Combining technical and fundamental analysis isn’t just a strategy; it’s my secret weapon. I see the market’s flow, not just its face. I catch the rhythm of prices and pulse of value. Together, they tell me stories no single method can. I’ve honed this dual-view. Now, I look beyond the charts to the core of the companies, weaving numbers and narratives into a holistic view of the investment landscape. Stick around, and I’ll show you how to play this game of smarts, not just stakes. Ready to dive into a world where savvy investors thrive by marrying the granular with the grand? Let’s break down the synergy between these twin powers and take your investing game to the next level.

Understanding the Synergy Between Technical and Fundamental Analysis

Fundamentals of Combining Technical and Fundamental Analysis

What do you get when you mix two investment styles? You create a powerful toolset for making smart investments. Think of technical analysis and fundamental analysis like peanut butter and jelly – separate, they’re good, but together, they’re great! And here’s why.

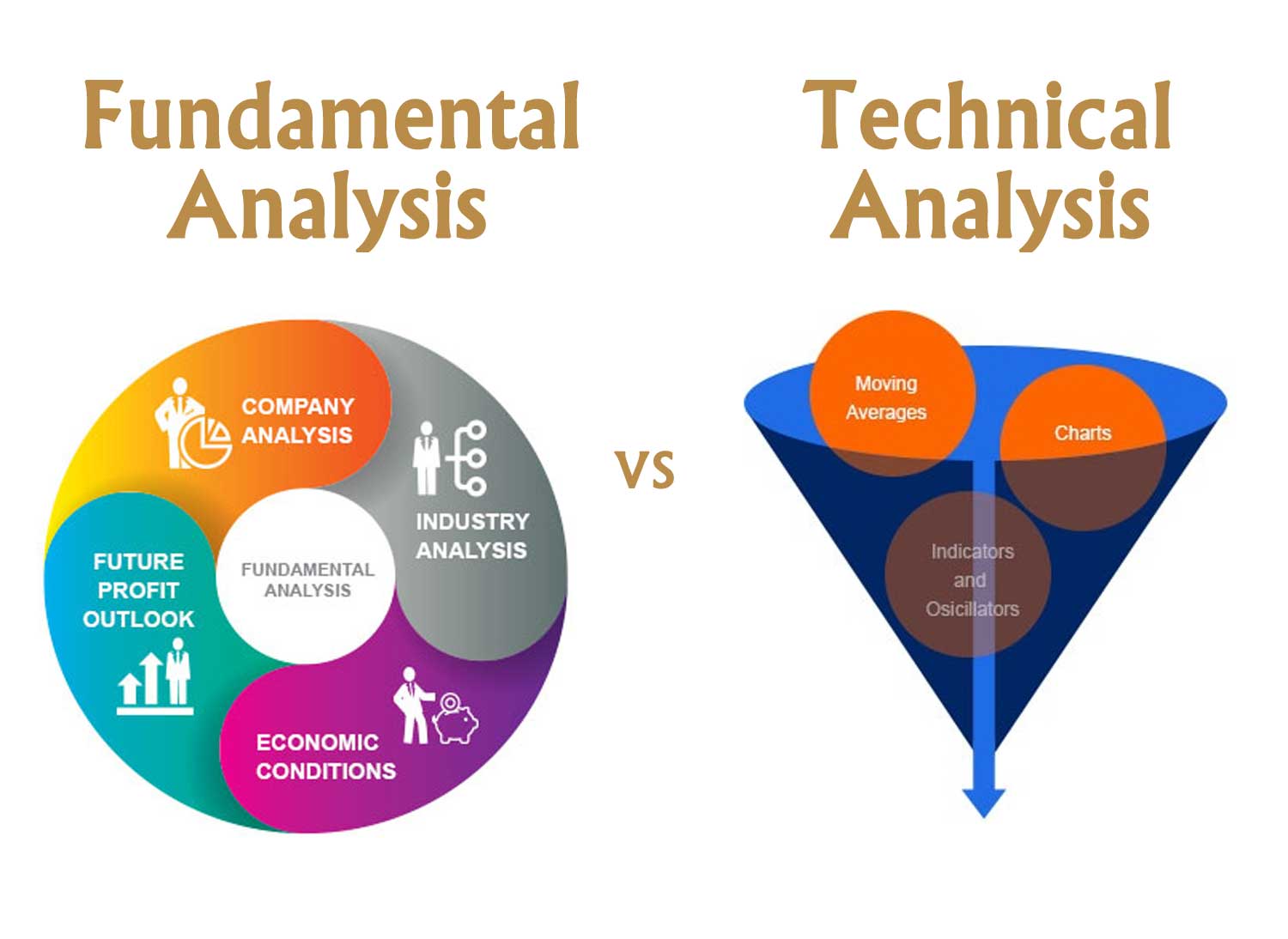

Technical analysis tools help us see where a stock’s price might head. Charts and patterns in trading give us a peek at how things have moved in the past. Price movement analysis and volume analysis trading clue us into what’s hot and what’s not. Now, meet its partner: fundamental analysis. It’s all about the company’s health. Does it make money? Can it pay its bills? What’s the growth outlook?

When we use both, smart investing kicks into high gear. With fundamental analysis principles, I dive into financial statement assessment. I look at balance sheets, income statements, and cash flow statements. These show me a company’s real deal. Then, I match that with what the charts say. It’s like getting to know someone inside and out.

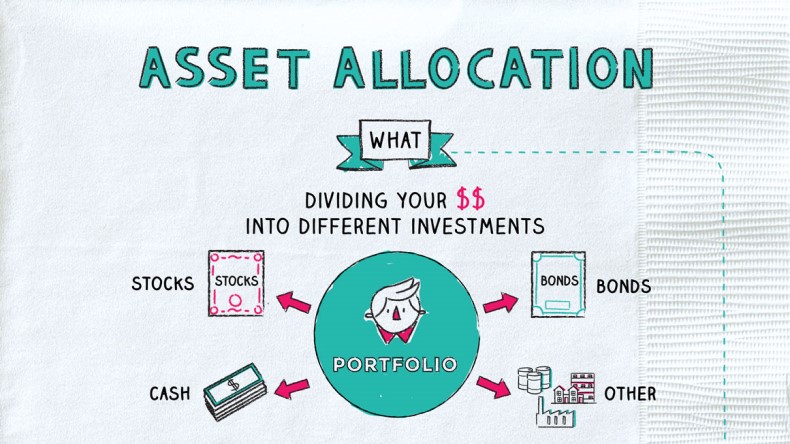

It’s not just about picking stocks either. Asset allocation techniques matter too. Diversified investment strategies mean not all your eggs are in one basket. It’s a good way to play it safe yet still have a chance to win big.

So, how do I decide what’s a good buy? I look at company valuation methods, like how much cash they have. Ratio analysis in stocks tells me if they’re priced right. I watch out for earnings quality assessment. Some companies might look good on paper but look closer, and you’ll see it’s not all sunshine.

I also think about who’s running the show. Management team analysis and competitive advantage evaluation tell me if they’ve got a secret sauce that could lead to success. And it’s not just about numbers.

There’s this thing called market sentiment assessment. It’s about getting the vibe of what investors feel. Investor psychology in analysis helps guess what they might do next. After all that, I make the call. I weigh out the risks, look at my charts, and make my move.

Real-World Application: Case Studies on Synergistic Analysis

Let’s bring this all to life with stories from the trenches. We’ve seen big companies surprise us when we least expect it. Take a tech giant like Apple. Technical analysis showed us it was on an uptrend with solid support levels. Fundamental analysis supported this with strong earnings and innovative products leading the pack.

And what about a company that didn’t look so good on the tech side but had solid basics? That’s where smart investing with both analyses shows its strength. It might mean waiting out the storm for the sunshine that’s due to show.

Market analysis methods pull in all kinds of info, like sector performance analysis and macroeconomic trends. They tell me if the whole playground is shaking or just a few swings.

In the end, it’s about using every tool you’ve got, integrating market analyses to make a choice you can stand by. Whether you’re a trader looking for a quick win or an investor in it for the long game, combining technical and fundamental analysis helps you make moves with eyes wide open.

The Toolbox for Modern Investors: Key Analytical Tools and Indicators

Navigating the Technical Analysis Landscape

When we dive into stocks, it’s like treasure hunting. We need the best tools. One such tool is technical analysis. It’s all about spotting patterns in charts. It helps us see where a stock might head next.

Technical analysis tools come in many forms. Think of them as your stock market Swiss army knife. For example, we use stock indicators to see if a stock is hot or not. Overlays help us compare different stocks.

With charts and patterns, we can predict price moves. It’s our crystal ball to find future prices. But we don’t stop there. We also look at how much of a stock people are buying and selling. This volume analysis is key for smart trading.

Uncovering the Pillars of Fundamental Analysis

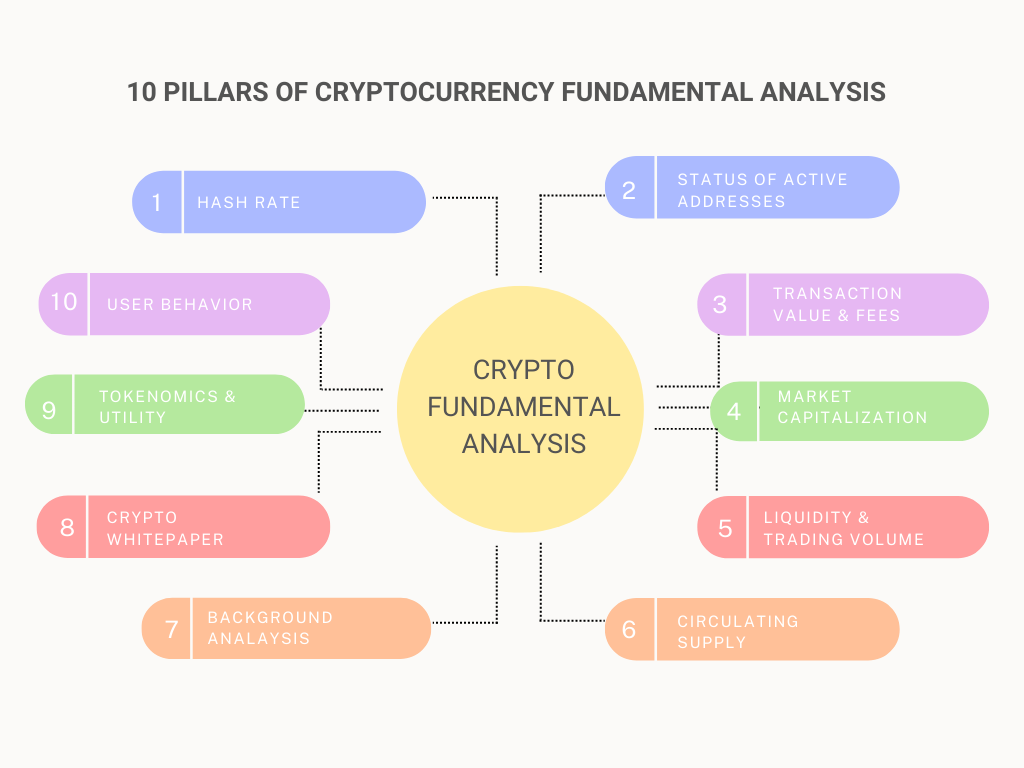

Now, on the other side, we have fundamental analysis. It’s different but just as mighty. This is where we play detective with a company’s value.

We dig into balance sheets. They show if a company stands on solid ground. If the income statements look good, the company may be making real money. But cash flow statements? They’re the secret sauce. They show the cash coming in and out. That’s critical for finding grower companies.

The people running the show matter too. That’s where management team analysis comes in. We ask, “Do these leaders have what it takes to win?” Then, we study their edge over others. This competitive advantage check can tell us if they’re likely to stay ahead.

Market sentiment is our mood ring. It shows what investors feel about a stock. Get this, even they have moods and those moods sway stock prices! By cracking investor psychology, we can often stay one step ahead.

It’s not all about picking stocks. We also have to manage risks. That’s where smart risk management in trading saves the day. We make sure our eggs aren’t all in one basket with portfolio diversification. It’s like not eating only candy to stay healthy.

We also have to decide if we’re in it for a quick win or the long game. That choice shapes how we use our tools. Long-term versus short-term analysis helps us match our strategies to our goals.

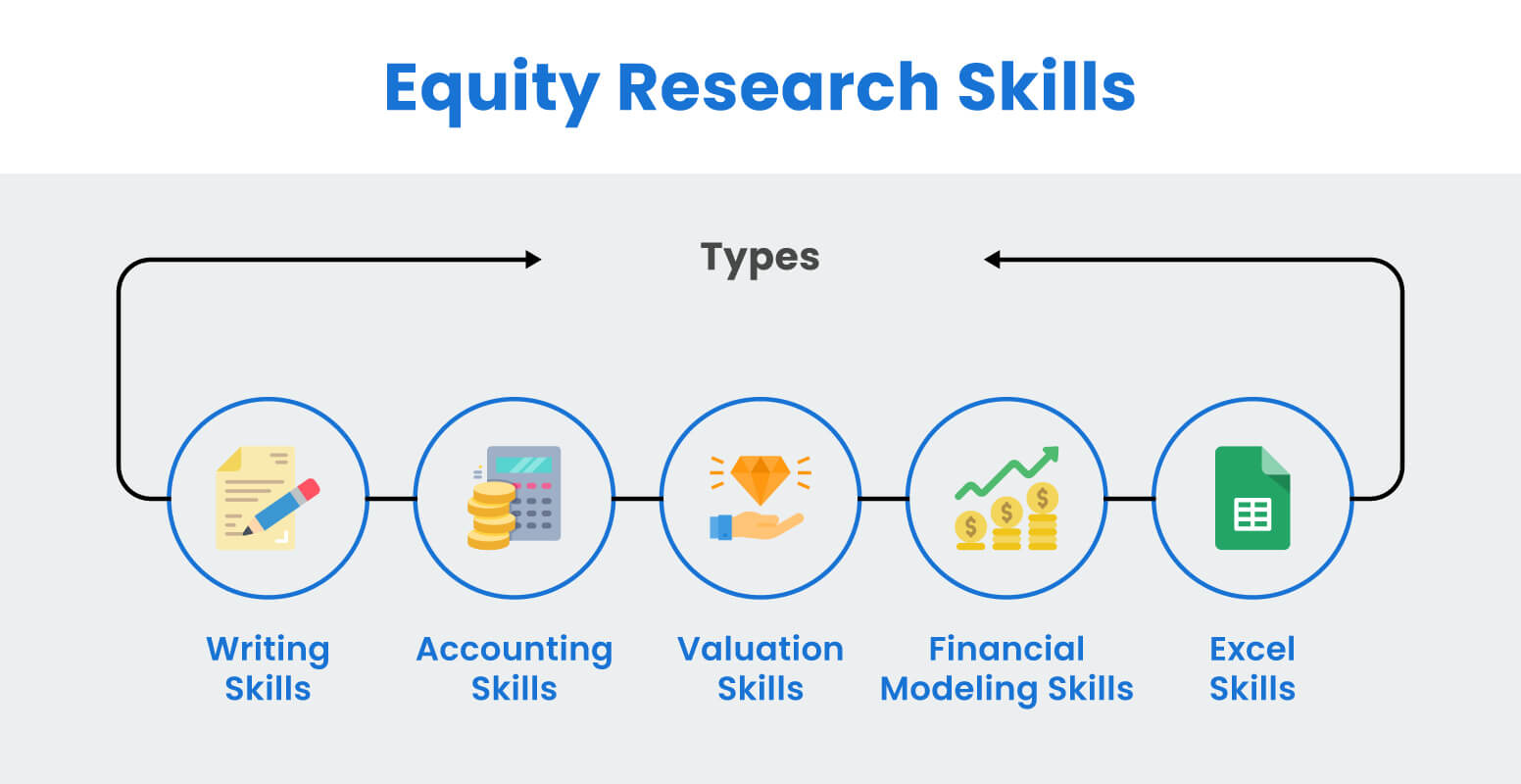

For a foolproof plan, we mix both types of analysis. We get numbers from charts and stories from financial reports. Combining quantitative and qualitative analysis gives us the full picture.

We have to keep our eyes open for the world around us too. What’s happening out there? Industry trends and sector performance whisper clues. And we can’t ignore the big picture – how the world’s economy and markets affect our investments.

As a modern investor, it’s about having a toolbox filled with all these instruments. Using them together helps us make wiser bets in this wild market. We learn from the past, understand the present, and prepare for the future. That’s the way to smarter investing.

In-Depth Market Analysis for Informed Investment Decisions

Mastering Chart Patterns and Price Movements

Charts and patterns guide traders like maps guide sailors. I look for shapes in stock graphs. These shapes can hint if prices may rise or fall. This is the core of technical analysis. Each pattern tells its own tale of market sentiment. Let’s say a ‘head and shoulders’ pattern appears. It often signals that stock prices might drop. Knowing this, I decide when to buy or sell.

But price alone won’t tell me everything. For smarter trades, I mix in volume analysis. Volume shows how many shares trade hands. High volume can mean a price move is strong. Low volume hints the move might not stick. This combo of price and volume paints a clear picture.

Now, tech tools can miss out on some info. So, I blend in fundamental analysis too. I dig into financial statements. I want healthy books; I look past shiny profits. What drives real growth? That’s what matters. I sift through each line of balance sheets and income statements.

And there’s more. I need to think about the team driving the company. A solid crew can mean smooth sailing for stocks. Plus, a company’s edge over rivals is like a trusty compass. It points to future wins.

Qualitative and Quantitative Aspects of Equity Research

Equity research is my telescope. It helps me spot distant treasure. Both company stories and hard numbers matter. I listen to what a company does and how it stacks in its field. Are they the top dog or the underdog?

I also use hard data. Ratios like earnings per share (EPS) show if a stock is a good deal. And, cash flows are the lifeblood of any firm. They must have more cash coming in than going out.

I don’t just guess where the market’s heading. I watch economic clues to feel the trend’s pulse. These clues include jobs reports, interest rates, and more. They shine a light on where things might go.

Then, there’s the world’s dance. Global events sway stocks. A tiff between countries can jerk prices around. I keep a keen eye on it all, from local uproars to overseas shifts.

By marrying the map with the story, I build a full view. I combine the hard stats with the soft tales. This mix is key to wise investing. It’s like having both a map and a compass when you’re lost in the woods.

In the end, mixing technical clues with company roots gives deep insight. This insight helps me steer through the stormy market seas. I grasp when a stock’s ready to pop and when to dock the cash.

No matter the type of investor you are, knowing both the numbers and stories is your best bet. It’s a balance of art and science. And it’s your guide to smarter, steadier investing.

Asset Allocation and Portfolio Optimization Strategies

Crafting a Diversified Portfolio with Mixed Analysis Approaches

Let’s talk smart investing. We want to make money right? Well, smart investing starts with a smart plan. That’s where asset allocation comes in. This is how you spread your money across different types of investments. It’s like not putting all your eggs in one basket!

To do this, you gotta mix different ways of looking at the market. We use stuff called technical analysis tools. Think of these as your investor’s magnifying glass. They zoom in on charts and patterns in trading. It’s all about timing: when to buy or sell.

But we can’t just look at patterns. That’s where fundamental analysis principles join the party. They’re like checking the health of a company you wanna invest in. It’s digging deep, looking at earnings, what the company owns and owes, and lots more.

Ever played with LEGO bricks? Think of each brick as a piece of financial info. The cool part is how you put them together. It could be a castle or a spaceship – your portfolio can be just as unique! It’s all about how you mix your analysis techniques, like stock evaluation strategies or market analysis methods.

The Role of Macro-Economic Factors and Industry Trends in Asset Allocation

Now, let’s zoom out a bit. We’ve been talking about looking close, but we also need to take a step back to see the big picture. That’s where economic indicators in investing come in. This is grown-up stuff, like jobs reports, inflation, and interest rates. They tell us if the economy is in good shape or if it’s hitting a rough patch.

But wait, there’s more! Sectors and industries have their own vibe too. Let’s say tech stocks are the cool kids right now, but maybe next year it’s green energy. By looking at these trends, we can guess – kinda smartly – what’s going to be hot or not.

When we mix all that info – how companies look up close and what’s happening in the wide world – we make better choices. It’s like being a chef and knowing which flavors work together. Integrating market analyses is basically your recipe book for awesome investing.

Remember, we’re always learning. The market’s like a big game, but instead of points, we want to make money, and to win, we need to play it smart. By using all the tools we’ve talked about, we give ourselves the best shot at making our money grow.

In this investing game, it’s your money and your future. So, learning the ropes of asset allocation techniques and diversified investment strategies isn’t just smart – it’s crucial. We’re looking for growth, stability, and those sweet returns. And with the right mix of technical and fundamental analysis, we’re on the right track to make our investment rocket ship soar!

In this post, we explored how blending technical and fundamental analysis helps investors make better choices. First, we learned the basics of mixing these methods. We dove into real-case studies, seeing the synergy in action. We then looked at the key tools and indicators every modern investor needs.

We navigated the terrain of technical analysis and uncovered the pillars of fundamental analysis. After that, we mastered chart patterns and the ins and outs of equity research. To top it off, we figured out how to craft a diversified portfolio and realized how big-picture economic trends affect our investing strategy.

I think it’s clear: using both technical and fundamental analysis gives us a solid ground to stand on. It’s like having a map and a compass when you’re in new territory. Keep these strategies in hand, and you’re set to make smarter, more informed investment choices. Let’s keep our investments strong and our risks smart. Happy investing!

Q&A :

Can you use both technical and fundamental analysis together?

Absolutely, combining technical and fundamental analysis can provide a more holistic approach to investing. While fundamental analysis helps investors understand the intrinsic value of an asset based on economic and financial factors, technical analysis focuses on price movements and market trends. By integrating both methods, investors can gain insights into both long-term value and short-term trading opportunities.

How do technical and fundamental analysis complement each other in trading?

Technical analysis and fundamental analysis complement each other by providing different perspectives on the market. Fundamental analysis gives traders insights into a company’s financial health, business model, and industry conditions, which can impact the asset’s long-term potential. Meanwhile, technical analysis helps in identifying the optimum entry and exit points by analyzing the price patterns and market sentiment, which is crucial for timing the trades effectively.

What are the benefits of combining technical and fundamental analysis for investment strategies?

Combining technical and fundamental analysis offers several benefits for investors. This dual approach allows for a comprehensive evaluation of potential investments, balancing the in-depth review of a company’s fundamentals with the timing precision provided by technical indicators. This can result in more informed decision-making, better risk management, and the potential for enhanced returns.

Is it possible to automate combining technical and fundamental analysis?

Yes, it is possible to automate the combination of technical and fundamental analysis through various trading platforms that offer algorithmic trading tools. These tools can be programmed to analyze fundamental data, such as earnings reports and economic indicators, alongside technical indicators like moving averages or relative strength index to make informed trading decisions. However, the effectiveness of such systems often depends on the quality of the algorithms and the relevance of the data inputted.

What are the limitations of combining technical and fundamental analysis?

The primary limitation of combining technical and fundamental analysis lies in the potential for conflicting signals that can lead to analysis paralysis or indecision. As the two approaches often focus on different time horizons and data sets, they can occasionally suggest opposing actions. Furthermore, the sheer volume of data to analyze can be overwhelming, and the subjective interpretation of this data may lead to inconsistent outcomes. It’s essential for investors to establish a clear framework to effectively integrate both approaches.