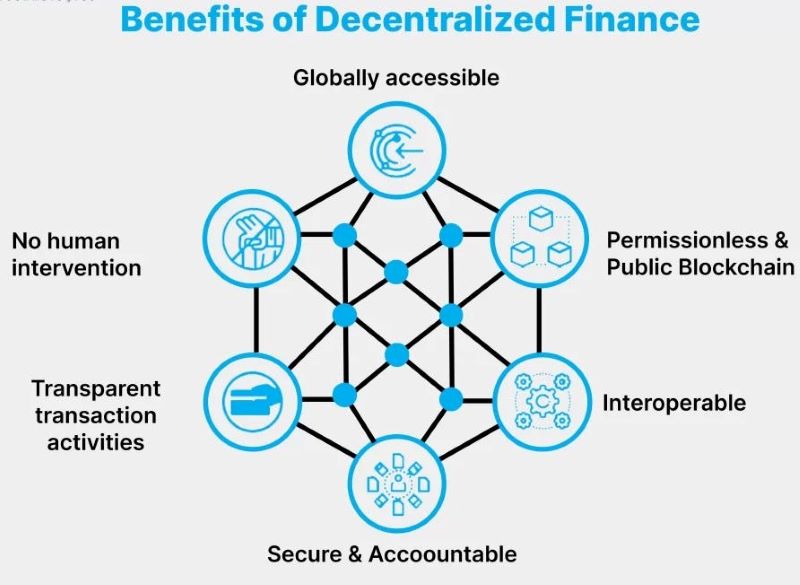

Decentralized finance or DeFi, is revolutionizing the financial world by leveraging blockchain technology to create a more accessible, transparent, and efficient financial ecosystem. Unlike traditional finance, which relies on intermediaries like banks and brokers, DeFi empowers individuals with direct peer-to-peer transactions, automated by smart contracts. This cutting-edge technology is disrupting the financial landscape, offering new opportunities for users to lend, borrow, trade, and invest in a trustless and permissionless manner.

What is decentralized finance (DeFi)?

Decentralized finance (DeFi) is a novel financial technology built upon secure distributed ledgers, similar to those utilized by cryptocurrencies. It aims to disrupt the traditional centralized financial system, where institutions like banks and brokerages act as intermediaries. DeFi empowers individuals by enabling direct peer-to-peer transactions, bypassing the need for intermediaries and offering a more open and accessible financial landscape.

How decentralized finance (DeFi) works?

Decentralized finance (DeFi) leverages peer-to-peer networks, advanced security protocols, and software and hardware advancements to create a financial system that operates without intermediaries like banks or financial institutions. These intermediaries typically charge fees for their services, which are essential in the traditional financial system.

However, DeFi eliminates this need by utilizing blockchain technology, enabling direct peer-to-peer transactions and removing the reliance on central authorities. This shift towards decentralization promises to revolutionize the financial landscape by increasing accessibility, reducing costs, and empowering individuals with greater control over their financial assets.

Blockchain

A blockchain is a decentralized and secure digital record of transactions. Each transaction is added as a “block” to the chain, with each new block containing information about the previous one, making it virtually impossible to alter previous records. This immutable nature, combined with strong security protocols, ensures the integrity and reliability of the data stored on the blockchain.

Individuals use digital wallets to hold private keys, which function like passwords, to access and manage their digital assets on the blockchain. These assets can be tokens or cryptocurrencies, representing value that can be securely transferred between users through unique private keys generated for each recipient. The blockchain’s design ensures that transactions are irreversible, safeguarding ownership and preventing fraudulent activities.

Applications

DeFi applications are user-friendly interfaces that interact with the blockchain, simplifying financial transactions for individuals. These applications provide various financial options, like lending, borrowing, and trading, without requiring technical expertise in blockchain operation. They automate processes by offering customizable features, such as setting interest rates or collateral requirements for loans. Users can easily search for and connect with other individuals or institutions globally to access financial services through these applications. By leveraging the blockchain’s global network, DeFi enables seamless cross-border transactions, promoting financial inclusivity and accessibility.

Goals of Decentralized Finance

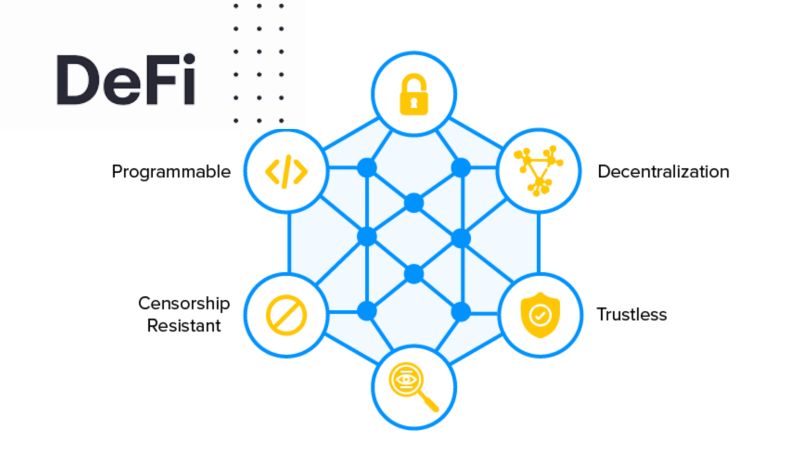

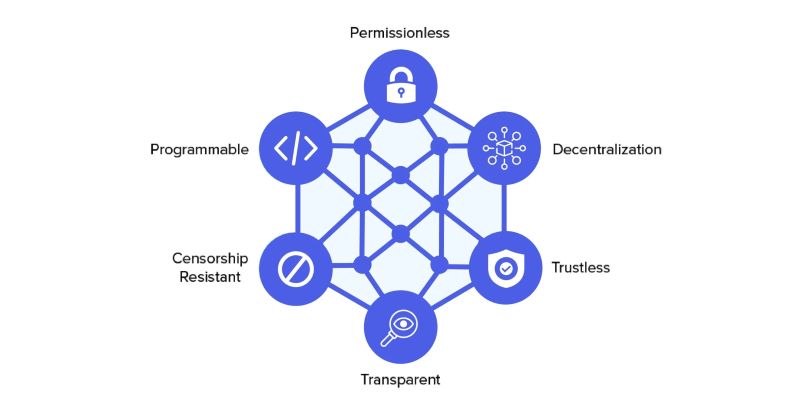

Decentralized finance (DeFi) aims to revolutionize the financial landscape by eliminating intermediaries and empowering individuals with greater control over their finances. Its key goals include:

Accessibility: DeFi platforms are open to anyone with an internet connection, regardless of their location or financial status. This fosters financial inclusivity and removes barriers to entry that exist in traditional finance.

Low fees and high interest rates: By cutting out intermediaries, DeFi enables direct peer-to-peer transactions, resulting in lower fees for users. Additionally, DeFi platforms often offer higher interest rates on savings and investments compared to traditional banks.

Security and transparency: Smart contracts on the blockchain automate and enforce financial agreements, ensuring transparency and reducing the risk of fraud. The immutable nature of blockchain technology further enhances security and prevents unauthorized tampering with transaction records.

Autonomy: DeFi eliminates the need to rely on centralized financial institutions, giving individuals greater control over their financial assets and decisions. This promotes financial independence and self-sovereignty.

What is an example of DeFi?

Aave is a prime example of decentralized finance (DeFi) in action. It operates as a decentralized liquidity market protocol, allowing users to participate as either liquidity suppliers or borrowers. By staking their crypto assets on Aave, users can earn interest income from borrowers who utilize those assets for various financial activities.

This demonstrates DeFi’s core principle of peer-to-peer financial interactions, where individuals can directly engage in lending and borrowing without relying on traditional intermediaries. Aave’s success highlights the growing potential of DeFi to revolutionize the financial landscape by offering innovative, accessible, and transparent financial services.

Decentralized Finance uses

Decentralized Exchanges (DEXs): These platforms, like Uniswap and PancakeSwap, allow users to trade cryptocurrencies directly with each other, without intermediaries.

Liquidity Providers: These pools of funds enable exchanges to provide selling opportunities for users, addressing the issue of illiquidity in the crypto market.

Lending/Yield Farming: DeFi lending platforms offer users the chance to earn interest on their crypto holdings by lending them out to others. Yield farming involves actively seeking out the highest returns by moving assets between different platforms.

Gambling/Prediction Markets: DeFi has facilitated the growth of decentralized gambling and prediction markets, where users can bet on various outcomes using cryptocurrencies.

NFTs: Non-fungible tokens, representing unique digital assets, remain popular among niche investors and collectors, contributing to the diverse landscape of DeFi.

How to get involved in DeFi

Getting involved in decentralized finance (DeFi) doesn’t have to be overwhelming. The initial step is to research and identify the specific activities or services that align with your interests. Next, choose a suitable wallet from the numerous options available, ensuring it is compatible with the DeFi platforms you plan to use.

After selecting your preferred wallet and activity, find a reputable exchange that offers the services you’re interested in. Purchase the necessary cryptocurrency through the exchange, and you’re ready to embark on your DeFi journey. Remember, research and due diligence are crucial to navigate the DeFi landscape safely and effectively.

Is DeFi a good investment?

While DeFi offers promising opportunities, investing in it comes with inherent risks. The vulnerability of DeFi platforms to hacks and exploits has been a persistent concern, although recent data suggests a decline in such incidents.

Nevertheless, the potential for future attacks remains a risk factor. Investing in DeFi, like any investment in cryptocurrencies and blockchain technology, requires careful consideration and an understanding of the volatile nature of the market. It’s essential to conduct thorough research and due diligence before investing, and to be prepared for potential losses.

Decentralized finance is not just a buzzword; it’s a rapidly growing movement that is transforming the way we interact with financial services. While still in its early stages, DeFi’s potential to democratize finance and empower individuals is undeniable. By eliminating intermediaries, reducing costs, and increasing accessibility, DeFi is paving the way for a more inclusive and equitable financial future.

Stay ahead of the curve and explore the latest developments in decentralized finance with Financial Insight Daily.