for strong ESG profiles by using specialized research and analytics services that examine various ESG criteria. These criteria can include a company’s carbon footprint, water usage, labor practices, diversity policies, and anti-corruption measures, among others. Investors may also utilize ESG scores or ratings provided by third-party firms to help guide their investment decisions within mainstream strategies.