Challenges of e-commerce payment platforms can make or break a business. If you own an online store, you know that getting people to click ‘buy’ is just half the battle. The real test? Keeping their data safe and making sure they don’t ditch their carts. You need a payment platform that fights fraud and makes paying easy. I tackle the tough stuff: fraud, high chargeback rates, and the tricks to keep shoppers happy. Let’s dive into making transactions smooth and secure for everyone.

Understanding Payment Gateway Challenges in E-Commerce

Tackling Fraud Detection and Prevention Mechanisms

Online shops face big risks with fraud. It’s a game of cat and mouse where the rules are always changing. Scammers get smarter day by day. So, our defenses must be stronger. Shops need systems that watch for signs of fraud, like many purchases in a short time or strange payment patterns.

We must do this without making legit buyers trip over security steps. This means a smooth checkout should go hand in hand with tight security. This balance is tough but not impossible. We use tech that learns and adapts to threats. The goal is simple: stop the bad guys, let the good guys have an easy ride.

For example, having an alert system is key. It flags risky transactions right away. This way, shops can act fast before losing money or goods. Real people check these alerts to make sure everything’s correct. By using smart tech and real checks, we keep online shoppers safe.

Addressing High Chargeback Rates and Their Impact

Now, let’s talk chargebacks. This is when buyers say “I didn’t make this buy” or “My item never came”. Shops then must give back the cash, which can really hit their pockets hard. High chargebacks can mean shops pay more fees and might even lose the right to sell online. Not good, right?

Shops need to show proof they did everything right, like sending goods on time or making sure the buy was legit. Also, shops should talk clearly about their return rules. This can stop some chargebacks as shoppers know what to expect.

But sometimes, things still go sideways. Then, it’s about having a quick way to solve disputes. We work on systems that help shops deal with these issues fast, keeping their good name and money safe. Being able to trust an online shop means everything. So, we take chargebacks seriously.

Online payments are like a bridge between buyers and shops. They need to be smooth, safe, and fair. It gets tough, but that’s where the fun is! We get to solve puzzles and keep everyone happy. It’s all about balance — keeping shops safe from fraud and customers happy with their buys. It’s a win-win when done right.

Enhancing User Experience in Secure Online Transactions

Simplifying Multi-Currency Payment Processing

I’ll level with you: shopping online should be easy, even when you cross borders. Imagine buying a cool toy from another country. You want to pay with your money, not theirs, right? But sometimes, online shops get this wrong, and it makes you just want to give up.

So, here’s what I do: I help these shops fix this issue. We call it multi-currency payment processing. It means you can pay in your money, no sweat. We sort out the currency mess so you won’t have to. Everyone wins. You’re happy, and the shop sells more toys.

Improving User Experience at Checkout to Lower Cart Abandonment Rates

Have you ever left a cart full of stuff without buying? I bet it was because the checkout was a pain. It happens a lot, and it’s called cart abandonment. It’s a big headache for stores when shoppers bail last minute.

My job is to make checkout easy peasy. It should be quick, with no tricky parts. Like having your stuff ready by the door, so you can just grab it and go. I work on making sure you can zip through without any hiccups. No more abandoned carts, just happy shopping trips.

Overcoming Technical and Compliance Obstacles

Navigating PCI Compliance and Data Security

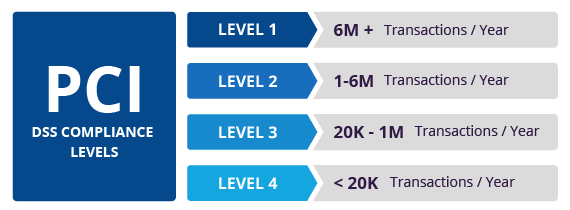

Handling PCI compliance is tough but key. In fact, without it, you risk big fines. Ensuring data security is part of this. It’s how we keep customer info safe. Have you heard of it before? PCI stands for Payment Card Industry. It sets the rules for how we handle card data. Ignoring it could mean real trouble.

Every online store must follow PCI rules. They state clear dos and don’ts. These keep credit card data safe. This means using special tech to guard this sensitive info. Safety measures like encryption are a must. They scramble card details so hackers can’t read them. Not only that, we need to keep checking our systems. We look for any weak spots to fix right away. These steps can be a lot for any shop owner. Yet, they’re important to stop data from leaking.

When it comes to these rules, there’s a lot to think about. You’ve got to make sure your software is up to date. Your website has to pass regular security checks too. All this is not just to avoid fines. It’s about keeping your shopper’s trust. No one wants their card info stolen.

Resolving Technical Issues and Delays in Payment Confirmation

Next let’s talk tech issues. They can slow down or stop payments. Fixing these fast is key. Have you ever had a payment problem online? It makes you worry, right? When payments lag, customers might leave. They may wonder if their order worked at all.

One big thing is to get good at spotting these hiccups. This could be anything from a broken link to a server overload. Once spotted, you need to jump on fixing them, pronto. Good tech support is your friend here. They are the folks who can get things moving again. And not just that. They can stop the same thing from happening in the future.

When payments don’t go through fast, it’s annoying. We all want a quick, easy shop online. That’s why it’s vital to sort out delays right away. To do this, start by checking where hang-ups happen. Is it at checkout? Or maybe when someone tries to pick their shipping? Look for patterns and work on those spots.

Another smart move is to keep your software on point. This means updating when a new version comes out. Plus, have a solid system to handle different payment types. This prepares you for anything that may come up.

Handling payments online is tough. There’s a lot to keep track of. But if we nail down these two big parts – following PCI rules and boosting our tech – we’re on the right path. We make shopping safe and smooth for all our customers. It’s all about building a place folks trust and love to buy from.

Strategizing for Cost-Effective and Trustworthy Payment Solutions

Optimizing Processing Fees and Adopting Alternative Payment Methods

If you’re in e-commerce, you know processing fees can bite. As an expert, I say every penny counts. So, how do we cut these fees? Simple. Shop around for providers. Compare rates. Don’t shy from negotiating. And hey, consider the whole deal, not just the rate. Some providers offer lower fees but have poor reliability. That’s a no-go.

What about those tricky international sales? Multi-currency transactions up the complexity. Have a system that deals well with different money forms without charging too much. Customers love to pay in their own currency. It makes them feel at home on your site.

Speaking of which, not everyone likes credit cards. Some trust PayPal, others swear by Apple Pay. We’ve got digital wallets, bank transfers, and more. Be sure to have these ready. It shows you care about your customer’s comfort. Plus, it may win you sales that you might’ve lost if you didn’t offer their favorite way to pay.

Balancing Customer Trust with Payment Method Accessibility and Security

Now, let’s talk trust. It’s the glue in e-commerce. Without it, no deal. You must have secure online transactions. PCI compliance is non-negotiable. It’s tough, true. But it’s vital for keeping card info safe. And when customers feel safe, they buy.

But be warned. Too much security can scare folks off. Ever faced a cart full of stuff, only to bail at the last step? Yes, cart abandonment is real. Too many checks feel like a quiz. And no one likes pop quizzes, right? Keep it smooth. Security should be like a good cop – there, but not in your face.

And here’s the thing. When you add new payment methods, test them. A lot. Your site should handle them like a charm. Nothing’s more annoying than a cool new option that doesn’t work when you try it. And if there’s an issue? Fix it fast. Great service gets talked about. It builds that precious trust.

So, there you go. E-commerce ain’t easy, but it’s a thrill. Aim for low fees, and keep those payments rolling smoothly from all corners of the world. Create a checkout that’s a breeze and keeps the crooks out. Offer a payment buffet to satisfy all tastes. And in this high-stakes game of trust, make sure you’re playing to win. This is how you turn challenges into victories.

In this blog, we tackled big e-commerce payment hiccups. We explored how to catch fraud early and handle too many chargebacks. We then looked at making it easier to buy things in different currencies and how to make checking out smoother. This can help fewer people leave their carts full.

Next, we talked about tricky tech and rules for keeping card info safe, plus fixing slow payment confirmations. At the end, we covered ways to cut down on costs without losing trust and how to pick safe, easy ways to pay.

I believe secure, user-friendly payment options are key for a successful online store. Keep these tips in mind to save money and keep your customers happy and coming back.

Q&A :

What are the common security challenges faced by e-commerce payment platforms?

E-commerce payment platforms must prioritize security to protect sensitive data against cyber threats such as hacking, phishing, and fraud. Implementing robust encryption, maintaining compliance with security standards like PCI DSS, and using secure payment gateways are key to mitigating these challenges.

How do e-commerce platforms overcome issues with payment gateways integration?

To effectively tackle integration issues, e-commerce platforms ensure compatibility with multiple payment gateways, provide seamless checkout experiences, and frequently update their systems to support the latest technologies. They also offer customer support to address any issues that arise quickly.

What strategies can be employed to handle multiple currency transactions in e-commerce?

E-commerce payment platforms can manage multicurrency transactions by using payment gateways that support currency conversion, offering dynamic currency conversion to customers, and using pricing strategies that account for exchange rate fluctuations. It’s also important to understand and comply with the tax laws and regulations of the countries they operate in.

How can e-commerce payment platforms improve transaction success rates?

Improving transaction success rates involves optimizing the checkout process for speed and ease of use, ensuring high reliability and uptime of the payment gateway, and providing multiple payment options. Additionally, using data analytics to monitor and address common points of failure can significantly enhance success rates.

What measures can be taken to reduce abandoned shopping carts due to payment issues in e-commerce?

Reducing shopping cart abandonment can be achieved by simplifying the checkout process, offering various secure payment options, and providing clear pricing and shipping information. Prompt customer support and follow-up on abandoned carts with targeted communications can also encourage customers to complete their purchases.