Economic factors causing stock market crash are rarely straightforward. Yet, they shape our financial world, rocking it to the core when least expected. Have you ever wondered what really sets off these downturns? I’m here to pull back the curtain. We’ll start by deciphering the subtle signs that spell trouble, from sneaky recession indicators to the often misunderstood interest rate hikes and their lethal dance with stock values. Get ready to unravel the economic mysteries that bring giants to their knees. It’s time to dive into the unspoken realities that trigger market chaos.

Deciphering the Signals: Recognizing Recession Indicators and Their Consequences on Markets

The Role of Recession Indicators in Predicting Market Crashes

We see signs before a storm hits, right? Well, it’s the same with the economy. We call these signs ‘recession indicators.’ They tell us trouble may be coming in our money world. Think of a patient’s heartbeat. Just like doctors keep tabs on it, economists watch things like job numbers, how much stuff factories make, and how often people spend money. These give us clues about our economy’s health.

When people lose jobs or make less stuff, it can mean problems. If it goes on for too long, the whole country feels sad. This sadness spreads to stocks too. Why? Because if folks are worried and not buying things, companies don’t make money. And when companies don’t do well, their stock prices usually fall. Think of it like a team. If one player is having a tough time, it can hurt the whole team’s game.

Understanding Interest Rate Hikes and Their Relationship with Stock Declines

Now, let’s chat about interest rate hikes. That’s when the money leaders, like the Federal Reserve, say it costs more to borrow money. This makes everything more pricey. If you have a toy you want, and it costs more to make, what happens? That’s right, the price goes up! This is not great news for business either. It can slow down how much stuff they sell.

Plus, if it costs more to borrow money, companies might not want to get loans to make their business grow. They sit tight and wait. Investors don’t like waiting. They get nervous and might sell their stocks. When lots of folks sell stocks, prices drop fast. No one wants that!

So, what happens when stocks fall? People who have money in the stock market lose cash. They feel less rich and spend less. When people spend less, businesses make less money, and might have to let workers go. Then, more people have less money, and they also spend less. It’s like a snowball rolling down a hill, getting bigger and faster.

We all need to keep an eye on these things. Job numbers, how much money people spend, and what the money bosses say about interest. These can tell us if a big financial storm might be on the way. We might not stop it, but we can get our raincoats ready, just in case. Remember, knowing what’s going on helps us stay one step ahead. Keep watching, and let’s make smart moves together!

Assessing Inflation’s Grip: How Investment Strategies Must Adapt

Inflation and Investment Dynamics During Economic Turbulence

Inflation happens when prices rise and your money buys less. It’s a key sign of trouble. Investors, like you and me, feel this pinch. Goods cost more, and our cash loses power.

What do we do? We change how we invest. We seek shelter in assets that beat inflation. Stocks often adjust to inflation, but not always. Some prices rise too fast, and stocks can’t keep up.

When inflation’s up, we watch central bank moves. Their fixes, like interest rate hikes, aim to cool off prices. But they can slow business too, and push us into an economic slam.

So what’s the impact of inflation on investment? It can cut profits and mess up our plans. We want gains, but inflation makes that tough. We need to play it smart, shifting gears as needed.

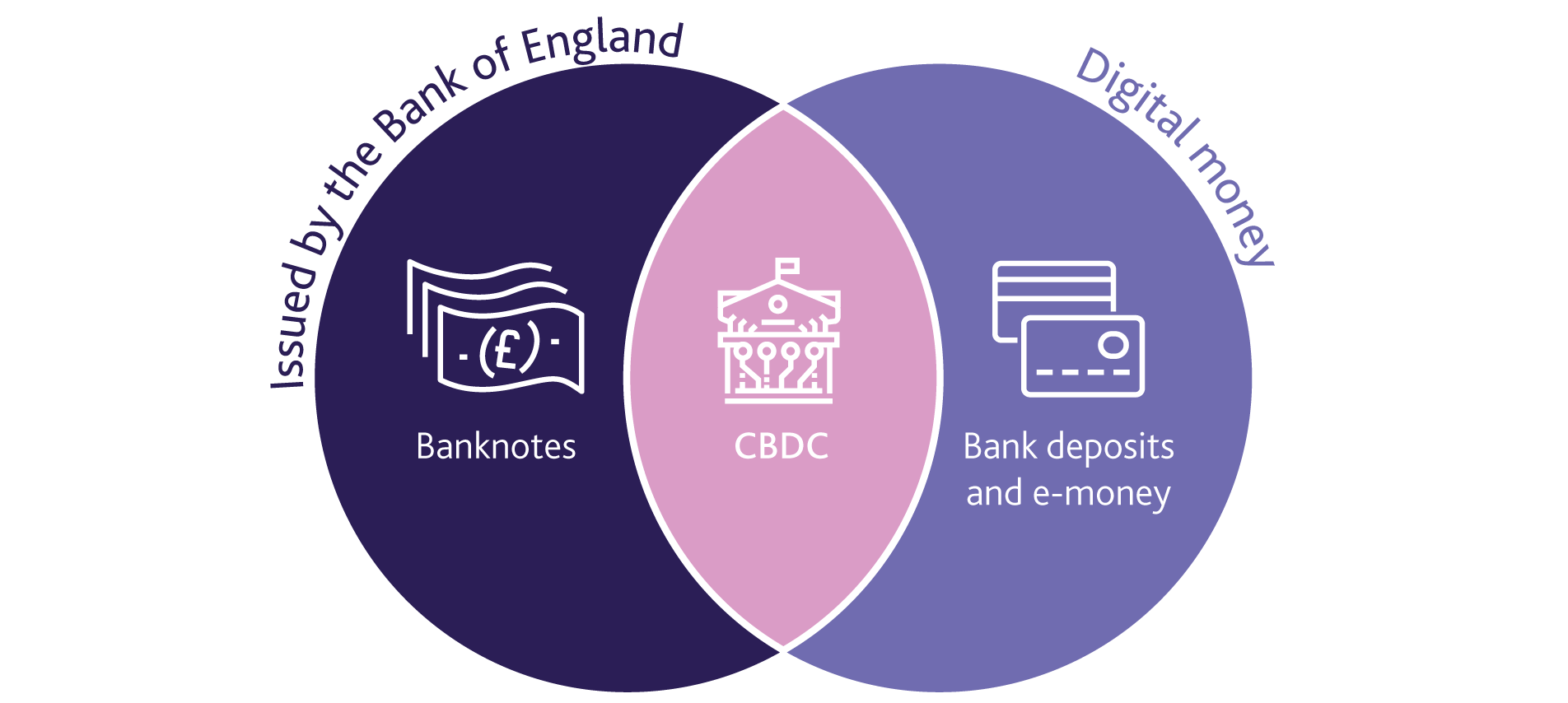

The Impact of Central Bank Policies on Long-Term Market Stability

Now, central banks, like the Fed, guide economies. They tweak interest rates to keep things steady. If prices soar, they hike rates to tame them down.

But here’s the rub: If they hike too much or too quick, they can hurt the market. Jobs can vanish, and folks spend less. That can start a crash.

Yet, these banks can’t just sit idle. They must balance things out – fight inflation but keep jobs safe. And they’ve got to look long term, past today’s upset.

What happens when they miss the mark? Maybe they’re slow to hike rates or go too far. This can cause a crash or a long slump. We’ve seen it before when the housing market crashed.

Under their watch, we keep an eye on signs like unemployment rates, trade imbalances, and when folks fret about what’s next (declining consumer confidence).

So our job? It’s to track these shifts, these clues. To brace for bumps and to dodge deep drops. It’s not easy, but with clear thinking, we can keep our money safer in wild times.

As I help folks steer their investments, one truth sticks out: Knowledge is king. The sharper our know-how on inflation and central bank plans, the better we can handle our cash. We can spot dangers sooner and find paths to profit even when the going gets tough.

Staying informed, staying agile – that’s how we play the long game. And as these economic winds howl, we tighten our grip and push on, aiming to stay ahead of the storm.

Analyzing the Domino Effect: Unemployment and Consumer Behavior

Linking Unemployment Rates to Market Confidence and Activity

Let’s talk jobs and money. When folks lose jobs, the fear spreads fast. Why? More job losses mean less cash in pockets. Fewer jobs can shake our trust in the market. When we see others out of work, we think hard before we spend. We stop buying stuff we don’t need. This means businesses sell less. They make less money and their stock value drops.

Unemployment rates are a big deal for the stock market. They show how many people can’t find work. When this number goes up, it’s a warning. It tells us that companies might be in trouble. If they are, it means they’re not making enough money. This can scare off investors.

Now, think about this. When you hear a factory in your town is closing, what do you feel? Worry, right? That worry spreads to everyone. Even folks who still have jobs might stop spending. They save more, just in case. This can turn into a huge problem for the economy.

Businesses need us to keep buying things. If we stop, they have to cut back too. They might even fire more workers. It’s like a row of dominoes falling over. One thing leads to another. And before we know it, stock prices may crash.

Consumer Confidence and Spending Patterns Preceding a Market Crash

Now, what about how we all feel about spending money? This is called consumer confidence. When we feel good about our jobs, we spend more. We might buy a new car or fix our house. This spending is fuel for the economy.

But what if we start to worry? Maybe prices are too high, or it’s just hard to pay bills. Then, we zip up our wallets. We only buy what we have to, like food and rent. When this happens, businesses feel the pinch. They see sales drop and profits fall.

So, what does this mean for the stock market? Low confidence can mean less money in the market. It’s a sign of trouble ahead. When people are scared, they don’t invest in stocks. They want to keep their money safe. And sometimes, that means pulling it out of stocks.

If enough people do this, stock prices can go down fast. This is because there are more people who want to sell than buy. Prices drop to get rid of the extra stocks. When we see prices fall, it can make us even more scared. It’s a cycle that’s hard to stop.

So, what have we learned? Jobs and spending are like the heart of the economy. They keep things moving. When jobs vanish and wallets snap shut, the stock market gets the chills. It can even crash if we’re not careful. Keep an eye on these signs if you’re thinking about stocks. They can tell us a lot about what might happen next.

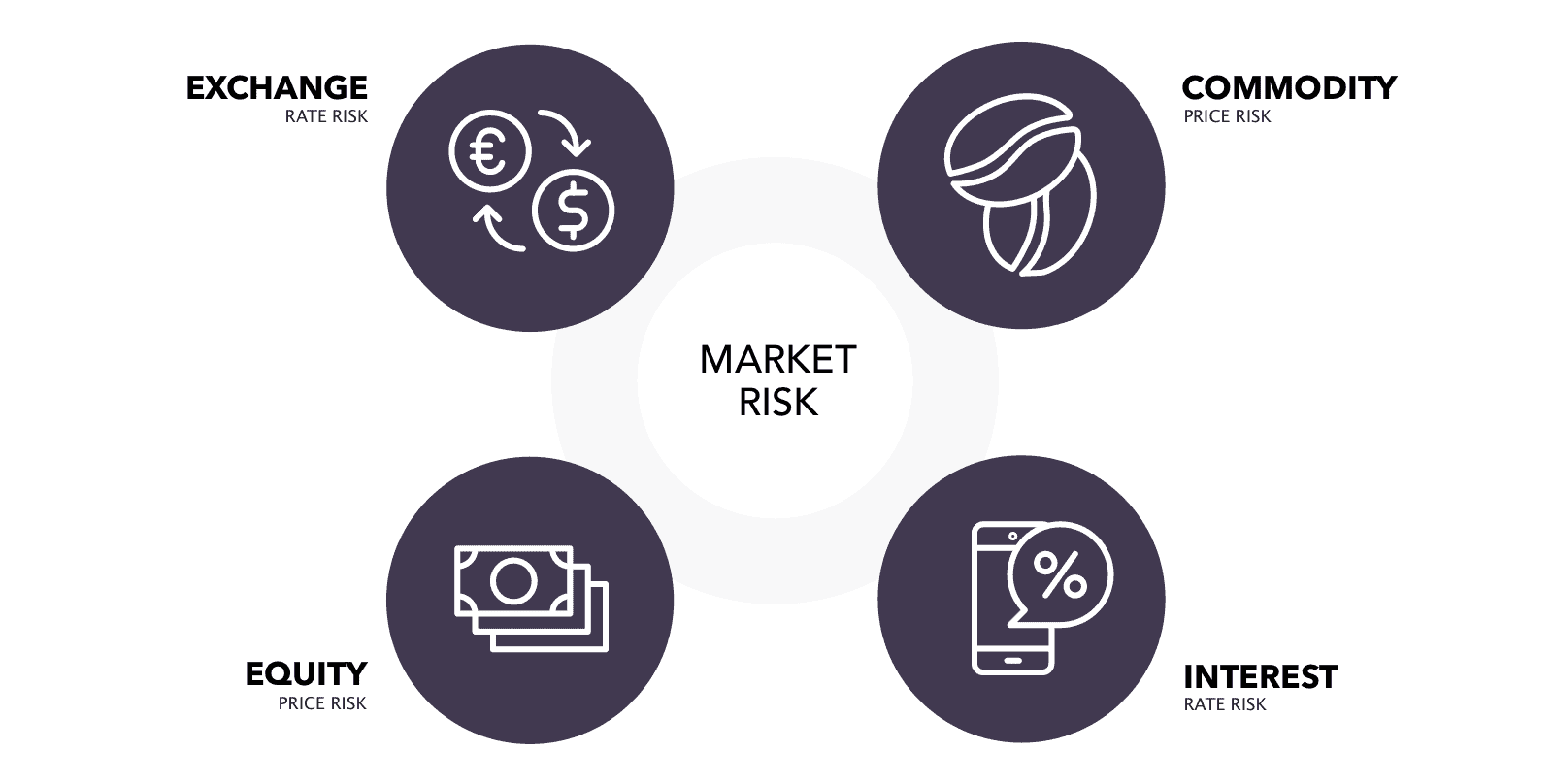

Navigating Through Economic Alert Zones: Identifying Key Market Risks

When Asset Bubbles Burst: Stock Overvaluation and the Road to Correction

Ever wondered what makes stock prices fall so fast? It often starts with prices too high. They don’t match the real value of companies. This is called stock overvaluation. When many investors realize this, prices drop quickly. This sudden drop can lead us to a market crash.

But how do we know if stocks are overvalued? We look at basic things like company earnings and their stock prices. If prices soar but earnings don’t, watch out! Prices may tumble down soon.

Another sign is when everyone is too excited about stocks. If people are buying stocks just because others do, that’s a red flag.

So when prices fall, that’s the market’s way of fixing overvalued stocks. It’s like the market is saying, “Hold on, let’s get back to what’s real!”

Recognizing Bear Market Triggers and Adjusting Investment Approaches

Do you ever hear about a “bear market”? It’s when stock prices keep dropping for a long time. A big bad bear likes to push prices down.

One trigger of a bear market is high interest rates. When borrowing money gets pricier, companies invest less and grow slower. This can scare investors. They sell their stocks, and prices fall.

Inflation can also trigger a bear market. As things cost more, people spend less. Companies make less money, and their stock prices can fall.

To stay safe in a bear market, people change how they invest. Instead of taking big risks, they go for safer options like bonds. They might also keep some cash aside. That way, they have money to invest when they spot a good chance.

Look, nobody likes losing money in stocks. But if we keep an eye on these signs, we can dodge big losses. And maybe, we can even find new ways to make money, no matter what the market does.

In this post, we’ve dived into the signs that spell trouble for markets. From recognizing recession indicators to understanding interest rates, we’ve covered how these factors can predict downturns. We also unpacked how inflation affects investments and the central bank’s role in market health.

Next, we examined how unemployment impacts market confidence and consumer spending, key to spotting crashes. Finally, we discussed how to spot risks like overvalued stocks and bear market triggers, crucial for smart investing.

My final thought? Stay sharp and proactive. By understanding these signs, you can better navigate the financial storms ahead. Your move can mean the difference between loss and stable gains. Keep learning, keep adjusting, and keep your investments on the right track.

Q&A :

What economic indicators predict a stock market crash?

Economic indicators that can predict a stock market crash usually involve a combination of high inflation rates, rapidly increasing interest rates to combat inflation, a significant decrease in consumer confidence, and a downturn in economic activities such as manufacturing and services. Sudden spikes in unemployment rates and unexpected drops in gross domestic product (GDP) can also serve as warning signs of an impending market downturn.

How do global economic factors contribute to a stock market crash?

Global economic factors can significantly influence stock market stability. Events such as international conflicts, trade wars, and global pandemics can disrupt supply chains, inflate commodity prices, and lead to market uncertainty. Additionally, financial crises in one country can spread to others through the interconnectedness of global markets, sometimes culminating in a widespread market crash.

Can fiscal and monetary policies prevent a stock market crash?

Fiscal and monetary policies can mitigate the risk of a stock market crash when applied judiciously. By adjusting interest rates, controlling the money supply, and influencing government spending, central banks and governments can stabilize economic growth and maintain investor confidence. However, if these policies are mismanaged or introduced too late, they might not prevent a crash.

What role does investor behavior play in causing a stock market crash?

Investor behavior plays a crucial role in both the buildup and the onset of a stock market crash. ‘Herd behavior’, where investors follow each other into buying or selling stocks, can lead to asset bubbles or panic selling. Furthermore, a lack of investor confidence can precipitate a market collapse as investors withdraw their funds en masse, leading to a sharp decline in stock prices.

Do high-interest rates always lead to a stock market crash?

While high-interest rates can lead to a decrease in consumer and business spending due to higher borrowing costs, which can negatively impact company profits and stock prices, it does not necessarily lead to a stock market crash. A gradual increase in rates, when well-communicated and anticipated by the markets, may not result in a crash. The overall impact also depends on other prevailing economic conditions and how these changes are perceived by investors.